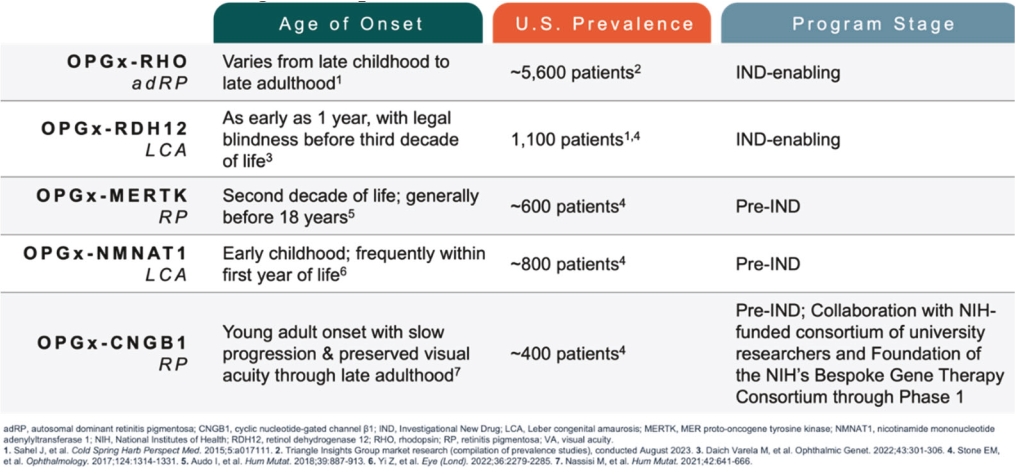

For our RDH12 therapeutic program, we in-license one patent family directed to compositions of matter and therapeutic methods using such compositions of matter, consisting of patents in the U.S., Japan, Australia, and additional foreign countries and pending patent applications in the U.S., Europe, and additional foreign countries. The foregoing patents, including any patents granted based on the pending patent applications, will expire in 2037, not including any patent term extension.

For our NMNAT1 therapeutic program, we in-license one patent family directed to compositions of matter and therapeutic methods using such compositions of matter, consisting of pending patent applications in the U.S., Europe, Japan, and additional foreign countries. These patents, if granted based on the pending patent applications, would expire in 2041, not including any patent term extension.

For our CNGB1 therapeutic program, we in-license one patent family directed to compositions of matter and therapeutic methods using such compositions of matter. This patent family contains a patent in Japan and pending patent applications in the U.S., Europe, and additional foreign countries, whereby the Japanese patent and patent applications, if granted, based on the foregoing pending patent applications, expire in year 2038, not including any patent term extension.

