DEF 14A: Definitive proxy statements

Published on February 14, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a−101)

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant | ☑ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a−6(e)(2))

|

| ☒ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material under §240.14a−12

|

Rexahn Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ |

No fee required.

|

| ☐ |

Fee computed on table below per Exchange Act Rules 14a−6(i)(1) and 0−11.

|

|

|

(1) |

Title of each class of securities to which transaction applies:

|

|

|

(2) |

Aggregate number of securities to which transaction applies:

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0−11 (set forth the amount on which the filing fee is calculated and state

how it was determined):

|

|

|

(4) |

Proposed maximum aggregate value of transaction:

|

|

|

(5) |

Total fee paid:

|

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0−11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1) |

Amount Previously Paid:

|

|

|

(2) |

Form, Schedule or Registration Statement No.:

|

|

|

(3) |

Filing Party:

|

|

|

(4) |

Date Filed:

|

REXAHN PHARMACEUTICALS, INC.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held March 26, 2019

To Our Shareholders:

Notice is hereby given that a Special Meeting of the Shareholders (the “Special Meeting”) of Rexahn Pharmaceuticals, Inc. (the

“Company”) will be held on March 26, 2019, at 8:00 a.m. (local time), at the Radisson Hotel, 3 Research Court, Rockville, Maryland 20850. The Special Meeting is called for the following purposes:

|

|

1. |

to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation, as amended, to effect a reverse stock split of the Company’s common stock at a

ratio within the range of 1:5 to 1:15, as determined by the Board of Directors and with such reverse stock split to be effected at such time and date, if at all, as determined by the Board of Directors in its sole discretion;

|

|

|

2. |

to approve the adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve

Proposal 1; and

|

|

|

3. |

to consider and take action upon such other matters as may properly come before the Special Meeting or any postponement or adjournment thereof.

|

The Board of Directors has fixed February 11, 2019 as the record date for the determination of shareholders entitled to notice of, and

to vote at, the Special Meeting. Only shareholders of record at the close of business on that date will be entitled to receive notice of and to vote at the Special Meeting or any adjournment or postponement thereof.

The Board of Directors recommends that you vote FOR

Proposal 1 and FOR Proposal 2.

You are cordially invited to attend the Special Meeting. Whether or not

you expect to attend, you are respectfully requested by the Board of Directors to promptly either sign, date and return the enclosed proxy card or vote via the

Internet or by telephone by following the instructions provided on the proxy card. A return envelope, which requires no postage if mailed in the United States, is enclosed for your

convenience.

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

|

Douglas J. Swirsky

|

|

|

President and Chief Executive Officer

|

|

|

February 14, 2019

|

|

Important Notice Regarding the Availability of Proxy Materials for the

Special Meeting of Shareholders to be Held on March 26, 2019:

Copies of our Proxy Materials, consisting of the

Notice of Special Meeting and the Proxy Statement are available at http://www.viewproxy.com/rexahn/2019SM

|

REXAHN PHARMACEUTICALS, INC.

15245 Shady Grove Road, Suite 455

Rockville, Maryland 20850

(240) 268-5300

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

To be held March 26, 2019

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors

(the “Board”) of Rexahn Pharmaceuticals, Inc. (“we”, “us”, or the “Company”) for the Special Meeting of Shareholders to be held at the Radisson Hotel, located at 3 Research

Court, Rockville, Maryland 20850, on March 26, 2019, at 8:00 a.m. (local time) and for any postponement or

adjournment thereof (the “Special Meeting”), for the purposes set forth in the accompanying Notice of Special Meeting of Shareholders.

We are providing our Proxy Materials to record shareholders by sending a printed copy of the full set of our proxy materials (the

“Proxy Materials”), consisting of the Notice of Special Meeting, this Proxy Statement and a proxy card (the “Proxy Card”) by mail. As permitted by Securities and Exchange Commission (“SEC”) rules, we are also providing access to the Proxy

Materials on the Internet.

The Proxy Statement and accompanying form of proxy are first being mailed to shareholders on or about February 19, 2019.

1

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND SPECIAL MEETING

| Q: |

Why are these materials being made available to me?

|

| A: |

The Proxy Materials are being provided to you in connection with the Special Meeting and include this Proxy Statement and the related Proxy Card that are being used in

connection with the Board’s solicitation of proxies for the Special Meeting. The information included in this Proxy Statement relates to the proposals to be voted on at the Special Meeting, the voting process and certain other

required information.

|

| Q: |

How do I access the Company’s Proxy Materials online?

|

| A: |

The Proxy Card provides instructions for accessing the Proxy Materials over the Internet, and includes the Internet address where those materials are available. The

Company’s Proxy Statement for the Special Meeting can also be viewed on the Company’s website at www.rexahn.com.

|

| Q: |

What shares owned by me can be voted?

|

| A: |

All shares of the Company’s common stock, par value $0.0001 per share (“Common Stock”) owned by you as of the close of business on the Record Date may be voted by you.

Each share of Common Stock is entitled to one vote. These shares include those (1) held directly in your name as the shareholder of record (“Shareholder of Record”),

and (2) held for you as the beneficial owner through a broker, bank or other nominee.

|

| Q: |

What is the Record Date?

|

| A: |

The Record Date is February 11, 2019. Only Shareholders of Record as of the close of business on this date will be entitled to vote at the Special Meeting.

|

| Q: |

How many shares are outstanding?

|

| A: |

As of the Record Date, the Company had 48,277,420 shares of Common Stock outstanding.

|

| Q: |

What is the difference between holding shares as a Shareholder of Record and as a beneficial owner?

|

| A: |

As summarized below, there are some distinctions between shares held of record and those owned beneficially.

|

Shareholder of Record

If your shares are registered directly in your name with the Company’s transfer agent, you are considered, with respect to those

shares, the Shareholder of Record. As the Shareholder of Record, you have the right to submit a proxy directly to the Company to have your shares voted at the meeting or to vote in person at the Special Meeting.

2

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares

held in “street name” and your broker, bank or other nominee is considered, with respect to those shares, the Shareholder of Record. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also

invited to attend the Special Meeting. However, because you are not the Shareholder of Record, you may not vote these shares in person at the Special Meeting unless you receive a proxy from your broker, bank or other nominee. Your broker, bank or

other nominee has provided voting instructions for you to use. If you wish to attend the Special Meeting and vote in person, please contact your broker, bank or other nominee so that you can receive a legal proxy to present at the Special

Meeting.

| Q: |

What am I voting on?

|

| A: |

You are being asked to vote on (1) a proposal to amend the Company’s Amended and Restated Certificate of Incorporation, as amended (the “Amended and Restated Certificate

of Incorporation”), to effect a reverse stock split of the Company’s Common Stock at a ratio within the range of 1:5 to 1:15, as determined by the Board, and with such reverse stock split to be effected at such time and date, if at

all, as determined by the Board of Directors in its sole discretion, and (2) a proposal to adjourn the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve

Proposal 1.

