10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 24, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

|

For the Fiscal Year Ended December 31, 2021

or

|

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

|

For the transition period from _____ to _____

Commission File No. 001-34079

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (248 )

681-9815

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

||

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

||

|

|

Smaller reporting company

|

||

|

Emerging growth company

|

|||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its

internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common equity held by non-affiliates of the registrant on June 30, 2021, based on the closing price on that date

of $5.28, was approximately $83,840,460 . As of March 23, 2022, there were 18,989,817 shares of the registrant’s common stock outstanding.

Documents Incorporated by Reference

Portions of the registrant’s Definitive Proxy Statement to be filed with the Commission pursuant to Regulation 14A in connection with the registrant’s 2022 Annual

Meeting of Stockholders, to be filed subsequent to the date hereof, are incorporated by reference into Part III of this report. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission not later than 120 days after

the conclusion of the registrant’s fiscal year ended December 31, 2021.

Ocuphire Pharma, Inc.

Form 10-K

|

PART I

|

6 |

||

|

ITEM 1.

|

6 |

||

|

ITEM 1A.

|

60 |

||

|

ITEM 1B.

|

100 |

||

|

ITEM 2.

|

101 |

||

|

ITEM 3.

|

101 |

||

|

ITEM 4.

|

101 |

||

|

PART II

|

102 |

||

|

ITEM 5.

|

102 |

||

|

ITEM 6.

|

102 |

||

|

ITEM 7.

|

103 |

||

|

ITEM 7A.

|

119 |

||

|

ITEM 8.

|

119 |

||

|

ITEM 9.

|

119 |

||

|

ITEM 9A.

|

119 |

||

|

ITEM 9B.

|

120 |

||

|

ITEM 9C.

|

120 |

||

|

PART III

|

121 | ||

|

ITEM 10.

|

121 |

||

|

ITEM 11.

|

121 |

||

|

ITEM 12.

|

121 |

||

|

ITEM 13.

|

121 |

||

|

ITEM 14.

|

121 |

||

|

PART IV

|

122 |

||

|

ITEM 15.

|

122 |

||

|

ITEM 16.

|

124 |

||

| 155 | |||

In this Annual Report on Form 10-K, unless otherwise specified, references to “we,” “us,” “our,” “Ocuphire” or “the Company” mean Ocuphire Pharma, Inc., together with its former subsidiary OcuSub Inc. Our financial

statements are prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). These forward-looking statements relate to us, our business prospects and our results of operations and are subject to certain risks and uncertainties posed by many factors and events that could cause our

actual business, prospects and results of operations to differ materially from those anticipated by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those described under

the heading “Risk Factors” included in this Annual Report on Form 10-K. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. In some cases, you can identify

forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of these terms

or other comparable terminology, although not all forward-looking statements contain these words. We undertake no obligation to revise any forward-looking statements in order to reflect events or circumstances that might subsequently arise. Readers

are urged to carefully review and consider the various disclosures made by us in this report and in our other reports filed with the U.S. Securities and Exchange Commission (the “SEC”) that advise interested parties of the risks and factors that

may affect our business.

SUMMARY RISK FACTORS

Our business is subject to a number of risks, as fully described in “Item 1A. Risk Factors” in this Annual Report. The principal factors and uncertainties include, among

others:

|

|

• |

Ocuphire currently depends entirely on the success of Nyxol and APX3330, its only product candidates. Ocuphire may never complete clinical development of, receive marketing approval for,

or successfully commercialize, Nyxol alone or as adjunctive therapy with low dose pilocarpine (LDP), APX3330, or other product candidates it may pursue in the future for any indication.

|

|

|

• |

The results of previous clinical trials may not be predictive of future results, and the results of Ocuphire’s current and planned clinical trials may not satisfy the requirements of the

FDA or non-U.S. regulatory authorities.

|

|

|

• |

Changes in regulatory requirements or FDA guidance, or unanticipated events during Ocuphire’s clinical trials, may result in changes to clinical trial protocols or additional clinical

trial requirements, which could result in increased costs to Ocuphire or delays in its development timeline.

|

|

|

• |

Ocuphire has incurred only losses since inception. Ocuphire expects to incur losses for the foreseeable future and may never achieve or maintain profitability.

|

|

|

• |

Ocuphire’s recurring operating losses have raised substantial doubt regarding its ability to continue as a going concern.

|

|

|

• |

Raising additional capital may cause dilution to Ocuphire’s stockholders, restrict Ocuphire’s operations, or require Ocuphire to relinquish rights to its technologies or product

candidates.

|

|

|

• |

Even if it receives marketing approval for its product candidates in the United States, Ocuphire may never receive regulatory approval to market such product candidates outside of the

United States.

|

|

|

• |

Ocuphire employees or its representatives may engage in misconduct or other improper activities, including violating applicable regulatory standards and requirements or engaging in

insider trading, which could significantly harm Ocuphire’s business.

|

|

|

• |

Ocuphire faces substantial competition, which may result in others discovering, developing, or commercializing products before or more successfully than it does.

|

|

|

• |

Ocuphire lacks experience in commercializing products, which may have an adverse effect on its business.

|

|

|

• |

If Ocuphire is unable to establish sales and marketing capabilities or enter into agreements with third parties to sell, market, and distribute its product candidates, if approved, it

may not be successful in commercializing such product candidates if and when they are approved.

|

|

|

• |

Product liability lawsuits against Ocuphire, or its suppliers and manufacturers, could cause it to incur substantial liabilities and could limit commercialization of any product

candidate that it may develop.

|

|

|

• |

Ocuphire is unable to control all aspects of its clinical trials due to its reliance on clinical research organizations (“CROs”), contract development and manufacturing organizations

(“CDMOs”) and other third parties that assist Ocuphire in conducting clinical trials.

|

|

|

• |

Ocuphire is unable to control the supply, manufacture and testing of bulk drug substances and the formulation, testing and packaging of preclinical and clinical drug supplies of its product candidates, and

will be unable to control these elements at the commercial stage, due to its reliance on third party manufacturers and analytical facilities.

|

|

|

• |

If Ocuphire is not able to establish new collaborations on commercially reasonable terms, it may have to alter its development, manufacturing, and commercialization plans.

|

|

|

• |

If Ocuphire is unable to obtain and maintain sufficient patent protection for its product candidates, its competitors could develop and commercialize products or technology similar or

identical to those of Ocuphire, which would adversely affect Ocuphire’s ability to successfully commercialize any product candidates it may develop, its business, results of operations, financial condition and prospects.

|

|

|

• |

If Ocuphire does not obtain protection under the Hatch-Waxman Act and similar foreign legislation by extending the patent terms and obtaining data exclusivity for its product candidate, its business may be

materially harmed.

|

|

|

• |

Ocuphire may not be able to protect or practice its intellectual property rights throughout the world.

