PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on April 6, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a−101)

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

|

Filed by the Registrant

|

☑

|

|

Filed by a Party other than the Registrant

|

☐

|

Check the appropriate box:

| ☑ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a−6(e)(2))

|

| ☐ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material Pursuant to Section 240.14a−12

|

Rexahn Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ |

No fee required.

|

| ☐ |

Fee computed on table below per Exchange Act Rules 14a−6(i)(1) and 0−11.

|

| (1) |

Title of each class of securities to which transaction applies:

|

| (2) |

Aggregate number of securities to which transaction applies:

|

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0−11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| (4) |

Proposed maximum aggregate value of transaction:

|

| (5) |

Total fee paid:

|

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0−11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| (1) |

Amount Previously Paid:

|

| (2) |

Form, Schedule or Registration Statement No.:

|

| (3) |

Filing Party:

|

| (4) |

Date Filed:

|

REXAHN PHARMACEUTICALS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held June 14, 2018

To Our Shareholders:

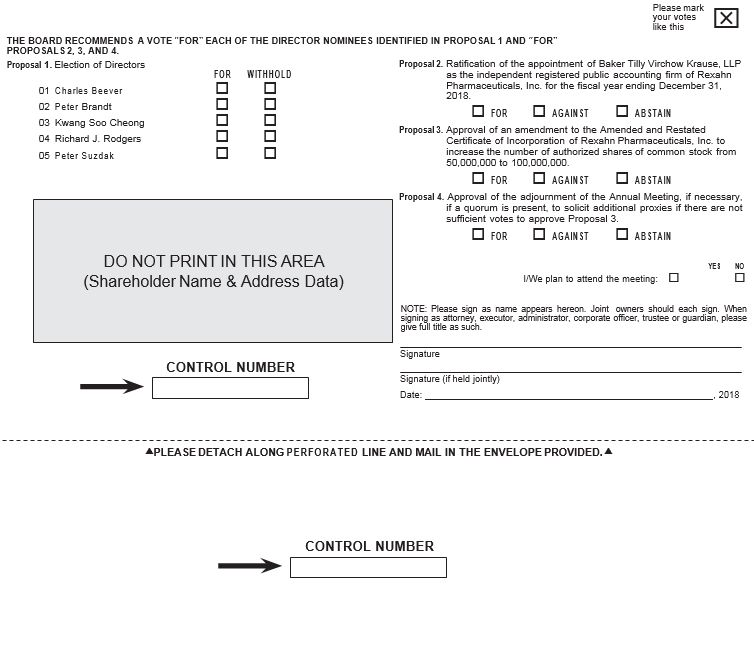

Notice is hereby given that the Annual Meeting of the Shareholders (the “Annual Meeting”) of Rexahn Pharmaceuticals, Inc. (the “Company”) will be held on June 14, 2018, at 8:00 a.m. (local time), at the Radisson Hotel, 3 Research Court, Rockville, Maryland 20850. The Annual Meeting is called for the following purposes:

| 1. |

to elect as directors the five nominees named in the accompanying proxy statement to a term of one year each, or until their successors have been elected and qualified;

|

| 2. |

to ratify the appointment of Baker Tilly Virchow Krause, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2018;

|

| 3. |

to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 50,000,000 to 100,000,000;

|

| 4. |

to approve the adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 3; and

|

| 5. |

to consider and take action upon such other matters as may properly come before the Annual Meeting or any postponement or adjournment thereof.

|

The Board of Directors has fixed , 2018 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to receive notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

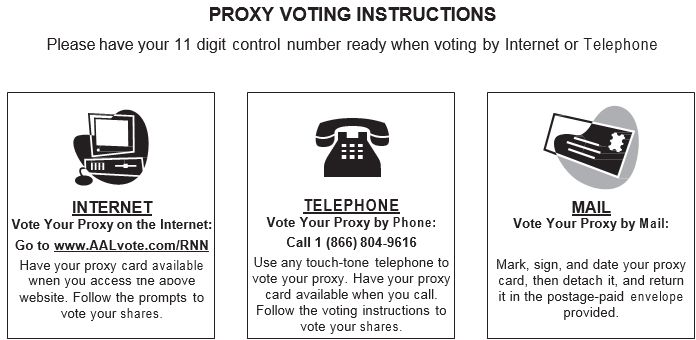

You are cordially invited to attend the Annual Meeting. Whether or not you expect to attend, you are respectfully requested by the Board of Directors to promptly either sign, date and return the enclosed proxy card or vote via the Internet or by telephone by following the instructions provided on the proxy card. A return envelope, which requires no postage if mailed in the United States, is enclosed for your convenience.

|

By Order of the Board of Directors,

|

|

|

Peter Brandt

|

|

|

Chairman of the Board of Directors

|

|

|

, 2018

|

|

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to be Held on June 14, 2018:

Copies of our Proxy Materials, consisting of the Notice of Annual Meeting, the Proxy Statement and our 2017 Annual Report are available at

http://www.viewproxy.com/rexahn/2018

|

REXAHN PHARMACEUTICALS, INC.

15245 Shady Grove Road, Suite 455

Rockville, Maryland 20850

(240) 268-5300

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To be held June 14, 2018

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors of Rexahn Pharmaceuticals, Inc. (“we”, “us”, or the “Company”) for the Annual Meeting of Shareholders to be held at the Radisson Hotel, located at 3 Research Court, Rockville, Maryland 20850, on June 14, 2018, at 8:00 a.m. (local time) and for any postponement or adjournment thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

We are providing our Proxy Materials to record shareholders by sending a printed copy of the full set of our proxy materials (the “Proxy Materials”), consisting of the Notice of Annual Meeting, this Proxy Statement and a proxy card (the “Proxy Card”), and our 2017 Annual Report to Shareholders by mail. As permitted by Securities and Exchange Commission (“SEC”) rules, we are also providing access to the Proxy Materials on the Internet.

The Proxy Statement and accompanying form of proxy are first being mailed to stockholders on or about , 2018.

1

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND ANNUAL MEETING

| Q: |

Why are these materials being made available to me?

|

| A: |

The Proxy Materials are being provided to you in connection with the Annual Meeting and include this Proxy Statement and the related Proxy Card that are being used in connection with the Board of Directors’ solicitation of proxies for the Annual Meeting. The information included in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process and certain other required information.

|

| Q: |

How do I access the Company’s Proxy Materials online?

|

| A: |

The Proxy Card provides instructions for accessing the Proxy Materials over the Internet, and includes the Internet address where those materials are available. The Company’s Proxy Statement for the Annual Meeting and the Company’s 2017 Annual Report to Shareholders can also be viewed on the Company’s website at www.rexahn.com.

|

| Q: |

What shares owned by me can be voted?

|

| A: |

All shares of the Company’s common stock, par value $0.0001 per share (“Common Stock”) owned by you as of the close of business on the Record Date may be voted by you. Each share of Common Stock is entitled to one vote. These shares include those (1) held directly in your name as the shareholder of record (“Shareholder of Record”), and (2) held for you as the beneficial owner through a broker, bank or other nominee.

|

| Q: |

What is the Record Date?

|

| A: |

The Record Date is , 2018. Only Shareholders of Record as of the close of business on this date will be entitled to vote at the Annual Meeting.

|

| Q: |

How many shares are outstanding?

|

| A: |

As of the Record Date, the Company had shares of Common Stock outstanding.

|

| Q: |

What is the difference between holding shares as a Shareholder of Record and as a beneficial owner?

|

| A: |

As summarized below, there are some distinctions between shares held of record and those owned beneficially.

|

Shareholder of Record

If your shares are registered directly in your name with the Company’s transfer agent, you are considered, with respect to those shares, the Shareholder of Record. As the Shareholder of Record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting.