|

The Company is not currently aware of any matters that will be brought before the Special Meeting (other than

procedural matters) that are not referred to in the enclosed Proxy Card. If any other business should properly come before the Special Meeting or any postponement or adjournment thereof, the persons named in the proxy will vote on such matters

according to their best judgment. Discretionary authority to vote on such matters is conferred by such proxies upon the persons voting them.

| Q: |

How do I vote?

|

| A: |

Shareholders of Record may vote by completing and signing the enclosed Proxy Card and returning it promptly in the enclosed postage prepaid, addressed envelope, or at the

Special Meeting in person. We will pass out written ballots to anyone who is eligible to vote at the Special Meeting. We also will request persons, firms, and corporations holding shares of the Company’s Common Stock in their names or

in the name of their nominees, which are beneficially owned by others, to send proxy material to and obtain proxies from the beneficial owners and will reimburse the holders for their reasonable expenses in so doing. Proxy Cards

properly executed and delivered by shareholders (by mail or via the Internet) and timely received by the Company will be voted in accordance with the instructions contained therein. If you authorize a proxy to vote your shares over

the Internet or by telephone, you should not return a Proxy Card by mail, unless you are revoking your proxy. If you hold your shares in “street name” through a broker, bank or other nominee, and are therefore not a Shareholder of

Record, you must request a legal proxy from your broker, bank or other nominee in order to vote at the Special Meeting.

|

If you hold your shares in “street name” through a broker, bank or other nominee, you may vote via the Internet by going to http://www.proxyvote.com, while Shareholders of Record may go to www.AALvote.com/RNNSM

to vote via the Internet. All shareholders must have their control number from their proxy card or voting instruction form in order to vote via the Internet.

3

| Q: |

How many votes do you need to hold the Special Meeting?

|

| A: |

Forty percent of the Company’s issued and outstanding shares of Common Stock as of the Record Date must be present at the Special Meeting, either in person or by proxy,

in order to hold the Special Meeting and conduct business. This is called a quorum.

|

| Q: |

What are the voting requirements to approve the proposals?

|

| A: |

The affirmative vote of a majority of the Company’s issued and outstanding shares is required to approve the reverse stock split. The affirmative vote of a majority of

the shares present in person or represented by proxy at the Special Meeting and entitled to vote on the matter is required to approve an adjournment of the Special Meeting.

|

| Q: |

Who will count the votes?

|

| A: |

Votes at the Special Meeting will be counted by an inspector of election, who will be appointed by the Board or the chairman of the Special Meeting.

|

| Q: |

What is the effect of not voting?

|

| A: |

If you are a beneficial owner of shares in street name and do not provide the broker, bank or other nominee that holds your shares with specific voting instructions then,

under applicable rules, the broker, bank or other nominee that holds your shares can generally vote on “routine” matters, but cannot vote on “non‑routine” matters. In the case of a non-routine item, your shares will be considered

“broker non-votes” on that proposal.

|

Proposal 1 (approval of the reverse stock split) and Proposal 2 (approval of the adjournment of the Special Meeting,

if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 1) are matters we believe will be considered “routine.”

If you are a Shareholder of Record and you do not cast your vote, no votes will be cast on your behalf on any of the

items of business at the Special Meeting. If you are a Shareholder of Record and you properly sign and return your Proxy Card, your shares will be voted as you direct. If no instructions are indicated on such Proxy Card and you are a Shareholder

of Record, shares represented by the proxy will be voted in the manner recommended by the Board on all matters presented in this Proxy Statement, namely “FOR” the approval of the reverse stock split and “FOR” the adjournment of the Special

Meeting, if necessary.

| Q: |

How are broker non-votes and abstentions treated?

|

| A: |

Broker non-votes and abstentions with respect to a proposal are counted as present or represented by proxy for purposes of establishing a quorum. If a quorum is present,

abstentions will count as votes against Proposal 2 (approval of the adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 1), and

broker non-votes and abstentions will have the same effect as votes against Proposal 1 (approval of the reverse stock split).

|

4

| Q: |

Can I revoke my proxy or change my vote after I have voted?

|

| A: |

You may revoke your proxy and change your vote by voting again via the Internet or telephone, by completing, signing, dating and returning a new Proxy Card or voting

instruction form with a later date, or by attending the Special Meeting and voting in person. Only your latest dated Proxy Card received at or prior to the Special Meeting will be counted. Your attendance at the Special Meeting will

not have the effect of revoking your proxy unless you forward written notice to the Secretary of the Company at the above stated address or you vote by ballot at the Special Meeting.

|

| Q: |

What does it mean if I receive more than one Proxy Card?

|

| A: |

It means that you have multiple accounts at the transfer agent and/or with brokers, banks or other nominees. To ensure that all of your shares in each account are voted,

please sign and return all Proxy Cards, vote with respect to all accounts via the internet or by telephone, or, if you plan to vote at the Special Meeting, contact each broker, bank or other nominee so that you can receive all

necessary legal proxies to present at the Special Meeting.

|

| Q: |

Who is soliciting my vote and who will bear the cost of this solicitation?

|

| A: |

Our Board is making this solicitation, and we will bear the entire cost of preparing, assembling, printing, mailing and distributing these

proxy materials and soliciting votes. We have engaged Alliance Advisors, LLC (“Alliance Advisors”) to assist us with the solicitation of proxies. We will pay Alliance Advisors a base fee of $6,000, plus out-of-pocket expenses and

additional fees based upon work performed at our request. We estimate the total amount payable to Alliance Advisors will be approximately $35,000 to $45,000. We have also agreed to indemnify Alliance Advisors against certain claims.

Alliance Advisors is reaching out to shareholders to encourage them to vote in favor of Proposal 1. In addition to solicitations by mail, Alliance Advisors may solicit proxies by telephone and e-mail. If Alliance Advisors calls you,

please answer the call. If you need assistance with the voting of your shares, you may contact Alliance Advisors toll free at (855) 643-7453. Copies of solicitation materials may be furnished to brokers, custodians, nominees and other

fiduciaries for forwarding to beneficial owners of shares of our Common Stock, and normal handling charges may be paid for such forwarding service. Officers and other Company employees, who will receive no additional compensation for

their services, may solicit proxies by mail, e-mail, via the Internet, personal interview or telephone.

|

| Q: |

Do I have appraisal or similar dissenter’s rights?

|

| A: |

Appraisal rights and similar rights of dissenters are not available to shareholders in connection with the proposals brought before the Special Meeting.

|

| Q: |

Where can I find the voting results of the Special Meeting?

|

| A: |

The Board will announce the voting results at the Special Meeting. We will also publish the results in a Current Report on Form 8-K within four business days after the

date of the Special Meeting. We will file that report with the SEC, and you can get a copy:

|

|

|

· |

by contacting the Company’s corporate offices via phone at (240) 268-5300 or by e-mail at ir@rexahn.com; or

|

|

|

· |

through the SEC’s EDGAR system at www.sec.gov.

|

5

PROPOSAL 1: APPROVAL OF AN AMENDMENT TO THE COMPANY’S

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

TO EFFECT A REVERSE STOCK SPLIT

General

The Board has unanimously approved, and recommended that our shareholders approve, an amendment to the Company’s Amended and Restated

Certificate of Incorporation in substantially the form attached hereto as Annex A (the “Certificate of Amendment”), to effect a reverse stock split at a ratio within a

range from 1-for-5 to 1-for-15, with the final ratio to be determined by the Board, in its sole discretion, following shareholder approval. If the shareholders approve the reverse stock split and the Board decides to implement it, the reverse

stock split will become effective at the effective time set forth in the Certificate of Amendment to be filed with the Secretary of State of the State of Delaware.