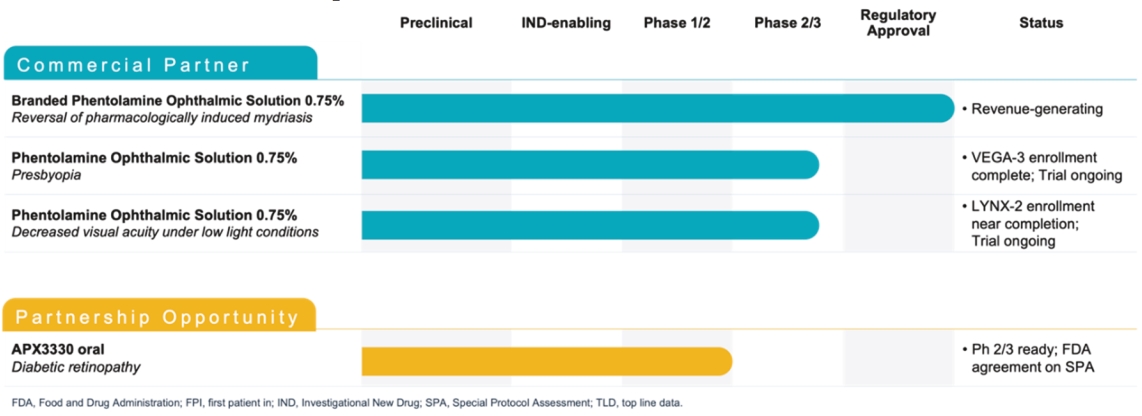

PS

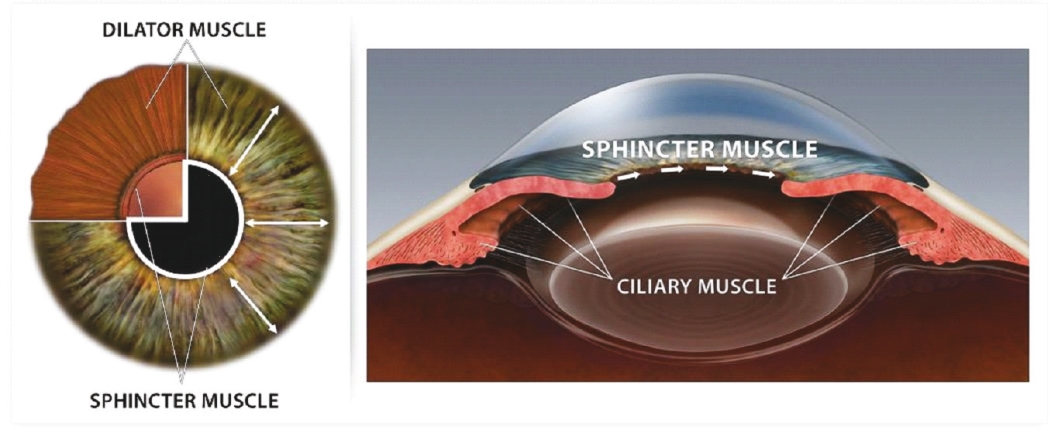

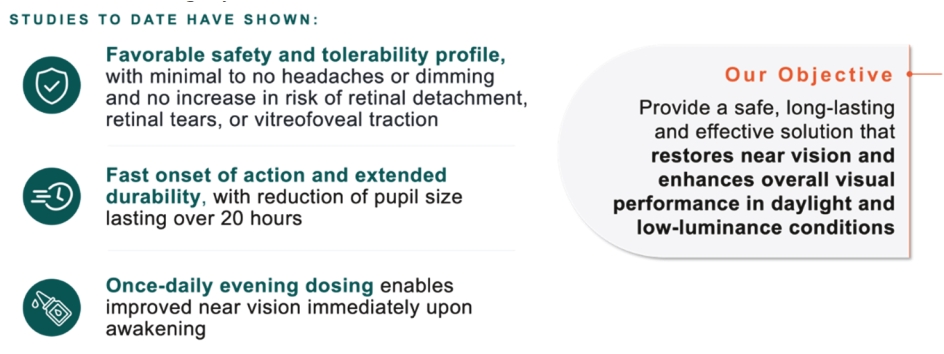

Our patent estate includes patents and patent applications to forms of phentolamine mesylate, formulations containing phentolamine mesylate, methods of using phentolamine mesylate, and methods of manufacturing phentolamine mesylate. We own all of the worldwide rights to PS for all indications, but out-license certain rights to PS pursuant to the Viatris License Agreement.

Our patent estate relating to PS contains over 12 U.S. patents, over seven pending U.S. non-provisional patent applications, a pending international patent application, as well as issued patents in Australia, Canada, Europe, Japan, and Mexico and pending patent applications in Europe, Japan, and other foreign countries. Multiple U.S. patents and counterpart Australian, Canadian, European, and Japanese patents are directed to aqueous phentolamine mesylate formulations and are scheduled to expire in 2034. Additional multiple U.S. patents and counterpart Australian, Canadian, European, and Japanese patents are directed to methods of improving visual performance using, for example, phentolamine mesylate and are scheduled to expire in 2034.

We also own two U.S. patents with claims to methods of treating presbyopia, and one U.S. patent with claims to methods of treating mydriasis—each of the foregoing U.S. patents are scheduled to expire in 2039. Additionally, we own one pending U.S. patent application with claims to treating presbyopia and two pending U.S. patent applications with claims to treating mydriasis. Counterpart patent applications are pending in Europe, Japan, and other foreign countries—if granted based on these pending applications, these patents would expire in 2039. Patent applications are also pending in the U.S., Europe, Japan, and other foreign countries directed to additional methods for treating mydriasis—if granted based on the foregoing patent applications, these patents would expire in 2042.

We also own two U.S. patents, one pending U.S. patent application, and pending foreign patent applications in Europe, Japan, and additional foreign countries directed to high-purity phentolamine mesylate and methods for making the same. We also have a pending international patent application, pending U.S. patent application, and pending European patent application directed to particular phentolamine mesylate crystal forms and their use—if granted based on the foregoing patent applications, these patents would expire in 2043.

We have obtained registration of the “RYZUMVI” trademark in the United States.