2

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name” and your broker, bank or other nominee is considered, with respect to those shares, the Shareholder of Record. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also invited to attend the Annual Meeting. However, because you are not the Shareholder of Record, you may not vote these shares in person at the Annual Meeting unless you receive a proxy from your broker, bank or other nominee. Your broker, bank or other nominee has provided voting instructions for you to use. If you wish to attend the Annual Meeting and vote in person, please contact your broker, bank or other nominee so that you can receive a legal proxy to present at the Annual Meeting.

| Q: |

What am I voting on?

|

| A: |

You are being asked to vote on (1) the election as directors of the five nominees named in this Proxy Statement to a term of one year each, or until their successors have been elected and qualified, (2) the ratification of the appointment of Baker Tilly Virchow Krause, LLP (“Baker Tilly”) as the independent registered public accounting firm of the Company for the year ending December 31, 2018, (3) the approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock from 50,000,000 to 100,000,000, and (4) the approval of the adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 3.

|

The Company is not currently aware of any matters that will be brought before the Annual Meeting (other than procedural matters) that are not referred to in the enclosed Proxy Card. If any other business should properly come before the Annual Meeting or any postponement or adjournment thereof, the persons named in the proxy will vote on such matters according to their best judgment. Discretionary authority to vote on such matters is conferred by such proxies upon the persons voting them.

| Q: |

How do I vote?

|

| A: |

Shareholders of Record may vote by completing and signing the enclosed Proxy Card and returning it promptly in the enclosed postage prepaid, addressed envelope, or at the Annual Meeting in person. We will pass out written ballots to anyone who is eligible to vote at the Annual Meeting. We also will request persons, firms, and corporations holding shares of the Company’s Common Stock in their names or in the name of their nominees, which are beneficially owned by others, to send proxy material to and obtain proxies from the beneficial owners and will reimburse the holders for their reasonable expenses in so doing. Proxy Cards properly executed and delivered by shareholders (by mail or via the Internet) and timely received by the Company will be voted in accordance with the instructions contained therein. If you authorize a proxy to vote your shares over the Internet or by telephone, you should not return a Proxy Card by mail, unless you are revoking your proxy. If you hold your shares in “street name” through a broker, bank or other nominee, and are therefore not a Shareholder of Record, you must request a legal proxy from your broker, bank or other nominee in order to vote at the Annual Meeting.

|

If you hold your shares in “street name” through a broker, bank or other nominee, you may vote via the Internet by going to www.proxyvote.com, while Shareholders of Record may go to www.aalvote.com/rnn to vote via the Internet. All shareholders must have their control number in order to vote via the Internet.

3

| Q: |

How many votes do you need to hold the Annual Meeting?

|

| A: |

Forty percent of the Company’s issued and outstanding shares of Common Stock as of the Record Date must be present at the Annual Meeting, either in person or by proxy, in order to hold the Annual Meeting and conduct business. This is called a quorum.

|

| Q: |

How many votes must the director nominees have to be elected?

|

| A: |

In order for a director to be elected, he must receive the affirmative vote of a plurality of the shares voted. There is no cumulative voting for the Company’s directors or otherwise.

|

| Q: |

What are the voting requirements to approve the other proposals?

|

| A: |

The affirmative vote of a majority of the shares cast in person or represented by proxy at the Annual Meeting and entitled to vote on the matter is required to ratify the Company’s independent auditors and to approve an adjournment of the Annual Meeting The affirmative vote of a majority of the Company’s issued and outstanding shares is required to approve the authorized share increase.

|

| Q: |

Who will count the votes?

|

| A: |

Votes at the Annual Meeting will be counted by an inspector of election, who will be appointed by the Board of Directors or the chairman of the Annual Meeting.

|

| Q: |

What is the effect of not voting?

|

| A: |

If you are a beneficial owner of shares in street name and do not provide the broker, bank or other nominee that holds your shares with specific voting instructions then, under applicable rules, the broker, bank or other nominee that holds your shares can generally vote on “routine” matters, but cannot vote on “non‑routine” matters. In the case of a non-routine item, your shares will be considered “broker non-votes” on that proposal.

|

Proposal 2 (ratification of the appointment of Baker Tilly Virchow Krause, LLP as the independent registered public accounting firm), Proposal 3 (approval of the authorized share increase) and Proposal 4 (approval of the adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 3) are matters we believe will be considered “routine.” Proposal 1 (election of directors), we believe will be considered “non-routine.”

If you are a Shareholder of Record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting. If you are a Shareholder of Record and you properly sign and return your Proxy Card, your shares will be voted as you direct. If no instructions are indicated on such Proxy Card and you are a Shareholder of Record, shares represented by the proxy will be voted in the manner recommended by the Board of Directors on all matters presented in this Proxy Statement, namely “FOR” all the director nominees, “FOR” the ratification of the appointment of Baker Tilly as the Company’s independent registered public accounting firm for the year ending December 31, 2018, “FOR” the approval of the authorized share increase, and “FOR” the adjournment of the Annual Meeting, if necessary.

4

| Q: |

How are broker non-votes and abstentions treated?

|

| A: |

Broker non-votes and abstentions with respect to a proposal are counted as present or represented by proxy for purposes of establishing a quorum. If a quorum is present, broker-non votes and votes to withhold will have no effect on the outcome of the votes on Proposal 1 (election of directors), but abstentions will count as votes against Proposal 2 (ratification of the appointment of Baker Tilly Virchow Krause, LLP as the independent registered public accounting firm) and Proposal 4 (approval of the adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 3), and broker non-votes and abstentions will have the same effect as votes against Proposal 3 (approval of the authorized share increase).

|

| Q: |

Can I revoke my proxy or change my vote after I have voted?

|

| A: |

You may revoke your proxy and change your vote by voting again via the Internet or telephone, by completing, signing, dating and returning a new Proxy Card or voting instruction form with a later date, or by attending the Annual Meeting and voting in person. Only your latest dated Proxy Card received at or prior to the Annual Meeting will be counted. Your attendance at the Annual Meeting will not have the effect of revoking your proxy unless you forward written notice to the Secretary of the Company at the above stated address or you vote by ballot at the Annual Meeting.

|

| Q: |

What does it mean if I receive more than one Proxy Card?

|

| A: |

It means that you have multiple accounts at the transfer agent and/or with brokers, banks or other nominees. To ensure that all of your shares in each account are voted, please sign and return all Proxy Cards, vote with respect to all accounts via the internet or by telephone, or, if you plan to vote at the Annual Meeting, contact each broker, bank or other nominee so that you can receive all necessary legal proxies to present at the Annual Meeting.

|

| Q: |

What are the costs of soliciting these proxies and who will pay?

|

| A: |

We will bear the costs of preparing, printing, assembling, and mailing the Proxy Materials and of soliciting proxies. In addition to solicitations by mail, the Company and its directors, officers and employees may solicit proxies by telephone and email. We will request brokers, custodians and fiduciaries to forward proxy soliciting material to the owners of shares of the Company’s Common Stock that they hold in their names. We will reimburse banks and brokers for their reasonable out-of-pocket expenses incurred in connection with the distribution of the Company’s proxy materials.

|

| Q: |

Do I have appraisal or similar dissenter’s rights?

|

| A: |

Appraisal rights and similar rights of dissenters are not available to shareholders in connection with proposals brought before the Annual Meeting.

|

5

| Q: |

Where can I find the voting results of the Annual Meeting?

|

| A: |

The Board of Directors will announce the voting results at the Annual Meeting. We will also publish the results in a Current Report on Form 8-K within four business days after the date of the Annual Meeting. We will file that report with the SEC, and you can get a copy:

|

| · |

by contacting the Company’s corporate offices via phone at (240) 268-5300 or by e-mail at ir@rexahn.com; or

|

| · |

through the SEC’s EDGAR system at www.sec.gov.

|

6

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITY HOLDERS

The table below sets forth the beneficial ownership of our Common Stock as of April 4, 2018 by the following individuals or entities:

| · |

each director and nominee;

|

| · |

each named executive officer identified in the Summary Compensation Table; and

|

| · |

all current directors and executive officers as a group.

|

As of April 4, 2018, no person or group of affiliated persons is known to us to beneficially own 5% or more of our outstanding Common Stock.