|

|

|

• |

Obtaining and maintaining Ocuphire’s patent protection depends on compliance with various procedural, document submission, fee payment, and other requirements imposed by governmental

agencies, and its patent protection could be reduced or eliminated for noncompliance with these requirements.

|

|

|

• |

Ocuphire depends on intellectual property sublicensed from Apexian Pharmaceuticals, Inc. (“Apexian”) for its APX3330 product candidate under development and its additional pipeline

candidates, and the termination of, or reduction or loss of rights under, this sublicense would harm Ocuphire’s business.

|

|

|

• |

Ocuphire is dependent on its key personnel, and if it is not successful in attracting and retaining highly qualified personnel, it may not be able to successfully implement its business

strategy.

|

|

|

• |

Ocuphire will need to develop and expand its company and may encounter difficulties in managing this development and expansion, which could disrupt its operations.

|

|

|

• |

The COVID-19 pandemic has and could continue to adversely impact Ocuphire’s business, including preclinical and clinical trials and regulatory approvals.

|

|

|

• |

Ocuphire’s insurance policies are expensive and protect only from some business risk, which leaves Ocuphire exposed to significant uninsured liabilities.

|

|

|

• |

If Ocuphire fails to comply with the continued listing standards of the Nasdaq Capital Market, Ocuphire common stock could be delisted. If it is delisted, Ocuphire common stock and the

liquidity of its common stock would be impacted.

|

|

|

• |

The market price of Ocuphire common stock may fluctuate significantly.

|

|

|

• |

Ocuphire may be subject to securities litigation, which is expensive and could divert management attention.

|

INDUSTRY AND MARKET DATA

In this Annual Report, we reference information, statistics and estimates regarding the medical devices and healthcare industries. We have obtained this information from various third-party sources, including industry and general publications, reports by market research firms and other sources. This information involves a number of assumptions and limitations, and we have not independently verified the

accuracy or completeness of this information. Some data and other information are also based on the good faith estimates of management, which are derived from our research, review of internal surveys, general information discussed in the

industry, and third-party sources. We believe that these external sources and estimates are reliable but have not independently verified them. The industries in which we operate are subject to a high degree of uncertainty, change, and risk due to

a variety of factors, including those described in “Item 1A. Risk Factors.” These and other factors could cause results to differ materially from those expressed in this Annual Report and other publications.

| ITEM 1. |

BUSINESS

|

Overview

Ocuphire is a clinical-stage ophthalmic biopharmaceutical company focused on developing and commercializing therapies for the treatment of refractive and retinal eye disorders. Ocuphire’s

pipeline currently includes two small molecule product candidates targeting several of such indications.

Its lead product candidate, Nyxol® Eye Drops (“Nyxol”), is a once-daily eye drop formulation of phentolamine mesylate

designed to reduce pupil diameter and improve visual acuity. As a result, Nyxol can potentially be used for the treatment of multiple indications such as reversal of pharmacologically-induced mydriasis (“RM”) (dilation of the pupil), presbyopia

(age-related blurry near vision) and dim light or night vision disturbances (“NVD”) (halos and glares). Ocuphire’s management believes these multiple indications potentially represent a significant market opportunity. Nyxol has been studied in

a total of 9 clinical trials (3 Phase 1, 5 Phase 2 and 1 Phase 3) in a total of over 560 patients (with over 330 Nyxol-treated) and has demonstrated promising clinical data for use in the multiple ophthalmic indications mentioned above.

Ocuphire reported positive top-line data from the first Phase 3 trial (MIRA-2) for RM, completed enrollment in a 2nd Phase 3 RM trial (MIRA-3) in February 2022, and completed enrollment on a pediatric safety study (MIRA-4) for RM in

March 2022. Ocuphire also reported positive top-line data from a Phase 2 trial of Nyxol for treatment of presbyopia, both alone and with low-dose pilocarpine (pilocarpine hydrochloride 0.4% ophthalmic solution, “LDP”) as adjunctive therapy. Ocuphire announced completion of enrollment of its NVD Phase 3 trial (LYNX-1) in January 2022. Ocuphire expects to report top-line results from

the MIRA-3 RM Phase 3 study by end of the first quarter of 2022, followed by the LYNX-1 NVD Phase 3 study and the MIRA-4 RM pediatric study in the second quarter of 2022. Assuming successful and timely completion of the RM trials, Ocuphire

anticipates submitting a new drug application (“NDA”) to the U.S. Food and Drug Administration (“FDA”) in late 2022 under the 505(b)(2) pathway for its drug led combination product. Ocuphire has started pre-commercialization planning and

activities in anticipation of a successful RM approval.

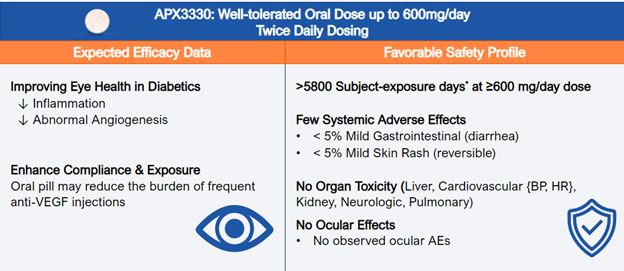

Ocuphire’s second product candidate, APX3330, is a twice-a-day oral tablet designed to target multiple pathways relevant to

retinal and choroidal (the vascular layer of the eye) diseases such as diabetic retinopathy (“DR”) and diabetic macular edema (“DME”) which, if left untreated, can result in permanent visual acuity loss and eventual blindness. DR is a disease

resulting from diabetes in which chronically elevated blood sugar levels cause progressive damage to blood vessels in the retina. DME is a severe form of DR which involves leakage of protein and fluid into the macula, the central portion of

the retina, causing swelling and vascular damage. Prior to Ocuphire’s in-licensing of the product candidate, APX3330 had been studied by other sponsors in a total of 11 clinical trials (6 Phase 1 and 5 Phase 2) in a total of over 420 healthy

volunteers or patients (with over 340 APX3330-treated) for inflammatory and oncology indications, and had demonstrated evidence of tolerability, pharmacokinetics, durability, and target engagement. Ocuphire has also in-licensed APX2009 and

APX2014, which are second-generation product candidates and analogs of APX3330. Ocuphire initiated a Phase 2 trial for APX3330 in April 2021 for the treatment of patients with DR, including moderately severe non-proliferative DR (“NPDR”) and

mild proliferative DR (“PDR”), as well as patients with DME without loss of central vision. In January 2022, Ocuphire reported masked safety data from the ongoing Phase 2 trial in DR/DME on 68 patients enrolled at the time. These safety data

are consistent with safety data from the prior 11 clinical trials with total exposure experience of over 5000 subject days with 600 mg daily dose of APX3330. Ocuphire also reported enrollment completion of 103 patients in the ZETA-1 trial in

March 2022, and expects to report top-line results from the ZETA-1 DR/DME Phase 2b study in the second half of 2022.

