DEF 14A: Definitive proxy statements

Published on April 29, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a−101)

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant | ☑ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a−6(e)(2))

|

| ☑ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material under §240.14a−12

|

Rexahn Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☑

|

No fee required.

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a−6(i)(1) and 0−11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0−11 (set forth the amount on which the filing fee is

calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0−11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

|

REXAHN PHARMACEUTICALS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held June 6, 2019

To Our Shareholders:

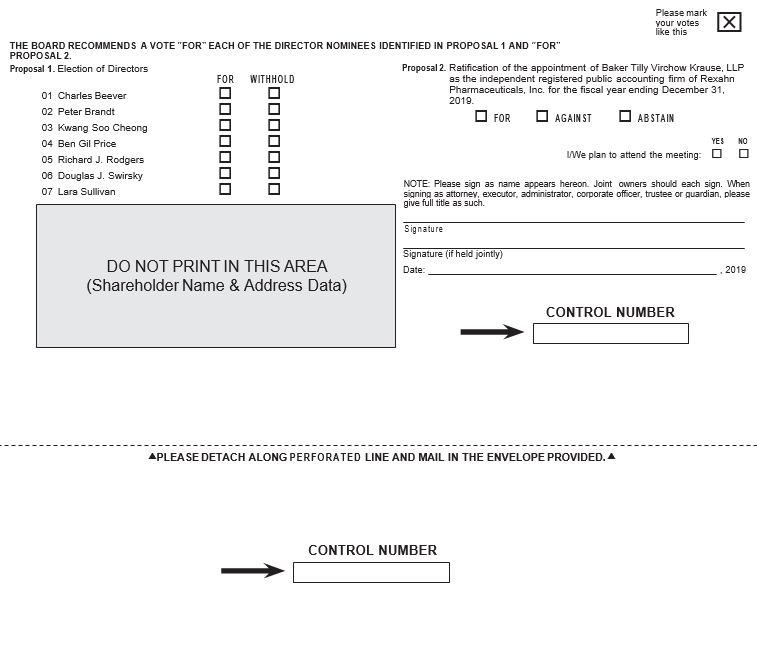

Notice is hereby given that the Annual Meeting of the Shareholders (the “Annual Meeting”) of Rexahn Pharmaceuticals, Inc. (the

“Company”) will be held on June 6, 2019, at 8:00 a.m. (local time), at the Radisson Hotel, 3 Research Court, Rockville, Maryland 20850. The Annual Meeting is called for the following purposes:

|

|

1. |

to elect as directors the seven nominees named in the accompanying proxy statement to a term of one year each, or until their successors have been elected and

qualified;

|

|

|

2. |

to ratify the appointment of Baker Tilly Virchow Krause, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2019;

and

|

|

|

3. |

to consider and take action upon such other matters as may properly come before the Annual Meeting or any postponement or adjournment thereof.

|

The Board of Directors has fixed April 25, 2019 as the record date for the determination of shareholders entitled to notice of, and

to vote at, the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to receive notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

The Board of Directors recommends that you vote FOR

Proposal 1 and FOR Proposal 2.

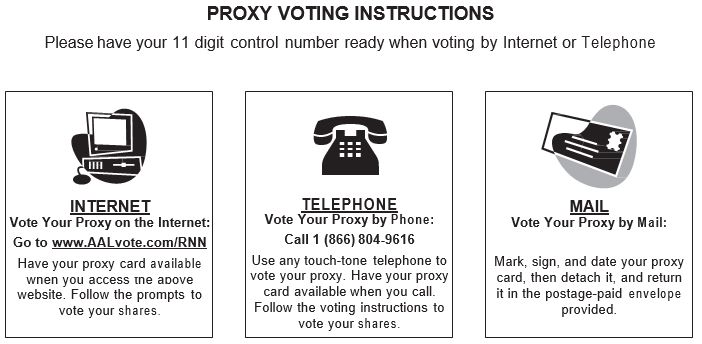

You are cordially invited to attend the Annual Meeting. Whether or

not you expect to attend, you are respectfully requested by the Board of Directors to promptly either sign, date and return the enclosed proxy card or vote via the

Internet or by telephone by following the instructions provided on the proxy card. A return envelope, which requires no postage if mailed in the United States, is enclosed for your

convenience.

|

By Order of the Board of Directors,

|

|

|

|

|

Douglas J. Swirsky

|

|

|

President and Chief Executive Officer

|

|

|

April 29, 2019

|

|

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to be Held on June 6, 2019:

Copies of our Proxy Materials, consisting of the

Notice of Annual Meeting, the Proxy Statement and our 2018 Annual Report are available at http://www.viewproxy.com/rexahn/2019

|

REXAHN PHARMACEUTICALS, INC.

15245 Shady Grove Road, Suite 455

Rockville, Maryland 20850

(240) 268-5300

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To be held June 6, 2019

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors

of Rexahn Pharmaceuticals, Inc. (“we”, “us”, or the “Company”) for the Annual Meeting of Shareholders to be held at the Radisson Hotel, located at 3 Research Court,

Rockville, Maryland 20850, on June 6, 2019, at 8:00 a.m. (local time) and for any postponement or

adjournment thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

We are providing our Proxy Materials to record shareholders by sending a printed copy of the full set of our proxy materials (the

“Proxy Materials”), consisting of the Notice of Annual Meeting, this Proxy Statement and a proxy card (the “Proxy Card”), and our 2018 Annual Report to Shareholders by mail. As required by Securities and Exchange Commission (“SEC”) rules, we

are also providing access to the Proxy Materials on the Internet.

The Proxy Statement and accompanying form of proxy are first being mailed to shareholders on or about May 3, 2019.

1

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND ANNUAL MEETING

| Q: |

Why are these materials being made available to me?

|

| A: |

The Proxy Materials are being provided to you in connection with the Annual Meeting and include this Proxy Statement and the related Proxy Card that are being used in

connection with the Board of Directors’ solicitation of proxies for the Annual Meeting. The information included in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process and certain

other required information.

|

| Q: |

How do I access the Company’s Proxy Materials online?

|

| A: |

The Proxy Card provides instructions for accessing the Proxy Materials over the Internet, and includes the Internet address where those materials are available. The

Company’s Proxy Statement for the Annual Meeting and the Company’s 2018 Annual Report to Shareholders can also be viewed on the Company’s website at www.rexahn.com.

|

| Q: |

What shares owned by me can be voted?

|

| A: |

All shares of the Company’s common stock, par value $0.0001 per share (“Common Stock”) owned by you as of the close of business on the Record Date may be voted by you.

Each share of Common Stock is entitled to one vote. These shares include those (1) held directly in your name as the shareholder of record (“Shareholder of Record”)

and (2) held for you as the beneficial owner through a broker, bank or other nominee.

|

| Q: |

What is the Record Date?

|

| A: |

The Record Date is April 25, 2019. Only Shareholders of Record as of the close of business on this date will be entitled to vote at the Annual Meeting.

|

| Q: |

How many shares are outstanding?

|

| A: |

As of the Record Date, the Company had 4,019,141 shares of Common Stock outstanding.

|

| Q: |

What is the difference between holding shares as a Shareholder of Record and as a beneficial owner?

|

| A: |

As summarized below, there are some distinctions between shares held of record and those owned beneficially.

|

Shareholder of Record

If your shares are registered directly in your name with the Company’s transfer agent, you are considered, with respect to those

shares, the Shareholder of Record. As the Shareholder of Record, you have the right to submit your voting proxy to have your shares voted at the Annual Meeting or to vote in person at the Annual Meeting.