As of April 4, 2018, 31,744,439 shares of our Common Stock were issued and outstanding. All persons named in the table below have sole voting power and sole investment power with respect to the shares indicated as beneficially owned. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock that could be acquired by the exercise of stock options within 60 days of April 4, 2018 are deemed outstanding, while such shares are not deemed outstanding for purposes of computing percentage ownership of any other person. In addition, unless otherwise indicated, the address for each person named below is c/o Rexahn Pharmaceuticals, Inc., 15245 Shady Grove Road, Suite 455, Rockville, Maryland 20850.

|

Shares of Rexahn Pharmaceuticals

Common Stock

Beneficially Owned

|

||||||||

|

Name of Beneficial Owner

|

Number of Shares

|

Percentage

|

||||||

|

Directors and Named Executive Officers:

|

||||||||

|

Peter Suzdak

|

477,948

|

(1)

|

1.5

|

%

|

||||

|

Charles Beever

|

65,500

|

(2)

|

*

|

|||||

|

Kwang Soo Cheong

|

64,800

|

(3)

|

*

|

|||||

|

Peter Brandt

|

75,500

|

(4)

|

*

|

|||||

|

Mark Carthy

|

50,500

|

(5)

|

*

|

|||||

|

Richard J. Rodgers

|

45,500

|

(6)

|

*

|

|||||

|

Tae Heum Jeong

|

171,125

|

(7)

|

*

|

|||||

|

Ely Benaim

|

158,393

|

(8)

|

*

|

|||||

|

Lisa Nolan

|

70,281

|

(9)

|

*

|

|||||

|

Douglas J. Swirsky

|

-

|

*

|

||||||

|

All current executive officers and directors as a group (9 persons)

|

1,008,422

|

(10)

|

3.2

|

%

|

||||

| * |

Represents less than 1% of the issued and outstanding shares of our Common Stock as of April 4, 2018.

|

| (1) |

Includes Dr. Suzdak’s options to purchase 455,698 shares of Common Stock that are currently exercisable or exercisable within 60 days of April 4, 2018.

|

| (2) |

Includes Mr. Beever’s options to purchase 64,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of April 4, 2018.

|

7

| (3) |

Includes Dr. Cheong’s options to purchase 64,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of April 4, 2018.

|

| (4) |

Includes Mr. Brandt’s options to purchase 60,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of April 4, 2018.

|

| (5) |

Includes Mr. Carthy’s options to purchase 50,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of April 4, 2018.

|

| (6) |

Includes Mr. Rodgers’ options to purchase 45,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of April 4, 2018.

|

| (7) |

Includes Dr. Jeong’s options to purchase 119,050 shares of Common Stock that are currently exercisable or exercisable within 60 days of April 4, 2018.

|

| (8) |

Includes Dr. Benaim’s options to purchase 156,018 shares of Common Stock that are currently exercisable or exercisable within 60 days of April 4, 2018.

|

| (9) |

Includes Dr. Nolan’s options to purchase 68,656 shares of Common Stock that are currently exercisable or exercisable within 60 days of April 4, 2018.

|

| (10) |

Includes options to purchase 965,872 shares of Common Stock that are currently exercisable or exercisable within 60 days of April 4, 2018.

|

8

PROPOSAL 1: ELECTION OF DIRECTORS

Five director nominees have been nominated for election at the Annual Meeting to serve a one-year term until the next Annual Meeting in 2019. All of the nominees currently serve on the Board of Directors. All nominees have consented to being named in this Proxy Statement and to serve if elected. Mark Carthy, who currently serves as a director, is not standing for reelection.

The Board of Directors recommends that the nominees listed below be elected as directors. We have no reason to believe that any of the nominees will not be a candidate or will be unable to serve. However, in the event that any of the nominees should become unable or unwilling to serve as a director, the persons named in the proxy have advised that they will vote (unless authority has been withdrawn) for the election of such person or persons as shall be designated by management.

The following table sets forth the names, ages and positions of our nominees for directors. All of the director nominees are currently members of the Board of Directors.

|

Name

|

Age

|

Position

|

|

Peter Brandt

|

61

|

Chairman of the Board of Directors

|

|

Peter Suzdak

|

59

|

Chief Executive Officer and Director

|

|

Charles Beever

|

65

|

Director

|

|

Kwang Soo Cheong

|

57

|

Director

|

|

Richard J. Rodgers

|

51

|

Director

|

Peter Brandt. Mr. Brandt has served as our Chairman since June 2015 and as director since September 2010. From February 2011 to early 2013, Mr. Brandt served on the Board of Directors and, in December 2012, became Chairman of the Board of Directors of ePocrates, Inc., a point of care medical applications company, which was acquired by athenahealth, Inc. Also, from November 2011 until March 2012, Mr. Brandt served as interim Chief Executive Officer and President of ePocrates, Inc. Mr. Brandt served as President, Chief Executive Officer, and as a member of the Board of Directors of Noven Pharmaceuticals, Inc., a specialty pharmaceutical company, from early 2008 until Noven’s acquisition by Hisamitsu Pharmaceutical Co., Inc. in August 2009. Prior to leading Noven, Mr. Brandt spent 28 years at Pfizer, the world’s largest pharmaceutical company. He served as Pfizer’s President – U.S. Pharmaceuticals Operations, where he helped deliver revenue and earnings growth while engineering major change within Pfizer’s U.S. pharmaceuticals organization. Prior to running U.S. operations, he led Pfizer’s Latin American pharmaceuticals operations, as well as the following Pfizer Worldwide Pharmaceuticals functions: finance, information technology, planning and business development. He also oversaw the operations of Pfizer’s care management subsidiary, Pfizer Healthcare Solutions. Mr. Brandt served as a director of Auxilium Pharmaceuticals, Inc. (“Auxilium”) from December 2010 to January 2015, at which time Auxilium was acquired by Endo International PLC. Mr. Brandt holds a B.A. from the University of Connecticut and an M.B.A. from the Columbia School of Business. Mr. Brandt contributes his broad operational management experience in the life sciences industry and experience serving on numerous boards of directors of life sciences companies to the Board of Directors.