As part of its strategy, Ocuphire will continue to explore opportunities to acquire additional ophthalmic assets and seek strategic partners for late-stage development, regulatory preparation,

and commercialization of drugs in key global markets.

Corporate History

On November 5, 2020, Ocuphire (formerly known as Rexahn Pharmaceuticals, Inc., and prior to the merger, referred to as “Rexahn”),

completed its reverse merger with Ocuphire Pharma, Inc. (“Private Ocuphire”), in accordance with the terms of the Agreement and Plan of Merger, dated as of June 17, 2020, as amended, by and among Rexahn, Private Ocuphire, and Razor Merger Sub,

Inc., a wholly-owned subsidiary of Rexahn (“Merger Sub”) (as amended, the “Merger Agreement”), pursuant to which Merger Sub merged with and into Private Ocuphire, with Private Ocuphire surviving as a wholly-owned subsidiary of Rexahn (the

“Merger”).

In connection with, and immediately prior to the completion of, the Merger, Rexahn effected a reverse stock split of the common

stock, at a ratio of 1-for-4 (the “Reverse Stock Split”). Under the terms of the Merger Agreement, after considering the Reverse Stock Split, Rexahn issued shares of its common stock to Private Ocuphire stockholders, based on a common stock

exchange ratio of 1.0565 shares of common stock for each share of Private Ocuphire common stock. In connection with the Merger, Rexahn changed its name from “Rexahn Pharmaceuticals, Inc.” to “Ocuphire Pharma, Inc.,” Merger Sub changed its name

from “Razor Merger Sub, Inc.” to “OcuSub Inc.”, and the business conducted by Rexahn became the business conducted by Private Ocuphire.

In December 2021, OcuSub Inc. was merged with and into the Company, with the Company remaining as the surviving entity.

Strategy

Ocuphire’s goal is to build a leading ophthalmic biopharmaceutical company that discovers, develops and commercializes best-in-class therapies for patients and provides attractive solutions for

physicians and payers. The key elements of Ocuphire’s strategy to achieve its goal are the following:

|

|

• |

Advance

the clinical development of Nyxol and APX3330. Ocuphire is currently conducting Phase 2 and Phase 3 registration trials of Nyxol and Phase 2b trials of APX3330 with the goal of filing a U.S. NDA

in late 2022 for Nyxol for RM, and advancing APX3330 towards Phase 3 studies in the future.

|

|

|

• |

Target Nyxol and APX3330 for large ophthalmic indications. Ocuphire believes

Nyxol has therapeutic potential to improve vision performance in RM, presbyopia and NVD. Ocuphire also believes AXP3330 has potential to improve the health of the retina in patients with DR, DME, and wet age-related macular degeneration

(wAMD), while reducing the burden of intravitreal injections.

|

|

|

• |

Maintain and expand its intellectual property portfolio. Ocuphire owns all

global patent rights to Nyxol with respect to its formulation, combinations, and use in multiple indications. Ocuphire also owns an exclusive worldwide sublicense for the Ref-1 Inhibitor program, including its lead product candidate

APX3330, for all its ophthalmic and diabetic indications, and compositions and methods of use for Ref-1 pipeline candidates, including APX2009 and APX2014. Ocuphire continues to explore additional opportunities to expand and extend this

intellectual property protection, both in the U.S. and in other jurisdictions.

|

|

|

• |

Maximize the global commercial value of Nyxol and APX3330. Ocuphire plans to

seek commercial partners both in and outside of the United States. Alternatively, Ocuphire believes it could independently commercialize Nyxol and/or APX3330 in the United States with a targeted sales force.

|

|

|

• |

Evaluate in-licensing and acquisition opportunities. Ocuphire’s team is well

qualified to identify and in-license or acquire clinical-stage ophthalmological assets and is evaluating opportunities to expand and diversify its pipeline.

|

Ocuphire is developing Nyxol and APX3330 for multiple indications. Ocuphire believes the two programs present similar potential advantages: (1) promising clinical data to date; (2) both

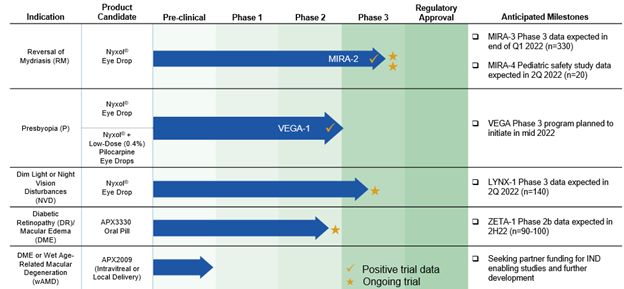

small-molecule clinical candidates; (3) convenient dosing route and schedule; (4) potential for first-line or adjunctive therapy; and (5) significant commercial potential. TABLE 1 below summarizes

Ocuphire’s current development pipeline of product candidates and their target indications and anticipated milestones for 2022:

TABLE 1. Ocuphire Pipeline: Product Candidates and Indications Pipeline

Note: 0.75% POS (Phentolamine Ophthalmic Solution) is the same as 1% PMOS (Phentolamine Mesylate Ophthalmic Solution). References to Nyxol with both

designations appear throughout this document, there is no difference in formulation between the two designations.

Based on the safety and efficacy data generated to date, as well as data expected from the MIRA-3 and MIRA-4 trials, Ocuphire

anticipates submitting its first NDA to the FDA for Nyxol for RM in late 2022 utilizing the 505(b)(2) pathway of the U.S. Federal Food, Drug, and Cosmetic Act (“FDCA”), which the FDA indicated would be acceptable for the Nyxol application. In

addition, Ocuphire anticipates filing NDAs for presbyopia and NVD and advancing APX3330 towards an NDA in the future. Ocuphire further anticipates that in the longer term, it will also submit marketing applications with regulators in other global

markets, initially considering the European Medicines Agency (“EMA”) and Japan’s Pharmaceuticals and Medical Devices Agency, and potentially other markets such as China.

In February 2018, Ocuphire was founded by Mina Sooch and subsequently merged in April 2018 with Ocularis Pharma, LLC, founded by Gerald Horn MD (the original innovator of phentolamine mesylate

ophthalmic solution to treat NVD), Alan R. Meyer, William Pitlick PhD, and Keith Terry. Many of Ocuphire’s employees, directors, advisors and consultants have been involved in the development of Nyxol and other ophthalmic drugs including approved

products such as LUMIFY®, Zirgan®, Durezol®, Upneeq®, Rhopressa®, Roclatan®, Vyzulta®, Xiidra®, Cequa®, and Dextenza®. The management team, led by CEO Mina

Sooch, collectively has significant experience in operating pharmaceutical companies and discovering, developing, and commercializing treatments in multiple therapeutic areas. Ocuphire also has a world-class medical advisory board of over 15 key

opinion leaders including retina specialists, refractive surgeons, and optometrists.

