DEF 14A: Definitive proxy statements

Published on July 23, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a−101)

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

|

Filed by the Registrant

|

☑ |

|

Filed by a Party other than the Registrant

|

☐ |

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a−6(e)(2))

|

| ☑ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material Pursuant to Section 240.14a−12

|

Rexahn Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ |

No fee required.

|

| ☐ |

Fee computed on table below per Exchange Act Rules 14a−6(i)(1) and 0−11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0−11 (set forth the amount on which the filing fee

is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0−11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

REXAHN PHARMACEUTICALS, INC.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held August 30, 2018

To Our Shareholders:

Notice is hereby given that a Special Meeting of the Shareholders (the “Special Meeting”) of Rexahn Pharmaceuticals, Inc. (the

“Company”) will be held on August 30, 2018, at 8:00 a.m. (local time), at the Radisson Hotel, 3 Research Court, Rockville, Maryland 20850. The Special Meeting is called for the following purposes:

|

|

1. |

to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 50,000,000 to

75,000,000;

|

|

|

2. |

to approve the adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal

1; and

|

|

|

3. |

to consider and take action upon such other matters as may properly come before the Special Meeting or any postponement or adjournment thereof.

|

The Board of Directors has fixed July 10, 2018 as the record date for the determination of shareholders entitled to notice of, and to

vote at, the Special Meeting. Only shareholders of record at the close of business on that date will be entitled to receive notice of and to vote at the Special Meeting or any adjournment or postponement thereof.

The Board of Directors recommends that you vote FOR

Proposal 1 and FOR Proposal 2.

You are cordially invited to attend the Special Meeting. Whether or not you expect to attend, you are respectfully requested by the

Board of Directors to promptly either sign, date and return the enclosed proxy card or vote via the Internet or by telephone by following the instructions provided on the proxy card. A return envelope, which requires no postage if mailed in the

United States, is enclosed for your convenience.

|

By Order of the Board of Directors,

|

|

|

|

|

Peter Brandt

|

|

|

Chairman of the Board of Directors

|

|

|

July 23, 2018

|

|

Important Notice Regarding the Availability of Proxy Materials for the

Special Meeting of Shareholders to be Held on August 30, 2018:

Copies of our Proxy Materials, consisting of the Notice of Special Meeting and the Proxy Statement are available at

http://www.viewproxy.com/rexahn/2018SM

|

REXAHN PHARMACEUTICALS, INC.

15245 Shady Grove Road, Suite 455

Rockville, Maryland 20850

(240) 268-5300

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

To be held August 30, 2018

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors of

Rexahn Pharmaceuticals, Inc. (“we”, “us”, or the “Company”) for the Special Meeting of Shareholders to be held at the Radisson Hotel, located at 3 Research Court, Rockville, Maryland 20850, on August 30, 2018, at 8:00 a.m. (local time) and for any

postponement or adjournment thereof (the “Special Meeting”), for the purposes set forth in the accompanying Notice of Special Meeting of Shareholders.

We are providing our Proxy Materials to record shareholders by sending a printed copy of the full set of our proxy materials (the “Proxy

Materials”), consisting of the Notice of Special Meeting, this Proxy Statement and a proxy card (the “Proxy Card”) by mail. As permitted by Securities and Exchange Commission (“SEC”) rules, we are also providing access to the Proxy Materials on the

Internet.

The Proxy Statement and accompanying form of proxy are first being mailed to stockholders on or about July 27, 2018.

1

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND SPECIAL MEETING

|

Q:

|

Why are these materials being made available to me?

|

| A: |

The Proxy Materials are being provided to you in connection with the Special Meeting and include this Proxy Statement and the related Proxy Card that are being used in

connection with the Board of Directors’ solicitation of proxies for the Special Meeting. The information included in this Proxy Statement relates to the proposals to be voted on at the Special Meeting, the voting process and certain

other required information.

|

|

Q:

|

How do I access the Company’s Proxy Materials online?

|

| A: |

The Proxy Card provides instructions for accessing the Proxy Materials over the Internet, and includes the Internet address where those materials are available. The

Company’s Proxy Statement for the Special Meeting can also be viewed on the Company’s website at www.rexahn.com.