2

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of

shares held in “street name” and your broker, bank or other nominee is considered, with respect to those shares, the Shareholder of Record. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and

are also invited to attend the Annual Meeting. However, because you are not the Shareholder of Record, you may not vote these shares in person at the Annual Meeting unless you receive a proxy from your broker, bank or other nominee. Your

broker, bank or other nominee has provided voting instructions for you to use. If you wish to attend the Annual Meeting and vote in person, please contact your broker, bank or other nominee so that you can receive a legal proxy to present at

the Annual Meeting.

| Q: |

What am I voting on?

|

| A: |

You are being asked to vote on (1) the election as directors of the seven nominees named in this Proxy Statement to a term of one year each, or until their successors

have been elected and qualified and (2) the ratification of the appointment of Baker Tilly Virchow Krause, LLP (“Baker Tilly”) as the independent registered public accounting firm of the Company for the fiscal year ending December

31, 2019.

|

The Company is not currently aware of any matters that will be brought before the Annual Meeting (other than procedural matters)

that are not referred to in the enclosed Proxy Card. If any other business should properly come before the Annual Meeting or any postponement or adjournment thereof, the persons named in the proxy will vote on such matters according to their

best judgment. Discretionary authority to vote on such matters is conferred by such proxies upon the persons voting them.

| Q: |

How do I vote?

|

| A: |

Shareholders of Record may vote by completing and signing the enclosed Proxy Card and returning it promptly in the enclosed postage prepaid, addressed envelope, or at

the Annual Meeting in person. We will pass out written ballots to anyone who is eligible to vote at the Annual Meeting. We also will request persons, firms, and corporations holding shares of the Company’s Common Stock in their

names or in the name of their nominees, which are beneficially owned by others, to send proxy material to and obtain proxies from the beneficial owners and will reimburse the holders for their reasonable expenses in so doing. Proxy

Cards properly executed and delivered by shareholders (by mail or via the Internet) and timely received by the Company will be voted in accordance with the instructions contained therein. If you authorize a proxy to vote your shares

over the Internet or by telephone, you should not return a Proxy Card by mail, unless you are revoking your proxy. If you hold your shares in “street name” through a broker, bank or other nominee, and are therefore not a Shareholder

of Record, you must request a legal proxy from your broker, bank or other nominee in order to vote at the Annual Meeting.

|

If you hold your shares in “street name” through a broker, bank or other nominee, you may vote via the Internet by going to www.proxyvote.com, while Shareholders of Record may go to www.aalvote.com/rnn

to vote via the Internet. All shareholders must have their control number (included in the proxy card or voting instructions) in order to vote via the Internet.

3

| Q: |

How many votes do you need to hold the Annual Meeting?

|

| A: |

Forty percent of the Company’s issued and outstanding shares of Common Stock as of the Record Date must be present at the Annual Meeting, either in person or by proxy,

in order to hold the Annual Meeting and conduct business. This is called a quorum.

|

| Q: |

How many votes must the director nominees have to be elected?

|

| A: |

In order for a director to be elected, the director must receive the affirmative vote of a plurality of the shares voted. There is no cumulative voting for the

Company’s directors or otherwise.

|

| Q: |

What are the voting requirements to approve the ratification of the independent auditor?

|

| A: |

The affirmative vote of a majority of the shares cast in person or represented by proxy at the Annual Meeting and entitled to vote on the matter is required to ratify

the Company’s independent auditors and to approve an adjournment of the Annual Meeting.

|

| Q: |

Who will count the votes?

|

| A: |

Votes at the Annual Meeting will be counted by an inspector of election, who will be appointed by the Board of Directors or the chairman of the Annual Meeting.

|

| Q: |

What is the effect of not voting?

|

| A: |

If you are a beneficial owner of shares in street name and do not provide the broker, bank or other nominee that holds your shares with specific voting instructions

then, under applicable rules, the broker, bank or other nominee that holds your shares can generally vote on “routine” matters, but cannot vote on “non‑routine” matters. In the case of a non-routine item, your shares will be

considered “broker non-votes” on that proposal.

|

Proposal 2 (ratification of the appointment of Baker Tilly Virchow Krause, LLP as the independent registered

public accounting firm) will be considered “routine” and Proposal 1 (election of directors) will be considered “non-routine.”

If you are a Shareholder of Record and you do not cast your vote, no votes will be cast on your behalf on any of

the items of business at the Annual Meeting. If you are a Shareholder of Record and you properly sign and return your Proxy Card, your shares will be voted as you direct. If no instructions are indicated on such Proxy Card and you are a

Shareholder of Record, shares represented by the proxy will be voted in the manner recommended by the Board of Directors on all matters presented in this Proxy Statement, namely “FOR” all the director nominees, and “FOR” the ratification of the

appointment of Baker Tilly as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019.

| Q: |

How are broker non-votes and abstentions treated?

|

| A: |

Broker non-votes and abstentions with respect to a proposal are counted as present or represented by proxy for purposes of establishing a quorum. If a quorum is

present, broker non votes and votes to withhold will have no effect on the outcome of the votes on Proposal 1 (election of directors), but abstentions will count as votes against Proposal 2 (ratification of the appointment of Baker

Tilly Virchow Krause, LLP as the independent registered public accounting firm).

|

4

| Q: |

Can I revoke my proxy or change my vote after I have voted?

|

| A: |

You may revoke your proxy and change your vote by voting again via the Internet or telephone, by completing, signing, dating and returning a new Proxy Card or voting

instruction form with a later date, or by attending the Annual Meeting and voting in person. Only your latest dated Proxy Card received at or prior to the Annual Meeting will be counted. Your attendance at the Annual Meeting will

not have the effect of revoking your proxy unless you forward written notice to the Secretary of the Company at the above stated address or you vote by ballot at the Annual Meeting.

|

| Q: |

What does it mean if I receive more than one Proxy Card?

|

| A: |

It means that you have multiple accounts at the transfer agent and/or with brokers, banks or other nominees. To ensure that all of your shares in each account are

voted, please sign and return all Proxy Cards, vote with respect to all accounts via the internet or by telephone, or, if you plan to vote at the Annual Meeting, contact each broker, bank or other nominee so that you can receive all

necessary legal proxies to present at the Annual Meeting.

|

| Q: |

What are the costs of soliciting these proxies and who will pay?

|

| A: |

We will bear the costs of preparing, printing, assembling, and mailing the Proxy Materials and of soliciting proxies. In addition to solicitations by mail, the Company

and its directors, officers and employees may solicit proxies by telephone and email. We will request brokers, custodians and fiduciaries to forward proxy soliciting material to the owners of shares of the Company’s Common Stock

that they hold in their names. We will reimburse banks and brokers for their reasonable out-of-pocket expenses incurred in connection with the distribution of the Company’s proxy materials.

|

| Q: |

Do I have appraisal or similar dissenter’s rights?

|

| A: |

Appraisal rights and similar rights of dissenters are not available to shareholders in connection with proposals brought before the Annual Meeting.

|

| Q: |

Where can I find the voting results of the Annual Meeting?

|

| A: |

The Board of Directors will announce the voting results at the Annual Meeting. We will also publish the results in a Current Report on Form 8-K within four business

days after the date of the Annual Meeting. We will file that report with the SEC, and you can get a copy:

|

|

|

• |

by contacting the Company’s corporate offices via phone at (240) 268-5300 or by e-mail at ir@rexahn.com; or

|

|

|

• |

through the SEC’s EDGAR system at www.sec.gov.

|

5

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITY HOLDERS

The table below sets forth the beneficial ownership of our Common Stock as of April 25, 2019 by the following individuals or

entities:

|

|

• |

each director and nominee;

|

|

|

• |

each named executive officer identified in the Summary Compensation Table; and

|

|

|

• |

all current directors and executive officers as a group.

|

As of April 25, 2019, based on our review of statements filed with the SEC pursuant to Sections 13(d) and 13(g) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), no person or group of affiliated persons is known to us to beneficially own 5% or more of our outstanding Common Stock.