Overview of Eye Disease Market

Anterior (Front of the Eye) Segment Disease Market

There are approximately 100 million dilations in the United States and this number is expected to go up with the increasing aging

and diabetic population that requires more frequent eye exams and procedures. Millions of Americans also suffer from various refractive errors. Presbyopia, one such refractive error, is common in patients over the age of 40 years which results

in decreased ability to see objects at a near distance. This condition affects over 120 million Americans and usually requires reading glasses and/or contact lenses for focusing on near objects. Further according to GlobalData, approximately 38

million patients in the U.S suffer from dim light or night vision disturbances caused by LASIK, night myopia, keratoconus, eye surgery, or natural aging process. There is also a global trend in vision disturbances in younger individuals due to

the overuse of smartphones. Ocuphire’s lead product candidate, Nyxol, is currently in late-stage clinical development for reversal of mydriasis (dilation), presbyopia and night vision disturbances, and has the potential to address an unmet need

for millions of patients in the US.

Retinal (Back of the Eye) Disease Market

Retinal damage is one of the leading causes of blindness and continues to grow with aging and larger diabetic populations around

the world. Diabetes is the leading cause of blindness among adults aged 20 – 74. According to the National Eye Institute, in the United States alone, over 7 million patients suffer from diabetic retinopathy (DR), a complication of diabetes in

which chronically elevated blood sugar levels cause damage to blood vessels in the retina. An additional 750,000 patients suffer from diabetic macular edema (DME), one of the most common complications of diabetic retinopathy where the macula

swells from fluid leaked from damaged blood vessels. The disease progression of both DR and DME involves abnormal vessel proliferation via VEGF signaling and inflammation. Ocuphire’s APX3330 oral tablet is currently in a Phase 2 clinical trial

for DR and has the potential to address this large DR and DME market with a novel, dual mechanism of action of inhibiting VEGF and inflammation. In addition, over 1 million patients in the United States suffer from wAMD. These retinal and

choroidal vascular diseases, which cause damage to the macula, are leading causes of severe, permanent vision loss. Currently, there are several drugs on the market indicated for anti-VEGF therapy, including Lucentis® (ranibizumab), a

monoclonal antibody marketed by Genentech, and EYLEA® (aflibercept), a recombinant fusion protein marketed by Regeneron Pharmaceuticals, Inc., that have become the standard of care for treating severe forms of DME and wAMD amongst

other retinal conditions. Avastin® (bevacizumab), a monoclonal antibody marketed by Genentech, is also used off-label to treat these same indications as it is more cost-effective than the other branded drugs. These three injectable

drugs are biologics with treatment administered in an ophthalmologist’s office. Annual worldwide sales of Lucentis and EYLEA for all indications totaled over $13 billion in 2020 ($3.5 billion for Lucentis and over $10 billion for EYLEA).

Summary of Ocuphire’s Product Candidates

Nyxol (phentolamine 0.75% ophthalmic solution)

Nyxol is a once-daily, sterile, preservative-free eye drop formulation containing phentolamine mesylate, a reversible, non-selective alpha-1 and alpha-2 adrenergic antagonist that acts on the

adrenergic nervous system and inhibits contraction of smooth muscle. Phentolamine mesylate, the drug substance and active component of Nyxol, is the active pharmaceutical ingredient (API) in two FDA-approved drugs, Regitine® and OraVerse®. Regitine, an injectable approved in 1952, is used mainly to treat pre-

or intra-operative hypertensive episodes in patients with pheochromocytoma. OraVerse, approved in 2007, is an intraoral submucosal injection used to reverse anesthesia after oral surgery. The FDA has stated that it would be acceptable for the

Nyxol application to reference the FDA’s previous review of safety and efficacy for Regitine® (Phentolamine Mesylate Injection, NDA 008278) and Oraverse® (Phentolamine Mesylate Injection, NDA 22159), pursuant to section 505(b)(2) of the U.S. Federal Food, Drug, and Cosmetic Act (“FDCA”). In multiple clinical trials,

Nyxol has shown to reduce pupil size, improve near and distance visual acuity in light and dark conditions, and improve low contrast visual acuity. Ocuphire is pursuing multiple indications for Nyxol, including RM, presbyopia, and NVD. For

treatment of presbyopia, Ocuphire is evaluating the efficacy of Nyxol both as a single-agent eye drop and as a combination with LDP.

Key attributes of Ocuphire’s product candidate Nyxol include the following:

|

|

• |

Reduction in pupil diameter with durable effects. In multiple Phase 2 and Phase

3 trials Nyxol reduced pupil diameter by approximately ~1 – 1.5 mm in both mesopic (dim) and photopic (bright) conditions, with such reductions sustained over 24 hours. Nyxol with LDP as adjunctive eye drop provides an optimal pupil

size of 2 mm – 3 mm.

|

|

|

• |

Improvement in distance corrected near visual acuity. When studied in patients

with presbyopia in Phase 2 trials, Nyxol alone and in combination with LDP showed statistically significant improvement in distance-corrected near visual acuity with ≥3 lines gain from baseline.

|

|

|

• |

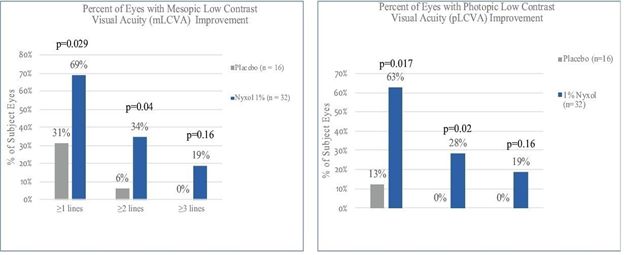

Improvement in low contrast visual acuity. When studied in patients with NVD in

multiple Phase 2 trials, Nyxol showed statistically significant improvement in low contrast mesopic best-corrected distance visual acuity at ≥1 and ≥2 lines, with a trend at ≥3 lines on a standard visual chart.

|

|

|

• |

Favorable tolerability profile. To date, Nyxol has been observed to be

well-tolerated, with unchanged or decreased intraocular pressure in the nine completed Phase 1, Phase 2 and Phase 3 clinical trials conducted. Nyxol produces a transient, mild hyperemia effect that disappears within several hours or

immediately upon application of anti-redness eye drops. Nyxol is also observed to have no systemic effects such as changes in blood pressure or heart rate.

|

|

|

• |

Designed

to be a convenient, once-daily eye drop or tunable combination option. Nyxol is being evaluated for chronic use as a once-daily administration before bedtime. Nyxol has been shown in multiple Phase 2 trials and a Phase 3 trial

to have a durable effect of over 24 hours, which could encourage patient compliance. Use of LDP eye drops as an adjunct to Nyxol may offer the benefit of tunability to presbyopia patients based on their vision and lifestyle needs.

