424B4: Prospectus filed pursuant to Rule 424(b)(4)

Published on February 17, 2021

Filed pursuant to Rule 424(b)(4)

Registration No. 333-252715

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 12, 2021)

6,987,400 Shares of

Common Stock

Offered by the selling stockholders

The selling stockholders may offer and sell up to an aggregate of 6,987,400 shares of

our common stock, from time to time, on the terms described in this prospectus supplement and the accompanying base prospectus. We will not receive any of the proceeds from the sale of the shares offered by the selling stockholders hereunder. To

the extent that any selling stockholder resells any securities, the selling stockholder may be required to provide you with this prospectus supplement and accompanying prospectus identifying and containing specific information about the selling

stockholders and the terms of the securities being offered.

The selling stockholders may sell the securities through underwriters or dealers,

directly to purchasers or through agents designated from time to time. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” on page S-49 of this prospectus

supplement and on page 66 of the base prospectus.

Our common stock is listed on the Nasdaq Capital Market under the symbol “OCUP.” On

February 11, 2021, the last reported sale price of our common stock on the Nasdaq Capital Market was $12.13 per share.

Investing in our securities involves a high degree of risk. You

should review carefully the risks and uncertainties described under the heading “Risk Factors” contained in this prospectus supplement on page S-7, on page 9 of the base prospectus, in our most recent

Annual Report on Form 10-K and Quarterly Report on Form 10-Q incorporated by reference into this prospectus, in the applicable prospectus supplement and in any free writing prospectuses we have authorized for use in

connection with a specific offering, and under similar headings in the other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 12, 2021.

TABLE OF CONTENTS

Prospectus Supplement

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

Prospectus

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

You should rely only on the information contained in, or incorporated by reference

into, this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with different information. We are not making an offer to sell or seeking an offer to buy securities under this prospectus supplement

or the accompanying prospectus in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus supplement, the applicable prospectus, and the documents incorporated by reference herein and therein, are

accurate only as of their respective dates, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus, or any sale of a security.

S-i

This prospectus supplement and the accompanying prospectus form a part of a

registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process under the Securities Act of 1933, as amended, or the Securities Act.

This document is in two parts. The first part is this prospectus supplement, which

describes the specific terms of this offering and certain other matters and may add, update or change information in the accompanying prospectus, including the documents incorporated by reference into this prospectus supplement. The second part

is the accompanying prospectus dated February 12, 2021, including the documents incorporated by reference therein, which provides you with general information about securities we may offer from time to time, some of which may not apply to this

offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the

information contained in the accompanying prospectus, on the other hand, you should rely on the information in this prospectus supplement. These documents contain important information you should consider when making your investment decision.

You should carefully read both this prospectus supplement and the accompanying

prospectus, together with the additional information described under “Where You Can Find More Information,” before buying any of the securities being offered.

Neither we nor the selling stockholders have authorized anyone to provide you with any

information other than contained in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that

others may give you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should not assume that the information contained in or incorporated by

reference in this prospectus supplement or accompanying prospectus is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains and incorporates by reference market data and industry

statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe that these sources are reliable, we do not guarantee the accuracy or completeness of this information and

we have not independently verified this information. Although we are not aware of any misstatements regarding the market and industry data presented in this prospectus and the documents incorporated herein by reference, these estimates involve

risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained herein and that are incorporated by reference into this prospectus. Accordingly, investors should not

place undue reliance on this information.

This prospectus contains summaries of certain provisions contained in some of the

documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed,

will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More

Information.”

Except as otherwise indicated herein or as the context otherwise requires, references

in this prospectus to “Ocuphire,” “the company,” “we,” “us,” “our” and similar references refer to Ocuphire Pharma, Inc., a corporation under the laws of the State of Delaware.

This prospectus and the information incorporated herein by reference include

trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus supplement, any accompanying prospectus are the property of their

respective owners.

S-ii

This summary highlights selected information contained elsewhere

in this prospectus or incorporated by reference herein and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus supplement and the accompanying

prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors” contained in this prospectus supplement, the accompanying prospectus and any related free writing prospectus, and under similar headings

in the other documents that are incorporated by reference into this prospectus supplement. You should also carefully read the information incorporated by reference into this prospectus supplement, including our financial statements and related

notes, and the exhibits to the registration statement of which this prospectus supplement is a part, before making your investment decision.

OCUPHIRE PHARMA, INC.

Overview

Ocuphire is a clinical-stage ophthalmic biopharmaceutical company focused on

developing and commercializing therapies for the treatment of several eye disorders. Ocuphire’s pipeline currently includes two small molecule product candidates targeting front and back of the eye indications.

Its lead product candidate, Nyxol® Eye Drops (“Nyxol”), is a once-daily eye drop

formulation of phentolamine mesylate designed to reduce pupil diameter and improve visual acuity. As a result, Nyxol can potentially be used for the treatment of multiple indications such as dim light or night vision disturbances (“NVD”),

pharmacologically-induced mydriasis (which refers to the use of pharmacological agents to dilate the pupil for office-based eye exams) and presbyopia (a gradual, age-related loss of the eyes’ ability to focus on nearby objects). Ocuphire

management believes this multiple indication potential represents a significant market opportunity. Nyxol has been studied across three Phase 1 and four Phase 2 trials totaling over 230 patients and has demonstrated promising clinical data for

use in multiple ophthalmic indications. Ocuphire initiated a Phase 3 trial for the treatment of NVD in the fourth quarter of 2020, a Phase 3 trial for reversal of pharmacologically-induced mydriasis (“RM”) in the fourth quarter of 2020, and

plans to initiate a Phase 2 trial in combination with low dose pilocarpine for presbyopia, in the first quarter of 2021. Ocuphire expects top-line results to read out as early as the first quarter of 2021 and throughout the remainder of 2021,

and, assuming successful and timely completion of further trials, anticipates submitting a new drug application (“NDA”) to the U.S. Food and Drug Administration (“FDA”) in early 2023 under the 505(b)(2) pathway.

Ocuphire’s second product candidate, APX3330, is a twice-a-day oral tablet, designed

to target multiple pathways relevant to retinal and choroidal (the vascular layer of the eye) vascular diseases, such as diabetic retinopathy (“DR”) and diabetic macular edema (“DME”) which if left untreated may result in permanent visual

acuity loss and eventual blindness. DR is a disease resulting from diabetes, in which chronically elevated blood sugar levels cause progressive damage to blood vessels in the retina. DME is a severe form of DR which involves leakage of protein

and fluid into the macula, the central portion of the retina, causing swelling. Prior to Ocuphire’s in-licensing of the product candidate, APX3330 had been studied by third parties in six Phase 1 and five Phase 2 trials totaling over 440

patients, for inflammatory and oncology indications, and had demonstrated promising evidence of tolerability, pharmacokinetics, durability and target engagement. Ocuphire plans to initiate a Phase 2 trial for APX3330 in the first quarter of

2021 for the treatment of patients with DR, including moderately severe non-proliferative DR (“NPDR”) and mild proliferative DR (“PDR”), as well as patients with DME without loss of central vision. Ocuphire has also in-licensed additional

second generation product candidates, analogs of APX3330, including APX2009 and APX2014.

As part of its strategy, Ocuphire will continue to explore opportunities to acquire

additional ophthalmic assets and to seek strategic partners for late stage development, regulatory preparation and commercialization of drugs in key global markets.