|

|

Q:

|

What shares owned by me can be voted?

|

| A: |

All shares of the Company’s common stock, par value $0.0001 per share (“Common Stock”) owned by you as of the close of business on the Record Date may be voted by you. Each

share of Common Stock is entitled to one vote. These shares include those (1) held directly in your name as the shareholder of record (“Shareholder of Record”), and (2) held for you as the beneficial owner through a broker, bank or

other nominee.

|

|

Q:

|

What is the Record Date?

|

| A: |

The Record Date is July 10,

2018. Only Shareholders of Record as of the close of business on this date will be entitled to vote at the Special Meeting.

|

|

Q:

|

How many shares are outstanding?

|

| A: |

As of the Record Date, the Company had 31,751,939 shares of Common Stock outstanding.

|

|

Q:

|

What is the difference between holding shares as a Shareholder of Record and as a beneficial owner?

|

| A: |

As summarized below, there are some distinctions between shares held of record and those owned beneficially.

|

Shareholder of Record

If your shares are registered directly in your name with the Company’s transfer agent, you are considered, with respect to those shares,

the Shareholder of Record. As the Shareholder of Record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Special Meeting.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares

held in “street name” and your broker, bank or other nominee is considered, with respect to those shares, the Shareholder of Record. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also

invited to attend the Special Meeting. However, because you are not the Shareholder of Record, you may not vote these shares in person at the Special Meeting unless you receive a proxy from your broker, bank or other nominee. Your broker, bank or

other nominee has provided voting instructions for you to use. If you wish to attend the Special Meeting and vote in person, please contact your broker, bank or other nominee so that you can receive a legal proxy to present at the Special Meeting.

2

| Q: |

What am I voting on?

|

| A: |

You are being asked to vote on (1) the approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized

shares of Common Stock from 50,000,000 to 75,000,000, and (2) the approval of the adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve

Proposal 1.

|

The Company is not currently aware of any matters that will be brought before the Special Meeting (other than procedural matters) that

are not referred to in the enclosed Proxy Card. If any other business should properly come before the Special Meeting or any postponement or adjournment thereof, the persons named in the proxy will vote on such matters according to their best

judgment. Discretionary authority to vote on such matters is conferred by such proxies upon the persons voting them.

| Q: |

How do I vote?

|

| A: |

Shareholders of Record may vote by completing and signing the enclosed Proxy Card and returning it promptly in the enclosed postage prepaid, addressed envelope, or at the

Special Meeting in person. We will pass out written ballots to anyone who is eligible to vote at the Special Meeting. We also will request persons, firms, and corporations holding shares of the Company’s Common Stock in their names or

in the name of their nominees, which are beneficially owned by others, to send proxy material to and obtain proxies from the beneficial owners and will reimburse the holders for their reasonable expenses in so doing. Proxy Cards

properly executed and delivered by shareholders (by mail or via the Internet) and timely received by the Company will be voted in accordance with the instructions contained therein. If you authorize a proxy to vote your shares over the

Internet or by telephone, you should not return a Proxy Card by mail, unless you are revoking your proxy. If you hold your shares in “street name” through a broker, bank or other nominee, and are therefore not a Shareholder of Record,

you must request a legal proxy from your broker, bank or other nominee in order to vote at the Special Meeting.

|

If you hold your shares in “street name” through a broker, bank or other nominee, you may vote via the Internet by going to www.proxyvote.com, while Shareholders of Record may go to www.aalvote.com/rnn

to vote via the Internet. All shareholders must have their control number in order to vote via the Internet.

| Q: |

How many votes do you need to hold the Special Meeting?

|

| A: |

Forty percent of the Company’s issued and outstanding shares of Common Stock as of the Record Date must be present at the Special Meeting, either in person or by proxy, in

order to hold the Special Meeting and conduct business. This is called a quorum.

|

| Q: |

What are the voting requirements to approve the proposals?

|

| A: |

The affirmative vote of a majority of the Company’s issued and outstanding shares is required to approve the authorized share increase. The affirmative vote of a majority

of the shares present in person or represented by proxy at the Special Meeting and entitled to vote on the matter is required to approve an adjournment of the Special Meeting.