The reverse stock split will be realized simultaneously for all outstanding Common Stock and the ratio determined by the Board will be

the same for all outstanding Common Stock. The reverse stock split will affect all holders of Common Stock uniformly and each shareholder will hold the same percentage of Common Stock outstanding immediately following the reverse stock split as

that shareholder held immediately prior to the reverse stock split, except for adjustments that may result from the treatment of fractional shares as described below. The proposed Certificate of Amendment will not reduce the number of authorized

shares of Common Stock (which will remain at 75,000,000) or preferred stock (which will remain at 10,000,000) or change the par values of our Common Stock (which will remain at $0.0001 per share) or preferred stock (which will remain at $0.0001

per share).

Purposes of the Proposed Reverse Stock Split

Listing on Another National Securities Exchange.

If the reverse stock split is approved, our Board will consider at that time whether it is in the best interests of our shareholders to

seek a listing of our Common Stock on the Nasdaq Stock Market or potentially another national securities exchange to improve the visibility of our Common Stock, enhance trading liquidity in shares of our Common Stock and provide us with greater

exposure to institutional investors. Eligibility for listing on Nasdaq is subject to a number of criteria, such as public float, minimum share price, number of shareholders, market capitalization, net income and other factors. For example, the

Nasdaq Stock Market requires, among other items, an initial bid price of at least $4.00 per share and, following initial listing, maintenance of a continued price of at least $1.00 per share. On February 11, 2019, the last reported sale price of

our Common Stock on the NYSE American was $0.60 per share. Reducing the number of outstanding shares of Common Stock should, absent other factors, increase the per share market price of the Common Stock, helping us move toward satisfying the

minimum bid price listing standards of the Nasdaq Stock Market. There can be no assurance that the market price for our Common Stock will increase in the same proportion as the reverse stock split or, if increased, that such price will be

maintained or that it will be sufficient to permit us to apply to list our shares on the Nasdaq Stock Market. We have not applied to transfer our listing to the Nasdaq Stock Market or another national securities exchange, and, even if we satisfy

the applicable listing requirements, we may not apply to have our Common Stock listed. Furthermore, even if we do satisfy the requirements and apply for listing, there is no guarantee that our application will be approved. Application for or

approval of our Common Stock for listing on the Nasdaq Stock Market or another national securities exchange is not a condition or requirement for effecting the reverse stock split.

6

Increase Our Common Stock Price to a Level More Appealing for Investors.

We believe that the reverse stock split could enhance the appeal of our Common Stock to the financial community, including institutional

investors, and the general investing public. We believe that a number of institutional investors and investment funds are reluctant to invest in lower-priced securities and that brokerage firms may be reluctant to recommend lower-priced

securities to their clients, which may be due in part to a perception that lower-priced securities are less promising as investments, are less liquid in the event that an investor wishes to sell its shares, or are less likely to be followed by

institutional securities research firms and therefore more likely to have less third-party analysis of the company available to investors. We believe that the reduction in the number of issued and outstanding shares of the Common Stock caused by

the reverse stock split, together with the anticipated increased stock price immediately following and resulting from the reverse stock split, may encourage interest and trading in our Common Stock and thus possibly promote greater liquidity for

our shareholders, thereby resulting in a broader market for the Common Stock than that which currently exists.

Enhance Our Profile for Potential Collaborators.

A key component of our corporate strategy is to seek to establish strategic alliances and partnerships with larger biotechnology and

pharmaceutical companies to support the development and commercialization and co-development of our drug candidates. We believe that a number of potential collaborators are reluctant to partner with companies that lack reasonable access to

capital and who trade at very low share prices. We believe that the reduction in the number of issued and outstanding shares of the Common Stock caused by the reverse stock split (which has the effect of increasing our authorized but unissued

shares of Common Stock), together with the anticipated increased stock price immediately following and resulting from the reverse stock split, may enhance our profile with potential partners and facilitate our business development strategy.

Maintaining our Listing on the NYSE American.

Our Common Stock is listed on the NYSE American. Section 1003(f)(v) of the NYSE American Company Guide provides that a company’s common

stock may be delisted from the NYSE American if it is selling for a substantial period of time at a low price per share and the Company fails to effect a reverse stock split within a reasonable time after being notified that the NYSE American

deems such action to be appropriate under all the circumstances. While we have not received a notice from the NYSE American providing notice that the NYSE American deems it appropriate for the Company to effect a reverse stock split, and our

Common Stock is not at the level at which we currently expect to receive such a notice, increasing the price of our Common Stock would provide us with a greater opportunity to avoid the receipt of such a notice in the future.

Delisting from the NYSE American may adversely affect our ability to raise additional financing through the public or private sale of

equity securities, may significantly affect the ability of investors to trade our securities and may negatively affect the value and liquidity of the Common Stock. Delisting also could have other negative results, including the potential loss of

employee confidence, the loss of institutional investors or interest in business development opportunities. Moreover, the Company committed in connection with the sale of securities to use commercially reasonably efforts to maintain the listing

of the Common Stock during such time that certain warrants are outstanding.

7

If the Common Stock were to be delisted from the NYSE American and we are not able to list the Common Stock on another exchange, the

Common Stock could be quoted on the OTC Bulletin Board or in the “pink sheets.”

Even if this proposal is approved, our Board will have complete discretion as to whether or not to consummate the reverse stock split. We

cannot assure you that all or any of the anticipated beneficial effects on the trading market for our Common Stock will occur. Our Board cannot predict with certainty what effect the reverse stock split will have on the market price of the

Common Stock, particularly over the longer term. Some investors may view a reverse stock split negatively, which could result in a decrease in our market capitalization. Additionally, any improvement in liquidity due to increased institutional

or brokerage interest or lower trading commissions may be offset by the lower number of outstanding shares. We cannot provide you with any assurance that our shares will qualify for, or be accepted for, listing on a national securities exchange.

As a result, the trading liquidity of our Common Stock may not improve. In addition, investors might consider the increased proportion of unissued authorized shares to issued shares to have an anti-takeover effect under certain circumstances

because the proportion allows for dilutive issuances.