As of April 25, 2019, 4,019,141 shares of our Common Stock were issued and outstanding. All persons named in the table below have

sole voting power and sole investment power with respect to the shares indicated as beneficially owned. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock that

could be acquired by the exercise of stock options within 60 days of April 25, 2019 are deemed outstanding, while such shares are not deemed outstanding for purposes of computing percentage ownership of any other person. In addition, the

address for each person named below is c/o Rexahn Pharmaceuticals, Inc., 15245 Shady Grove Road, Suite 455, Rockville, Maryland 20850.

|

Shares of Rexahn Pharmaceuticals

Common Stock

Beneficially Owned

|

||||||||

|

Name of Beneficial Owner

|

Number of Shares

|

Percentage

|

||||||

|

Directors and Named Executive Officers:

|

||||||||

|

Douglas J. Swirsky

|

11,544

|

(1)

|

*

|

|||||

|

Peter Brandt

|

6,289

|

(2)

|

*

|

|||||

|

Charles Beever

|

6,121

|

(3)

|

*

|

|||||

|

Kwang Soo Cheong

|

5,230

|

(4)

|

*

|

|||||

|

Ben Gil Price

|

1,250

|

*

|

||||||

|

Richard J. Rodgers

|

3,791

|

(5)

|

*

|

|||||

|

Lara Sullivan

|

-

|

*

|

||||||

|

Lisa Nolan

|

12,054

|

(6)

|

*

|

|||||

|

Peter Suzdak

|

55,428

|

(7)

|

1.4

|

%

|

||||

|

Ely Benaim

|

21,816

|

(8)

|

*

|

|||||

|

All current executive officers and directors as a group (8 persons)

|

46,279

|

(9)

|

1.1

|

%

|

||||

| * |

Represents less than 1% of the issued and outstanding shares of our Common Stock as of April 25,

2019.

|

| (1) |

Includes Mr. Swirsky’s options to purchase 7,378 shares of Common Stock that are currently

exercisable or exercisable within 60 days of April 25, 2019.

|

6

| (2) |

Includes Mr. Brandt’s options to purchase 5,039 shares of Common Stock that are currently

exercisable or exercisable within 60 days of April 25, 2019.

|

| (3) |

Includes Mr. Beever’s options to purchase 5,205 shares of Common Stock that are currently

exercisable or exercisable within 60 days of April 25, 2019.

|

| (4) |

Includes Dr. Cheong’s options to purchase 5,205 shares of Common Stock that are currently

exercisable or exercisable within 60 days of April 25, 2019.

|

| (5) |

Includes Mr. Rodgers’ options to purchase 3,791 shares of Common Stock that are currently

exercisable or exercisable within 60 days of April 25, 2019.

|

| (6) |

Includes Dr. Nolan’s options to purchase 10,118 shares of Common Stock that are currently

exercisable or exercisable within 60 days of April 25, 2019.

|

| (7) |

Includes Dr. Suzdak’s options to purchase 53,054 shares of Common Stock that are currently exercisable or exercisable within 60 days of April 25, 2019.

|

| (8) |

Includes Dr. Benaim’s options to purchase 21,421 shares of Common Stock that are currently

exercisable or exercisable within 60 days of April 25, 2019.

|

| (9) |

Includes options to purchase 36,736 shares of Common Stock that are currently exercisable or

exercisable within 60 days of April 25, 2019.

|

7

PROPOSAL 1: ELECTION OF DIRECTORS

Seven director nominees have been nominated for election at the Annual Meeting to serve a one-year term until the next Annual

Meeting in 2020. All of the nominees currently serve on the Board of Directors. All nominees have consented to being named in this Proxy Statement and to serve if elected.

The Board of Directors recommends that the nominees listed below be elected as directors. We have no reason to believe that any of

the nominees will not be a candidate or will be unable to serve. However, in the event that any of the nominees should become unable or unwilling to serve as a director, the persons named in the proxy have advised that they will vote (unless

authority has been withdrawn) for the election of such person or persons as shall be designated by management.

The following table sets forth the names, ages and positions of our nominees for directors. All of the director nominees are

currently members of the Board of Directors.

|

Name

|

Age

|

Position

|

|

Peter Brandt

|

62

|

Chairman of the Board of Directors

|

|

Douglas J. Swirsky

|

49

|

President and Chief Executive Officer and Director

|

|

Charles Beever

|

66

|

Director

|

|

Kwang Soo Cheong

|

58

|

Director

|

|

Richard J. Rodgers

|

52

|

Director

|

|

Ben Gil Price

|

63

|

Director

|

|

Lara Sullivan

|

46

|

Director

|

Peter Brandt. Mr. Brandt has served as our

Chairman since June 2015 and as director since September 2010. From February 2011 to early 2013, Mr. Brandt served on the Board of Directors and, in December 2012, became Chairman of the Board of Directors of ePocrates, Inc., a point of care

medical applications company, which was acquired by athenahealth, Inc. Also, from November 2011 until March 2012, Mr. Brandt served as interim Chief Executive Officer and President of ePocrates, Inc. Mr. Brandt served as President, Chief

Executive Officer, and as a member of the Board of Directors of Noven Pharmaceuticals, Inc., a specialty pharmaceutical company, from early 2008 until Noven’s acquisition by Hisamitsu Pharmaceutical Co., Inc. in August 2009. Prior to leading

Noven, Mr. Brandt spent 28 years at Pfizer, the world’s largest pharmaceutical company. He served as Pfizer’s President – U.S. Pharmaceuticals Operations, where he helped deliver revenue and earnings growth while engineering major change within

Pfizer’s U.S. pharmaceuticals organization. Prior to running U.S. operations, he led Pfizer’s Latin American pharmaceuticals operations, as well as the following Pfizer Worldwide Pharmaceuticals functions: finance, information technology,

planning and business development. He also oversaw the operations of Pfizer’s care management subsidiary, Pfizer Healthcare Solutions. Mr. Brandt served as a director of Auxilium Pharmaceuticals, Inc. (“Auxilium”) from December 2010 to January

2015, at which time Auxilium was acquired by Endo International PLC. Mr. Brandt holds a B.A. from the University of Connecticut and an M.B.A. from the Columbia School of Business. Mr. Brandt contributes his broad operational management

experience in the life sciences industry and experience serving on numerous boards of directors of life sciences companies to the Board of Directors.

8

Douglas J. Swirsky. Mr. Swirsky has served as our President and Chief Executive Officer and a Director since November 2018, and served as our President, Chief Financial Officer, and Corporate

Secretary from January 2018 to November 2018. Prior to joining the Company, Mr. Swirsky was most recently President, CEO and a director of GenVec, Inc., a publicly traded biotechnology company, a position he held from 2013 through the sale of

the company in 2017. He joined GenVec in 2006 as Chief Financial Officer. Prior to joining GenVec, Mr. Swirsky was a Managing Director and the Head of Life Sciences Investment Banking at Stifel Nicolaus from 2005 to 2006 and held investment

banking positions at Legg Mason from 2002 until Stifel Financial’s acquisition of the Legg Mason Capital Markets business in 2005. He has also previously held investment banking positions at UBS, PaineWebber and Morgan Stanley. Mr. Swirsky also

currently serves on the board of directors of Fibrocell Science, Inc., Cellectar Biosciences, Inc., and Pernix Therapeutics Holdings, Inc. Mr. Swirsky is a certified public accountant and a CFA® charter holder. He received his B.S. in Business

Administration from Boston University and his M.B.A. from the Kellogg School of Management at Northwestern University. Mr. Swirsky contributes extensive financial and industry experience to the Board of Directors.