|

| Q: |

Who will count the votes?

|

| A: |

Votes at the Special Meeting will be counted by an inspector of election, who will be appointed by the Board of Directors or the chairman of the Special Meeting.

|

| Q: |

What is the effect of not voting?

|

| A: |

If you are a beneficial owner of shares in street name and do not provide the broker, bank or other nominee that holds your shares with specific voting instructions then,

under applicable rules, the broker, bank or other nominee that holds your shares can generally vote on “routine” matters, but cannot vote on “non-routine” matters. In the case of a non-routine item, your shares will be considered

“broker non-votes” on that proposal.

|

3

Proposal 1 (approval of the authorized share increase) and Proposal 2 (approval of the adjournment of the Special Meeting, if necessary,

if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 1) are matters we believe will be considered “routine.”

If you are a Shareholder of Record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business

at the Special Meeting. If you are a Shareholder of Record and you properly sign and return your Proxy Card, your shares will be voted as you direct. If no instructions are indicated on such Proxy Card and you are a Shareholder of Record, shares

represented by the proxy will be voted in the manner recommended by the Board of Directors on all matters presented in this Proxy Statement, namely “FOR” the approval of the authorized share increase, and “FOR” the adjournment of the Special

Meeting, if necessary.

|

Q:

|

How are broker non-votes and abstentions treated?

|

| A: |

Broker non-votes and abstentions with respect to a proposal are counted as present or represented by proxy for purposes of establishing a quorum. If a quorum is present,

broker non-votes and abstentions will have the same effect as votes against Proposal 1 (approval of the authorized share increase), and broker-non votes will have no effect on the outcome of the votes on Proposal 2 (approval of the

adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 1), while abstentions will have the same effect as votes against proposal 2.

|

|

Q:

|

Can I revoke my proxy or change my vote after I have voted?

|

| A: |

You may revoke your proxy and change your vote by voting again via the Internet or telephone, by completing, signing, dating and returning a new Proxy Card or voting

instruction form with a later date, or by attending the Special Meeting and voting in person. Only your latest dated Proxy Card received at or prior to the Special Meeting will be counted. Your attendance at the Special Meeting will not

have the effect of revoking your proxy unless you forward written notice to the Secretary of the Company at the above stated address or you vote by ballot at the Special Meeting.

|

|

Q:

|

What does it mean if I receive more than one Proxy Card?

|

| A: |

It means that you have multiple accounts at the transfer agent and/or with brokers, banks or other nominees. To ensure that all of your shares in each account are voted,

please sign and return all Proxy Cards, vote with respect to all accounts via the internet or by telephone, or, if you plan to vote at the Special Meeting, contact each broker, bank or other nominee so that you can receive all necessary

legal proxies to present at the Special Meeting.

|

|

Q:

|

Who is soliciting my vote and who will bear the cost of this solicitation?

|

| A: |

Our Board of Directors is making this solicitation, and we will bear the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and

soliciting votes. We have engaged Alliance Advisors LLC (“Alliance”) to assist us with the solicitation of proxies and expect to pay Alliance approximately $30,000, plus expenses, for its services. Alliance is reaching out to stockholders to encourage them to vote in favor of Proposal 1. In addition to solicitations by mail, Alliance may solicit proxies by telephone and email. If Alliance calls you, please answer the call. If you need assistance with the voting of your shares, you may contact

Alliance toll free at (844) 670-2142. Copies of solicitation materials may be furnished to brokers, custodians, nominees and other fiduciaries for forwarding to beneficial owners of shares of Rexahn common stock, and normal

handling charges may be paid for such forwarding service. Officers and other Rexahn employees, who will receive no additional compensation for their services, may solicit proxies by mail, e-mail, via the Internet, personal interview or

telephone.

|

4

| Q: |

Do I have appraisal or similar dissenter’s rights?

|

| A: |

Appraisal rights and similar rights of dissenters are not available to shareholders in connection with proposals brought before the Special Meeting.

|

|

Q:

|

Where can I find the voting results of the Special Meeting?