Determination of Ratio

The ratio of the reverse stock split, if approved and implemented, will be a ratio of not less than 1-for-5 and not more than 1-for-15,

as determined by the Board in its sole discretion. In determining the reverse stock split ratio, the Board will consider numerous factors, including:

|

|

· |

the historical and projected performance of the Common Stock;

|

|

|

· |

prevailing market conditions;

|

|

|

· |

general economic and other related conditions prevailing in our industry and in the marketplace;

|

|

|

· |

the projected impact of the selected reverse stock split ratio on trading liquidity in the Common Stock and our ability to qualify the Common Stock for listing on another

national securities exchange;

|

|

|

· |

our capitalization (including the number of shares of Common Stock issued and outstanding);

|

|

|

· |

the prevailing trading price for Common Stock and the volume level thereof; and

|

|

|

· |

potential devaluation of our market capitalization as a result of a reverse stock split.

|

The purpose of asking for authorization to implement the reverse stock split at a ratio to be determined by the Board, as opposed to a

ratio fixed in advance, is to give the Board the flexibility to take into account then-current market conditions and changes in the price of the Common Stock and to respond to other developments that may be deemed relevant when considering the

appropriate ratio.

8

Principal Effects of the Reverse Stock Split

A reverse stock split refers to a reduction in the number of outstanding shares of a class of a corporation’s capital stock, which may be

accomplished, as in this case, by reclassifying and combining all of our outstanding shares of Common Stock into a proportionately smaller number of shares. For example, if the Board decides to implement a 1-for-5 reverse stock split of Common

Stock, then a shareholder holding 10,000 shares of Common Stock before the reverse stock split would instead hold 2,000 shares of Common Stock immediately after the reverse stock split. Each shareholder’s proportionate ownership of outstanding

shares of Common Stock would remain the same, except that shareholders that would otherwise receive fractional shares as a result of the reverse stock split will receive cash payments in lieu of fractional shares.

The following table illustrates the effects of the reverse stock split at certain exchange ratios within the 1-for-5 to 1-for-15 range,

without giving effect to any adjustments for fractional shares of Common Stock on our outstanding shares of Common Stock and authorized shares of capital stock as of February 11, 2019:

|

Before Reverse

Stock Split

|

After Reverse Stock Split

|

|||||||||||||||

|

1-for-5

|

1-for-10

|

1-for-15

|

||||||||||||||

|

Common Stock Authorized

|

75,000,000

|

75,000,000

|

75,000,000

|

75,000,000

|

||||||||||||

|

Preferred Stock Authorized

|

10,000,000

|

10,000,000

|

10,000,000

|

10,000,000

|

||||||||||||

|

Common Stock Issued and Outstanding

|

48,277,420

|

9,655,484

|

4,827,742

|

3,218,494

|

||||||||||||

|

Common Stock Underlying Options, Restricted Stock Units and Warrants

|

26,435,515

|

5,287,103

|

2,643,551

|

1,762,367

|

||||||||||||

|

Common Stock Available for Grant under Equity Incentive Plan

|

283,729

|

56,745

|

28,372

|

18,915

|

||||||||||||

|

Total Common Stock Authorized but Unreserved

|

3,336

|

60,000,668

|

67,500,335

|

70,000,224

|

||||||||||||

Because no fractional shares will be issued, holders of Common Stock could be eliminated in the event that the proposed reverse stock

split is implemented. However, the Board does not intend to use the reverse stock split as a part of or a first step in a “going private” transaction within the meaning of Rule 13e-3 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”). There is no plan or contemplated plan by the Company to take itself private as of the date of this Proxy Statement. As of February 11, 2019, we had approximately 31 record holders who held fewer than 15 shares of Common Stock,

out of a total of approximately 54 record holders. The reverse stock split will not decrease the number of our public shareholders (as defined in the NYSE American Company Guide) below the required minimum of 300 and, as a result, it should not

have a negative effect on our continued listing status on NYSE American.

9

The number of authorized shares of Common Stock will not be decreased and will remain at 75,000,000. Because the number of outstanding

shares will be reduced as a result of the reverse stock split, the number of shares available for issuance will be increased. Following our most recent equity offering in January 2019, we have limited authorized but unissued shares available for

future capital raising transactions or strategic transactions.

Our Board believes that we will need to raise additional capital in the ordinary course of business, including to fund our clinical

development programs and/or complete a strategic partnering transaction, which may involve a partner making an equity investment in our company. In either case, we do not have sufficient authorized but unissued shares to accomplish these goals,

which is why we are not seeking a proportional adjustment of our authorized shares in connection with the reverse stock split. The resulting increase in our authorized but unissued shares will provide flexibility to raise additional capital when

needed to fund our ongoing clinical development programs to key value inflection points. If the shareholders do not approve the proposed amendment, we will be limited by the inability to use shares of Common Stock for equity financings or

collaborations, which we believe will harm our shareholder value. The inability to use equity financings in order to raise capital could lead to delays to or the suspension of our clinical programs as a result of the lack of funding. The

inability to raise capital could also have a negative impact on potential collaborations, partnerships, and other business opportunities integral to our growth and success by creating a perception that we do not have reasonable access to capital

and because some collaborators and partners will be interested in acquiring some of our equity as part of collaborations, partnerships or other ventures. Similarly, we may have difficulty attracting, retaining and motivating skilled and

experienced employees, officers and directors if they also perceive that we do not have access to capital and ability to use authorized capital for general corporate purposes.

As of the date of this Proxy Statement, we have no specific plans, arrangements or understandings, whether written or oral, with respect

to the increase in shares available for issuance as a result of the reverse stock split. See the table above under the caption “Principal Effects of the Reverse Stock Split” that shows the number of unreserved shares of Common Stock that would be

available for issuance at various reverse stock split ratios.

Potential Anti-Takeover and Dilutive Effects

The purpose of the reverse stock split is not to establish any barriers to a change of control or acquisition of the Company. However,

because the number of authorized shares of Common Stock will remain at 75,000,000, this proposal, if adopted and implemented, will result in a relative increase in the number of authorized but unissued shares of our Common Stock vis-à-vis the

outstanding shares of our Common Stock and could, under certain circumstances, have an anti-takeover effect. Shares of Common Stock that are authorized but unissued provide our Board with flexibility to effect, among other transactions, public or

private financings, mergers, acquisitions, stock dividends, stock splits and the granting of equity incentive awards. However, these authorized but unissued shares may also be used by our Board, consistent with and subject to its fiduciary

duties, to deter future attempts to gain control of us or make such actions more expensive and less desirable. After implementation of the proposed amendment, our Board will continue to have authority under the provisions of our Amended and

Restated Certificate of Incorporation to issue additional shares from time to time without delay or further action by the shareholders except as may be required by applicable law or the NYSE American listing standards, assuming the Company

remains listed on NYSE American. Our Board is not aware of any attempt to take control of our business and has not considered the reverse stock split to be a tool to be utilized as a type of anti-takeover device. We currently have no plans,

proposals or arrangements to issue any shares of Common Stock that would become newly available for issuance as a result of the reverse stock split.

10

In addition, if we do issue additional shares of our Common Stock, the issuance could have a dilutive effect on earnings per share and

the book or market value of the outstanding Common Stock, depending on the circumstances, and would likely dilute a shareholder’s percentage voting power in the Company. Holders of Common Stock are not entitled to preemptive rights or other

protections against dilution. Our Board intends to take these factors into account before authorizing any new issuance of shares.