|

|

|

• |

Stable, cost-effective ophthalmic formulation. Nyxol is a single-use, preservative-free, proprietary eye drop formulation with stability suitable to support potential commercialization. Its active pharmaceutical ingredient, phentolamine mesylate USP

grade, is a small molecule with advantages of standardized, scalable, and lower-cost manufacturing processes.

|

Ocuphire is initially pursuing Nyxol for the following three indications as a first-line therapy (in the case of presbyopia, both as a single agent and with low-dose pilocarpine as an adjunctive drop):

|

|

• |

RM, the reversal of pharmacologically induced dilation of the pupils, where

dilation leads to increased sensitivity to light and an inability to focus, making it difficult to read, work, and drive. RM is a single-use indication for which no approved therapy is commercially available at present.

|

|

|

• |

Presbyopia,

a condition in which the eye’s lens loses elasticity, affecting its ability to focus on near objects. Presbyopia typically occurs after age 40 and most patients use reading glasses in order to read or see objects close to them. VuityTM,

approved in October 2021 and launched in December 2021, is the only eye drop currently marketed for the treatment of presbyopia.

|

|

|

• |

NVD, a condition in which peripheral imperfections (aberrations) of the cornea

scatter light when the pupil opens wide in dim light. Patients with NVD experience glare, halos, starbursts, and decreased contrast sensitivity. NVD is a new indication with no approved therapies.

|

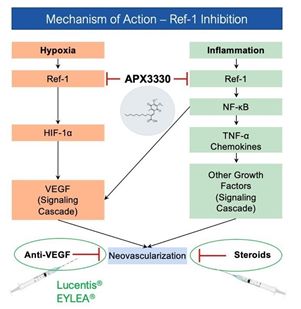

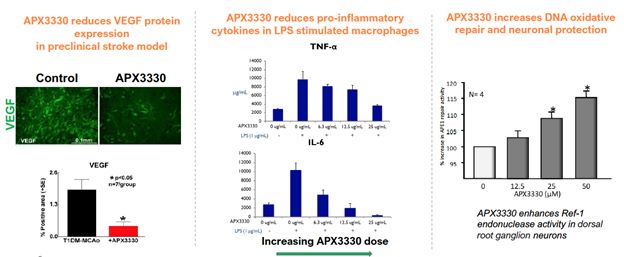

APX3330

APX3330 (E3330), originally developed by Eisai Co., Ltd. and Apexian Pharmaceuticals, Inc., is a small molecule that specifically targets Apurinic/Apyrimidinic Endonuclease 1/Redox Factor-1

(APE-1/Ref-1, referred to as Ref-1), a dual function protein involved in the regulation of transcription factors critical to cell signaling. Ref-1 regulates inflammation, angiogenesis (blood vessel formation), and reduction-oxidation (redox)

signaling, as well as DNA repair that is critical to normal function of neurons. By inhibiting redox activity and not DNA repair, APX3330 has been shown in preclinical studies to reduce angiogenesis and inflammation via modulation of several

important proangiogenic and proinflammatory transcription factors such as NF-κB and HIF-1a and its downstream target, VEGF (Vascular Endothelial Growth Factor). These transcription factors are implicated in multiple pathways relevant to the

pathophysiology of retinal and choroidal vascular diseases, including diabetic retinopathy (DR), diabetic macular edema (DME), and wet age-related macular degeneration (wAMD). Moreover, data from these preclinical studies suggest that APX3330 is

a promising candidate for clinical evaluation of the efficacy and safety of an oral systemic therapy to treat these important diseases.

Key attributes of Ocuphire’s product candidate APX3330 include the following:

|

|

• |

Potential to be the first oral therapy. Compared to frequent intravitreal

anti-VEGF injections, associated with ocular complications, once or twice a day oral administration of APX3330 could be a convenient alternative treatment for retinal disease, if approved.

|

|

|

• |

Upstream target implicated in two validated pathways. APX3330 is designed to

lead to inhibition of two validated cell signaling pathways (angiogenesis and inflammation) known to cause various retinal diseases. Moreover, the APX3330 mechanism of action is distinct in working upstream of the current anti-VEGF

therapies, suggesting that it could complement anti-VEGF therapies and potentially reduce frequency of doctor visits and intravitreal injections.

|

|

|

• |

Favorable tolerability profile. In 11 completed Phase 1 and Phase 2 clinical

trials, APX3330 was well-tolerated with no significant acute neurologic, cardiovascular, hepatic, or pulmonary events.

|

|

|

• |

Potential

benefit of systemic administration. As a systemic agent, APX3330 can be expected to treat bilateral (both eyes) retinal vascular disease.

|

|

|

• |

Stable,

cost-effective oral tablet. APX3330 is formulated as an oral tablet with favorable stability characteristics, and its active pharmaceutical ingredient is a small molecule with the advantages of standardized, scalable, and

lower-cost manufacturing processes.

|

Ocuphire is initially pursuing APX3330 for the following indications as a first-line or adjunctive therapy:

|

|

• |

DR, the leading cause of vision loss in adults aged 20–74 years, which results

from chronic elevations of glucose in the blood that leads to cell damage in the retina.

|

|

|

• |

DME, one of the most common complications of DR, in which vascular leakage

causes swelling of the retinal macula and a loss of visual acuity.

|

|

|

• |

wAMD, a chronic eye disorder that causes visual distortions in the central part

of one’s vision, in which abnormal blood vessels leak fluid or blood into the macula, the part of the eye that is critical for central and color vision.

|

Ocuphire’s Target Indications

RM (Nyxol)

Mydriasis Overview

Every year in the U.S., over 100 million eye exams or procedures are performed that require dilation of the pupil (mydriasis) to examine the back of the eye either for routine check-ups, disease

monitoring or surgical procedures. The mydriasis is achieved either by stimulating the iris dilator muscle with the use of alpha agonists (e.g., phenylephrine), or by blocking the iris sphincter muscle with the use of muscarinic antagonists

(e.g., tropicamide) or a combination of both mydriatic agents. Typically, pharmacologically induced mydriasis dilates the pupil to 7 mm to 8 mm, a size suitable for ophthalmic examination of the retina and other structures of the interior of the

eye. Such pharmacologically induced mydriasis can last from a few hours (typically 6 hours) up to 24 hours, depending on the pigmentation of the iris, one’s age, and other factors. Side effects of mydriasis include sensitivity to light and

blurred vision, which make it difficult to read, work, or drive. Many dilating drops also cause cycloplegia, the temporary paralysis of the muscle which allows the eye to focus on near objects. For this reason, many patients may request to avoid

dilation, thus limiting the eye care provider’s ability to conduct a comprehensive annual eye exam.

Limitations of Existing Treatments for Reversal of Mydriasis

There is no approved product presently on the market for reversal of mydriasis and Ocuphire is not aware of any others in development. In 1990, the

FDA approved the selective alpha-1 antagonist dapiprazole, marketed as Rev-Eyes®, to reverse mydriasis induced by adrenergic or anticholinergic agents. Rev-Eyes

was eventually withdrawn from the market for reasons unrelated to safety or efficacy, according to the FDA.