|

| A: |

The Board of Directors will announce the voting results at the Special Meeting. We will also publish the results in a Current Report on Form 8-K within four business days

after the date of the Special Meeting. We will file that report with the SEC, and you can get a copy:

|

|

|

· |

by contacting the Company’s corporate offices via phone at (240) 268-5300 or by e-mail at ir@rexahn.com; or

|

|

|

· |

through the SEC’s EDGAR system at www.sec.gov.

|

5

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITY HOLDERS

The table below sets forth the beneficial ownership of our Common Stock as of July 10, 2018 by the following individuals or entities:

|

|

· |

each director and nominee;

|

|

|

· |

each named executive officer identified in the Summary Compensation Table; and

|

|

|

· |

all current directors and executive officers as a group.

|

As of July 10, 2018, no person or group of affiliated persons is known to us to beneficially own 5% or more of our outstanding Common

Stock.

As of July 10, 2018, 31,751,939 shares of our Common Stock were issued and outstanding. All persons named in the table below have sole

voting power and sole investment power with respect to the shares indicated as beneficially owned. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock that could be

acquired by the exercise of stock options within 60 days of July 10, 2018 are deemed outstanding, while such shares are not deemed outstanding for purposes of computing percentage ownership of any other person. In addition, unless otherwise

indicated, the address for each person named below is c/o Rexahn Pharmaceuticals, Inc., 15245 Shady Grove Road, Suite 455, Rockville, Maryland 20850.

|

Shares of Rexahn Pharmaceuticals

Common Stock

Beneficially Owned

|

||||||||

|

Name of Beneficial Owner

|

Number of Shares

|

Percentage

|

||||||

|

Directors and Named Executive Officers:

|

||||||||

|

Peter Suzdak

|

516,542

|

(1)

|

1.6

|

%

|

||||

|

Charles Beever

|

63,500

|

(2)

|

*

|

|||||

|

Kwang Soo Cheong

|

62,800

|

(3)

|

*

|

|||||

|

Peter Brandt

|

75,500

|

(4)

|

*

|

|||||

|

Richard J. Rodgers

|

45,500

|

(5)

|

*

|

|||||

|

Tae Heum Jeong

|

173,625

|

(6)

|

*

|

|||||

|

Ely Benaim

|

171,831

|

(7)

|

*

|

|||||

|

Lisa Nolan

|

79,750

|

(8)

|

*

|

|||||

|

Douglas J. Swirsky

|

-

|

*

|

||||||

|

All current executive officers and directors as a group (8 persons)

|

1,015,423

|

(9)

|

3.2

|

%

|

||||

|

*

|

Represents less than 1% of the issued and outstanding shares of our Common Stock as of July 10, 2018.

|

| (1) |

Includes Dr. Suzdak’s options to purchase 494,292 shares of Common Stock that are currently exercisable or exercisable within 60 days of July 10, 2018.

|

| (2) |

Includes Mr. Beever’s options to purchase 62,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of July 10, 2018.

|

| (3) |

Includes Dr. Cheong’s options to purchase 62,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of July 10, 2018.

|

| (4) |

Includes Mr. Brandt’s options to purchase 60,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of July 10, 2018.

|

| (5) |

Includes Mr. Rodgers’ options to purchase 45,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of July 10, 2018

|

6

| (6) |

Includes Dr. Jeong’s options to purchase 121,550 shares of Common Stock that are currently exercisable or exercisable within 60 days of July 10, 2018.

|

| (7) |

Includes Dr. Benaim’s options to purchase 169,456 shares of Common Stock that are currently exercisable or exercisable within 60 days of July 10, 2018.

|

| (8) |

Includes Dr. Nolan’s options to purchase 78,125 shares of Common Stock that are currently exercisable or exercisable within 60 days of July 10, 2018.

|

| (9) |

Includes options to purchase 972,873 shares of Common Stock that are currently exercisable or exercisable within 60 days of July 10, 2018.

|

7

PROPOSAL 1: APPROVAL OF AN AMENDMENT TO THE COMPANY’S

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 50,000,000 TO 75,000,000

The Board of Directors has unanimously approved, and recommended that our shareholders approve, an amendment to our Amended and Restated

Certificate of Incorporation, in substantially the form attached hereto as Annex A (the “Certificate of Amendment”) (in the event it is deemed by the Board to be

advisable), to increase the number of authorized shares of Common Stock from 50,000,000 to 75,000,000. If the shareholders approve the authorized share amendment, the authorized share increase will become effective upon the filing of the

Certificate of Amendment with the Secretary of State of the State of Delaware.