Certain Risks Associated with the Reverse Stock Split

Before voting on this Proposal 1, you should consider the following risks associated with the implementation of the reverse stock split:

|

|

· |

Although we expect that the reverse stock split will result in an increase in the market price of the Common Stock, we cannot assure you that the reverse stock split, if

implemented, will increase the market price of the Common Stock in proportion to the reduction in the number of shares of the Common Stock outstanding or result in a permanent increase in the market price, nor can we assure you that

we will be able to move our listing to the Nasdaq Stock Market.

|

|

|

· |

The effect the reverse stock split may have upon the market price of the Common Stock cannot be predicted with any certainty, and the history of similar reverse stock

splits for companies in similar circumstances to ours is varied. For example, the market price of the Common Stock increased after we effected a previous reverse stock split in May 2017, but we have been unable to maintain that price.

The market price of the Common Stock is dependent on many factors, including our business and financial performance, general market conditions, prospects for future success and other factors detailed from time to time in the reports

we file with the SEC. Accordingly, the total market capitalization of the Common Stock after the proposed reverse stock split may be lower than the total market capitalization before the proposed reverse stock split and, in the

future, the market price of the Common Stock following the reverse stock split may not exceed or remain higher than the market price prior to the proposed reverse stock split.

|

|

|

· |

The reverse stock split may result in some shareholders owning “odd lots” of less than 100 shares of Common Stock on a post-split basis. These odd lots may be more

difficult to sell, or require greater transaction costs per share to sell, than shares in “round lots” of even multiples of 100 shares.

|

|

|

· |

While the Board believes that a higher stock price may help generate investor interest, there can be no assurance that the reverse stock split will result in a per share

price that will attract institutional investors or investment funds or that such share price will satisfy the investing guidelines of institutional investors or investment funds. As a result, the trading liquidity of the Common Stock

may not necessarily improve.

|

|

|

· |

While we believe that the reverse stock split may enhance our profile with potential partners and facilitate our business development strategy, there can

be no assurance that we will enter into agreements with any such potential partners on commercially reasonable terms or at all.

|

11

|

|

· |

Although the Board believes that the decrease in the number of shares of Common Stock outstanding as a consequence of the reverse stock split and the anticipated increase

in the market price of Common Stock could encourage interest in the Common Stock and possibly promote greater liquidity for our shareholders, such liquidity could also be adversely affected by the reduced number of shares outstanding

after the reverse stock split.

|

|

|

· |

The reverse stock split will have the effect of increasing the number of authorized but unissued shares of Common Stock, which could then be used for issuances that are

dilutive to current shareholders. In addition, investors might consider the increased proportion of unissued authorized shares to have an anti-takeover effect.

|

Effect on Fractional Shareholders

No fractional shares of Common Stock will be issued in connection with the reverse stock split. If, as a result of the reverse stock

split, a shareholder of record would otherwise hold a fractional share, the shareholder will receive a cash payment in lieu of the issuance of any such fractional share in an amount per share equal to the closing price per share on the NYSE

American on the effective date of the reverse stock split, without interest. The ownership of a fractional interest will not give the holder thereof any voting, dividend or other right except to receive the cash payment therefor.

If a shareholder is entitled to a cash payment in lieu of any fractional share interest, a check will be mailed to the shareholder’s

registered address as soon as practicable after the reverse stock split. By signing and cashing the check, shareholders will warrant that they owned the shares of Common Stock for which they received a cash payment.

Shareholders should be aware that, under the escheat laws of the various jurisdictions where shareholders reside, where we are domiciled

and where the funds will be deposited, sums due for fractional interests that are not timely claimed after the Effective Time (as defined below) may be required to be paid to the designated agent for each such jurisdiction. Thereafter,

shareholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

Effect on Beneficial Shareholders

If you hold shares of Common Stock in street name through a broker, bank or other nominee, we will treat your Common Stock in the same

manner as Common Stock held by Shareholders of Record. Brokers and other nominees will be instructed to effect the reverse stock split for their customers holding Common Stock in street name. However, these brokers, banks and other nominees may

have different procedures for processing a reverse stock split. If you hold shares of Common Stock in street name, we encourage you to contact your broker, bank or other nominee.

12

Registered “Book-Entry” Holders of Common Stock

If you hold shares of Common Stock electronically in book-entry form with our transfer agent, you do not currently have and will not be

issued stock certificates evidencing your ownership after the reverse stock split, and you do not need to take action to receive post-reverse stock split shares. If you are entitled to post-reverse stock split shares, a transaction statement will

automatically be sent to you indicating the number of shares of Common Stock held following the reverse stock split.

If you are entitled to a payment in lieu of any fractional share interest, payment will be made as described above under “Effect on

Fractional Shareholders.”

Effect on Registered Shareholders Holding Certificates

As soon as practicable after the reverse stock split, our transfer agent will mail transmittal letters to each shareholder holding shares

of Common Stock in certificated form. The letter of transmittal will contain instructions on how a shareholder should surrender his or her certificate(s) representing shares of Common Stock (the “Old Certificates”) to the transfer agent in

exchange for certificates representing the appropriate number of whole shares of post-reverse stock split Common Stock (the “New Certificates”). No New Certificates will be issued to a shareholder until such shareholder has surrendered all Old

Certificates, together with a properly completed and executed letter of transmittal, to the transfer agent. No shareholder will be required to pay a transfer or other fee to exchange his or her Old Certificates. Shareholders will then receive a

New Certificate(s) representing the number of whole shares of Common Stock that they are entitled as a result of the reverse stock split. Until surrendered, we will deem outstanding Old Certificates held by shareholders to be cancelled and only

to represent the number of whole shares of post-reverse stock split Common Stock to which these shareholders are entitled. Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of stock, will

automatically be exchanged for New Certificates.

If you are entitled to a payment in lieu of any fractional share interest, payment will be made as described above under “Effect on

Fractional Shareholders.”

Effect on Outstanding Options, Warrants and Restricted Stock Units

Upon a reverse stock split, all outstanding options, warrants, restricted stock units and future or contingent rights to acquire Common

Stock will be adjusted to reflect the reverse stock split. With respect to all outstanding options and warrants to purchase Common Stock, the number of shares of Common Stock that such holders may purchase upon exercise of such options or

warrants will decrease, and the exercise prices of such options or warrants will increase, in proportion to the fraction by which the number of shares of Common Stock underlying such options and warrants are reduced as a result of the reverse

stock split. Also, the number of shares reserved for issuance under our existing stock option and equity incentive plans would be reduced proportionally based on the ratio of the reverse stock split.