Ocuphire estimates that there are 15-20 million moderate-to-severe NVD patients in

the United States, over 80 million eye exams conducted per year with pharmacologically-induced mydriasis, over 100 million presbyopia patients, over 7 million patients with DR, and 750,000 patients with DME. There are no currently approved

pharmacological products on the market for NVD, RM, or presbyopia. In the case of presbyopia there are non-pharmacologic and potentially inconvenient treatments such as reading glasses or contact lenses, as well as invasive surgical

interventions with associated risks such as creation or worsening of NVD. For DR and DME, intraocular injections targeting vascular endothelial growth factors (“VEGF”) (a family of proteins that promote

S-1

angiogenesis – the formation of new blood vessels – and vascular permeability)

are approved globally, but these chronic therapies require frequent biweekly or monthly office visits and are prone to side effects such as hemorrhage, intraocular infection, and increased risk of blood clots.

Ocuphire is developing Nyxol and APX3330 for multiple indications. Ocuphire believes

the two programs present similar potential advantages: (1) promising clinical data to date; (2) small molecules; (3) convenient dosing route and schedule; (4) potential for first-line or adjunct therapy; and (5) significant commercial

potential. In the fourth quarter of 2020, Ocuphire initiated Phase 3 clinical trials for Nyxol in NVD and RM, with announcement of completion of enrollment in Phase 3 RM trial in the fourth quarter of 2020. In the first quarter of 2021.

Ocuphire expects to initiate a Phase 2 proof of concept trial in presbyopia for a kit combination of Nyxol and low-dose pilocarpine, a pupil constrictor with a mechanism different and complementary to Nyxol. In preparation for at least one of

the two Phase 3 registration trials for Nyxol, Ocuphire plans to launch a blow-fill-seal manufacturing program for preservative-free single use Nyxol eye drops. Furthermore, Ocuphire plans to initiate a 6-month rabbit toxicology study in the

first quarter of 2021, completion of which is necessary prior to commencement of the Phase 3 safety exposure trial for chronic indications. Ocuphire also expects to launch a Phase 2 trial for APX3330 in DR and DME in the first quarter of 2021

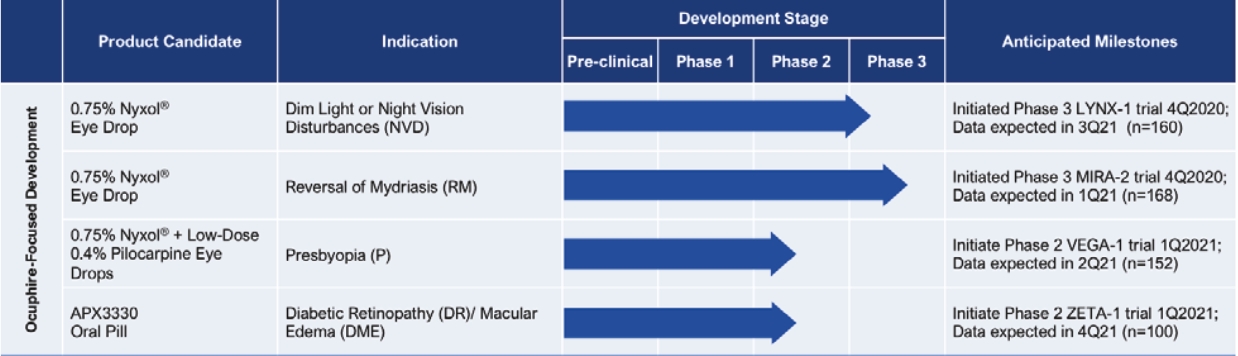

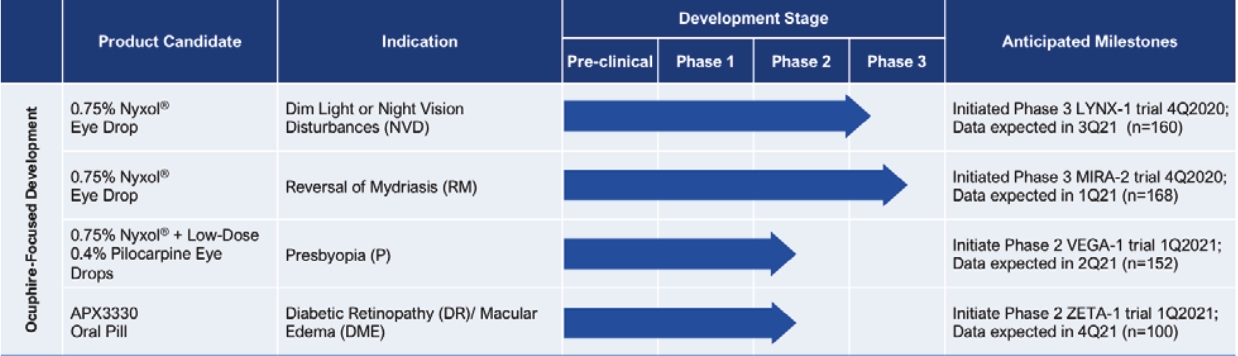

with a concurrent Phase 2/3 oral tablet manufacturing program. TABLE 1 below summarizes Ocuphire’s current development pipeline of product candidates and their target indications:

TABLE 1. Ocuphire Pipeline Indications

Note: 0.75% Nyxol (Phentolamine Ophthalmic Solution) is the same

as 1% Nyxol (Phentolamine Mesylate Ophthalmic Solution).

The Merger, Reverse Stock Split and Name Change

On November 5, 2020, Ocuphire (formerly known as Rexahn Pharmaceuticals, Inc., and

prior to the merger, referred to as “Rexahn”), completed its business combination with Ocuphire Pharma, Inc. (“Ocuphire Private Company”), in accordance with the terms of the Agreement and Plan of Merger, dated as of June 17, 2020, as amended,

by and among Rexahn, Ocuphire Private Company, and Razor Merger Sub, Inc., a wholly-owned subsidiary of Rexahn (“Merger Sub”) (as amended, the “Merger Agreement”), pursuant to which Merger Sub merged with and into Ocuphire Private Company, with

Ocuphire Private Company surviving as a wholly owned subsidiary of Rexahn (the “Merger”).

In connection with, and immediately prior to the completion of, the Merger, Rexahn

effected a reverse stock split of the common stock, at a ratio of 1-for-4 (the “Reverse Stock Split”). Under the terms of the Merger Agreement, after taking into account the Reverse Stock Split, Rexahn issued shares of its common stock to

Ocuphire Private Company stockholders, based on a common stock exchange ratio of 1.0565 shares of common stock for each share of Ocuphire Private Company common stock. In connection with the Merger, Rexahn changed its name from “Rexahn

Pharmaceuticals, Inc.” to “Ocuphire Pharma, Inc.,” and the business conducted by Rexahn became the business conducted by Ocuphire Private Company.

Private Placement of Common Shares and Warrants

On November 5, 2020, Ocuphire and Ocuphire Sub completed a private placement

transaction (the “Pre-Merger Financing”) with certain accredited investors (the “Investors”) pursuant to that certain Amended and Restated Securities Purchase Agreement (the “Securities Purchase Agreement”) dated June 29, 2020 by and among the

Company, Ocuphire Sub and the Investors for an aggregate purchase price of approximately $21.15 million (the “Purchase Price”).