9

Peter Suzdak. Dr. Suzdak joined us as Chief Executive Officer in February 2013, and has served as a director since June 2013. Dr. Suzdak has over 25 years of diverse experience, including several management positions, in the pharmaceutical industry. Most recently, Dr. Suzdak was Chief Scientific Officer of Corridor Pharmaceuticals, a company developing small molecule compounds to treat pulmonary and vascular disorders, from 2010 to 2013. Prior to Corridor Pharmaceuticals, he was co-Founder, Chief Executive Officer and Chief Scientific Officer of Cardioxyl Pharmaceuticals, a company focused on therapies for the treatment of cardiovascular disease, from 2006 to 2009. Prior to Cardioxyl Pharmaceuticals, he was President and Chief Executive Officer of Artesian Therapeutics, a company engaged in the development of small molecule therapeutics for cardiovascular diseases, from 2002 to 2005. Dr. Suzdak’s experience also includes his position as Senior Vice President of Research and Development of Guilford Pharmaceuticals, a company that developed therapeutics and diagnostics for neurological diseases and cancer, from 1995 to 2002, and as Director of Neurobiology for Novo Nordisk from 1988 to 1995. Dr. Suzdak holds a Ph.D. in pharmacology and toxicology from the University of Connecticut. Dr. Suzdak contributes his extensive pharmacology, clinical development, business development, and pharmaceutical management experience, including his day-to-day leadership of the Company, to the Board of Directors.

Charles Beever. Mr. Beever has served as a director since May 2006. From 1993 to June 2015, he was a Vice President of PwC Strategy&, a global strategy consulting firm, formerly Booz & Company and Booz Allen Hamilton (“Booz Allen”), Prior to being elected Vice President of Booz Allen in 1993, he served as staff member and Engagement Manager at Booz Allen from January 1984 to October 1993. Prior to joining Booz Allen, Mr. Beever served in various management roles at McGraw-Edison Company. Mr. Beever holds a B.A. in Economics from Haverford College, where he was elected to Phi Beta Kappa, and an M.B.A. from the Harvard Graduate School of Business Administration. Mr. Beever contributes extensive managerial and business experience to the Board of Directors.

Kwang Soo Cheong. Dr. Cheong has served as a director since May 2006. He is a faculty member at the Department of Finance of the Johns Hopkins University Carey Business School, where he was an Assistant Professor from 2001 to 2005 and has been an Associate Professor from 2006 to date. Dr. Cheong was an Assistant Professor of Economics at the University of Hawaii from 1994 to 2001, and a lecturer at the Department of Economics of Stanford University from 1993 to 1994. During the summer of 1995, Dr. Cheong was a Visiting Fellow in the Taxation and Welfare Division at the Korea Development Institute in Korea. Dr. Cheong holds a B.A. in Economics and an M.A. in Economics from Seoul National University, and a Ph.D. in Economics from Stanford University. Dr. Cheong’s distinguished academic career focused on finance and economics contributes to the Board of Directors’ perspective.

Richard J. Rodgers. Mr. Rodgers has served as a director since December 2014. In addition to his board seat with the Company, Mr. Rodgers currently serves on the Board of Directors of Ardelyx, Inc., a pharmaceutical company, and 3-V Biosciences, Inc., a clinical stage pharmaceutical company. Mr. Rodgers was previously Executive Vice President, Chief Financial Officer, Secretary and Treasurer of TESARO, Inc., an oncology-focused biopharmaceutical company that he co-founded, from March 2010 until August 2013. He served as the Chief Financial Officer from June 2009 to February 2010 of Abraxis BioScience, which was subsequently acquired by Celgene. Prior to that, Mr. Rodgers served as Senior Vice President, Controller and Chief Accounting Officer of MGI PHARMA, from 2004 until its acquisition by Eisai in January 2008. He has held finance and accounting positions at several private and public companies, including Arthur Anderson. Mr. Rodgers received a B.S. in Financial Accounting from St. Cloud State University and his MBA in Finance from the University of Minnesota, Carlson School of Business. Mr. Rodgers’ contributes extensive financial and industry experience to the Board of Directors.

The Board of Directors recommends a vote FOR the election of each of the director nominees.

10

Executive Officers

In addition to Peter Suzdak, whose information is included above, set forth below are our executive officers:

Douglas J. Swirsky. Mr. Swirsky, 48, has served as President, Chief Financial Officer, and Corporate Secretary since January 2018. Prior to joining the Company, Mr. Swirsky was most recently President, CEO and a director of GenVec, Inc., a publicly traded biotechnology company, a position he held from 2013 through the sale of the company in 2017. He joined GenVec in 2006 as Chief Financial Officer. Prior to joining GenVec, Mr. Swirsky was a Managing Director and the Head of Life Sciences Investment Banking at Stifel Nicolaus from 2005 to 2006 and held investment banking positions at Legg Mason from 2002 until Stifel Financial’s acquisition of the Legg Mason Capital Markets business in 2005. He has also previously held investment banking positions at UBS, PaineWebber and Morgan Stanley. Mr. Swirsky is on the board of directors of Fibrocell Science, Inc., Cellectar Biosciences, Inc., and Pernix Therapeutics Holdings, Inc. Mr. Swirsky is a certified public accountant and a CFA® charter holder. He received his B.S. in Business Administration from Boston University and his M.B.A. from the Kellogg School of Management at Northwestern University.

Ely Benaim. Dr. Benaim, 57, has served as Chief Medical Officer since February 2015. Prior to joining the Company, Dr. Benaim was Senior Vice President of Regulatory Affairs & Chief Medical Officer of BERG, LLC, a biopharmaceutical company, from June 2013 to January 2015. Prior to joining BERG, LLC, from March 2011 to June 2013, Dr. Benaim was Global Clinical Development Leader at Millennium Pharmaceuticals Inc., where he oversaw global clinical development of the Aurora A kinase inhibitor program. Prior to joining Millennium, Dr. Benaim served as Vice President of Clinical Affairs for Sangamo BioSciences, where he lead the development of zinc-fingers transcription factors cellular therapies in the areas of Cancer, Diabetes, Neurology, Cardiovascular and HIV. Before Sangamo, Dr. Benaim served at Amgen as Global Clinical Lead for clinical development across several drug development programs. Prior to Amgen he was a Senior Director, Oncology Clinical Development at Salmedix, Inc., where he led the development of TREANDA® to a Phase 3 pivotal trial for lymphoma. Dr. Benaim received his M.D. from the Universidad Central de Venezuela, Caracas and completed his pediatric residency training at the University of South Florida. He completed fellowships in pediatric oncology and bone marrow transplantation at St. Jude's Children's Research Hospital, in Memphis, Tennessee. From 1997 to 2004, he was Assistant Professor in the Department of Pediatrics at the University of Tennessee and an Assistant Member to the Department of Hematology/Oncology.

Lisa Nolan. Dr. Nolan, 55, has served as Chief Business Officer since June 2016. Prior to this, she served as Chief Business Officer of Relmada Therapeutics, Inc., a clinical-stage biotechnology company, from April 2015 to June 2016. From March 2010 through June 2016. Dr. Nolan served as Managing Director of Nolex Advisors, LLC, a business development and management consultancy firm, where she led successful competitive processes for out-licensing of early and late-stage pharmaceutical products. Over the course of her career, Dr. Nolan has held various leadership roles at biopharmaceutical companies including Chief Business Officer at Topigen Pharmaceuticals, where she led the acquisition of Topigen by Pharmaxis. Additionally, she served as Vice President, Global Business Development and Strategic Marketing for SkyePharma Inc., where she completed over a dozen out-licensing deals in the U.S. and Europe with deal values ranging in excess of $500 million. Dr. Nolan holds a Ph.D. in clinical pharmacology and a M.Sc., and B.Sc., in pharmacy from Trinity College in Dublin, Ireland.

11

Director Independence

Our Common Stock is listed on NYSE American. We use the NYSE American definition of “Independent Director” in determining whether a director is independent in his capacity as a director and in his capacity as a member of a board committee. For the Audit Committee, we additionally use Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Each director serving on the Audit Committee must also comply with the following additional NYSE American requirements:

(a) the director must not have participated in the preparation of our financial statements or any current subsidiary at any time during the past three years; and

(b) the director must be able to read and understand fundamental financial statements, including our balance sheet, income statement, and cash flow statement.