13

Procedure for Effecting the Reverse Stock Split

If our shareholders approve this proposal, and the Board elects to effect the reverse stock split, we will effect the reverse stock split

by filing the Certificate of Amendment (as completed to reflect the reverse stock split ratio as determined by the Board, in its discretion, within the range of not less than 1-for-5 and not more than 1-for-15) with the Secretary of State of the

State of Delaware. The reverse stock split will become effective, and the combination of, and reduction in, the number of our outstanding shares as a result of the reverse stock split will occur automatically, at the effective time set forth in

the Certificate of Amendment (referred to as the “Effective Time”), without any action on the part of our shareholders and without regard to the date that stock certificates representing any certificated shares prior to the reverse stock split

are physically surrendered for new stock certificates. Beginning at the Effective Time, each certificate representing pre-reverse stock split shares will be deemed for all corporate purposes to evidence ownership of post-reverse stock split

shares. The text of the Certificate of Amendment is subject to modification to include such changes as may be required by the office of the Secretary of State of the State of Delaware and as the Board deems necessary and advisable to effect the

reverse stock split.

The Board reserves the right, notwithstanding shareholder approval and without further action by the shareholders, to elect not to

proceed with the reverse stock split if, at any time prior to filing the Certificate of Amendment, the Board, in its sole discretion, determines that it is no longer in the best interests of the Company and its shareholders to proceed with the

reverse stock split. By voting in favor of the reverse stock split, you are expressly also authorizing the Board to delay (until March 26, 2020) or abandon the reverse stock split. If the Certificate of Amendment has not been filed with the

Secretary of State of the State of Delaware by the close of business on March 26, 2020, the Board will abandon the reverse stock split.

Shareholders should not destroy any stock certificate(s) and should not submit any certificate(s) until they receive a

letter of transmittal from our transfer agent.

Material U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following is a summary of important tax considerations of the reverse stock split. It addresses only shareholders who hold Common

Stock as capital assets. It does not purport to be complete and does not address shareholders subject to special rules, such as financial institutions, tax-exempt organizations, insurance companies, dealers in securities, foreign shareholders,

shareholders who hold their pre-reverse stock split shares as part of a straddle, hedge or conversion transaction, and shareholders who acquired their pre-reverse stock split shares pursuant to the exercise of employee stock options or otherwise

as compensation. This summary is based upon current law, which may change, possibly even retroactively. It does not address tax considerations under state, local, foreign and other laws. The tax treatment of a shareholder may vary depending upon

the particular facts and circumstances of such shareholder. Each shareholder is urged to consult with such shareholder’s own tax advisor with respect to the tax consequences of the reverse stock split.

A shareholder generally will not recognize gain or loss on the reverse stock split, except to the extent of cash, if any, received in

lieu of a fractional share interest. The aggregate tax basis of the post-reverse stock split shares received will be equal to the aggregate tax basis of the pre-reverse stock split shares exchanged therefor (excluding any portion of the holder’s

basis allocated to fractional shares), and the holding period of the post-reverse stock split shares received will include the holding period of the pre-reverse stock split shares exchanged.

14

A holder of the pre-reverse stock split shares who receives cash will generally be treated as having exchanged a fractional share

interest for cash in a redemption by us. The amount of any gain or loss will be equal to the difference between the portion of the tax basis of the pre-reverse stock split shares allocated to the fractional share interest and the cash received,

and generally would be a long-term capital gain or loss to the extent that the holder's holding period exceeds 12 months.

The foregoing views are not binding on the Internal Revenue Service or the courts. Accordingly, each shareholder should consult with his

or her own tax advisor with respect to all of the potential tax consequences to him or her of the reverse stock split.

Accounting Matters

The par value of the Common Stock will remain unchanged at $0.0001 per share after the reverse stock split. As a result, our stated

capital, which consists of the par value per share of the Common Stock multiplied by the aggregate number of shares of the Common Stock issued and outstanding, will be reduced proportionately at the Effective Time of the reverse stock split.

Correspondingly, our additional paid-in capital, which consists of the difference between our stated capital and the aggregate amount paid to us upon the issuance of all currently outstanding shares of Common Stock, will be increased by a number

equal to the decrease in stated capital. Further, net loss per share, book value per share and other per share amounts will be increased as a result of the reverse stock split because there will be fewer shares of Common Stock outstanding.

Required Vote

The affirmative vote of the holders of a majority of the shares of the Common Stock outstanding on the Record Date will be required to

approve the reverse stock split. Accordingly, abstentions and broker non-votes (to the extent a broker does not exercise its authority to vote) will have the same effect as a vote against the proposal. Shares represented by valid proxies and not

revoked will be voted at the Special Meeting in accordance with the instructions given. If no voting instructions are given, such shares will be voted “FOR” this proposal.

The Board recommends that you vote FOR the approval of the reverse stock split.

15

PROPOSAL 2: THE ADJOURNMENT OF THE SPECIAL MEETING

Our shareholders are being asked to consider and vote upon an adjournment of the Special Meeting, if necessary, if a quorum is

present, to solicit additional proxies if there are insufficient votes in favor of approval of a proposed amendment to our Amended and Restated Certificate of Incorporation to effectuate a reverse stock split as described in Proposal 1.

Approval of the adjournment of the Special Meeting requires an affirmative vote of the majority of shares present in person or

represented by proxy and entitled to vote on the matter. Abstentions will count against the proposal.

The Board Recommends that you vote FOR the adjournment of the Special

Meeting, if a quorum is present, to solicit additional proxies if there are insufficient votes to approve Proposal 1.

16

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITY HOLDERS

The table below sets forth the beneficial ownership of our Common Stock as of February 11, 2019 by the following individuals or

entities:

|

·

|

each director;

|

|

·

|

each named executive officer; and

|

|

·

|

all current directors and executive officers as a group.

|

As of February 11, 2019, based on our review of statements filed with the SEC pursuant to Section 13(d) and 13(g) of the Exchange Act, no person or group

of affiliated persons is known to us to beneficially own 5% or more of our outstanding Common Stock.

As of February 11, 2019, 48,277,420 shares of our Common Stock were issued and

outstanding. Unless otherwise indicated, all persons named in the table below have sole voting power and sole investment power with respect to the shares indicated as beneficially owned. In computing the number of shares beneficially owned by a

person and the percentage ownership of that person, shares of Common Stock that could be acquired by the exercise of stock options or warrants or the vesting of restricted stock units within 60 days of February 11, 2019 are deemed outstanding,

while such shares are not deemed outstanding for purposes of computing percentage ownership of any other person. In addition, unless otherwise indicated, the address for each person named below is c/o Rexahn Pharmaceuticals, Inc., 15245 Shady

Grove Road, Suite 455, Rockville, Maryland 20850.