S-2

Pursuant to the Pre-Merger Financing, (i) Ocuphire Sub issued and sold to the

Investors shares of Ocuphire Sub’s common stock (the “Initial Shares”) which converted pursuant to the exchange ratio in the Merger into an aggregate of approximately 1,249,996 shares (the “Converted Initial Shares”) of the Company’s common

stock, (ii) Ocuphire Sub deposited into escrow, for the benefit of the Investors, additional shares of Ocuphire Sub’s common stock (the “Additional Shares”) which converted pursuant to the exchange ratio in the Merger into an aggregate of

approximately 3,749,992 shares of common stock (the “Converted Additional Shares”), which Converted Additional Shares were delivered (or became deliverable) to the Investors on November 19, 2020, and (iii) the Company agreed to issue to each

Investor on the tenth trading day following the consummation of the Merger Series A Warrants representing the right to acquire shares of common stock equal to the sum of (a) the Converted Initial Shares purchased by the Investor, (b) the

Converted Additional Shares delivered or deliverable to the Investor, without giving effect to any limitation on delivery contained in the Securities Purchase Agreement and (c) the number of shares of Common Stock, if any, underlying the Series

B Warrants issued to the Investor (the “Series A Warrants”) and additional Series B Warrants to purchase shares of Common Stock (the “Series B Warrants” and together with the Series A Warrants, the “Series A/B Warrants”).

On November 19, 2020 (the “Warrant Closing Date”), pursuant to the terms of the

Amended and Restated Securities Purchase Agreement, the Company issued the Series A Warrants and the Series B Warrants. For a description of the Series A Warrants and Series B Warrants, see “Description of Capital Stock—Outstanding Warrants.”

On February 3, 2021, the Company entered into a Waiver Agreement with each of the

investors (collectively, the “Waiver Agreements”). Pursuant to the Waiver Agreements, the investors and the Company agreed to waive certain rights, finalize the exercise price and number of Warrants, and, in the case of certain major holders

(“Major Holders”), grant certain registration rights for the shares underlying the Warrants as described herein.

Waiver of Warrant Resets and Final Determination

of Number of Series B Warrants

Pursuant to the Waiver Agreements, each investor agreed to waive the reset

provisions in the Warrants in order to allow for one more immediate and final reset of the number of shares of common stock underlying the Warrants and the exercise price of the Series A Warrants such that (A) the exercise price of the Series A

Warrants was fixed at the initial exercise price of $4.4795 per share, (B) the number of shares underlying all of the Series A Warrants was fixed at the initial number of 5,665,838 in the aggregate and (C) in the case of all Holders, the number

of shares underlying all of the Series B Warrants was fixed at 1,708,334 in the aggregate with respect to such Holders (the “Final Series B Reset”).

The directors and the officers waived their right to the Final Series B Reset such

that the number of Series B Warrants for such directors and officers was fixed at the initial number of Series B Warrants issued to them on November 19, 2020.

The Waiver Agreement provides that the Company may file this registration statement

on Form S-3, and may further file registration statements and undertake Subsequent Placements at any time following the close of business on March 1, 2021, subject to the Major Holders’ participation rights.

In connection with the Waiver Agreement, each of the Major Holder’s participation

rights were extended to December 31, 2021, subject to a limitation of participation in any such Subsequent Placement (50% in the aggregate); provided that such participation rights will not apply to any at-the-market equity offering implemented

by the Company through a broker dealer at any time following the Effective Date; and provided further that the Company will not be able to issue any equity securities under such at-the-market equity offering until on or after April 15, 2021.

Risks Associated with our Business

Our business is subject to numerous risks, as described under the heading “Risk

Factors” contained on page S-7.

Selling Stockholders

The selling stockholders acquired Series A Warrants and Series B Warrants

exercisable for shares of our common stock in November 2020. See the section entitled “Selling Stockholders” on page S-47 of this prospectus.

Company Information

Our principal executive offices are located at 37000 Grand River Avenue, Suite 120,

Farmington Hills, MI 48335. Our telephone number is (248) 681-9815. Our website address is www.ocuphire.com. The information contained in, or accessible through, our website does not constitute part of this prospectus, should not be relied on

in determining

S-3

whether to make an investment decision, and the inclusion of our website address

in this prospectus is an inactive textual reference only.

S-4

Investing in our securities involves a high degree of risk. The following is a

summary of the principal risks and uncertainties that could materially adversely affect our business, financial condition, or results of operations. You should read this summary together with the more detailed description of risk factors

contained under the heading “Risk Factors” in this prospectus supplement on page S-7, as well as in the accompanying prospectus on page 9.

|

•

|

Ocuphire currently depends entirely on the success of Nyxol and APX3330, its only product candidates. Ocuphire may never

receive marketing approval for, or successfully commercialize, Nyxol, APX3330, or other product candidates it may pursue in the future for any indication.

|

|

•

|

The results of previous clinical trials may not be predictive of future results, and the results of Ocuphire’s current and

planned clinical trials may not satisfy the requirements of the FDA or non-U.S. regulatory authorities.

|

|

•

|

Changes in regulatory requirements or FDA guidance, or unanticipated events during Ocuphire’s clinical trials, may result in

changes to clinical trial protocols or additional clinical trial requirements, which could result in increased costs to Ocuphire or delays in its development timeline.

|

|

•

|

Ocuphire has incurred only losses since inception. Ocuphire expects to incur losses for the foreseeable future and may never

achieve or maintain profitability.

|

|

•

|

Ocuphire’s recurring operating losses have raised substantial doubt regarding its ability to continue as a going concern.

|

|

•

|

Raising additional capital may cause dilution to Ocuphire’s stockholders, restrict Ocuphire’s operations, or require Ocuphire

to relinquish rights to its technologies or product candidates.

|

|

•

|

Even if it receives marketing approval for its product candidates in the United States, Ocuphire may never receive regulatory

approval to market such product candidates outside of the United States.

|

|

•

|

Even if Ocuphire obtains marketing approval for its product candidates, such product candidates could be subject to

post-marketing restrictions or withdrawal from the market, and Ocuphire may be subject to substantial penalties if it fails to comply with regulatory requirements or experience unanticipated problems with a product following approval.

|

|

•

|

Ocuphire’s relationships with healthcare providers and third-party payors will be subject to applicable fraud and abuse and

other healthcare laws and regulations, which could expose Ocuphire to criminal sanctions, civil penalties, contractual damages, reputational harm, and diminished profits and future earnings, among other penalties and consequences.

|

|

•

|

Ocuphire employees may engage in misconduct or other improper activities, including violating applicable regulatory standards

and requirements or engaging in insider trading, which could significantly harm Ocuphire’s business.

|

|

•

|

Ocuphire faces substantial competition, which may result in others discovering, developing, or commercializing products

before or more successfully than it does.

|

|

•

|

Ocuphire lacks experience in commercializing products, which may have an adverse effect on its business.

|

|

•

|

If Ocuphire is unable to establish sales and marketing capabilities or enter into agreements with third parties to sell,

market, and distribute its product candidates, if approved, it may not be successful in commercializing such product candidates if and when they are approved.

|

|

•

|

Even if Ocuphire is able to commercialize its product candidates, their profitability will likely depend in significant part

on third-party reimbursement practices, which, if unfavorable, would harm its business.

|

|

•

|

Product liability lawsuits against Ocuphire, or its suppliers and manufacturers, could cause it to incur substantial

liabilities and could limit commercialization of any product candidate that it may develop.

|

|

•

|

Ocuphire will be unable to directly control all aspects of its clinical trials due to its reliance on clinical research

organizations (CROs) and other third parties that assist Ocuphire in conducting clinical trials.

|

|

•

|

If Ocuphire is not able to establish new collaborations on commercially reasonable terms, it may have to alter its

development, manufacturing, and commercialization plans.