Nyxol Opportunity in RM

Nyxol has been shown in clinical studies to expedite the reversal of mydriasis compared to the eye’s natural process. According to GlobalData market research, over 65% of patients report a

moderate to severe negative impact of a dilated exam, underscoring the potential value of Nyxol’s role in improving comfort and daily function after pupil dilation. Additionally, an estimated 45% of patients responded that they would be very

likely to request a dilation reversal drop, and more than 40% of eye care providers would be likely to use a reversal drop if such a treatment were commercially available. Ocuphire believes that many people who undergo pupil dilation would

benefit from a reversal treatment that has the potential to get patients back to their normal routines faster and avoid the subjective discomfort of dilation. Ocuphire also believes that if providers can offer a reversal drop there could

potentially be more compliance with annual dilated eye exams.

Presbyopia (Nyxol)

Presbyopia Overview

Presbyopia is an age-related condition with onset most common in people over 40 years old. As the eye ages, the lens becomes stiffer, which limits the eye’s ability to adjust its focus for

reading or for other tasks that require clear vision at near distances. Presbyopia patients experience blurred near vision, difficulty seeing in dim light, and eye strain. In young healthy eyes, lenses are able to focus light from objects at

different distances by a process called accommodation. During accommodation, muscles surrounding the lens contract, causing the lens to change shape and increasing the focusing power of the eye. This allows dynamic, clear vision at both near and

far distances. With increasing age, the lens becomes stiffer as the structural crystallin proteins become misfolded. This increased lens stiffness limits the eye’s ability to adjust its focus for reading or for other tasks that require clear

vision at near distances. Because of the ubiquity of the condition, presbyopia represents a large market both in the United States and abroad totaling over 2 billion presbyopia patients. It is estimated that 120 million Americans have presbyopia,

and this number is expected to grow as the population above the age of 45 increases.

Existing Treatments for Presbyopia

The U.S FDA approved VuityTM (1.25% pilocarpine) eye drop for the treatment of presbyopia in October 2021. Vuity

was launched in December 2021 and is marketed by Allergan, an AbbVie company. Additional available treatments for presbyopia include reading glasses, bifocals, gradients, bifocal contact lenses, and multifocal intraocular lenses. Reading glasses

can be inconvenient and must be taken off and put on frequently throughout the day to see objects at far and near distances, respectively. Many patients express frustration with losing or forgetting their glasses. Additionally, some patients find

glasses unflattering. Contact lenses for presbyopia also have drawbacks. They can only be used monocularly, where one eye is fitted with a presbyopic lens while the other is used for distance vision, which often leads to eye strain and other

negative side effects.

A small portion of patients elect surgical intervention, including laser treatment to achieve monovision and insertion of KAMRA Inlays, a plastic implant into the cornea of the non-dominant eye

to increase its depth of field. The risks of such interventions are those associated with all ocular surgeries, such as a potential decrease in contrast sensitivity and the creation or worsening of NVD.

Nyxol Opportunity in Presbyopia

Pupil diameter management is a promising strategy for the pharmacological treatment of presbyopia. Recent research suggests that

an optimal pupil size of 2 mm to 3 mm diameter will lead to significant improvement in presbyopia symptoms by increasing depth of focus without compromising distance vision in photopic or mesopic lighting conditions. Ocuphire is evaluating

Nyxol as both a single-agent eye drop and with LDP as an adjunctive eye drop to achieve optimal pupil size and improve near vision. Nyxol has shown in several Phase 2 trials the ability to reduce pupil diameter size by 1-1.5 mm alone and by

2-2.5 mm when Nyxol is used with LDP. Nyxol alone provides durable near vision efficacy gain of up to 18 hours, and the Nyxol + LDP combination allows additional efficacy gains of up to least 6 hours.

With respect to the treatment of presbyopia, Ocuphire believes that tolerability, convenience, and preservation of distance vision

quality are of the utmost importance. Presbyopia is considered a “benign” condition, in that there is no risk of death or complete vision loss. Thus, any therapies without robust tolerability will not be suitable alternatives to reading glasses

or contact lenses. Nyxol is being developed to be applied once daily before bed, with potential resolution of any mild transient hyperemia by morning. According to GlobalData market research, 69% of patients would consider an eye drop

alternative. Ocuphire believes that many presbyopes who are unsatisfied with their reading glasses or monocular contact lenses, and who would prefer a less invasive alternative than surgical intervention, would find Nyxol single-agent eye drop

or the Nyxol + LDP drops a promising option, if approved.

NVD (Nyxol)

NVD Overview

Vision at night or in dim light conditions is different from daytime vision in several important ways. Most notably, at night, the pupils dilate to allow more light into the eye. Diminished night

vision is a natural part of aging as well as a common side effect of several conditions and procedures. NVD is caused by peripheral imperfections (aberrations) of the cornea which scatter light when the pupil dilates in dim light conditions.

These imperfections can be naturally occurring, especially with age, or surgically induced from refractive procedures such as LASIK. As the pupil dilates in response to mesopic conditions, light passes through the periphery of the cornea and

lens, unlike during photopic conditions. Any imperfections or aberrations present on the periphery cause light to reach the retina in a non-focused and scattered way, creating glare, halos, starbursts, ghosting, and a loss of contrast sensitivity

(“CS”). These visual disturbances can be debilitating to a variety of everyday activities, especially driving. The light emitted by traffic lights and other cars scatters and obscures most of the visual field, making driving in dim light

conditions hazardous. Glare, in particular, can be dangerous while driving. In one study of 297 drivers given vision tests that correlate with accidents, 45% of the drivers who reported difficulty driving at night were unable to perform any of

the tests with glare.

The effects of NVD can be reduced or eliminated by reducing the pupil size to a smaller diameter that prevents the scattering effect without impeding the ability to see at night. NVD can occur

naturally (night myopia) and is commonly caused by ocular surgery (“LASIK”). One significant cause of night myopia is keratoconus, an orphan disease that starts at a young age with progressive thinning of the cornea usually due to genetic and

environmental causes. Ocuphire estimates there are about 38 million individuals in the US that suffer from NVD, with an estimated 16 million having moderate-to-severe NVD that may be directly addressable with a pupil management approach. Market

research conducted by GlobalData of patients who self-report NVD showed 25% completely avoid driving at night. Furthermore, 67% who report moderate or severe NVD would be willing to try an eye drop treatment option. These patients can be

segmented by the origins of their vision disturbance. Approximately 44% of NVD are the result of night myopia, followed by approximately 30% from cortical cataracts, 15% from post-intraocular lens (“IOL”) implants, and 10% following LASIK

surgery. These conditions span an age range of late teenagers to those 80 years and older.