As of July 10, 2018, there were 31,751,939 shares of our Common Stock outstanding. In addition, as of the same date, 3,714,425 shares of

Common Stock were reserved for issuance under our equity compensation plans, and 7,099,609 shares of

Common Stock were reserved for issuance upon exercise of our warrants to purchase Common Stock. Accordingly, there are 7,434,027 shares of Common Stock available for all other corporate purposes, such as additional capital raising activities, prior

to the addition of the shares for which we are seeking approval pursuant to this proposal. At the Company’s Annual Meeting of Shareholders in June 2018, the Board of Directors

requested a larger increase to the Company’s authorized shares of Common Stock than what is currently being proposed, and while the proposal at the Annual Meeting received the affirmative vote of a majority of the shares cast, it was not approved

because it did not receive the affirmative vote of the holders of a majority of the shares of the Common Stock outstanding on the record date for that meeting. Based on the level of support for the prior proposal and discussions with shareholders,

the Board of Directors is now presenting this proposal with a smaller increase to the authorized shares of Common Stock.

Although at present there are no specific plans, arrangements or understandings to issue any of the newly authorized shares, the Board of Directors

believes an increase in the number of authorized shares of Common Stock is necessary because the availability of additional authorized but unissued shares will provide us with greater flexibility in considering actions that may be desirable or

necessary to accomplish our business objectives and that involve the issuance of our Common Stock. An increase in the number of authorized shares would allow us to issue Common Stock for a variety of corporate purposes, such as raising additional

capital, without the delay associated with soliciting shareholder approval and convening a special meeting of shareholders. Capital that we raise through the issuance of additional shares could be used to continue or expand our current clinical

development programs, or to expand or diversify our business or research and development programs through the acquisition of other businesses or products.

If the shareholders do not approve the proposed amendment, we will be limited by the lack of unissued and unreserved authorized shares

of Common Stock in our ability to use shares of Common Stock for equity financings or collaborations, and our shareholder value may be harmed by this limitation. The inability to use equity financings in order to raise capital could lead to delays

to or the suspension of our clinical programs as a result of the lack of funding. The inability to raise capital could also have a negative impact on potential collaborations, partnerships, and other business opportunities integral to our growth

and success by creating a perception that we do not have reasonable access to capital and because some collaborators and partners will be interested in acquiring some of our equity as part of collaborations, partnerships or other ventures.

Similarly, we may have difficulty attracting, retaining and motivating skilled and experienced employees, officers and directors if they also perceive that we do not have access to capital and ability to use authorized capital for general corporate

purposes. In short, if our stockholders do not approve this proposal, we may not be able to access the capital markets, complete corporate collaborations, partnerships or other strategic transactions, attract, retain and motivate employees, and

pursue other business opportunities integral to our growth and success. Without access to additional authorized shares for these fundamental activities, our Board of Directors may be forced to seek strategic alternatives with third parties who will

have enhanced leverage because they will be aware that the Company’s options are limited.

If the shareholders approve the proposed amendment, the Board may cause the issuance of the additional shares of Common Stock without

further approval, except as may be required by law, regulatory authorities, or the rules of NYSE American or any other stock exchange on which our shares may be listed. The proposed new authorized shares of Common Stock would become part of the

existing class of Common Stock and, if and when issued, would have the same rights and privileges as the shares of common stock presently issued and outstanding. Our shareholders do not have any preemptive right to purchase or subscribe for any

part of any new or additional issuance of our securities. The increase in the authorized shares of Common Stock will not itself cause any changes in our capital accounts or have any immediate effect on the rights of existing shareholders. However,

to the extent that additional authorized shares of common stock are issued in the future, the issuance could have the effect of diluting existing shareholder earnings per share, book value per share and voting power.

