DFAN14A: Additional definitive proxy soliciting materials filed by non-management and Rule 14(a)(12) material

Published on April 2, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

|

OPUS GENETICS, INC. |

|

(Name of Registrant as Specified In Its Charter) |

|

MINA SOOCH Michael P. Burrows Carolyn Cassin Martin Dober lAWRENCE FINGERLE Mark H. Ravich john Weber |

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Mina Sooch, together with the other participants named herein (collectively, the “Restore Value Slate”), has filed a preliminary proxy statement and accompanying WHITE universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of Ms. Sooch’s slate of highly qualified director nominees at the 2025 annual meeting of stockholders of Opus Genetics, Inc., a Delaware corporation (the “Company”).

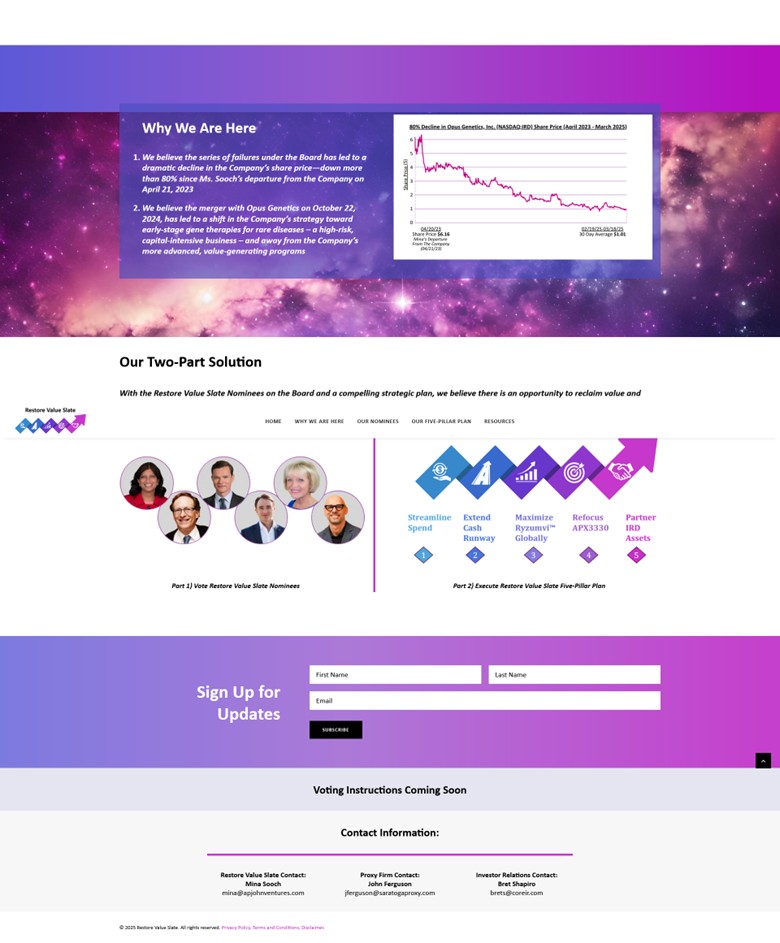

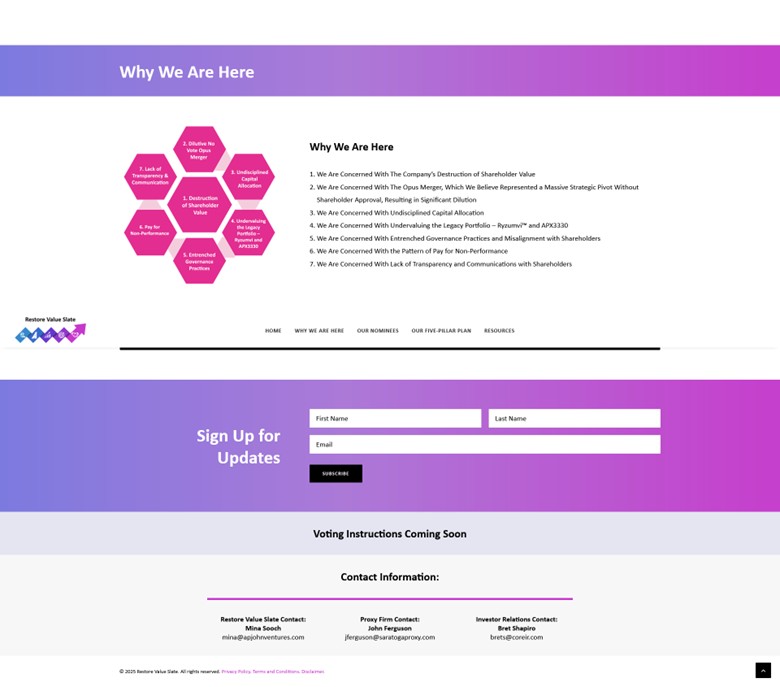

On the evening of April 1, 2025, the Restore Value Slate launched a website to communicate with the Company’s stockholders. The website address is https://restorevalueslate.com/. The following materials were posted by the Restore Value Slate to https://restorevalueslate.com/, certain of which were previously filed with the SEC:

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Mina Sooch, together with the other participants named herein (collectively, the “Restore Value Slate”) has filed a preliminary proxy statement and accompanying WHITE universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of Ms. Sooch’s slate of highly qualified director nominees at the 2025 annual meeting of stockholders of Opus Genetics, Inc., a Delaware corporation (the “Company”).

THE RESTORE VALUE SLATE STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS, INCLUDING A PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the anticipated proxy solicitation are expected to be Ms. Sooch, Mark H. Ravich, Lawrence Fingerle, Michael P. Burrows, Carolyn Cassin, Martin Dober and John Weber.

As of the date hereof, Ms. Sooch directly beneficially owns 786,877 shares of common stock, par value $0.0001 per share (the “Common Stock”), of the Company, 5,100 shares of which are held in record name. As of the date hereof, Mr. Ravich directly beneficially owns 345,900 shares of Common Stock. As of the date hereof, Mr. Fingerle directly beneficially owns 5,711 shares of Common Stock. As of the date hereof, Mr. Burrows directly beneficially owns 4322 shares of Common Stock. As of the date hereof, Ms. Cassin indirectly beneficially owns 108,907 shares of Common Stock, consisting of 52,574 shares of Common Stock directly owned by The Belle Michigan Impact Fund Investor Side Fund, and 56,233 shares of Common Stock owned by The Belle Michigan Impact Fund, LP. As of the date hereof, Mr. Dober does not beneficially own any shares of Common Stock. As of the date hereof, Mr. Weber does not beneficially own any shares of Common Stock.