We currently have a total of six directors, five of whom are Independent Directors. Our Independent Directors are Messrs. Brandt, Beever, Carthy and Rodgers and Dr. Cheong. As Mr. Carthy is not standing for re-election, there will be a total of four independent directors should all of our director nominees be elected.

Board Leadership Structure

The Board of Directors does not have a policy on whether the role of Chairman and Chief Executive Officer should be separate or combined. However, at the present time, these roles are separate. The Board of Directors believes that utilizing separate individuals as Chairman and Chief Executive Officer will provide for additional leadership and management perspective as we progress in the development of our drug candidates. Four of our five director nominees are independent and each of our standing committees (Audit, Nominating and Corporate Governance, and Compensation) is comprised solely of independent directors. We believe this structure provides adequate oversight of Company operations by our independent directors in conjunction with our Chairman and Chief Executive Officer.

The Audit Committee has primary responsibility for oversight of risk management on behalf of the Board of Directors. Management reports to the Audit Committee on matters relating to risk management and the Audit Committee and management communicate directly with the full Board of Directors on these matters.

Board of Directors and Board of Directors Meetings

The Board of Directors held seven meetings during the year ended December 31, 2017. Each current director attended 75% or more of the meetings of the Board of Directors and committees of which they were members during the period in which he or she served as a director during the year ended December 31, 2017.

Any shareholder who wishes to send any communications to the Board of Directors or to individual directors should deliver such communications to our executive offices, 15245 Shady Grove Road, Suite 455, Rockville, Maryland 20850, Attention: Corporate Secretary (secretary@rexahn.com). Any such communication should indicate whether the communication is intended to be directed to the entire Board of Directors or to a particular director(s), and must indicate the number of shares of Common Stock beneficially owned by the shareholder. The Secretary will forward appropriate communications to the Board of Directors and/or the appropriate director(s), but will not forward inappropriate communications. Inappropriate communications include correspondence that does not relate to our business or affairs or the functioning of the Board of Directors or its committees, advertisements or other commercial solicitations or communications, and communications that are frivolous, threatening, illegal or otherwise not appropriate for delivery to directors.

12

Members of the Board of Directors are encouraged to attend the Annual Meeting if they are available. All members of the Board of Directors in office at the time attended the Annual Meeting held in 2017.

Board of Directors Committees

The Board of Directors has three standing committees, the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee, each of which is composed of three members. Each of these committees has a charter that is available on our website at www.rexahn.com.

Audit Committee

The Audit Committee Charter provides that such committee, among other things:

| · |

appoints or replaces and oversees our independent auditors and approves all audit engagement fees and terms;

|

| · |

preapproves all audit (including audit-related) services, internal control-related services and permitted non-audit services (including fees and terms thereof) to be performed for us by our independent auditors;

|

| · |

reviews and discusses with our management and independent auditors significant issues regarding accounting and auditing principles and practices and financial statement presentations;

|

| · |

reviews and approves our procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by our employees of concerns regarding accounting or auditing matters; and

|

| · |

reviews and oversees our compliance with legal and regulatory requirements.

|

Mr. Rodgers, Dr. Cheong, and Mr. Beever serve as members of the Audit Committee. Mr. Rodgers serves as Chair of the Audit Committee. The Board of Directors has determined that both Mr. Rodgers and Dr. Cheong are qualified audit committee financial experts within the meaning of applicable SEC regulations. Each of the current members meets the criteria for independence required by NYSE American and Rule 10A-3 under the Exchange Act. During the year ended December 31, 2017, the Audit Committee met five times.

13

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee Charter provides that such committee, among other things:

| · |

reviews, evaluates and seeks out candidates qualified to become Board of Directors members;

|

| · |

reviews committee structure and recommends directors for appointment to committees;

|

| · |

develops, reevaluates (not less frequently than every three years) and recommends the selection criteria for Board of Directors and committee membership;

|

| · |

establishes procedures to oversee evaluation of the Board of Directors, its committees, individual directors and management; and

|

| · |

develops and recommends guidelines on corporate governance.

|

Mr. Brandt, Mr. Beever, and Dr. Cheong currently serve as members of the Nominating and Corporate Governance Committee. Mr. Brandt serves as Chair of the Nominating and Corporate Governance Committee. Each of the Nominating and Corporate Governance Committee’s members meets the criteria for independence required by NYSE American.

The Nominating and Corporate Governance Committee reviews, evaluates and seeks out candidates qualified to become Board of Directors members. The Board of Directors currently includes individuals with a diversity of experience, including scientific, business, financial and academic backgrounds. However, while diversity relating to background, skill, experience and perspective is one factor considered in the nomination process, we do not have a formal policy relating to diversity. Nominations may be submitted by directors, officers, employees, shareholders and others for recommendation to the Board of Directors. In fulfilling this responsibility, the Nominating and Corporate Governance Committee also consults with the Board of Directors and the Chief Executive Officer concerning director candidates. While we do not have in place formal procedures by which shareholders may recommend director candidates to the Nominating and Corporate Governance Committee, shareholders may communicate with the members of the Board of Directors, including the Nominating and Corporate Governance Committee, by writing to the Secretary of the Board of Directors at our headquarters address. Candidates submitted by directors and management, as well as candidates recommended by stockholders, are evaluated in the same manner as other candidates identified to the Nominating and Corporate Governance Committee. In addition, our Amended and Restated Bylaws establish a procedure with regard to shareholder proposals for the Annual Meeting of Shareholders, including nominations of persons for election to the Board of Directors. Because shareholders have an adequate opportunity to recommend nominees for directors, we believe that formal procedures are not necessary. During the year ended December 31, 2017, the Nominating and Corporate Governance Committee met once.

14

Compensation Committee

The Compensation Committee Charter provides that such committee, among other things:

| · |

fixes salaries of executive officers and reviews salary plans for other executives in senior management positions;

|

| · |

reviews and makes recommendations with respect to the compensation and benefits for non-employee directors, including through equity-based plans;

|

| · |

evaluates the performance of the Chief Executive Officer and other senior executives and assists the Board of Directors in developing and evaluating potential candidates for executive positions; and

|

| · |

administers the incentive compensation, deferred compensation and equity-based plans pursuant to the terms of the respective plans.

|

The Compensation Committee may delegate this authority to subcommittees consisting of one or more of its members.

Our Chief Executive Officer makes recommendations to the Compensation Committee regarding our business goals and the performance of executives in achieving those goals, and recommends other executives’ compensation levels to the Compensation Committee based on such performance. The Compensation Committee considers these recommendations and then makes an independent decision regarding officer compensation levels and awards.

As part of determining compensation for our executive officers, the Compensation Committee has engaged Radford, an AON Hewitt Consulting company, as its independent compensation consultant. Radford provides analysis and recommendations to the Compensation Committee regarding:

| · |

trends and emerging topics with respect to executive compensation;

|

| · |

peer group selection for executive compensation benchmarking;

|

| · |

compensation practices for our peer group;

|

| · |

compensation programs for executives; and

|

| · |

stock utilization and related metrics.

|

When requested, Radford consultants attend meetings of the Compensation Committee. Radford reports to the Compensation Committee and not to management, although Radford confers with management for purposes of gathering information for its analyses and recommendations. In determining to engage Radford, the Compensation Committee considered the independence of Radford, and determined that Radford and the individual compensation advisors employed by Radford are independent.