Limitations of Existing Treatments for NVD

The biggest challenge for the treatment of NVD is the lack of safe, tolerable, convenient, and effective treatments. Despite a large number of addressable patients with moderate-to-severe NVD,

there is no FDA-approved treatment on the market for NVD. Some commonly used tools such as tinted glasses are not effective, and in fact, may worsen patients’ vision at night. Off-label use of approved miotic agents, such as regular-strength

pilocarpine, are unsuitable for the treatment of NVD because they reduce pupil size to a degree that may impede safe night vision and may cause loss of accommodation.

Nyxol Opportunity in NVD

Ocuphire believes it may have a new NVD treatment option that could improve patients’ ability to see in dim lighting and significantly improve their quality of life. Nyxol is currently the only

product candidate in development for NVD and could become the first pharmacological treatment option if approved. In addition to a potential first-mover advantage, Nyxol is being developed to be administered via convenient, once-daily dosing

before bedtime and has been shown in multiple Phase 2 clinical trials to improve low contrast visual acuity in mesopic (dim) conditions on the standard visual chart. Nyxol has also been shown to be well-tolerated in these trials.

Diabetic Retinopathy (APX3330)

Diabetic Retinopathy Overview

Diabetic Retinopathy (“DR”) is an eye disease resulting from diabetes, affecting over 7 million patients in the U.S., in which chronically elevated blood sugar levels cause damage to blood

vessels in the retina. It is the leading cause of vision loss in adults aged 20–74 years. There are two major types of DR:

|

|

• |

Non-proliferative DR, or NPDR. NPDR is an earlier, more typical stage of DR and can progress into

more severe forms of DR over time if untreated and if exposure to elevated blood sugar levels persists.

|

|

|

• |

Proliferative DR, or PDR. PDR is a more advanced stage of DR than NPDR. It is characterized by

retinal neovascularization and, if left untreated, leads to permanent damage and blindness.

|

Therapies for NPDR and PDR are distinct. For NPDR, treatment is usually directed at observation, lifestyle changes, and control of elevated blood sugars that led to progression of NPDR in the

first place. On the other hand, PDR has historically been treated with laser therapy but, more recently, use of anti-VEGF therapies has emerged as a complementary first-line treatment for PDR. In the Protocol S trial by the Diabetic Retinopathy

Clinical Research Network, Lucentis was found to be noninferior to laser therapy in patients with PDR. Moreover, in 2018, from Regeneron’s PANORAMA trial, EYLEA®

reversed disease progression in patients with moderately severe to severe NPDR.

Diabetic Macular Edema (APX3330)

Diabetic Macular Edema Overview

Diabetic Macular Edema (“DME”) is a common complication of DR where the macula swells with fluid leaked from damaged blood vessels as a result of worsening diabetic retinopathy. It is one of the

most common reasons for blindness in diabetics, affecting approximately 750,000 patients. DME may cause blurriness in the center of vision, the appearance of straight lines as wavy, colors that look dull or washed out, or blind spots. The

pathogenesis of DME involves vascular leakage, retinal ischemia, and release of vaso-proliferative growth factors and inflammatory mediators.

In DME, corticosteroids and anti-VEGF agents are used to treat vascular leakage, inflammation and hypoxia/angiogenesis. In patients whose disease has progressed to DR with DME, anti-VEGF agents

are first line therapy followed by corticosteroids. Lucentis was approved for treatment of DME with a dosing regimen of a 0.3 mg injection approximately every four weeks. Similarly, EYLEA® was approved with a dosing regimen of a 2.0 mg injection approximately every four weeks.

Limitations of Existing Treatments for DR and DME

In DR (especially NPDR), despite the approvals of anti-VEGF therapeutics in recent years, the use of injectables is not adopted in practice as preferred treatment as the disease is asymptomatic

and patients are reluctant to undergo injections or laser therapy.

In DME and late-stage DR, intravitreal VEGF inhibitors are approved globally, however these therapies rarely provide a complete solution to the underlying vascular problem associated with DR and

DME. Although these therapeutic agents have been successful for some patients, significant proportions of patients are resistant and refractory. Moreover, serious side effects including hemorrhage and intraocular infections are possible with

intravitreal injections. Both Lucentis and EYLEA are also associated with increased risks of blood clots in the arteries. In addition, intravitreal injections require frequent visits to the ophthalmologist, usually on the order of every 4 weeks

with a few anti-VEGF therapies in development that are working on increasing the time between injections (8 – 12 weeks).

APX3330 Opportunity in DR and DME

Anti-VEGF therapies block the activity of VEGF, but in chronic diseases such as DR and DME, an agent that prevents the production of VEGF poses a large opportunity to improve patient outcomes.

Moreover, recent reports in scientific literature demonstrate that diabetic eye disease has an inflammatory component, unrelated to VEGF’s actions. Because inflammation and hypoxic signaling (VEGF production) play crucial roles in both vascular

leakage and neovascularization of DR and DME, treatments that impinge upon both pro-inflammatory and hypoxic signaling offer a promising therapeutic strategy. APX3330’s target of Ref-1 may leverage this dual mechanism to reduce the production and

hence the quantity of VEGF and prevent inflammatory damage. This potentially allows for improved response to treatment and may extend the duration between invasive treatments for late-stage retinal diseases (DME, wAMD). Moreover, as a potential

first-in-class, orally administered product candidate twice a day, it has the potential to be a more convenient option at an earlier stage of disease especially for DR than intravitreal anti-VEGF injections, which are burdensome to patients and

have a significant side effect profile including cataract formation, increased intraocular pressure, intraocular infections, and retinal detachments. APX3330 was well-tolerated and demonstrated a favorable safety profile in completed clinical

trials of healthy volunteers and patients with hepatitis or cancer. The safety data from the ongoing masked ZETA-1 trial in diabetic patients is consistent with data from the prior eleven clinical trials.

Other Indications: wAMD (APX3330)

Age-Related Macular Degeneration (“AMD”) is a common eye condition affecting 11 million individuals in the U.S. and 196 million globally, mostly over the age of 55 years. It is a progressive

disease affecting the central portion of the retina, known as the macula, which is the region of the eye responsible for sharpness, central vision and color perception. wAMD is an advanced form of AMD characterized by neovascularization and fluid

leakage under the retina. It is the leading cause of severe vision loss in patients over the age of 50 in the United States and EU. While wAMD represents only 10% of the number of cases of AMD overall, it is responsible for 90% of AMD-related

severe vision loss. Untreated or undertreated wAMD results in further blood vessel leakage, fluid in the macula, and ultimately scar tissue formation, which can lead to permanent vision loss or even blindness as a result of the scarring and

retinal deformation that occur during periods of non-treatment or undertreatment. Similar to severe DR and DME, current therapy for wAMD consists of intravitreal injections, mainly of Lucentis and EYLEA. The limitations of these therapies are

described in the section above titled, “Limitations of Existing Treatment for DR and DME”. Based on APX3330 targeting Ref-1 and reduction of VEGF production, it has potential use in wAMD. Further, to enter the wAMD injectable market, Ocuphire is

considering the utility of an intravitreal formulation of APX2009, a second-generation product candidate analog of APX3330. APX2009 data suggest improved efficacy against the Ref-1 target compared to APX3330 (as published in the Journal of

Pharmacology and Experimental Therapeutics).