|

S-5

|

•

|

If Ocuphire is unable to obtain and maintain sufficient patent protection for its product candidates, its competitors could

develop and commercialize products or technology similar or identical to those of Ocuphire, which would adversely affect Ocuphire’s ability to successfully commercialize any product candidates it may develop, its business, results of

operations, financial condition and prospects.

|

|

•

|

If Ocuphire does not obtain protection under the Hatch-Waxman Act and similar foreign legislation by extending the patent

terms and obtaining data exclusivity for its product candidate, its business may be materially harmed.

|

|

•

|

Changes in U.S. patent law could diminish the value of patents in general, thereby impairing Ocuphire’s ability to protect

its product candidates.

|

|

•

|

Ocuphire may not be able to protect or practice its intellectual property rights throughout the world.

|

|

•

|

Obtaining and maintaining Ocuphire’s patent protection depends on compliance with various procedural, document submission,

fee payment, and other requirements imposed by governmental agencies, and its patent protection could be reduced or eliminated for noncompliance with these requirements.

|

|

•

|

Ocuphire depends on intellectual property sublicensed from Apexian Pharmaceuticals, Inc. (“Apexian”) for its APX3330 product

candidate under development and its additional pipeline candidates, and the termination of, or reduction or loss of rights under, this sublicense would harm Ocuphire’s business.

|

|

•

|

Ocuphire is dependent on its key personnel, and if it is not successful in attracting and retaining highly qualified

personnel, it may not be able to successfully implement its business strategy.

|

|

•

|

Ocuphire will need to develop and expand its company, and may encounter difficulties in managing this development and

expansion, which could disrupt its operations.

|

|

•

|

The COVID-19 pandemic has and could continue to adversely impact Ocuphire’s business, including pre-clinical and clinical

trials and regulatory approvals.

|

|

•

|

Ocuphire’s insurance policies are expensive and protect only from some business risk, which leaves Ocuphire exposed to

significant uninsured liabilities.

|

|

•

|

Ocuphire does not anticipate paying any cash dividends in the foreseeable future.

|

|

•

|

If Ocuphire fails to comply with the continued listing standards of the Nasdaq Capital Market, Ocuphire common stock could be

delisted. If it is delisted, Ocuphire common stock and the liquidity of its common stock would be impacted.

|

|

•

|

The market price of Ocuphire common stock may fluctuate significantly.

|

|

•

|

Ocuphire may be subject to securities litigation, which is expensive and could divert management attention.

|

S-6

Investing in our securities involves a high degree of risk. Before

deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described below, under the heading “Risk Factors” contained in the accompanying prospectus and discussed under the section entitled “Risk

Factors” contained in our most recent Annual Report on Form 10-K and in our most recent Quarterly Report on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated by reference into this

prospectus in their entirety, together with other information in this prospectus, the documents incorporated by reference and any free writing prospectus that we may authorize for use in connection with this offering.

The risks described in these documents are not the only ones we

face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance

may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or

cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled “Forward-Looking Statements.”

Risks Related to Development of Ocuphire’s Product Candidates

Ocuphire currently depends entirely on the

success of Nyxol and APX3330, its only product candidates. Ocuphire may never receive marketing approval for, or successfully commercialize, Nyxol, APX3330, or other product candidates it may pursue in the future for any indication.

Ocuphire currently has only two product candidates, Nyxol and

APX3330, in clinical development, and its business depends on their successful clinical development, regulatory approval and commercialization. The research, testing, manufacturing, labeling, approval, sale, marketing and distribution of a drug

product are subject to extensive regulation by the FDA and other regulatory authorities in the United States and other countries, where regulations may differ. Ocuphire is not permitted to market its product candidates in the United States until

it receives approval of an NDA from the FDA or in any foreign countries until it receives the requisite approval from such countries. Ocuphire has not submitted an NDA to the FDA or comparable applications to other regulatory authorities or

received marketing approval for its product candidates. Before obtaining regulatory approval for the commercial sale of its product candidates for a particular indication, Ocuphire must demonstrate through preclinical testing and clinical trials

that the applicable product candidate is safe and effective for use in that target indication. This process can take many years and may be followed by post-marketing studies and surveillance together which will require the expenditure of

substantial resources beyond the proceeds raised in the Pre-Merger Financing. Of the large number of drugs in development in the United States, only a small percentage of drugs successfully complete the FDA regulatory approval process and are

commercialized. Accordingly, even if Ocuphire is able to complete development of its product candidates, Ocuphire cannot assure you that its product candidates will be approved or commercialized.

Obtaining approval of an NDA is an extensive, lengthy, expensive and

uncertain process, and the FDA may delay, limit or deny approval of Ocuphire’s product candidates for many reasons, including:

|

•

|

the data collected from preclinical studies and clinical trials of Ocuphire’s product candidates may not be sufficient to

support the submission of an NDA;

|

|

•

|

Ocuphire may not be able to demonstrate to the satisfaction of the FDA that its product candidates are safe and effective for

any indication;

|

|

•

|

the results of clinical trials may not meet the level of statistical significance or clinical significance required by the FDA

for approval;

|

|

•

|

the FDA may disagree with the number, design, size, conduct, or implementation of Ocuphire’s clinical trials;

|

|

•

|

the FDA may not find the data from preclinical studies and clinical trials sufficient to demonstrate that Ocuphire’s product

candidates’ clinical and other benefits outweigh the safety risks;

|

|

•

|

the FDA may disagree with Ocuphire’s interpretation of data from preclinical studies or clinical trials;

|

|

•

|

the FDA may not accept data generated at Ocuphire’s clinical trial sites;

|

S-7

|

•

|

the FDA may have difficulties scheduling an advisory committee meeting in a timely manner or the advisory committee may

recommend against approval of Ocuphire’s application or may recommend that the FDA require, as a condition of approval, additional preclinical studies or clinical trials, limitations on approved labeling or distribution and use

restrictions;

|

|

•

|

the FDA may require development of a Risk Evaluation and Mitigation Strategy (REMS) as a condition of approval;

|

|

•

|

the FDA may identify deficiencies in the manufacturing processes or facilities of third party manufacturers with which Ocuphire

enters into agreements for clinical and commercial supplies; or

|

|

•

|

the FDA may change its approval policies or adopt new regulations.

|

The results of previous clinical trials may

not be predictive of future results, and the results of Ocuphire’s current and planned clinical trials may not satisfy the requirements of the FDA or non-U.S. regulatory authorities.

The results from the prior preclinical studies and clinical trials

for Nyxol and APX3330 discussed elsewhere in this prospectus may not necessarily be predictive of the results of future preclinical studies or clinical trials. Even if Ocuphire is able to complete its planned clinical trials of its product

candidates according to its current development timeline, the results from its prior clinical trials of its product candidates may not be replicated in these future trials. Many companies in the pharmaceutical and biotechnology industries

(including those with greater resources and experience than Ocuphire) have suffered significant setbacks in late-stage clinical trials after achieving positive results in early stage development, and Ocuphire cannot be certain that it will not

face similar setbacks. These setbacks have been caused by, among other things, preclinical findings made while clinical trials were underway or safety or efficacy observations made in clinical trials, including previously unreported adverse

events (“AEs”). Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that believed their product candidates performed satisfactorily in preclinical studies and clinical trials

nonetheless have failed to obtain FDA approval. Additionally, Ocuphire is developing, as a treatment for Presbyopia, a combination product candidate of Nyxol and low-dose pilocarpine in a two-part kit, which have not been studied together yet. If

Ocuphire fails to produce positive results in its clinical trials of any of its product candidates, the development timelines and regulatory approvals and commercialization prospects for its product candidates and its business and financial

prospects, would be adversely affected. If Ocuphire fails to produce positive results in its clinical trials of any of its product candidates, the development timelines, regulatory approvals, and commercialization prospects for its product

candidates, as well as Ocuphire’s business and financial prospects, would be adversely affected. Further, Ocuphire’s product candidates may not be approved even if they achieve their respective primary endpoints in Phase 3 registration trials.