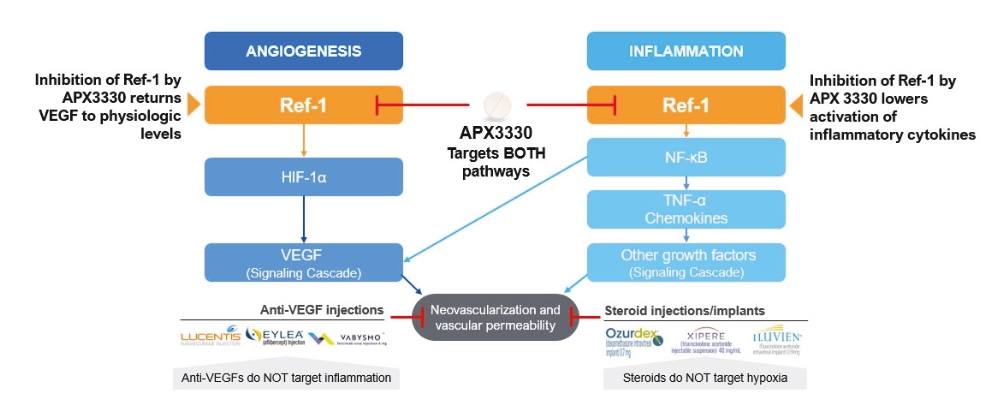

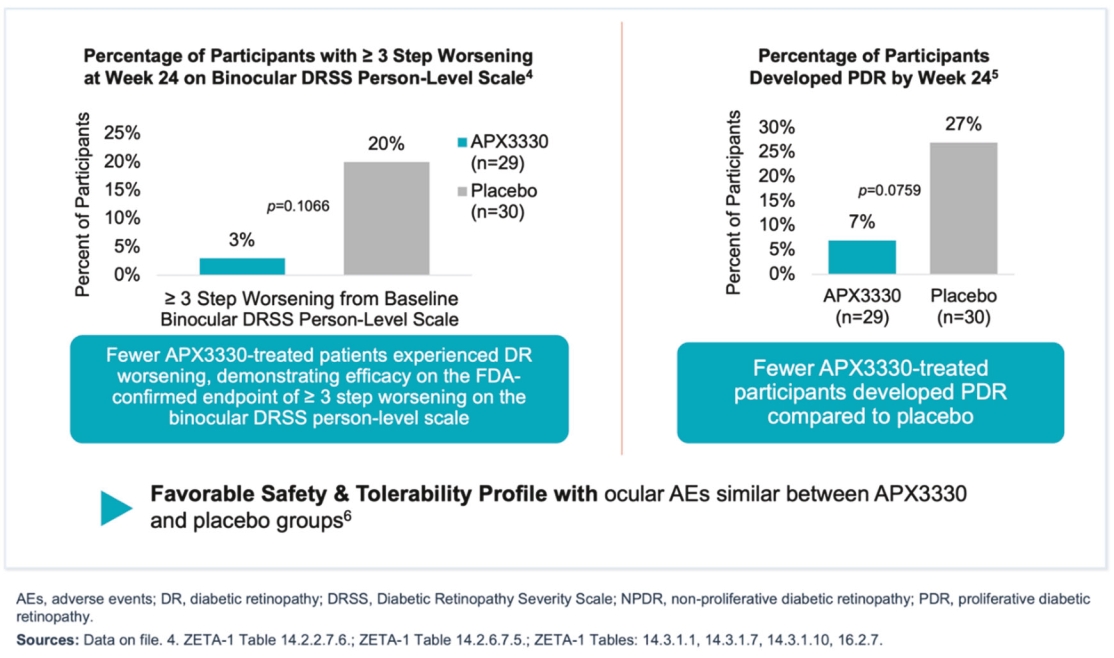

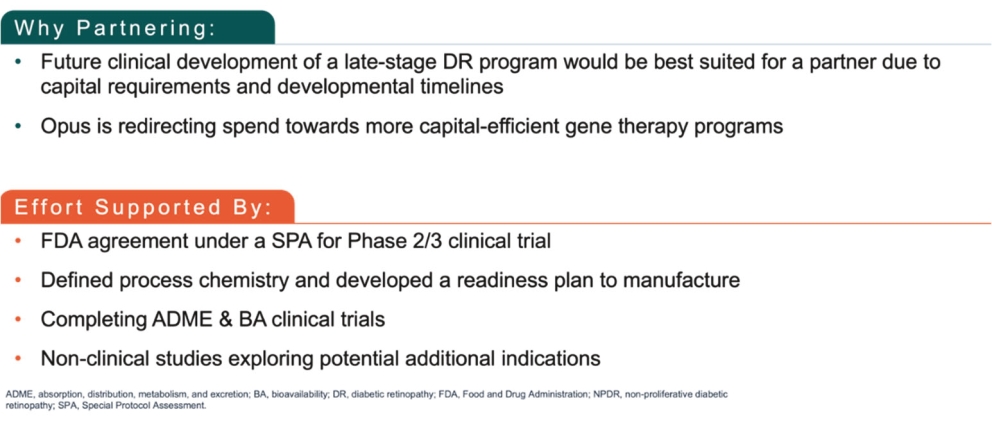

APX3330

As of December 31, 2024, the patent estate that we in-license for APX3330 and related compounds contains nine U.S. patents and two pending U.S. non-provisional patent applications, as well as issued patents in Europe, Japan, and additional foreign countries, and pending patent applications in Europe, Japan, and additional foreign countries. The license is for the use and commercialization of APX3330 and related compounds covered by the subject patents and patent applications in the field of human health uses for ophthalmic and diabetes mellitus indications.

One in-licensed U.S. patent is directed to methods of treating diabetic retinopathy and other diseases using, for example, APX3330, and is scheduled to expire in year 2030, not including any patent term extension.