Charles Beever. Mr. Beever has served as a

director since May 2006. From 1993 to June 2015, he was a Vice President of PwC Strategy&, a global strategy consulting firm, formerly Booz & Company and Booz Allen Hamilton (“Booz Allen”), Prior to being elected Vice President of Booz

Allen in 1993, he served as staff member and Engagement Manager at Booz Allen from January 1984 to October 1993. Prior to joining Booz Allen, Mr. Beever served in various management roles at McGraw-Edison Company. Mr. Beever holds a B.A. in

Economics from Haverford College, where he was elected to Phi Beta Kappa, and an M.B.A. from the Harvard Graduate School of Business Administration. Mr. Beever contributes extensive managerial and business experience to the Board of Directors.

Kwang Soo Cheong. Dr. Cheong has served as

a director since May 2006. He is a faculty member at the Department of Finance of the Johns Hopkins University Carey Business School, where he was an Assistant Professor from 2001 to 2005 and has been an Associate Professor since 2006. Dr.

Cheong was an Assistant Professor of Economics at the University of Hawaii from 1994 to 2001, and a lecturer at the Department of Economics of Stanford University from 1993 to 1994. During the summer of 1995, Dr. Cheong was a Visiting Fellow in

the Taxation and Welfare Division at the Korea Development Institute in Korea. Dr. Cheong holds a B.A. in Economics and an M.A. in Economics from Seoul National University, and a Ph.D. in Economics from Stanford University. Dr. Cheong’s

distinguished academic career focused on finance and economics contributes to the Board of Directors’ perspective.

Richard J. Rodgers. Mr. Rodgers has served as a director since December 2014. In addition to his board seat with the Company, Mr. Rodgers currently serves on the Board of Directors of Ardelyx, Inc., a

pharmaceutical company, and 3-V Biosciences, Inc., a clinical stage pharmaceutical company. Mr. Rodgers was previously Executive Vice President, Chief Financial Officer, Secretary

and Treasurer of TESARO, Inc., an oncology-focused biopharmaceutical company that he co-founded, from March 2010 until August 2013. He served as the Chief Financial Officer from June 2009 to February 2010 of Abraxis BioScience, which was

subsequently acquired by Celgene. Prior to that, Mr. Rodgers served as Senior Vice President, Controller and Chief Accounting Officer of MGI PHARMA, from 2004 until its acquisition by Eisai in January 2008. He has held finance and accounting

positions at several private and public companies, including Arthur Anderson. Mr. Rodgers received a B.S. in Financial Accounting from St. Cloud State University and his M.B.A. in Finance from the University of Minnesota, Carlson School of

Business. Mr. Rodgers contributes extensive financial and industry experience to the Board of Directors.

9

Ben Gil Price. Dr. Price has served as a director since November 2018. Since 2017, Dr. Price has served as chief medical officer of the pharmacovigilance team of ProPharma Group, a global industry leader in

comprehensive compliance services that span the entire lifecycle of pharmaceuticals, biologics, and devices. He previously served as chief executive officer and chief medical Officer of Drug Safety Solutions, Inc., a provider of solutions for

clinical and drug safety operations, from 2002 until its acquisition by ProPharma Group in 2017. From 1997 to 2002, Dr. Price was the director of clinical development for oncology at MedImmune, Inc., which is now the biologics subsidiary of

AstraZeneca plc. Prior to joining MedImmune, Dr. Price worked in the contract research organization sector. Dr. Price began his pharmaceutical career at Glaxo Inc., which is now GlaxoSmithKline plc, where he worked for nearly nine years on both

the commercial and research sides of that company. From 2007 to 2016, Dr. Price served on the board of directors of Sarepta Therapeutics, Inc., a commercial-stage biopharmaceutical company focused on the discovery and development of unique

RNA-targeted therapeutics for the treatment of rare neuromuscular diseases. Dr. Price is a clinical physician trained in internal medicine, and is a former member of the American Medical Association, the Academy of Pharmaceutical Physicians and

a past member of the American Society for Microbiology. Dr. Price contributes experience in the clinical, research and commercial sectors in the fields of medicine and pharmaceuticals.

Lara Sullivan. Dr. Sullivan has served as a director since February 2019. Dr. Sullivan is a founder and from 2017 to 2018 served as president of SpringWorks Therapeutics, Inc., a clinical stage biopharmaceutical

company. Prior to joining SpringWorks Therapeutics, Dr. Sullivan served as a vice president of Pfizer Inc., a multinational pharmaceutical company, from 2011 to 2017. While at Pfizer she helmed strategy and portfolio operations for the

company’s early-stage pipeline and led the work, inside Pfizer and with outside patient groups and partners, to create SpringWorks Therapeutics. Prior to joining Pfizer, Dr. Sullivan was an associate principal in the pharmaceutical and medical

products practice at McKinsey & Company, where she advised biopharmaceutical clients on a variety of strategic and operational issues, with a particular emphasis on research and development productivity. Dr. Sullivan also served as a

principal at Paul Capital Partners, where she led due diligence for investments in their healthcare fund, and earlier in her career worked in healthcare equity research and municipal finance at Credit Suisse First Boston. Dr. Sullivan holds an

M.D. from the University of Pennsylvania School of Medicine, an M.B.A. from The Wharton School at the University of Pennsylvania, and a B.A. in comparative literature from Cornell University. Dr. Sullivan contributes her experience in the life

sciences industry to the Board of Directors.

The Board of Directors recommends a vote FOR the election of each of the director nominees.

Executive Officers

In addition to Douglas J, Swirsky, whose information is included above, set forth below is information about our other executive

officer:

Lisa Nolan. Dr. Nolan, 56, has served as Chief Business Officer since June 2016 and as our Corporate Secretary since November 2018. Prior to this, she served as Chief Business Officer of

Relmada Therapeutics, Inc., a clinical-stage biotechnology company, from April 2015 to June 2016. From March 2010 through June 2016, Dr. Nolan served as Managing Director of Nolex Advisors, LLC, a business development and management consultancy

firm, where she led successful competitive processes for out-licensing of early and late-stage pharmaceutical products. Over the course of her career, Dr. Nolan has held various leadership roles at biopharmaceutical companies including Chief

Business Officer at Topigen Pharmaceuticals, where she led the acquisition of Topigen by Pharmaxis. Additionally, she served as Vice President, Global Business Development and Strategic Marketing for SkyePharma Inc., where she completed over a

dozen out-licensing deals in the U.S. and Europe with deal values ranging in excess of $500 million. Dr. Nolan holds a Ph.D. in clinical pharmacology and a M.Sc., and B.Sc., in pharmacy from Trinity College in Dublin, Ireland.

10

Director Independence

Our Common Stock is currently listed on NYSE American. We use the NYSE American definition of “Independent Director” in determining

whether a director is independent in his capacity as a director and in his capacity as a member of a board committee. For the Audit Committee, we additionally use Rule 10A-3(b)(1) under the Exchange Act.

Each director serving on the Audit Committee must also comply with the following additional NYSE American requirements:

(a) the director must not have participated in the

preparation of our financial statements or any current subsidiary at any time during the past three years; and

(b) the director must be able to read and understand

fundamental financial statements, including our balance sheet, income statement, and cash flow statement.

We currently have a total of seven directors, six of whom are Independent Directors. Our Independent Directors are Messrs. Brandt,

Beever, and Rodgers and Drs. Cheong, Price and Sullivan. In making the independence determination with respect to Dr. Price, the Board considered that his employer provides pharmacovigilance services to the Company.