Mr. Beever, Mr. Rodgers and Mr. Brandt currently serve as members of the Compensation Committee. Mr. Beever serves as Chairman of the Compensation Committee. Each of the members meets the criteria for independence required by NYSE American. During the year ended December 31, 2017, the Compensation Committee met four times.

15

COMPENSATION OF EXECUTIVE OFFICERS

Compensation Discussion & Analysis

This Compensation Discussion & Analysis addresses the principles underlying our policies and decisions with respect to the compensation of our executive officers who are named in the “Summary Compensation Table” below, or our “named executive officers,” and material factors relevant to these policies and decisions. It should be read together with the related tables and disclosures that follow. Our named executive officers for the year ended December 31, 2017 were:

| · |

Peter Suzdak, our Chief Executive Officer

|

| · |

Tae Heum Jeong, our former Chief Financial Officer

|

| · |

Ely Benaim, our Chief Medical Officer

|

| · |

Lisa Nolan, our Chief Business Officer

|

During 2017, the above individuals were the only individuals who served as executive officers.

Compensation Philosophy and Objectives

Our primary objectives with respect to the compensation of our named executive officers are to attract top executive talent, and to retain and motivate our existing executives because we believe they have experience and competencies that are critical to achievement of our business goals. We seek to achieve these objectives by:

| · |

Establishing the components of our compensation packages at competitive levels. This means using comparative market data to target overall compensation levels, with a focus on cash conservation that results in cash compensation at or below the 50th percentile.

|

| · |

Using an annual variable incentive compensation that is tied to specific corporate goals. Our annual incentive program is focused on motivating our executives to achieve Company-wide goals that are tied to our strategic plan.

|

| · |

Using equity awards that vest over time and deliver greater value as our stock price increases. We use equity awards in order to align our named executive officers’ interests with the interest of our shareholders in increasing long-term shareholder value.

|

Strong Compensation Practices

Our compensation program features a number of practices designed to align further the interests of our named executive officers with those of our shareholders.

Practices we employ:

| · |

We pay for performance. Compensation tied to Company performance comprises a significant part of an executive’s total compensation. Performance is used for determining the size of both short-term and long-term awards.

|

| · |

We target pay competitively. We seek to target pay to verifiable market data in order to ensure that we are both paying fairly and not overpaying our executives.

|

| · |

We use an independent compensation consultant. The Compensation Committee uses Radford to help verify market and best practices.

|

| · |

We have meaningful vesting periods. Beginning with awards made in 2015, equity awards used for our long-term incentive program typically vest over four years.

|

16

Practices we do not employ:

| · |

We do not provide for excessive perquisites. We do not provide any perquisites to our named executive officers, except for de minimis amounts of additional life insurance for Dr. Jeong and Dr. Nolan.

|

| · |

We do not offer guaranteed bonuses. We do not pay annual bonuses without achievement of performance goals, regardless of the reason for the failure to achieve performance goals, and we retain the flexibility to take into account overall Company performance in determining whether to pay bonuses.

|

| · |

We do not permit hedging. We prohibit profiting from short-term speculative swings in the value of our stock through “short sales”, “put” and “call” options, and hedging transactions.

|

Compensation Setting Process

Determination of Compensation. The Compensation Committee of the Board of Directors makes compensation decisions regarding our named executive officers. Our compensation program and the compensation arrangements and packages we have for our named executive officers have been influenced over the last several years by our change from a company led by our founder to a company led by a new chief executive officer and other new executive officers. As those changes occurred, the Compensation Committee determined that it would be appropriate to have a more structured and competitive compensation program. As a result of that decision, in mid-2014 the Compensation Committee engaged Radford as an independent compensation consultant to provide advice on the overall compensation program, as well as information regarding market and best practices. We used the information provided by Radford in 2014 for setting 2015 and 2016 compensation. At the end of 2016 the Committee received a report from Radford, which we used to help set 2017 compensation.

When making decisions about compensation for the named executive officers other than Dr. Suzdak, the Compensation Committee considers the recommendations of Dr. Suzdak regarding their performance and the Committee’s compensation consultant, as well as its industry experience and business judgment. Dr. Suzdak does not make recommendations with respect to his own compensation.

The Compensation Committee also intends to consider the outcome of say on pay votes when making executive compensation decisions in the future. In the last shareholder vote, approximately 86% of the votes cast on the “say on pay” proposal were voted in favor of that proposal. The Compensation Committee believes that this overwhelming majority of votes cast, which was an increase over the prior year, affirms shareholders’ support for the judgment of the Compensation Committee in setting executive compensation and, as a result, did not set or change 2017 executive compensation as a direct result of the prior shareholder vote.

17

Independent Compensation Consultant. Radford, as the Compensation Committee’s independent compensation consultant, provides analysis and recommendations to the Compensation Committee regarding:

| · |

trends and emerging topics with respect to executive compensation;

|

| · |

peer group selection for executive compensation benchmarking;

|

| · |

compensation practices for our peer group;

|

| · |

compensation programs for executives; and

|

| · |

stock utilization and related metrics.

|

When requested, Radford consultants attend meetings of the Compensation Committee. Radford reports to the Compensation Committee and not to management, although Radford confers with management for purposes of gathering information for its analyses and recommendations.

Comparative Framework. As discussed above, as part of its consideration of executive officer compensation for 2017, the Compensation Committee used a comparative framework provided by Radford that was consistent with the framework initially developed with the assistance of Radford in 2014. This framework blends equally information from the proxy statements of a peer group of companies and from survey data assembled by Radford in order to come up with a competitive market composite against which compensation can be measured. The survey data used for the competitive market composite in advance of setting compensation for 2017 was based on public biopharmaceutical companies having fewer than 100 employees and a market capitalization of between $14 million and $230 million and was taken from the Radford 2016 Global Life Sciences Survey.

To develop the peer group of companies, the Compensation Committee, with assistance from Radford, considered the stage of product development, market capitalization and other key business metrics of biotechnology and biopharmaceutical companies. The selected peer group consisted of the following companies:

|

Actinium Pharmaceuticals

|

GlycoMimetics, Inc.

|

Ocera Therapeutics

|

|

ArQule

|

GTx

|

Soligenix

|

|

AVEO Pharmaceuticals

|

Heat Biologics

|

Stemline Therapeutics

|

|

Cerulean Pharmaceuticals

|

Kura Oncology

|

Tokai Pharmaceuticals

|

|

CytRx

|

MEI Pharma

|

TRACON Pharmaceuticals

|

|

Endocyte

|

Mirati Therapeutics

|

Verastem

|

|

Fate Therapeutics

|

Neuralstem

|

In 2016, when this peer group was confirmed by the Compensation Committee for use in setting 2017 compensation, none of these companies had active product candidates more advanced than Phase 3 and our market capitalization was at approximately the 24th percentile of the group.

Components of our Compensation Program

The compensation program for our named executive officers consists of base salary, annual variable incentives under our short-term incentive (“STI”) program and long-term incentives, for which we currently use stock option awards. Our named executive officers are also entitled to certain compensation upon termination of their employment. We believe these different forms of compensation provide appropriate incentives to achieve our business goals within the context of our overall philosophy for compensation.

It is the objective of the Compensation Committee to generally establish compensation for our named executive officers so that base salary and short-term incentive target opportunities are at or below the 50th percentile of the competitive market composite, with long-term incentive opportunities between the 50th and the 75h percentile of the competitive market composite, subject to downward adjustment to reflect prior performance. The Compensation Committee believes these targets are consistent with our philosophy discussed above of establishing compensation at competitive levels in order to attract and retain high performing executives, while focusing on opportunities to align our named executive officers’ interests with the interest of our shareholders in increasing long-term shareholder value.