|

Shares of Rexahn Pharmaceuticals

Common Stock

Beneficially Owned

|

||||||||||||

|

Name of Beneficial Owner

|

Number of

Shares

|

Percentage

|

||||||||||

|

Directors and Named Executive Officers:

|

||||||||||||

|

Douglas J. Swirsky

|

128,125

|

(1

|

)

|

*

|

||||||||

|

Charles Beever

|

73,500

|

(2

|

)

|

*

|

||||||||

|

Kwang Soo Cheong

|

62,800

|

(3

|

)

|

*

|

||||||||

|

Peter Brandt

|

75,500

|

(4

|

)

|

*

|

||||||||

|

Richard J. Rodgers

|

45,500

|

(5

|

)

|

*

|

||||||||

|

Ben Gil Price

|

15,000

|

*

|

||||||||||

|

Ely Benaim

|

268,926

|

(6

|

)

|

*

|

||||||||

|

Lisa Nolan

|

123,468

|

(7

|

)

|

*

|

||||||||

|

Peter Suzdak

|

665,187

|

(8

|

)

|

1.36

|

%

|

|||||||

|

Tae Heum Jeong

|

164,368

|

(9

|

)

|

*

|

||||||||

|

All current executive officers and directors as a group (8 persons)

|

792,819

|

(10

|

)

|

1.62

|

%

|

|||||||

| * |

Represents less than 1% of the issued and outstanding shares of our Common Stock as of February 11, 2019.

|

17

| (1) |

Includes Mr. Swirsky’s options to purchase 78,125 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 11, 2019.

|

| (2) |

Includes Mr. Beever’s options to purchase 62,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 11, 2019.

|

| (3) |

Includes Dr. Cheong’s options to purchase 62,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 11, 2019.

|

| (4) |

Includes Mr. Brandt’s options to purchase 60,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 11, 2019.

|

| (5) |

Consists of Mr. Rodgers’ options to purchase 45,500 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 11, 2019.

|

| (6) |

Includes Dr. Benaim’s (i) options to purchase 264,176 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 11, 2019 and (ii) 2,375 shares of Common Stock underlying restricted stock units that will vest within 60 days of February 11, 2019.

|

| (7) |

Includes Dr. Nolan’s (i) options to purchase 100,218 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 11, 2019 and (ii) 1,625 shares of Common Stock underlying restricted stock units that will vest within 60 days of February 11, 2019.

|

| (8) |

Dr. Suzdak’s resignation was effective as of November 13, 2018. The share amounts set forth in the table consist of (i) 22,250 shares of Common Stock as reported on a

Form 4 filed March 2, 2018, (ii) 6,250 shares of Common Stock underlying restricted stock units that vested since March 2, 2018 and (iii) options to purchase 636,687 shares of Common Stock held by Dr. Suzdak as of February 11, 2019.

|

| (9) |

Dr. Jeong’s resignation was effective as of March 15, 2018. The share amounts set forth in the table consist of (i) 50,500 shares of Common Stock as reported on a Form 4

filed January 12, 2015, (ii) 1,575 shares of Common Stock underlying restricted stock units that vested since January 12, 2015, (iii) options to purchase 110,718 shares of Common Stock that are currently exercisable or exercisable

within 60 days of February 11, 2019 and (iv) 1,575 shares of Common Stock underlying restricted stock units that will vest within 60 days of February 11, 2019.

|

| (10) |

Includes (i) options to purchase 673,519 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 11, 2019 and (ii) 4,000 shares of Common Stock underlying restricted stock units that will vest within 60 days of February 11, 2019.

|

18

SHAREHOLDER PROPOSALS

Shareholder Proposals Pursuant to Rule 14a-8

Shareholders interested in submitting a proposal for inclusion in the proxy statement for the 2019 Annual Meeting of Shareholders (the

“2019 Annual Meeting”) may do so by submitting the proposal in writing to our executive offices, 15245 Shady Grove Road, Suite 455, Rockville, Maryland 20850, Attention: Corporate Secretary. Pursuant to Rule 14a-8 under the Exchange Act, to be

eligible for inclusion in our proxy statement for the 2019 Annual Meeting, shareholder proposals must have been received no later than December 24, 2018, which was 120 days prior to the anniversary date of the Proxy Statement for the 2018 Annual

Meeting. The submission of a shareholder proposal does not guarantee that it will be included in the proxy statement.

Nominations and Shareholder Proposals Under our Bylaws

Our Amended and Restated Bylaws also establish an advance notice procedure with regard to nominations of persons for election to the

Board and shareholder proposals to be brought before an annual meeting. No shareholder proposal or nomination may be brought before the 2019 Annual Meeting unless, among other things, the submission contains certain information concerning the

proposal or the nominee, as the case may be, and other information specified in our Amended and Restated Bylaws, and the submission is received by us no earlier than the close of business on February 14, 2019, and no later than March 16, 2019.

Proposals or nominations not meeting these requirements will not be entertained at the 2019 Annual Meeting.

Shareholders recommending candidates for consideration by the Nominating and Corporate Governance Committee must provide the

candidate’s name, biographical data and qualifications. Any such recommendation should be accompanied by a written statement from the individual of his or her consent to be named as a candidate and, if nominated and elected, to serve as a

director. These requirements are separate from, and in addition to, the SEC’s requirements that a shareholder must meet in order to have a shareholder proposal included in the proxy statement. A copy of the full text of these bylaw provisions may

be obtained from our website at www.rexahn.com.

HOUSEHOLDING

If you are a beneficial owner, but not the record holder, of shares of our Common Stock, your broker, bank or other nominee may only

deliver one (1) copy of this Proxy Statement to multiple shareholders at the same address, unless that nominee has received contrary instructions from one (1) or more of the shareholders. We will deliver, upon request, a separate copy of this

Proxy Statement to a shareholder at a shared address to which a single copy of the documents was delivered. A shareholder desiring to receive a separate copy of the Proxy Statement, now or in the future, should call our Secretary, Lisa Nolan, at

240-268-5300, or submit a request by writing to 15245 Shady Grove Road, Suite 455, Rockville, Maryland 20850 or by emailing us at ir@rexahn.com. Also, beneficial owners sharing an address who are receiving multiple copies of proxy materials and

annual reports and who wish to receive a single copy of such materials in the future will need to contact their broker, bank or other nominee to request that only a single copy of each document be mailed to all shareholders at the same address in

the future.

19

Annex A

CERTIFICATE OF AMENDMENT

OF

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

REXAHN PHARMACEUTICALS, INC.

Rexahn Pharmaceuticals, Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), does hereby certify as

follows:

1. The name of the Corporation is Rexahn Pharmaceuticals, Inc.

2. Article 4 of the Amended and Restated Certificate of Incorporation of

the Corporation, as amended to date, is hereby amended by replacing the second paragraph thereof with the following:

“Upon the filing and effectiveness (the “Effective Time”) of this

amendment to the Corporation’s Amended and Restated Certificate of Incorporation, as amended, pursuant to the Delaware General Corporation Law, each [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] shares of the Common Stock issued immediately

prior to the Effective Time (the “Old Common Stock”) shall be reclassified and combined into one validly issued, fully paid and non-assessable share of the Corporation’s common stock, $.0001 par value per share (the “New Common Stock”), without

any action by the holder thereof (the “Reverse Stock Split”) and without increasing or decreasing the authorized number of shares of Common Stock or the Corporation’s

preferred stock, par value $0.0001 per share. No fractional shares of New Common Stock shall be issued as a result of the Reverse Stock Split and, in lieu thereof, upon surrender after the Effective Time of a certificate or book entry position

which formerly represented shares of Old Common Stock that were issued and outstanding immediately prior to the Effective Time, any person who would otherwise be entitled to a fractional share of New Common Stock as a result of the Reverse

Stock Split, following the Effective Time, shall be entitled to receive a cash payment equal to the fraction of a share of New Common Stock to which such holder would otherwise be entitled multiplied by the closing price per share of the New

Common Stock on the NYSE American at the close of business on the date of the Effective Time. Each certificate that theretofore represented shares of Old Common Stock shall thereafter represent that number of shares of New Common Stock into

which the shares of Old Common Stock represented by such certificate shall have been reclassified and combined; provided, that each person holding of record a stock certificate or certificates that represented shares of Old Common Stock shall

receive, upon surrender of such certificate or certificates, a new certificate or certificates evidencing and representing the number of shares of New Common Stock to which such person is entitled under the foregoing reclassification and

combination.”