8

An increase in the number of authorized shares of our common stock may make it more difficult to, or discourage an attempt to, obtain

control of us by means of a takeover bid that the Board determines is not in our best interest nor in the best interests our shareholders. However, the Board does not intend or view the proposed increase in the number of authorized shares of common

stock as an anti-takeover measure and is not aware of any attempt or plan to obtain control of us. We have no current plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover consequences.

The affirmative vote of the holders of a majority of the shares of the Common Stock outstanding on the Record Date will be required to

approve the authorized share increase. Accordingly, abstentions and broker non-votes (to the extent a broker does not exercise its authority to vote) will have the same effect as a vote against the proposal. Shares represented by valid proxies and

not revoked will be voted at the Special Meeting in accordance with the instructions given. If no voting instructions are given, such shares will be voted “FOR” this proposal.

The Board of Directors recommends that you vote FOR the approval of the Amendment to the Company’s Amended and Restated

Certificate of Incorporation to Increase the Authorized Shares of Common Stock from 50,000,000 to 75,000,000

9

PROPOSAL 2: THE ADJOURNMENT OF THE SPECIAL MEETING

Our shareholders are being asked to consider and vote upon an adjournment of the Special Meeting, if necessary, if a quorum is present,

to solicit additional proxies if there are insufficient votes in favor of approval of a proposed amendment to our restated certificate of incorporation to increase the authorized shares of common stock as described in Proposal 1.

Approval of the adjournment of the Special Meeting requires an affirmative vote of a majority in interest of the shareholders present in

person or by proxy and entitled to vote at the Special Meeting. Abstentions will count against the proposal.

The Board of Directors Recommends that you vote FOR

the adjournment of the Special Meeting, if a quorum is present, to solicit additional proxies if there are insufficient votes to approve Proposal 1.

10

SHAREHOLDER PROPOSALS

Shareholder Proposals Pursuant to Rule 14a-8

Shareholders interested in submitting a proposal for inclusion in the proxy statement for the 2019 Annual Meeting of Shareholders may do

so by submitting the proposal in writing to our executive offices, 15245 Shady Grove Road, Suite 455, Rockville, Maryland 20850, Attention: Corporate Secretary. Pursuant to Rule 14a-8 under the Exchange Act, to be eligible for inclusion in our

proxy statement for the 2019 Annual Meeting, shareholder proposals must be received no later than December 24, 2018, which is 120 days prior to the anniversary date of the proxy statement for the 2018 Annual Meeting. The submission of a shareholder

proposal does not guarantee that it will be included in the proxy statement.

Nominations and Shareholder Proposals Under our Bylaws

Our Amended and Restated Bylaws also establish an advance notice procedure with regard to nominations of persons for election to the

Board of Directors and shareholder proposals to be brought before an annual meeting. No shareholder proposal or nomination may be brought before the 2019 Annual Meeting unless, among other things, the submission contains certain information

concerning the proposal or the nominee, as the case may be, and other information specified in our Amended and Restated Bylaws, and the submission is received by us no earlier than the close of business on February 14, 2019, and no later than March

16, 2019. Proposals or nominations not meeting these requirements will not be entertained at the 2019 Annual Meeting.

Shareholders recommending candidates for consideration by the Nominating and Corporate Governance Committee must provide the candidate’s

name, biographical data and qualifications. Any such recommendation should be accompanied by a written statement from the individual of his or her consent to be named as a candidate and, if nominated and elected, to serve as a director. These

requirements are separate from, and in addition to, the SEC’s requirements that a shareholder must meet in order to have a shareholder proposal included in the proxy statement. A copy of the full text of these bylaw provisions may be obtained from

our website at www.rexahn.com.

HOUSEHOLDING

If you are a beneficial owner, but not the record holder, of shares of our Common Stock, your broker, bank or other nominee may only

deliver one (1) copy of this Proxy Statement to multiple shareholders at the same address, unless that nominee has received contrary instructions from one (1) or more of the shareholders. We will deliver, upon request, a separate copy of this Proxy

Statement to a shareholder at a shared address to which a single copy of the documents was delivered. A shareholder desiring to receive a separate copy of the Proxy Statement, now or in the future, should call our President, Chief Financial Officer

and Secretary, Douglas J. Swirsky, at 240-268-5300, or submit a request by writing to 15245 Shady Grove Road, Suite 455, Rockville, Maryland 20850 or by emailing us at ir@rexahn.com. Also, beneficial owners sharing an address who are receiving

multiple copies of proxy materials and annual reports and who wish to receive a single copy of such materials in the future will need to contact their broker, bank or other nominee to request that only a single copy of each document be mailed to

all shareholders at the same address in the future.