The FDA or non-U.S. regulatory authorities may disagree with Ocuphire’s trial designs or its interpretation of data from preclinical studies and clinical trials. In addition, any of these regulatory authorities may change requirements for the

approval of a product candidate even after reviewing and providing comments or advice on a protocol for a pivotal clinical trial that has the potential to result in approval by the FDA or another regulatory authority. Furthermore, any of these

regulatory authorities may also approve Ocuphire’s product candidate for fewer or more limited indications than it requests or may grant approval contingent on the performance of costly post-marketing clinical trials.

Ocuphire completed two Phase 2b clinical trials for Nyxol in

patients with pharmacologically induced mydriasis and in elderly patients with ocular hypertension (“OHT”) in the second half of 2019. For Nyxol, Ocuphire commenced a Phase 3 trial for the treatment of NVD in the fourth quarter of 2020, a Phase 3

trial for RM in the fourth quarter of 2020, and plans to commence a Phase 2 trial in combination with low-dose pilocarpine for presbyopia, in the first quarter of 2021. For APX3330, Ocuphire plans to commence a Phase 2 trial for the treatment of

patients with DR, including patients with moderately severe NPDR and mild PDR, as well as patients with DME without loss of central vision, in the first quarter of 2021. Ocuphire also plans to pursue further clinical and preclinical trials as

described elsewhere in this prospectus. If successful, Ocuphire plans to eventually seek regulatory approvals of Nyxol and APX3330 initially in the United States, Canada, and Europe, and may seek approvals in other geographies. Before obtaining

regulatory approvals for the commercial sale of any product candidate for any target indication, Ocuphire must demonstrate with substantial evidence gathered in preclinical studies and adequate and well-controlled clinical studies, and, with

respect to approval in the United States, to the satisfaction of the FDA, that the product candidate is safe and effective for use for that target indication. Ocuphire cannot assure you that the FDA or non-U.S. regulatory authorities would

consider its planned clinical trials to be sufficient to serve as the basis for approval of its product candidates for any indication. The FDA and non-U.S. regulatory authorities retain broad discretion in evaluating the results of Ocuphire’s

clinical trials and in determining whether the results demonstrate that its product

S-8

candidates are safe and effective. If Ocuphire is required to conduct clinical

trials of its product candidates in addition to those it has planned prior to approval, Ocuphire will need substantial additional funds, and cannot assure you that the results of any such outcomes trial or other clinical trials will be sufficient

for approval.

If clinical trials of Ocuphire’s product

candidates fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities or do not otherwise produce positive results, Ocuphire may incur additional costs or experience delays in completing, or ultimately be unable to

complete, the development and commercialization of such product candidates.

Before obtaining marketing approval from regulatory authorities for

the sale of Nyxol, Ocuphire must complete additional Phase 2 and Phase 3 clinical trials to demonstrate the safety and efficacy in humans. Additionally, for chronic indication Ocuphire must complete a six-month toxicology study in rabbits.

Clinical testing is expensive, difficult to design and implement, can take many years to complete, and is uncertain as to outcome. A failure of one or more clinical trials can occur at any stage of development. In addition, based on the Phase 2

safety, tolerability and efficacy results of APX3330 in patients with DR/DME, Ocuphire might need further animal toxicology studies and additional Phase 2 and Phase 3 clinical trials before obtaining marketing approval from regulatory authorities

for the sale of APX3330.

Ocuphire, or its future collaborators, may experience numerous

unforeseen events during, or as a result of, clinical trials that could result in increased development costs and delay, and could limit or prevent its ability to receive marketing approval or commercialize its product candidates, including:

|

•

|

regulators or IRBs may not authorize Ocuphire or its investigators to commence a clinical trial or conduct a clinical trial at

a prospective trial site including due to the ongoing COVID-19 pandemic or other public health emergency;

|

|

•

|

government or regulatory delays and changes in regulatory requirements, policy and guidelines may require Ocuphire to perform

additional clinical trials or use substantial additional resources to obtain regulatory approval, including due to the ongoing COVID-19 pandemic or other public health emergency;

|

|

•

|

Ocuphire may have delays in reaching or fail to reach agreement on acceptable clinical trial contracts or clinical trial

protocols with prospective trial sites, including due to the ongoing COVID-19 pandemic or other public health emergency;

|

|

•

|

clinical trials may produce negative or inconclusive results, and Ocuphire may decide, or regulators may require it, to conduct

additional clinical trials or abandon product development programs, including due to the ongoing COVID-19 pandemic or other public health emergency;

|

|

•

|

the number of patients required for clinical trials may be larger, enrollment in these clinical trials may be slower or

participants may drop out of these clinical trials at a higher rate than Ocuphire anticipates, including due to the ongoing COVID-19 pandemic or other public health emergency;

|

|

•

|

Ocuphire’s third-party contractors may fail to comply with regulatory requirements or meet their contractual obligations to

Ocuphire in a timely manner, or at all;

|

|

•

|

Ocuphire’s patients or medical investigators may be unwilling to follow its clinical trial protocols;

|

|

•

|

Ocuphire might have to suspend or terminate clinical trials for various reasons, including a finding that the participants are

being exposed to unacceptable health risks;

|

|

•

|

the cost of clinical trials may be greater than Ocuphire anticipates, including due to the ongoing COVID-19 pandemic or other

public health emergency;

|

|

•

|

the supply or quality of any product candidate or other materials necessary to conduct clinical trials may be insufficient or

inadequate;

|

|

•

|

the product candidate may have undesirable side effects or other unexpected characteristics, causing Ocuphire or its

investigators, regulators or IRBs to suspend or terminate the trials;

|

|

•

|

clinical trials may be delayed or terminated because of the ongoing COVID-19 pandemic or another public health emergency; and

|

|

•

|

federal agencies may, due to reduced manpower or diverted resources to the COVID-19 pandemic, require more time to review

clinical trial protocols and INDs.

|

S-9

If Ocuphire experiences delays or

difficulties in the enrollment of patients in clinical trials, Ocuphire’s ability to conduct and complete those clinical trials, and its ability to seek and receive necessary regulatory approvals, could be delayed or prevented.