18

Base Salary. The base salary payable to each named executive officer is intended to provide a fixed component of compensation reflecting the executive’s skill set, experience, roles and responsibilities.

For 2017, each of the named executive officers received increases in salary consistent with benchmarking recommendations from the 2016 report delivered to the Committee by Radford. Dr. Suzdak and Dr. Jeong’s salaries previously had been increased in mid-2014 and set at the 25th percentile of the competitive market composite at the time. When we hired Dr. Benaim in 2015 and Dr. Nolan in 2016, their base salaries were set at amounts resulting from the negotiations necessary to attract them and reflected approximately the 50th percentile of the competitive market composite data being used by the Company at the time as part of its executive compensation program. The named executive officers’ 2017 salaries generally fell in line with the percentage benchmarks previously used for the applicable named executive officer.

Short-term Incentive Program.

General. Our STI program is intended to provide a cash incentive to our named executive officers for achieving Company-wide goals approved at the beginning of each year by the Compensation Committee. We believe that having an annual STI program provides an important and customary retention tool and motivates our executives to achieve the specific goals that are a part of the program. The Compensation Committee establishes a set bonus target expressed as a percentage of salary for each named executive officer and established goals for the STI program. After the conclusion of the year, the Compensation Committee determines at what level the goals were achieved.

Target Payout. The STI program is structured so that achievement of the Company-wide goals at a level of 100% would result in the named executive officer receiving an STI target payment in an amount equal to a specified percentage of his or her base salary. The target percentages were equal to 50%, 35%, 40% and 35% for Dr. Suzdak, Dr. Jeong, Dr. Benaim and Dr. Nolan, respectively. These percentages were consistent with the 50th percentile of the competitive market composite provided by Radford in 2016. Accordingly, because these percentages are expressed as a percentage of base salaries, the STI payment opportunities for Dr. Suzdak and Dr. Jeong are lower than the 50th percentile of the competitive market composite.

Company-wide Goals. For 2017, the Compensation Committee established three categories of Company-wide goals. This approach of using Company-wide goals reflects our belief that if the primary focus of our named executive officers is the achievement of Company-wide goals that are shared across the organization, then we will increase the likelihood of achieving our strategic plan. However, in order to take into account individual performance, the Compensation Committee established different weighting for each named executive officer based on their areas of responsibility. For 2017, the Compensation Committee selected the following goals:

| 1. |

Clinical and Scientific Goals, the purpose of which was to advance the clinical status of compounds in the portfolio (weighted 40% for Dr. Suzdak, 50% for Dr. Benaim, 30% for Dr. Jeong and 40% for Dr. Nolan):

|

19

| · |

Complete Stage 2 of RX-3117 Phase 1b/2a clinical proof-of-concept trial in pancreatic cancer

|

| · |

Determine maximum tolerated dose of RX-3117 in combination with Abraxane®

|

| · |

Complete Stage 1of RX-3117 Phase 2a clinical trial in bladder cancer

|

| · |

Complete enrollment of RX-5902 (Supinoxin) Phase 2a clinical trial in triple negative breast cancer

|

| · |

Complete RX-0201 (Archexin) Phase 2a clinical trial in metastatic renal cell carcinoma

|

| · |

Complete filing of RX-5902 solubility enhancing derivative patent application and synthesize/characterize related drug conjugate

|

| 2. |

Financial and Strategic Goals, the purpose of which was to end the year with a longer cash ‘runway’ than at the beginning of the year (weighted 40% for Dr. Suzdak, 30% for Dr. Benaim 50% for Dr. Jeong, and 40% for Dr. Nolan):

|

| · |

Complete a corporate partnership for specified product candidates

|

| · |

Complete additional financings

|

| · |

Target greater than 12 months of cash on hand at year end

|

| 3. |

Operational goals, the purpose of which was to have effective operations (weighted 20% for each named executive officer):

|

| · |

Meet or exceed expense and cash management targets based on 2017budget, including introducing practices to improve overall productivity

|

| · |

Build a stronger organization

|

Achievement of Company-wide Goals and Payout. In early 2017, the Compensation Committee assessed our progress on the Company-wide goals and determined the amounts earned under the STI program. The Committee determined that progress had been made on the clinical goals, but the goals related to the RX-3117 clinical trial with Abraxane and the RX-0201 Phase 2a clinical trial had not been completed by the end of the year. The Committee determined for the financial and strategic goals that while we had completed two financings in 2017 and met targets for cash on hand, a corporate partnership had not been completed. The Committee determined that the operational goals were fully met based on continued strong improvements to the organization and our achievement of our budget expectations. The Committee’s assessment of the goal completion, as well as its overall assessment of the performance of the named executive officers, resulted in an STI payout for Dr. Suzdak of 70% of his target (or 35% of his base salary), 70% for Dr. Jeong (or 24.5% of his base salary), 85% for Dr. Benaim (or 34% of his base salary), and 70% for Dr. Nolan (or 24.5% of her base salary).

20

The table below shows each executive officer’s target STI award and the amount earned under the STI plan. The STI awards were paid in cash.

|

Name

|

Target STI Payout

|

Earned STI

Award

Percentage

|

Earned STI Award

Value

|

|||||||||

|

Peter Suzdak

|

$

|

225,000

|

70

|

%

|

$

|

157,500

|

||||||

|

Tae Heum Jeong

|

$

|

105,000

|

70

|

%

|

$

|

73,500

|

||||||

|

Ely Benaim

|

$

|

160,000

|

85

|

%

|

$

|

136,000

|

||||||

|

Lisa Nolan

|

$

|

113,750

|

70

|

%

|

$

|

79,625

|

||||||

Long-term Incentive Program. Our use of equity awards is intended to align our named executive officers’ interests with the interest of our shareholders by providing an incentive to our named executive officers to increase long-term shareholder value. Furthermore, we believe that in the biopharmaceutical industry, equity awards are a primary motivator to retain executives. For 2017, we used a mix of stock options and restricted stock units for equity awards. We determine the size, mix and frequency of the awards based on numerous factors, including the executive’s skills and experience, the executive’s responsibilities, performance in the prior year and the approach to setting compensation described under “—Determination of Compensation” above.

In January 2017, the Compensation Committee granted a mix of stock options and restricted stock units (“RSUs”) to Dr. Suzdak, Dr. Jeong, Dr. Benaim and Dr. Nolan. RSUs were awarded in 2017 for the first time in order to provide named executive officers with awards that have immediate in-the-money value, to encourage retention, and increase the direct alignment with stockholder interests. The Compensation Committee granted these awards 75% as stock options and 25% as RSUs by value, which reflects the Committee’s view of the balance of providing incentives to our executives to achieve future stock price appreciation with the benefits of RSUs. In determining the size of the awards, the Committee considered market composite data and generally adjusted awards downward to reflect each executive’s 2016 performance with respect to the goals under the 2016 short-term incentive plan, balanced by a view of the executive’s future potential.

All of the stock options and RSUs issued to the named executive officers vest over a four year-period, with the first installment vesting on the first anniversary of the award in the case of stock options and on the last business day of the month following the first anniversary of the award in the case of RSUs.

Employment Agreements. At the time each of our named executive officers joined the Company, we entered into employment agreements with them. Dr. Jeong’s agreement was subsequently amended in 2010 to reflect developments in our business. These agreements were designed to be a part of a competitive compensation package for a publicly traded company and to keep our named executive officers focused on our business goals and objectives. The agreements are described in detail in the narrative disclosure following the Summary Compensation Table below. On December 11, 2017, Dr. Jeong informed us of his resignation from the Company effective March 15, 2018, and entered into an agreement with us to formalize the terms of his resignation and to provide for an arrangement pursuant to which Dr. Jeong has agreed to provide transition and advisory services through March 15, 2019.