Board Leadership Structure

The Board of Directors does not have a formal policy on whether the role of Chairman and Chief Executive Officer should be separate

or combined. However, at the present time, these roles are separate. The Board of Directors believes that utilizing separate individuals as Chairman and Chief Executive Officer will provide for additional leadership and management perspective

as we progress in the development of our drug candidates. Six of our seven director nominees are independent and each of our standing committees (Audit, Nominating and Corporate Governance, and Compensation) is comprised solely of independent

directors. We believe this structure provides adequate oversight of Company operations by our independent directors in conjunction with our Chairman and Chief Executive Officer.

The Audit Committee has primary responsibility for oversight of risk management on behalf of the Board of Directors. Management reports to the Audit Committee on matters relating to risk management and the Audit Committee and management communicate directly with the full Board of Directors on these

matters.

Board of Directors and Board of Directors Meetings

The Board of Directors held 11 meetings during the year ended December 31, 2018. Each current director attended 75% or more of the

meetings of the Board of Directors and committees of which they were members during the period in which he or she served as a director during the year ended December 31, 2018.

11

Any shareholder who wishes to send any communications to the Board of Directors or to individual directors should deliver such

communications to our executive offices, 15245 Shady Grove Road, Suite 455, Rockville, Maryland 20850, Attention: Corporate Secretary (secretary@rexahn.com). Any such communication should indicate whether the communication is intended to be

directed to the entire Board of Directors or to a particular director(s), and must indicate the number of shares of Common Stock beneficially owned by the shareholder. The Corporate Secretary will forward appropriate communications to the Board

of Directors and/or the appropriate director(s), but will not forward inappropriate communications. Inappropriate communications include correspondence that does not relate to our business or affairs or the functioning of the Board of Directors

or its committees, advertisements or other commercial solicitations or communications, and communications that are frivolous, threatening, illegal or otherwise not appropriate for delivery to directors.

Members of the Board of Directors are encouraged to attend the Annual Meeting if they are available. Four of the five members of the

Board of Directors in office at the time attended the Annual Meeting held in 2018.

Board of Directors Committees

The Board of Directors has three standing committees, the Audit Committee, the Compensation Committee and the Nominating and

Corporate Governance Committee, each of which is composed of three members. Each of these committees has a charter that is available on our website at www.rexahn.com.

Audit Committee

The Audit Committee Charter provides that such committee, among other things:

|

|

• |

appoints or replaces and oversees our independent auditors and approves all audit engagement fees and terms;

|

|

|

• |

preapproves all audit (including audit-related) services, internal control-related services and permitted non-audit services (including fees and terms thereof) to be

performed for us by our independent auditors;

|

|

|

• |

reviews and discusses with our management and independent auditors significant issues regarding accounting and auditing principles and practices and financial statement

presentations;

|

|

|

• |

reviews and approves our procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and

the confidential, anonymous submission by our employees of concerns regarding accounting or auditing matters; and

|

|

|

• |

reviews and oversees our compliance with legal and regulatory requirements.

|

12

Mr. Rodgers, Dr. Cheong, and Mr. Beever serve as members of the Audit Committee. Mr. Rodgers serves as Chair of the Audit Committee.

The Board of Directors has determined that both Mr. Rodgers and Dr. Cheong are qualified audit committee financial experts within the meaning of applicable SEC regulations. Each of the current members meets the criteria for independence

required by NYSE American and Rule 10A-3 under the Exchange Act. During the year ended December 31, 2018, the Audit Committee met five times.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee Charter provides that such committee, among other things:

|

|

• |

reviews, evaluates and seeks out candidates qualified to become Board of Directors members;

|

|

|

• |

reviews committee structure and recommends directors for appointment to committees;

|

|

|

• |

develops, reevaluates (not less frequently than every three years) and recommends the selection criteria for Board of Directors and committee membership;

|

|

|

• |

establishes procedures to oversee evaluation of the Board of Directors, its committees, individual directors and management; and

|

|

|

• |

develops and recommends guidelines on corporate governance.

|

Mr. Brandt, Dr. Sullivan, and Dr. Cheong currently serve as members of the Nominating and Corporate Governance Committee. Mr. Brandt

serves as Chair of the Nominating and Corporate Governance Committee. Each of the Nominating and Corporate Governance Committee’s members meets the criteria for independence required by NYSE American.

The Nominating and Corporate Governance Committee reviews, evaluates and seeks out candidates qualified to become Board of Directors

members. The Board of Directors currently includes individuals with a diversity of experience, including scientific, business, financial and academic backgrounds. However, while diversity relating to background, skill, experience and

perspective is one factor considered in the nomination process, we do not have a formal policy relating to diversity. Nominations may be submitted by directors, officers, employees, shareholders and others for recommendation to the Board of

Directors. In fulfilling this responsibility, the Nominating and Corporate Governance Committee also consults with the Board of Directors and the Chief Executive Officer concerning director candidates. While we do not have in place formal

procedures by which shareholders may recommend director candidates to the Nominating and Corporate Governance Committee, shareholders may communicate with the members of the Board of Directors, including the Nominating and Corporate Governance

Committee, by writing to the Secretary of the Board of Directors at our headquarters address. Candidates submitted by directors and management, as well as candidates recommended by shareholders, are evaluated in the same manner as other

candidates identified to the Nominating and Corporate Governance Committee. In addition, our Amended and Restated Bylaws establish a procedure with regard to shareholder proposals for the Annual Meeting of Shareholders, including nominations of

persons for election to the Board of Directors. Because shareholders have an adequate opportunity to recommend nominees for directors, we believe that formal procedures are not necessary. During the year ended December 31, 2018, the Nominating

and Corporate Governance Committee met twice.

13

Compensation Committee

The Compensation Committee Charter provides that such committee, among other things:

|

|

• |

fixes salaries of executive officers and reviews salary plans for other executives in senior management positions;

|

|

|

• |

reviews and makes recommendations with respect to the compensation and benefits for non-employee directors, including through equity-based plans;

|

|

|

• |

evaluates the performance of the Chief Executive Officer and other senior executives and assists the Board of Directors in developing and evaluating potential

candidates for executive positions; and

|

|

|

• |

administers the incentive compensation, deferred compensation and equity-based plans pursuant to the terms of the respective plans.

|

The Compensation Committee may delegate this authority to subcommittees consisting of one or more of its members.

Our Chief Executive Officer makes recommendations to the Compensation Committee regarding our business goals and the performance of

executives in achieving those goals, and recommends other executives’ compensation levels to the Compensation Committee based on such performance. The Compensation Committee considers these recommendations and then makes an independent decision

regarding officer compensation levels and awards.

As part of determining compensation for our executive officers, the Compensation Committee has engaged Radford, an AON Hewitt

Consulting company, as its independent compensation consultant. Radford provides analysis and recommendations to the Compensation Committee regarding:

|

|

• |

trends and emerging topics with respect to executive compensation;

|

|

|

• |

peer group selection for executive compensation benchmarking;

|

|

|

• |

compensation practices for our peer group;

|

|

|

• |

compensation programs for executives; and

|

|

|

• |

stock utilization and related metrics.

|

Radford reports to the Compensation Committee and not to management, although Radford confers with management for purposes of gathering information for its analyses and recommendations.In determining to engage Radford, the Compensation Committee considered the independence of Radford, and determined that Radford and the individual compensation advisors employed by Radford are independent.

Mr. Beever, Mr. Rodgers and Dr. Price currently serve as members of the Compensation Committee. Mr. Beever serves as Chairman of the

Compensation Committee. Each of the members meets the criteria for independence required by NYSE American. During the year ended December 31, 2018, the Compensation Committee met five times.

14

Ad Hoc Committees

From time to time, the Board may create ad hoc committees for specific purposes. In February 2019, the Board formed the Business

Development Committee, which is intended to assist the Board with its oversight of the Company’s business development and in-licensing activities with the goal of maximizing the value of the Company’s current and future development programs.