3. This Certificate of Amendment has been duly adopted by the Board of

Directors and stockholders of the Corporation in accordance with Section 242 of the General Corporation Law of the State of Delaware.

4. This

Certificate of Amendment shall become effective as of 7:00 a.m., Eastern Time on _________, 2019.

[Signature page follows]

1

IN WITNESS WHEREOF, the Corporation has caused its duly authorized officer to execute this Certificate of Amendment on this ___ day

of _________, 2019.

|

REXAHN PHARMACEUTICALS, INC.

|

||

|

By:

|

||

|

Name:

|

Douglas J. Swirsky

|

|

|

Title:

|

President and Chief Executive Officer

|

|

REXAHN PHARMACEUTICALS, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

FOR THE SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 26, 2019

The undersigned hereby appoints Douglas J. Swirsky and Lisa Nolan, and each of them, with power to act without the other and

with full power of substitution, as proxies and attorneys-in-fact and hereby authorizes them to represent and vote, as provided below, all the shares of Rexahn Pharmaceuticals, Inc. common stock which the undersigned is entitled to vote, and, in

their discretion, to vote upon such other business as may properly come before the Special Meeting of Shareholders of Rexahn Pharmaceuticals, Inc. to be held on March 26, 2019, at 8:00 a.m. (local time), at the Radisson Hotel, 3 Research Court,

Rockville, Maryland 20850, or any adjournment thereof, with all powers which the undersigned would possess if present at the meeting.

This proxy is revocable and will be voted as directed, but if no instructions are specified,

this proxy will be voted “FOR” Proposal 1 and “FOR” Proposal 2. If any other business is presented at the Special Meeting of Shareholders, this proxy will be voted by those named in this proxy in their best judgment. At the present time, the Board of Directors knows of no other business to be presented at the Special Meeting of Shareholders.

Please mark, date, sign, and mail your proxy promptly in the envelope provided

IMPORTANT: SIGNATURE REQUIRED ON THE OTHER SIDE

PLEASE DETACH ALONG PERFORATED LINE AND MAIL IN THE ENVELOPE PROVIDED.

PLEASE DETACH ALONG PERFORATED LINE AND MAIL IN THE ENVELOPE PROVIDED.

KEEP THIS PORTION FOR YOUR RECORDS.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to be held March 26,

2019.

The Proxy Statement is available at:

http://www.viewproxy.com/rexahn/2019SM

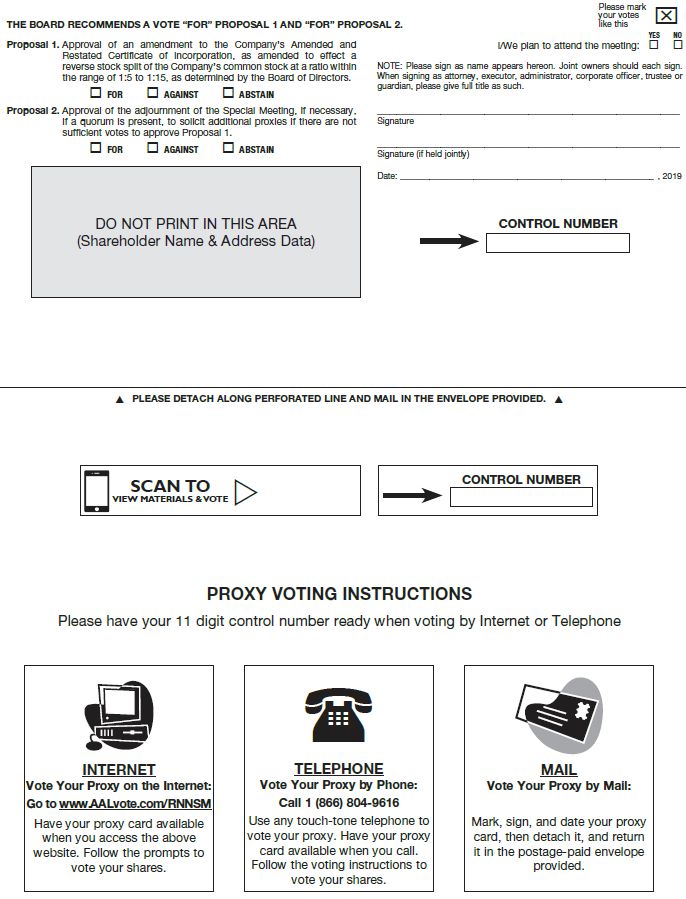

THE BOARD RECOMMENDS A VOTE “FOR” PROPOSAL 1 AND “FOR” PROPOSAL 2. Please mark your votes like this x Proposal 1. Approval of an

amendment to the Company’s Amended and Restated Certificate of Incorporation, as amended to effect a reverse stock split of the Company’s common stock at a ratio within the range of 1:5 to 1:15, as determined by the Board of Directors. o FOR o

AGAINST o ABSTAIN Proposal 2. Approval of the adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 1. o FOR o AGAINST o ABSTAIN DO NOT PRINT IN

THIS AREA (Shareholder Name & Address Data) I/We plan to attend the meeting: o o YES NO NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee or

guardian, please give full title as such. ______________________________________________________________ Signature ______________________________________________________________ Signature (if held jointly) Date:

____________________________________________________ , 2019 CONTROL NUMBER I/We plan to attend the meeting: o o YES NO SCAN t PLEASE DETACH ALONG PERFORATED LINE AND MAIL IN THE ENVELOPE PROVIDED. tSCAN TO VIEW MATERIALS & VOTE CONTROL NUMBER

PROXY VOTING INSTRUCTIONS Please have your 11 digit control number ready when voting by Internet or Telephone INTERNET Vote Your Proxy on the Internet: Go to www.AALvote.com/RNNSM Have

your proxy card available when you access the above website. Follow the prompts to vote your shares. TELEPHONE Vote Your Proxy by Phone: Call 1 (866) 804-9616 Use any touch-tone telephone to vote your proxy. Have your proxy card available when you

call. Follow the voting instructions to vote your shares. MAIL Vote Your Proxy by Mail: Mark, sign, and date your proxy card, then detach it, and return it in the postage-paid envelope provided.