Payments on Termination. Pursuant to their employment agreements, each of our named executive officers is entitled to specified benefits in the event of the termination of their employment under specified circumstances, including termination following a change of control of the Company. The terms of these arrangements are more fully described below under “Employment Agreements” and “Potential Payments Upon a Termination or Change in Control.” We believe these protections are appropriate for the senior executives of a biopharmaceutical company such as the Company, including because of the level of acquisition activity in this industry. We believe that providing benefits in the event of a change of control of the Company allows our named executive officers to focus their attention on building our business rather than on the personal implications of a transaction.

21

REPORT OF THE COMPENSATION COMMITTEE

THE FOLLOWING REPORT OF THE COMPENSATION COMMITTEE DOES NOT CONSTITUTE SOLICITING MATERIAL AND SHOULD NOT BE DEEMED FILED OR INCORPORATED BY REFERENCE INTO ANY OTHER FILING BY US UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934, EXCEPT TO THE EXTENT WE SPECIFICALLY INCORPORATE THIS REPORT.

The Compensation Committee of the Board of Directors of the Company has reviewed and discussed with management the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K. Based on such review and discussions, the Compensation Committee recommended to the board that the Compensation Discussion and Analysis be included in this Proxy Statement and in the Company’s Annual Report on Form 10-K (including through incorporation by reference to this Proxy Statement).

|

By the Compensation Committee:

|

|

|

Charles Beever (Chairman)

|

|

|

Richard J. Rodgers

|

|

|

Peter Brandt

|

22

Summary Compensation Table

The following table sets forth the annual and long-term compensation, from all sources, for our named executive officers for services rendered in all capacities to the Company for the years ended December 31, 2017, 2016 and 2015, except as noted below. Our named executive officers include our principal executive officer, our principal financial officer during 2017 and the two other executive officers that served as executive officers during 2017. The compensation described in this table does not include medical or other benefits which are available generally to all of our salaried employees.

|

Name and Principal Position(s)

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

($)(1)

|

Option

Awards

($)(1)(2)

|

Non-

Equity

Incentive

Plan

($)(2)(3)

|

All Other

Compensation

($)

|

Total

($)

|

||||||||||||||||||||||

|

Peter D. Suzdak

Chief Executive Officer

|

2017

|

450,000

|

--

|

46,000

|

135,743

|

157,500

|

16,489

|

805,732

|

||||||||||||||||||||||

|

2016

|

430,000

|

--

|

-

|

229,581

|

150,500

|

14,010

|

824,091

|

|||||||||||||||||||||||

|

2015

|

430,000

|

--

|

-

|

629,484

|

-

|

12,947

|

1,072,431

|

|||||||||||||||||||||||

|

Tae Heum Jeong

Former Chief Financial Officer

|

2017

|

300,000

|

-

|

11,592

|

34,658

|

73,500

|

15,557

|

435,307

|

||||||||||||||||||||||

|

2016

|

295,000

|

-

|

-

|

22,958

|

61,950

|

13,736

|

393,644

|

|||||||||||||||||||||||

|

2015

|

295,000

|

-

|

-

|

185,342

|

-

|

12,947

|

493,289

|

|||||||||||||||||||||||

|

Ely Benaim (4)

Chief Medical Officer

|

2017

|

400,000

|

--

|

17,480

|

51,987

|

136,000

|

16,300

|

621,767

|

||||||||||||||||||||||

|

2016

|

375,000

|

100,000

|

-

|

114,791

|

120,000

|

13,983

|

723,774

|

|||||||||||||||||||||||

|

2015

|

343,750

|

50,000

|

-

|

606,590

|

61,875

|

96,586

|

1,158,801

|

|||||||||||||||||||||||

|

Lisa Nolan (5)

Chief Business Officer

|

2017

|

325,000

|

-

|

11,960

|

36,391

|

79,625

|

16,027

|

469,003

|

||||||||||||||||||||||

|

2016

|

156,513

|

-

|

-

|

192,870

|

38,220

|

12,024

|

399,627

|

|||||||||||||||||||||||

| (1) |

Reflects grant date fair value computed in accordance with FASB ASC Topic 718.

|

| (2) |

The actual value realized by each officer with respect to option awards will depend on the difference between the market value of our Common Stock on the date the option is exercised and the exercise price. For 2015, option awards reflect options awarded as an equity grant as a long-term incentive in addition to amounts paid in respect of the portion of 2015 short-term incentive awards that was delivered in equity.

|

| (3) |

For 2015, non-equity incentive awards for Dr. Suzdak and Dr. Jeong, and a portion of the award for Dr. Benaim, were paid by delivery of additional stock options. See the discussion in footnote 2 above.

|

| (4) |

Dr. Benaim joined us in February 2015. His 2015 salary represents salary for the portion of 2015 during which he was our employee.

|

| (5) |

Dr. Nolan joined us in July 2016. Her 2016 salary represents salary for the portion of 2016 during which she was our employee.

|

23

Grants of Plan-Based Awards Table

This table provides information regarding grants of plan-based awards to each of our named executive officers during 2017:

|

Name

|

Award Type

|

Grant

Date

|

Estimated Future

Payouts

Under

Non-

Equity

Incentive

Plan

Awards (Target)

($)

|

All

Other

Stock Awards: Number

of Units

of Stock

(#)

|

All Option Awards:

Number of Securities Underlying Options (#)

|

Exercise

or Base

Price of Option Awards ($/Share)

(1)

|

Grant

Date

Fair

Value of Stock

and

Option Awards

($) (2)

|

|||||||

|

Peter Suzdak

|

STI Award

|

|

225,000

|

|||||||||||

|

RSUs

|

1/20/2017

|

25,000

|

46,000

|

|||||||||||

|

Stock Options

|

1/20/2017

|

117,500

|

1.84

|

135,743

|

||||||||||

|

Tae Heum

Jeong

|

STI Award

|

|

105,000

|

|||||||||||

|

RSUs

|

1/20/2017

|

6,300

|

11,592

|

|||||||||||

|

Stock Options

|

1/20/2017

|

30,000

|

1.84

|

34,658

|

||||||||||

|

Ely Benaim

|

STI Award

|

|

160,000

|

|||||||||||

|

RSUs

|

1/20/2017

|

9,500

|

17,480

|

|||||||||||

|

Stock Options

|

1/20/2017

|

45,000

|

1.84

|

51,987

|

||||||||||

|

Lisa Nolan

|

STI Award

|

|

113,750

|

|||||||||||

|

RSUs

|

1/20/2017

|

6,500

|

11,960

|

|||||||||||

|

Stock Options

|

1/20/2017

|

31,500

|

1.84

|

36,391

|

| (1) |

Amounts represent the closing price of our Common Stock as reported on NYSE American on the grant date.

|

| (2) |

Reflects the grant date fair value of each award computed in accordance with ASC 718. These amounts do not correspond to the actual value that will be recognized by the named executive officers.

|

Narrative Disclosure Relating to Summary Compensation Table and Grants of Plan-Based Awards Table

For an explanation of the amount of salary, bonus, stock and option awards and other compensation paid to our named executive officers, please see “–Compensation Discussion & Analysis–Components of Our Compensation Program” above and “–Employment Agreements” below, as well as the footnotes to the Summary Compensation Table and Grants of Plan-Based Awards Table.

Employment Agreements

We have employment agreements with each of our named executive officers.

24