Dr. Sullivan, Dr. Price and Mr. Brandt currently serve as members of the Business Development Committee. Dr. Sullivan serves as Chair of the Business Development Committee.

15

COMPENSATION OF EXECUTIVE OFFICERS

Compensation

Overview

This Compensation Overview addresses the

compensation of our executive officers who are named in the “Summary Compensation Table” below, or our “named executive officers.” It should be read together with the related tables and disclosures that follow. Our named executive officers

for the year ended December 31, 2018 were:

|

|

• |

Douglas J. Swirsky, our President and Chief Executive Officer

|

|

|

• |

Peter Suzdak, our former Chief Executive Officer

|

|

|

• |

Ely Benaim, our former Chief Medical Officer

|

|

|

• |

Lisa Nolan, our Chief Business Officer and Corporate Secretary

|

Compensation Setting Process

Determination

of Compensation. The

Compensation Committee of the Board of Directors makes compensation decisions regarding our named executive officers. The Compensation Committee has engaged Radford as an independent compensation consultant to provide advice on the overall

compensation program, as well as information regarding market and best practices. At the end of 2016 the Committee received a report from Radford, which we used to help set 2017 compensation and which was used again for 2018.

The Compensation Committee also intends to

consider the outcome of say on pay votes when making executive compensation decisions in the future. In the last shareholder vote in 2017, approximately 86% of the votes cast on the “say on pay” proposal were voted in favor of that proposal.

The Compensation Committee believes that this overwhelming majority of votes cast, which was an increase over the prior vote, affirms shareholders’ support for the judgment of the Compensation Committee in setting executive compensation and,

as a result, did not set or change 2018 executive compensation as a direct result of the prior shareholder vote.

Independent

Compensation Consultant. Radford,

as the Compensation Committee’s independent compensation consultant, provides analysis and recommendations to the Compensation Committee regarding:

|

|

• |

trends and emerging topics with respect to executive compensation;

|

|

|

• |

peer group selection for executive compensation benchmarking;

|

|

|

• |

compensation practices for our peer group;

|

|

|

• |

compensation programs for executives; and

|

|

|

• |

stock utilization and related metrics.

|

When requested, Radford consultants

attend meetings of the Compensation Committee. Radford reports to the Compensation Committee and not to management, although Radford confers with management for purposes of gathering information for its analyses and recommendations.

16

Components of our Compensation Program

The compensation program for our named

executive officers consists of base salary, annual variable incentives under our short-term incentive (“STI”) program and long-term incentives, for which we currently use stock option awards. Our named executive officers are also entitled to

certain compensation upon termination of their employment. We believe these different forms of compensation provide appropriate incentives to achieve our business goals within the context of our overall philosophy for compensation.

Base

Salary. The base salary payable to each named executive officer is intended to provide a fixed component of compensation reflecting the

executive’s skill set, experience, roles and responsibilities.

Short-term

Incentive Program. Our STI

program is intended to provide a cash incentive to our named executive officers for achieving Company-wide goals approved at the beginning of each year by the Compensation Committee. We believe that having an annual STI program provides an

important and customary retention tool and motivates our executives to achieve the specific goals that are a part of the program. The Compensation Committee establishes a set bonus target expressed as a percentage of salary for each named

executive officer and established goals for the STI program. After the conclusion of the year, the Compensation Committee determines at what level the goals were achieved.

Long-term

Incentive Program. Our use of equity awards is intended to align our named executive officers’ interests with the interest of our shareholders

by providing an incentive to our named executive officers to increase long-term shareholder value. Furthermore, we believe that in the biopharmaceutical industry, equity awards are a primary motivator to retain executives. We determine the

size, mix and frequency of the awards based on numerous factors, including the executive’s skills and experience, the executive’s responsibilities, performance in the prior year and our approach to setting compensation. For 2018, we used

stock options for equity awards. All of the stock options issued to the named executive officers vest over a four year-period, with the first

installment vesting on the first anniversary of the award.

Employment

Agreements. At the time each of our named executive officers joined the Company, we entered into employment agreements with them. Dr. Swirsky’s agreement was subsequently amended in 2018 to reflect his promotion to Chief Executive Officer.

These agreements were designed to be a part of a competitive compensation package for a publicly traded company and to keep our named executive officers focused on our business goals and objectives. The agreements are described in detail in

the narrative disclosure following the Summary Compensation Table below. In November 2018, Dr. Suzdak informed us of his resignation from the Company, and entered into an agreement with us to formalize the terms of his resignation. In March

2019, Dr. Benaim informed us of his resignation from the Company.

Payments

on Termination. Pursuant to their employment agreements, each of our named executive officers who is currently employed by us is entitled to specified benefits in the event of the termination of their employment under specified circumstances,

including termination following a change of control of the Company. The terms of these arrangements are more fully described below under “Employment Agreements.” We believe these protections are appropriate for the senior executives of a

biopharmaceutical company such as the Company, including because of the level of acquisition activity in this industry. We believe that providing benefits in the event of a change of control of the Company allows our named executive

officers to focus their attention on building our business rather than on the personal implications of a transaction.

17

Summary Compensation Table

The following table sets forth the annual and long-term compensation, from all sources, for our named executive officers for

services rendered in all capacities to the Company for the years ended December 31, 2018 and 2017, except as noted below. Our named executive officers include our current principal executive officer and financial officer, our former principal

executive officer during 2018, and the two other executive officers that served as executive officers during 2018. The compensation described in this table does not include medical or other benefits which are available generally to all of our

salaried employees.

|

Name and Principal

Position(s)

|

Year

|

Salary

($)

|

Stock

Awards

($)(1)

|

Option

Awards

($)(1)(2)

|

Non-

Equity

Incentive

Plan

($)(2)

|

All Other

Compensation

($)

|

Total

($)

|

|||||||||||||||||||

|

Douglas J. Swirsky

President and Chief Executive Officer

|

2018

|

359,952

|

-

|

703,977

|

106,250

|

14,175

|

1,184,354

|

|||||||||||||||||||

|

Peter D. Suzdak (3)

Former Chief Executive Officer

|

2018

|

419,931

|

-

|

167,999

|

-

|

713,715

|

1,301,645

|

|||||||||||||||||||

|

2017

|

450,000

|

46,000

|

135,743

|

157,500

|

16,489

|

805,732

|

||||||||||||||||||||

|

Ely Benaim (4)

Former Chief Medical Officer

|

2018

|

440,000

|

-

|

294,861

|

100,000

|

16,500

|

851,361

|

|||||||||||||||||||

|

2017

|

400,000

|

17,480

|

51,987

|

136,000

|

16,300

|

621,767

|

||||||||||||||||||||

|

Lisa Nolan

Chief Business Officer and Corporate Secretary

|

2018

|

335,000

|

-

|

62,999

|

80,000

|

16,407

|

494,406

|

|||||||||||||||||||

|

2017

|

325,000

|

11,960

|

36,391

|

79,625

|

16,027

|

469,003

|

||||||||||||||||||||

| (1) |

Reflects grant date fair value computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. A

discussion of assumptions used in calculating grant date fair value of our equity awards can be found in Note 11 to the Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2018.

|

| (2) |

The actual value realized by each officer with respect to option awards will depend on the difference between the market value of our Common Stock on the date the

option is exercised and the exercise price.

|

| (3) |

Dr. Suzdak resigned from the Company in November 2018. The amounts specified under the “All Other Compensation” column for Dr. Suzdak include payments upon termination

of $697,500 pursuant to his employment agreement and his separation agreement.

|

| (4) |

Dr. Benaim resigned from the Company in March 2019.

|

18

Employment Agreements

We have employment agreements with each of our named executive officers.