Ocuphire or its future collaborators may not be able to initiate or

continue clinical trials for its product candidates if Ocuphire is unable to locate and enroll a sufficient number of eligible patients to participate in these trials as required by the FDA or analogous regulatory authorities outside the United

States. Patient enrollment can be affected by many factors, including:

|

•

|

severity of the disease under investigation;

|

|

•

|

availability and efficacy of medications already approved for the disease under investigation;

|

|

•

|

eligibility criteria for the trial in question;

|

|

•

|

competition for eligible patients with other companies conducting clinical trials for product candidates seeking to treat the

same indication or patient population;

|

|

•

|

its payments for conducting clinical trials;

|

|

•

|

perceived risks and benefits of the product candidate under study;

|

|

•

|

efforts to facilitate timely enrollment in clinical trials;

|

|

•

|

patient referral practices of physicians;

|

|

•

|

the ability to monitor patients adequately during and after treatment;

|

|

•

|

proximity and availability of clinical trial sites for prospective patients;

|

|

•

|

the ability of patients to safely participate in clinical trials during the COVID-19 pandemic or other public health

emergencies; and

|

|

•

|

the ability to monitor patients adequately during periods in which social distancing is required or recommended due to the

COVID-19 pandemic.

|

Ocuphire expects that its late stage clinical trials of Nyxol and

APX3330 will commence in the fourth quarter of 2020 through the first quarter of 2021 and each trial may take up to 3 to 9 months to enroll; however, Ocuphire cannot assure you that its timing and enrollment assumptions are correct given the

above factors. The recent COVID-19 pandemic may also increase the time required to recruit patients for a study, and may also diminish the ability to monitor patients during the clinical trial. Ocuphire’s inability to enroll a sufficient number

of patients for its clinical trials or retain sufficient enrollment through the completion of its trials would result in significant delays or may require Ocuphire to abandon one or more clinical trials altogether. Enrollment delays in Ocuphire’s

clinical trials may result in increased development costs for its product candidates and cause its stock price to decline.

Ocuphire or others could discover that

Ocuphire’s product candidates lack sufficient efficacy, or that they cause undesirable side effects that were not previously identified, which could delay or prevent regulatory approval or commercialization.

Because both Nyxol and APX3330 have been tested in relatively small

patient populations, at a limited range of daily doses up to .75% Phentolamine Ophthalmic Solution (which is the same as 1% Phentolamine Mesylate Ophthalmic Solution) and 720 mg respectively, and for limited durations to date, it is possible that

Ocuphire’s clinical trials have or will indicate an apparent positive effect of Nyxol or APX3330 that is greater than the actual positive effect, if any, or that additional and unforeseen side effects may be observed as its development

progresses. Additionally, the combination product candidate of Nyxol and pilocarpine may not achieve the efficacy that is expected based on the individual contributions to efficacy. The discovery that either Nyxol or APX3330 lacks sufficient

efficacy, or that they cause undesirable side effects (including side effects not previously identified in Ocuphire’s completed clinical trials), could cause Ocuphire or regulatory authorities to interrupt, delay, or discontinue clinical trials,

and could result in the denial of regulatory approval by the FDA or other non-U.S. regulatory authorities for any or all targeted indications.

S-10

The discovery that Ocuphire’s product candidates lack sufficient

efficacy or that they cause undesirable side effects that were not previously identified could prevent Ocuphire from commercializing such product candidates and generating revenues from sales. In addition, if Ocuphire receives marketing approval

for its product candidates and Ocuphire or others later discover that it is less effective, or identify undesirable side effects caused by its product candidates:

|

•

|

regulatory authorities may withdraw their approval of the product;

|

|

•

|

Ocuphire may be required to recall the product, change the way this product is administered, conduct additional clinical

trials, or change the labeling or distribution of the product (including REMS);

|

|

•

|

additional restrictions may be imposed on the marketing of, or the manufacturing processes for, the product;

|

|

•

|

Ocuphire may be subject to fines, injunctions, or the imposition of civil or criminal penalties;

|

|

•

|

Ocuphire could be sued and held liable for harm caused to patients;

|

|

•

|

the product may be rendered less competitive and sales may decrease; or

|

|

•

|

Ocuphire’s reputation may suffer generally both among clinicians and patients.

|

Any one or a combination of these events could prevent Ocuphire from

achieving or maintaining market acceptance of the affected product candidate, or could substantially increase the costs and expenses of commercializing the product candidate, which in turn could delay or prevent Ocuphire from generating

significant, or any, revenues from the sale of the product candidate.

Changes in regulatory requirements or FDA

guidance, or unanticipated events during Ocuphire’s clinical trials, may result in changes to clinical trial protocols or additional clinical trial requirements, which could result in increased costs to Ocuphire or delays in its development

timeline.

Changes in regulatory requirements or FDA guidance, or unanticipated

events during Ocuphire’s clinical trials, may force Ocuphire to amend clinical trial protocols or the FDA may impose additional clinical trial requirements. Amendments to Ocuphire’s clinical trial protocols would require resubmission to the FDA

and IRBs for review and approval, and may adversely impact the cost, timing or successful completion of a clinical trial. If Ocuphire experiences delays completing, or if it terminates, any Phase 2 or Phase 3 trials, or if it is required to

conduct additional clinical trials, the commercial prospects for its product candidates may be harmed and its ability to generate product revenues will be delayed.

If Ocuphire fails to receive regulatory

approval for any of its planned indications for its product candidates or fails to develop additional product candidates, Ocuphire’s commercial opportunity will be limited.

Ocuphire is initially focused on the development of its product

candidates for its target indications, the treatment of NVD, pharmacologically-induced mydriasis, presbyopia, DR and DME. However, Ocuphire cannot assure you that it will be able to obtain regulatory approval of its product candidates for any

indication, or successfully commercialize its product candidates, if approved. If Ocuphire does not receive regulatory approval for, or successfully commercialize, its product candidates for one or more of its targeted or other indications,

Ocuphire’s commercial opportunity will be limited.

Ocuphire may pursue clinical development of additional acquired or

in-licensing product candidates. Developing, obtaining regulatory approval for and commercializing additional product candidates will require substantial additional funding beyond the net proceeds of the Pre-Merger Financing, and are prone to the

risks of failure inherent in drug product development. Ocuphire cannot assure you that it will be able to successfully advance any additional product candidates through the development process.

Even if it obtains FDA approval to market additional product

candidates, Ocuphire cannot assure you that any such product candidates will be successfully commercialized, widely accepted in the marketplace, or more effective than other commercially available alternatives. If Ocuphire is unable to

successfully develop and commercialize additional product candidates, its commercial opportunity will be limited.

Ocuphire has limited drug research and

discovery capabilities and may need to acquire or license product candidates from third parties to expand its product candidate pipeline.

Ocuphire currently has limited drug research and discovery

capabilities. Accordingly, if it is to expand its product candidate pipeline beyond Nyxol and APX3330 and its pipeline candidates, Ocuphire may need to acquire

S-11

or license product candidates from third parties. Ocuphire would face significant

competition in seeking to acquire or license promising product candidates. Many of its competitors for such promising product candidates may have significantly greater financial resources and more extensive experience in preclinical testing and

clinical trials, obtaining regulatory approvals, and manufacturing and marketing pharmaceutical products, and thus, may be a more attractive option to a potential licensor than Ocuphire. If Ocuphire is unable to acquire or license additional

promising product candidates, it may not be able to expand its product candidate pipeline.

If Ocuphire is able to acquire or license other product candidates,

such license agreements will likely impose various obligations upon it, and its licensors may have the right to terminate the license thereunder in the event of a material breach or, in some cases, at will. A termination of a future license could

result in Ocuphire’s loss of the right to use the licensed intellectual property, which could adversely affect Ocuphire’s ability to develop and commercialize a future product candidate, if approved, as well as harm its competitive business

position and its business prospects.

Ocuphire may expend its limited resources to

pursue a particular indication and fail to capitalize on indications that may be more profitable or for which there is a greater likelihood of success.