July 23, 2018

11

Annex A

CERTIFICATE OF AMENDMENT

OF

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

REXAHN PHARMACEUTICALS, INC.

Rexahn Pharmaceuticals, Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), does hereby certify as

follows:

1. The name of the Corporation is Rexahn Pharmaceuticals, Inc.

2. Article 4 of the Amended and Restated Certificate of Incorporation of the

Corporation, as amended to date, is hereby amended by replacing the first paragraph thereof with the following:

The total number of shares of all classes of stock which the Corporation shall have the authority to issue is

85,000,000 shares of the par value of $.0001 each, of which 10,000,000 are to be of a class designated Preferred Stock (the “Preferred Stock”) and 75,000,000 shares of the par value of $.0001 each are to be of a class designated Common Stock (the

“Common Stock”).

3. This Certificate of Amendment has been duly adopted by the Board of

Directors and stockholders of the Corporation in accordance with Section 242 of the General Corporation Law of the State of Delaware.

4. This Certificate of Amendment shall become effective at ____________

___.m. Eastern _____________Time on ___________, 201_.

IN WITNESS WHEREOF, the Corporation has caused its duly authorized officer to execute this Certificate of Amendment on this __________ day of _________,

_________.

|

|

REXAHN PHARMACEUTICALS, INC.

|

|

|

By:

|

||

|

Name:

|

||

|

Title:

|

||

REXAHN PHARMACEUTICALS, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR THE SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 30, 2018

The undersigned hereby appoints Peter Suzdak and Douglas J. Swirsky, and each of them, with power

to act without the other and with full power of substitution, as proxies and attorneys-in-fact and hereby authorizes them to represent and vote, as provided below, all the shares of Rexahn Pharmaceuticals, Inc. common stock which the undersigned is

entitled to vote, and, in their discretion, to vote upon such other business as may properly come before the Special Meeting of Shareholders of Rexahn Pharmaceuticals, Inc. to be held on August 30, 2018, at 8:00 a.m. (local time), at the Radisson

Hotel, 3 Research Court, Rockville, Maryland 20850, or any adjournment thereof, with all powers which the undersigned would possess if present at the meeting.

This proxy is

revocable and will be voted as directed, but if no instructions are specified, this proxy will be voted “FOR” Proposal 1 and “FOR” Proposal 2. If any other business is presented at the Special Meeting of Shareholders, this proxy will be voted by

those named in this proxy in their best judgment. At the present time, the Board of Directors knows of no other business to be presented at the Special Meeting of Shareholders.

Please mark, date, sign, and mail your proxy promptly in the envelope provided

IMPORTANT: SIGNATURE REQUIRED ON THE OTHER SIDE

PLEASE DETACH ALONG PERFORATED LINE AND MAIL

IN THE ENVELOPE PROVIDED.

KEEP THIS PORTION FOR YOUR RECORDS.

Important Notice Regarding the Availability of Proxy Materials for the

Special Meeting of Shareholders to be held August 30, 2018.

The Proxy Statement and 2017 Annual Report to Shareholders are available at: http://www.viewproxy.com/rexahn/2018SM