Effective January 2, 2018, we entered into an employment agreement with Mr. Swirsky to serve as our President and Chief Financial

Officer, which was subsequently amended on November 14, 2018 upon Mr. Swirsky’s promotion to Chief Executive Officer. Pursuant to the amended employment agreement, we agreed to pay Mr. Swirsky a base salary of $425,000 (increased from $350,000)

with the option of a discretionary annual cash bonus of up to 40% of his base salary for 2018 and up to 50% of his base salary for subsequent years, as determined by performance against objectives and milestones set by the Board of Directors.

Mr. Swirsky’s employment agreement provided for an initial grant of 20,833 options to purchase shares of our common stock, and the amended employment agreement entered into in connection with his promotion to Chief Executive Officer provided

for an additional grant of 41,666 options to purchase shares of our Common Stock and that the Board of Directors may award him additional options each year. In the event Mr. Swirsky’s employment is terminated by reason of disability or for

“cause,” as defined in the employment agreement, we will pay Mr. Swirsky his base salary owed up to the termination date, including payment for any unused vacation days, and any earned but unpaid annual bonus for a year prior to the year in

which the termination occurs. If we terminate Mr. Swirsky’s employment without cause or Mr. Swirsky terminates his employment with “Good Reason,” as defined below, then Mr. Swirsky’s stock options will be subject to accelerated vesting to the

extent to which they would have vested within the 12 months following termination and we shall pay Mr. Swirsky his base salary owed up to the termination date, including payment for any unused vacation days, any earned but unpaid annual bonus

for a year prior to the year which the termination occurs, a lump sum equal to his then-current annual base salary, an amount equal to the pro-rata portion of the bonus that he otherwise would have been entitled to, and COBRA premiums for 12

months, if he makes a timely election and is eligible for coverage. In the event we terminate Mr. Swirsky’s employment without cause or Mr. Swirsky terminates his employment with Good Reason within the two-year period following a “Change of

Control,” as defined in the 2013 Plan, we shall pay Mr. Swirsky his base salary owed up to the termination date, including payment for any unused vacation days, any earned but unpaid annual bonus for a year prior in which the termination

occurs, a lump sum equal to 150% of his current annual base salary and 150% of his target bonus, an amount equal to the bonus he would have otherwise been entitled to, assuming Mr. Swirsky would have received a bonus for the fiscal year equal

to his target bonus if he had stayed employed with the company for the entire year, and COBRA premiums for 18 months if he makes a timely election. Mr. Swirsky’s equity awards would also vest and become exercisable in connection with the Change

of Control. A resignation by Mr. Swirsky is deemed a resignation for “Good Reason” if he provides written notice to the Company of the specific circumstances alleged to constitute Good Reason within 90 days after any one or more of the

following events and such Good Reason is not cured within 30 days of our receipt of such notice:

|

|

• |

a material diminution in his duties or authority inconsistent with his position;

|

|

|

• |

a reduction of his salary or target bonus percentage;

|

|

|

• |

a relocation requiring him to be based at any office that is more than 35 miles from our office at the time of the signing of the agreement; or

|

|

|

• |

any material breach by the Company of the terms and provisions of the agreement or any other material agreement between Mr. Swirsky and the Company.

|

The employment agreement also contains a provision prohibiting Mr. Swirsky from soliciting our executives, employees, customers or clients for a

period of 12 months following his termination.

19

Effective as of February 4, 2013, we entered into an employment agreement with Dr. Suzdak to serve as our Chief Executive Officer

for a term of two years with the option to renew the employment agreement for additional one-year periods thereafter until terminated. Pursuant to the employment agreement, we agreed to pay Dr. Suzdak an initial annual base salary of $330,000,

with the option of a discretionary annual cash bonus of up to 40% of his base salary, as determined by performance against objectives and milestones set by the Board of Directors. The employment agreement also provided for an initial grant of

10,000 options to purchase shares of our Common Stock, and that the Board of Directors could award him additional options each year. The employment agreement also contained a provision prohibiting Dr. Suzdak from soliciting our executives,

employees, customers or clients for a period of 12 months following his termination.

On November 13, 2018, Dr. Suzdak informed us of his resignation from the Company effective immediately, and we entered into an

agreement (the “Separation Agreement”) to formalize the terms of Dr. Suzdak’s departure and to provide for an arrangement pursuant to which Dr. Suzdak has agreed to provide transition and advisory services, as reasonable requested by our Chief

Executive Officer, through November 30, 2019. Pursuant to the Separation Agreement, Dr. Suzdak’s resignation was treated under his employment agreement as a termination without cause or a termination by Dr. Suzdak for Good Reason. As a result,

Dr. Suzdak’s stock options were subject to accelerated vesting such that options that would have vested within the 12 months following termination vested immediately, and we paid Dr. Suzdak a lump sum equal to his then-current annual base

salary, a bonus equal to 50% of his annual salary, and COBRA premiums for 12 months, if he makes a timely election and is eligible for coverage. In addition, pursuant to the Separation Agreement, Dr. Suzdak will receive cash compensation of

$10,000 per month, payable in monthly installments, as consideration for the transition and advisory services thereunder, with the first payment beginning on December 31, 2018.

Effective as of February 2, 2015, we entered into an employment agreement with Dr. Benaim to serve as our Chief Medical Officer.

Pursuant to the employment agreement, we agreed to pay Dr. Benaim an initial annual base salary of $375,000, a signing bonus of $50,000, and a discretionary annual cash bonus of up to 40% of his base salary, based on a program and criteria

established by the Compensation Committee. The employment agreement also provided for an initial grant of 10,000 options to purchase shares of our Common Stock. Dr. Benaim resigned from the Company effective March 31, 2019.

Effective as of July 6, 2016, we entered into an employment agreement with Dr. Nolan to serve as our Chief Business Officer.

Pursuant to the employment agreement, we agreed to pay Dr. Nolan an initial annual base salary of $320,000 and a discretionary annual cash bonus of up to 35% of her base salary, based on a program and criteria established by the Compensation

Committee. The employment agreement also provided for an initial grant of 10,000 options to purchase shares of our Common Stock. In the event Dr. Nolan’s employment is terminated by reason of disability or for “cause,” as defined in the

employment agreement, we will pay Dr. Nolan her base salary owed up to the termination date, including payment for any unused vacation days. If we terminate Dr. Nolan’s employment without cause or Dr. Nolan terminates her employment with good

reason, then Dr. Nolan’s stock options will be subject to accelerated vesting to the extent to which they would have vested within the nine months following termination and we shall pay Dr. Nolan a lump sum equal to her then-current annual base

salary, an amount equal to the pro-rata portion of the bonus that she otherwise might have been entitled to, and COBRA premiums for nine months, if she makes a timely election. A resignation by Dr. Nolan is deemed a resignation for “Good

Reason” if she provides written notice to the Company of the specific circumstances alleged to constitute Good Reason within 90 days after any one or more of the following events and such Good Reason is not cured within 30 days of our receipt

of such notice:

20

|

|

• |

a material diminution in her duties, responsibilities or authority inconsistent with his position, authority, duties or responsibilities;

|

|

|

• |

a material reduction in her annual base salary or target bonus percentage; or

|

|

|

• |

any material breach by the Company of the terms and provisions of the agreement.

|

In the event we terminate Dr. Nolan’s employment without cause or Dr. Nolan terminates her employment with Good Reason within the one-year period

following a “Change of Control,” as defined in the 2013 Plan, we shall pay Dr. Nolan a lump sum equal to 150% of her then-current annual base salary, an amount equal to the bonus she would otherwise been entitled to, assuming Dr. Nolan would

have received a bonus for that fiscal year equal to her target bonus if she had stayed employed with the company for the entire year, and COBRA premiums for 18 months if she makes a timely election. Dr. Nolan’s equity awards would also vest and

become exercisable in connection with the Change of Control. The employment agreement also contains a provision prohibiting Dr. Nolan from soliciting our executives, employees, customers or clients for a period of 12 months following her

termination.