Because Ocuphire has limited financial and managerial resources, it

is currently focusing only on development programs that it identifies for specific indications for its product candidates. As a result, Ocuphire may forego or delay pursuit of opportunities for other indications, or with other potential product

candidates that later prove to have greater commercial potential. Ocuphire’s resource allocation decisions may cause it to fail to capitalize on viable commercial products or profitable market opportunities. Ocuphire’s spending on current and

future research and development programs for specific indications or future product candidates may not yield any commercially viable product. If Ocuphire does not accurately evaluate the commercial potential or target market for its product

candidates, it may not gain approval or achieve market acceptance of that candidate, and its business and financial results will be harmed.

Risks Related to Ocuphire’s Financial Position and Need for Additional

Capital

Ocuphire has incurred only losses since

inception. Ocuphire expects to incur losses for the foreseeable future and may never achieve or maintain profitability.

Since inception, Ocuphire incurred only operating losses. Prior to

the Merger, Ocuphire Private Company’s net losses were approximately $6.2 million and $1.6 million for the years ended December 31, 2019 and 2018, respectively, and $5.9 million for the nine-month period ended September 30, 2020. As of September

30, 2020, Ocuphire Private Company had an accumulated deficit of $14 million. Ocuphire has funded its operations primarily through issuance of common stock, warrants, promissory notes and convertible notes in private placements. It has devoted

substantially all of its financial resources and efforts on research and development, including clinical development of its product candidates. Even assuming Ocuphire obtains regulatory approval for one or more of its product candidates, Ocuphire

expects that it will be at least three years before it has a product candidate ready for commercialization. Ocuphire expects to continue to incur significant expenses and increased operating losses for the foreseeable future.

To become and remain profitable, Ocuphire must develop and

eventually commercialize a product with market potential. This will require Ocuphire to be successful in a range of challenging activities, including completing preclinical testing and clinical trials, obtaining regulatory approval for a product

candidate, manufacturing, marketing, and selling any drug for which it may obtain regulatory approval and satisfying any post-marketing requirements. Ocuphire is the early stages of most of these activities. Ocuphire may never succeed in these

activities and, even if it does, it may never generate revenues that are significant or large enough to achieve profitability.

If Ocuphire does achieve profitability, it may not be able to

sustain or increase profitability on an annual basis. Its failure to become or remain profitable may decrease Ocuphire’s value and could impair its ability to raise capital, maintain its research and development efforts, expand its business, or

continue its operations.

S-12

Ocuphire has not generated any revenue and may

never be profitable.

Ocuphire’s ability to become profitable depends upon its ability to

generate revenue. To date, Ocuphire has not generated any revenue from its product candidates, Nyxol and APX3330, and it does not currently have any other products or product candidates. Ocuphire does not know if, or when, it will generate any

revenue. Ocuphire does not expect to generate significant revenue unless and until it obtains marketing approval of, and commercializes, Nyxol or APX3330. Ocuphire’s ability to generate revenue depends on a number of factors, including its

ability to:

|

•

|

obtain favorable results from and complete the clinical development of both Nyxol and APX3330 for their planned indications,

including successful completion of the Phase 2 and Phase 3 trials for these indications;

|

|

•

|

submit an application to regulatory authorities for both product candidates and receive marketing approval in the United States

and foreign countries;

|

|

•

|

contract for the manufacture of commercial quantities of its product candidates at acceptable cost levels;

|

|

•

|

establish sales and marketing capabilities to effectively market and sell its product candidates in the United States or other

markets, alone or with a pharmaceutical partner; and

|

|

•

|

achieve market acceptance of its product candidates in the medical community and with third-party payors.

|

Even if Ocuphire’s product candidates are approved for commercial

sale in one or all of the initial indications that it is pursuing, they may not gain market acceptance or achieve commercial success. In addition, Ocuphire anticipates incurring significant costs associated with commercializing its product

candidates. Ocuphire may not achieve profitability soon after generating product revenue, if ever, and may be unable to continue operations without continued funding.

Ocuphire’s recurring operating losses have

raised substantial doubt regarding its ability to continue as a going concern.

Ocuphire’s recurring operating losses raise substantial doubt about

its ability to continue as a going concern. For the fiscal year ended December 31, 2019, its independent registered public accounting firm has issued its report on Ocuphire’s financial statements and has expressed substantial doubt about its

ability to continue as a going concern. Ocuphire has no current source of revenue to sustain its present activities, and it does not expect to generate revenue until and unless the FDA or other applicable regulatory authorities approves, and it

successfully commercializes, its product candidates. Accordingly, Ocuphire’s ability to continue as a going concern will require it to obtain additional financing to fund its operations. Uncertainty surrounding Ocuphire’s ability to continue as a

going concern may make it more difficult for it to obtain financing for the continuation of its operations and could result in a loss of confidence by investors, suppliers, contractors, and employees.

Ocuphire’s relatively short operating

history may make it difficult for investors to evaluate the success of its business to date and to assess its future viability.

Ocuphire is a clinical-stage company, and its operations to date

have been limited to organizing and staffing its company, business planning, raising capital, and developing its product candidates. Ocuphire has not yet demonstrated its ability to successfully complete a Phase 3 program, obtain regulatory

approval, manufacture a product at commercial scale, or conduct sales and marketing activities necessary for successful product commercialization.

Additionally, there is no operating history on which you may

evaluate this business and its prospects. Investment in a start-up company such as Ocuphire is inherently subject to many risks. These risks and difficulties include challenges in accurate financial planning as a result of: (a) accumulated

losses; (b) uncertainties resulting from a relatively limited time period in which to develop and evaluate business strategies as compared to companies with longer operating histories; (c) compliance with regulation required to commence sales on

some future products; (d) reliance on third parties for operations; (e) financing the business; and (f) meeting the challenges of the other risk factors described herein. Ocuphire has no operating history upon which investors may base an

evaluation of its performance; therefore, it is subject to all risks incident to the creation and development of a new business. There can be no assurance that Ocuphire can realize its plans on the projected timetable in order to reach

sustainable or profitable operations.

S-13

Ocuphire will need substantial additional

capital in the future. If additional capital is not available, it will have to delay, reduce or cease operations.

Although Ocuphire believes that the net proceeds from the Pre-Merger

Financing, together with cash on hand, will be sufficient to fund its operations through 2021, Ocuphire will need to raise additional capital to continue to fund the further development of its product candidates and operations. Its future capital

requirements may be substantial and will depend on many factors including:

|

•

|

the scope, size, rate of progress, results, and costs of researching and developing its product candidates, and initiating and

completing its preclinical studies and clinical trials;

|

|

•

|

the cost, timing and outcome of its efforts to obtain marketing approval for its product candidates in the United States and

other countries, including to fund the preparation and filing of an NDA with the FDA for its product candidates and to satisfy related FDA requirements and regulatory requirements in other countries;

|

|

•

|

the number and characteristics of any additional product candidates it develops or acquires, if any;

|

|

•

|

Ocuphire’s ability to establish and maintain collaborations on favorable terms, if at all;

|

|

•

|

the amount of revenue, if any, from commercial sales, should its product candidates receive marketing approval;

|

|

•

|

the costs associated with commercializing its product candidates, if Ocuphire receives marketing approval, including the cost

and timing of developing sales and marketing capabilities or entering into strategic collaborations to market and sell its product candidates;

|

|

•

|

the cost of manufacturing its product candidates or products Ocuphire successfully commercializes; and

|

|

•

|

the costs associated with general corporate activities, such as the cost of filing, prosecuting and enforcing patent claims and

making regulatory filings.

|

Changing circumstances may cause Ocuphire to consume capital

significantly faster than it currently anticipates. Because the outcome of any clinical trial is highly uncertain, Ocuphire cannot reasonably estimate the actual amounts necessary to successfully complete the development, regulatory approval and

commercialization of its product candidates. Additional financing may not be available when Ocuphire needs it, or may not be available on terms that are favorable to Ocuphire. In addition, Ocuphire may seek additional capital due to favorable

market conditions or strategic considerations, even if Ocuphire believes it has sufficient funds for its current or future operating plans. If adequate funds are unavailable to it on a timely basis, or at all, Ocuphire may not be able to continue

the development its product candidates, or commercialize its product candidates, if approved, unless it finds a strategic partner.