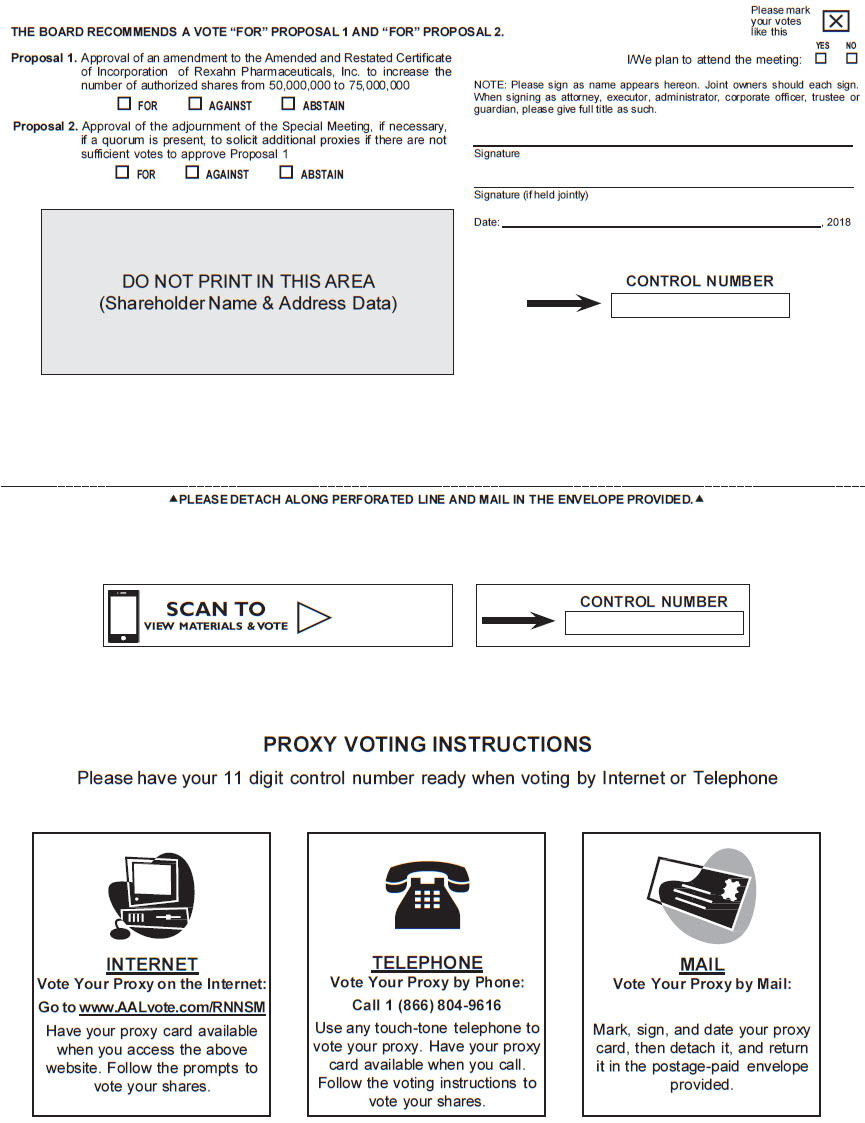

THE BOARD RECOMMENDS A VOTE “FOR” PROPOSAL 1 AND “FOR” PROPOSAL 2.Please mark your votes like this Proposal 1. Approval of an amendment to the Amended and Restated Certificate of Incorporation of Rexahn Pharmaceuticals, Inc. to increase

the number of authorized shares from 50,000,000 to 75,000,000 FORAGAINST ABSTAIN Proposal 2. Approval of the adjournment of the Special Meeting, if necessary, YES NO I/We plan to attend the meeting:NOTE: Please sign as name appears hereon.

Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee or guardian, please give full title as such.if a quorum is present, to solicit additional proxies if there are not sufficient votes to

approve Proposal FOR AGAINST ABSTAIN Signature Signature (if held jointly) Date:, 2018 DO NOT PRINT IN THIS AREA (Shareholder Name & Address Data) CONTROL NUMBER PLEASE DETACH ALONG PERFORATED LINE AND MAIL IN THE ENVELOPE PROVIDED.CONTROL

NUMBER PROXY VOTING INSTRUCTIONS Please have your 11 digit control number ready when voting by Internet or Telephone INTERNET Vote Your Proxy on the Internet: Go to www.AALvote.com/RNNSM Have your proxy card available when you access the above

website. Follow the prompts to vote your shares.TELEPHONE Vote Your Proxy by Phone: Call 1 (866) 804-9616 Use any touch-tone telephone to vote your proxy. Have your proxy card available when you call. Follow the voting instructions to vote your

shares. MAIL Vote Your Proxy by Mail: Mark, sign, and date your proxy card, then detach it, and return it in the postage-paid envelope provided.