21

Outstanding Equity Awards at Fiscal Year-End

The following table shows the certain information regarding outstanding equity awards the named executive officers and which

remained outstanding as of December 31, 2018.

|

Option Awards

|

Stock Awards

|

||||||||||||||||||||

|

Name

|

Number of Securities

Underlying Unexercised

Options (#)

|

Option

Exercise

Price ($)

|

Option

Expiration

Date

|

Number of Units of

Stock that Have Not

Vested

|

Market Value of Units of

Stock that Have Not

Vested ($)

|

||||||||||||||||

|

Exercisable

|

Unexercisable

|

||||||||||||||||||||

|

Douglas J. Swirsky

|

-

|

20,833

|

(1)

|

25.20

|

1/2/2028

|

||||||||||||||||

|

-

|

41,666

|

(2)

|

13.08

|

11/14/2028

|

|||||||||||||||||

|

Peter Suzdak

|

10,000

|

-

|

44.40

|

2/28/2020

|

|||||||||||||||||

|

2,916

|

-

|

136.80

|

2/28/2020

|

||||||||||||||||||

|

8,333

|

-

|

99.60

|

2/28/2020

|

||||||||||||||||||

|

9,166

|

-

|

85.20

|

2/28/2020

|

||||||||||||||||||

|

3,430

|

-

|

42.00

|

2/28/2020

|

||||||||||||||||||

|

7,986

|

-

|

42.00

|

2/28/2020

|

||||||||||||||||||

|

6,935

|

-

|

22.08

|

2/28/2020

|

||||||||||||||||||

|

4,288

|

-

|

27.48

|

2/28/2020

|

||||||||||||||||||

|

Ely Benaim

|

9,583

|

417

|

(3)

|

85.20

|

2/2/2025

|

||||||||||||||||

|

822

|

-

|

42.00

|

1/28/2026

|

||||||||||||||||||

|

3,037

|

1,129

|

(4)

|

42.00

|

1/28/2026

|

|||||||||||||||||

|

1,796

|

1,954

|

(5)

|

22.08

|

1/20/2027

|

|||||||||||||||||

|

-

|

3,786

|

(6)

|

27.48

|

1/26/2028

|

|||||||||||||||||

|

16,666

|

(7)

|

21.36

|

3/7/2028

|

||||||||||||||||||

|

594

|

(8)

|

6,629

|

|||||||||||||||||||

|

Lisa Nolan

|

6,041

|

3,959

|

(9)

|

31.20

|

7/6/2026

|

||||||||||||||||

|

1,257

|

1,368

|

(5)

|

22.08

|

1/20/2027

|

|||||||||||||||||

|

-

|

3,508

|

(6)

|

27.48

|

1/26/2028

|

|||||||||||||||||

|

406

|

(10)

|

4,531

|

|||||||||||||||||||

| (1) |

Represents option award granted under the 2013 Plan on January 2, 2018, which vested 25% on January 2, 2019, and one forty-eighth of which vested or will vest on the

first business day of each month beginning February 2019 and ending January 2022.

|

| (2) |

Represents option award granted under the 2013 Plan on November 14, 2018, which will vest 25% on November 14, 2019, and one forty-eighth of which will vest on the first

business day of each month beginning December 2019 and ending November 2022.

|

| (3) |

Represents option award granted under the 2013 Plan on February 2, 2015, which vested 25% on February 2, 2016, and one forty-eighth of which vested on the first

business day of each month beginning March 2016 and ending February 2019.

|

| (4) |

Represents option award granted under the 2013 Plan on January 28, 2016, which vested 25% on January 28, 2017, and one forty-eighth of which vested or will vest on the

first business day of each month beginning February 2017 and ending January 2020.

|

| (5) |

Represents option award granted under the 2013 Plan on January 20, 2017, which vested 25% on January 20, 2018, and one forty-eighth of which vested or will vest on the

first business day of each month beginning February 2018 and ending January 2021.

|

| (6) |

Represents option award granted under the 2013 Plan on January 26, 2018, which vested 25% on January 26, 2019 and one forty-eighth of which vested or will vest on the

first business day of each month beginning February 2019 and ending January 2022.

|

| (7) |

Represents option award granted under the 2013 Plan on March 7, 2018, which vested 25% on March 7, 2019 and one forty-eighth of which vested or will vest on the first

business day of each month beginning March 2019 and ending February 2022.

|

| (8) |

Represents restricted stock unit award granted under the 2013 Plan on January 20, 2017, which vested 25% on February 28, 2018 and 2019 and the remainder were scheduled

to vest in two equal annual installments on the last business day in February, beginning February 28, 2020. Upon Dr. Benaim’s resignation in March 2019, his then unvested restricted stock units were forfeited.

|

| (9) |

Represents option award granted under the 2013 Plan on July 6, 2016, which vested 25% on July 6, 2017, and one forty-eighth of which vested or will vest on the first

business day of each month beginning August 2017 and ending July 2020.

|

| (10) |

Represents restricted stock unit award granted under the 2013 Plan on January 20, 2017, which vested 25% on February 28, 2018 and 2019 and the remainder of which will

vest in two equal annual installments on the last business day in February, beginning February 28, 2020.

|

22

Director Compensation

The table below sets forth information concerning the compensation of our directors for the year ended December 31, 2018, except for

Mr. Swirsky and Dr. Suzdak, whose compensation is disclosed above.

|

Name

|

Fees Earned Or

Paid In Cash ($)

|

Equity

Awards ($) (1)

|

All Other

Compensation

($)

|

Total ($)

|

||||||||||||

|

Peter Brandt

|

70,000

|

36,162

|

-

|

106,162

|

||||||||||||

|

Charles Beever

|

54,375

|

36,162

|

-

|

90,537

|

||||||||||||

|

Kwang Soo Cheong

|

46,250

|

36,162

|

-

|

82,412

|

||||||||||||

|

Richard J. Rodgers

|

55,000

|

36,162

|

-

|

91,162

|

||||||||||||

|

Ben Gil Price

|

3,955

|

81,998

|

-

|

85,953

|

||||||||||||

|

Mark Carthy

|

21,875

|

-

|

-

|

21,875

|

||||||||||||

| (1) |

Grant date fair value computed in accordance with FASB ASC Topic 718. The actual value realized with respect to option awards will depend on the difference between the

market value of our Common Stock on the date the option is exercised and the exercise price. As of December 31, 2018, Mr. Beever and Dr. Cheong each had 8,516 option awards outstanding; Mr. Brandt had 8,350 option awards

outstanding; Mr. Rodgers had 7,102 option awards outstanding; and Dr. Price had 9,406 option awards outstanding.

|

| (2) |

Dr. Price joined the Board of Directors in November 2018. Dr. Sullivan joined the Board of Directors in February 2019. Mr. Carthy did not stand for re-election at our

Annual Meeting in June 2018. Dr. Suzdak resigned from the Board of Directors in November 2018.

|

23

Elements of Non-Employee Director Compensation

Our director compensation program is designed to attract and retain qualified, independent directors to represent shareholders on

the Board and act in their best interest. The Compensation Committee, which consists solely of independent directors, has primary responsibility for setting our director compensation program. Radford assists the Compensation Committee in

evaluating our director compensation program.

Based on its review of an assessment by Radford regarding director compensation, in 2015, the Board approved a new director