Raising additional capital may cause

dilution to Ocuphire’s stockholders, restrict Ocuphire’s operations, or require Ocuphire to relinquish rights to its technologies or product candidates.

Until such time, if ever, as Ocuphire can generate substantial

product revenues, it expects to finance its cash needs through a combination of equity and debt financings as well as potential strategic collaborations and licensing arrangements. It does not have any committed external source of funds. Debt

financing or preferred equity financing, if available, may involve agreements that include covenants limiting or restricting Ocuphire’s ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring

dividends.

If Ocuphire raises funds through strategic collaborations or

marketing, distribution, or licensing arrangements with third parties, it may have to relinquish valuable rights to its technologies, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be

favorable to it. If it is unable to raise additional funds when needed, Ocuphire may be required to delay, limit, reduce or terminate its product development or future commercialization efforts or grant rights to develop and market product

candidates that it would otherwise prefer to develop and market itself. This may reduce the value of its common stock.

S-14

Risks Related to Government Regulation

The FDA requires the completion of a toxicology

study of similar duration before trials longer than 6 months can be conducted such as Phase 3 safety exposure trials for chronic indications or efficacy trials with such 6 month endpoints. This may lead to a significant delay in the commencement

of long term clinical trials by Ocuphire or the failure of its product candidates to obtain marketing approval.

At this time, Ocuphire can run trials using Nyxol up to 28 days in

duration based on its completed 28-day rabbit toxicology study. Therefore, the planned Phase 3 registration efficacy trials for NVD, with dosing for 7 to 14 days, may be conducted without further toxicology studies. Until Ocuphire has completed a

six-month toxicology for Nyxol, FDA regulations restrict it from conducting clinical trials of six months or more in duration targeting chronic indications, which at this time is only the planned 1 year Phase 3 safety exposure trial for NVD.

Ocuphire plans to initiate the in-life portion of the six-month toxicology study in rabbits for Nyxol in the first quarter of 2021, with an expected completion and draft report 12 months later. For APX3330, the drug has already been dosed for

more than a year in humans and completed over 15 single- and repeat-dose toxicology studies in rats and dogs (including 2 studies up to 3 months in duration); with this data the FDA has reviewed, with no comments, Ocuphire’s planned 24 week

clinical trial without the need for further toxicology studies needed. However, the FDA may require Ocuphire to complete further animal toxicology studies for future clinical trials prior to any marketing approval from regulatory authorities for

the sale of APX3330. Clinical trials may be delayed due to these clinical restrictions and additional oversight by the FDA. In addition, the findings in the toxicology studies could impact the NDA reviews, and, if approved, labels and uses of

Ocuphire’s product candidates.

Even if it receives marketing approval for its

product candidates in the United States, Ocuphire may never receive regulatory approval to market such product candidates outside of the United States.

In addition to the United States, Ocuphire intends to seek

regulatory approval to market its product candidates in Europe, Japan, Canada, and Australia, and potentially other markets. If Ocuphire pursues additional product candidates in the future, it may seek regulatory approval of such product

candidates outside the United States. In order to market any product outside of the United States, however, Ocuphire must establish and comply with the numerous and varying safety, efficacy and other regulatory requirements of these other

countries. Approval procedures vary among countries and can involve additional product candidate testing and additional administrative review periods. The time required to obtain approvals in other countries might differ from that required to

obtain FDA approval. The marketing approval processes in other countries may include all of the risks detailed above regarding FDA approval in the United States as well as other risks. In particular, in many countries outside of the United

States, products must receive pricing and reimbursement approval before the product can be commercialized. Obtaining this approval can result in substantial delays in bringing products to market in such countries. Marketing approval in one

country does not ensure marketing approval in another, but a failure or delay in obtaining marketing approval in one country may have a negative effect on the regulatory process in others. Failure to obtain marketing approval in other countries

or any delay or other setback in obtaining such approval would impair Ocuphire’s ability to market its product candidates in such foreign markets. Any such impairment would reduce the size of Ocuphire’s potential market, which could have an

adverse impact on its business, results of operations and prospects.

Even if Ocuphire obtains marketing approval

for its product candidates, such product candidates could be subject to post-marketing restrictions or withdrawal from the market, and Ocuphire may be subject to substantial penalties if it fails to comply with regulatory requirements or

experience unanticipated problems with a product following approval.

Any product candidate for which Ocuphire, or its future

collaborators, obtains marketing approval in the future, as well as the manufacturing processes, post-approval studies and measures, labeling, advertising, and promotional activities for such drug, among other things, will be subject to continual

requirements of and review by the FDA and other regulatory authorities. These requirements include submissions of safety and other post-marketing information and reports, registration and listing requirements, requirements relating to

manufacturing, quality control, quality assurance and corresponding maintenance of records and documents, requirements regarding the distribution of samples to physicians and recordkeeping. Even if marketing approval of a product candidate is

granted, the approval may be subject to limitations on the indicated uses for which the drug may be marketed or to the conditions of approval, including the requirement to implement a REMS, which could include requirements for a restricted

distribution system.

The FDA may also impose requirements for costly post-marketing

studies or clinical trials and surveillance to monitor the safety or efficacy of a product candidate. The FDA and other agencies, including the Department of

S-15

Justice, closely regulate and monitor the post-approval marketing and promotion of

drugs to ensure that they are manufactured, marketed, and distributed only for the approved indications and in accordance with the provisions of the approved labeling. The FDA imposes stringent restrictions on manufacturers’ communications

regarding off-label use and if Ocuphire, or any future collaborator, does not market a product candidate for which it receives marketing approval for only its approved indications, Ocuphire, or the collaborator, may be subject to warnings or

enforcement action for off-label promotion. Violation of the Federal Food, Drug, and Cosmetic Act (“FDC Act”) and other statutes, including the False Claims Act, relating to the promotion and advertising of prescription drugs, may lead to

investigations or allegations of violations of federal or state healthcare fraud and abuse laws and state consumer protection laws.

In addition, later discovery of previously unknown AEs or other

problems with Ocuphire’s product candidates or its manufacturers or manufacturing processes, or failure to comply with regulatory requirements, may yield various results, including:

|

•

|

litigation involving patients taking Ocuphire’s drugs;

|

|

•

|

restrictions on such drugs, manufacturers, or manufacturing processes;

|

|

•

|

restrictions on the labeling or marketing of a drug;

|

|

•

|

restrictions on drug distribution or use;

|

|

•

|

requirements to conduct post-marketing studies or clinical trials;

|

|

•

|

warning letters or untitled letters;

|

|

•

|

withdrawal of the drugs from the market;

|

|

•

|

refusal to approve pending applications or supplements to approved applications that Ocuphire submits;

|

|

•

|

product recall or public notification or medical product safety alerts to healthcare professionals;

|

|

•

|

fines, restitution, or disgorgement of profits or revenues;

|

|

•

|

suspension or withdrawal of marketing approvals;

|

|

•

|

damage to relationships with any potential collaborators;

|

|

•

|