Ocuphire’s Product Candidates

Nyxol Mechanism of Action

Ocuphire’s lead product candidate, Nyxol, is a once-daily sterile eye drop formulation of phentolamine mesylate designed to reduce pupil diameter and improve visual acuity. The active

pharmaceutical ingredient of Nyxol, phentolamine mesylate, is a non-selective alpha-1 and alpha-2 adrenergic antagonist that inhibits activation of the smooth muscle of the iris, reducing pupil diameter. Nyxol shares many of the attributes of

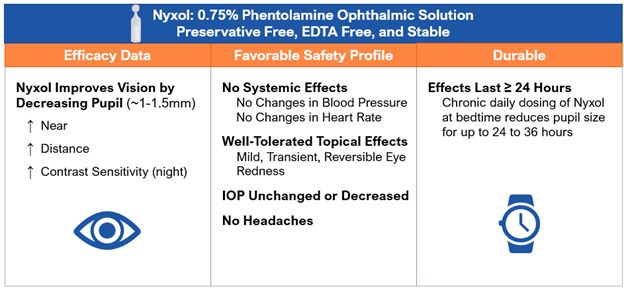

existing ophthalmic eye drops, including a convenient route of administration and cost-effective manufacturing process, with the potential advantage of once-daily dosing (FIGURE 1).

FIGURE 1. Nyxol Product Candidate Profile

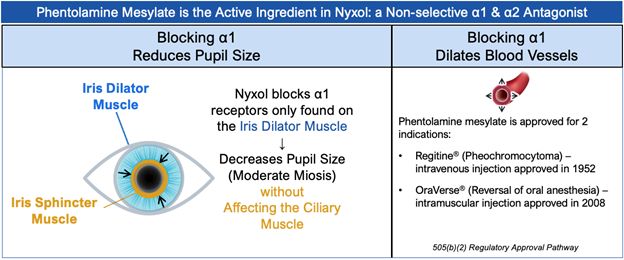

Phentolamine is a nonselective alpha-1 & alpha-2 adrenergic antagonist. Dilation of the pupil is controlled by the radial iris dilator muscles surrounding the pupil which are activated by the

alpha-1 receptors of the adrenergic nervous system. Alpha-1 antagonists bind to the receptors to inhibit the pupillary response and reduce dilation (FIGURE 2). Phentolamine mesylate is the active

ingredient in two injectable FDA-approved drugs, Regitine and OraVerse, as described previously.

For the RM indication, pharmacologically induced mydriasis is achieved either by stimulating the iris dilator muscle with the use of alpha agonists (e.g., phenylephrine), or by blocking the iris

sphincter muscle with the use of muscarinic antagonists (e.g., tropicamide). Nyxol, either by directly antagonizing the alpha-1 agonist or by indirectly antagonizing the pupil dilation effect of muscarinic blocking, may expedite the reversal of

mydriasis prior to natural reversal.

For presbyopic patients, to overcome the lens’ inability to change shape (accommodation) and focus light from near objects, pupil diameter reduction to a small size will allow light to come in

the eye only in a near straight direction and increase the depth of focus (the “pinhole effect”). Ocuphire believes that it is possible to reach a target 2 mm to 3 mm optimal pupil diameter by relaxing the dilator iris muscle with Nyxol and

contracting the iris sphincter muscle with a muscarinic agonist such as a low dose pilocarpine. This could result in an optimal depth of focus and near vision clarity without the assistance of lenticular accommodation.

Lastly, for the NVD indication, it is proposed that a moderate miotic effect by application of Nyxol might mitigate night vision difficulties, a large portion of which are caused by imperfections

or aberrations present on the periphery of the cornea. Therefore, the effects of these imperfections can be reduced or eliminated by reducing the pupil size to a smaller diameter, knowing that a smaller pupil blocks what would be unfocused,

aberrant rays of light on the retina.

FIGURE 2. Nyxol’s Mechanism of Action

Nyxol Clinical Experience Summary

Nyxol has been assessed in nine investigator-initiated and sponsored Phase 1, Phase 2 and Phase 3 clinical trials. Across all trials, over 330 adult patients have been exposed to at least one

dose of phentolamine ophthalmic solution. All Phase 2 and Phase 3 trials have been accepted for poster or oral presentation at the annual American Academy of Ophthalmology (AAO), Association for Research in Vision and Ophthalmology (ARVO), or

American Society of Cataract and Refractive Surgery (ASCRS) meetings.

Ocuphire believes that results from Nyxol’s Phase 1, Phase 2 and Phase 3 trials support its current development plan focused on RM, presbyopia and NVD patients. Specifically, patients treated

with Nyxol were observed to have statistically significant decreases in pupil diameter and improved visual acuity. Nyxol has shown consistent ability to decrease pupil diameter at the selected dose of 0.75% POS by approximately 20-25% (~1 – 1.5

mm) in both mesopic and photopic conditions.

A summary of Ocuphire’s completed clinical trials is shown below (TABLE 2). Note that Nyxol in its current proprietary formulation of phentolamine mesylate ophthalmic solution was first introduced in the NYX-01a2 trial, and prior to that, a formulation of phentolamine mesylate in artificial

tears solution was used.

TABLE 2. Summary of Completed and Ongoing Clinical Trials with Nyxol

|

Trial

Name

(IND

Number)

|

|

Patient /

Indication

|

Phase

|

Trial Objectives

|

|

Doses

|

Number of

Patients^

|

Dosing

|

Key

Endpoints

|

|||||

|

NYX-001

(67-288)

|

|

Healthy Volunteers

|

1

|

Double-masked, randomized, single dose, 3-arm controlled, parallel trial to determine the efficacy and safety of phentolamine mesylate

|

0.2%

PMOS

|

Nyxol*=15, Visine=15,

Visine + Nyxol*=15

Total = 45

|

Single-dose

|

Safety and Efficacy (PD)

|

||||||

|

NYX-002^

(67-288)

|

|

Healthy Volunteers

|

1

|

Double-masked, randomized, placebo-controlled, single-dose, incomplete block, 3-period crossover, dose escalation trial evaluating the tolerability and efficacy of

phentolamine mesylate

|

|

0.2%, 0.4%, 0.8%

PMOS

|

Nyxol*=16 Placebo=12

Total = 16

|

Single-dose

|

Safety and Efficacy (PD, VA)

|

|

OP-NYX-004^

(73-987)

|

|

Night Vision Disturbances Patients

|

1 / 2

|

Double-masked, randomized, placebo-controlled, single-dose, incomplete block 3-period crossover, dose escalation trial to determine the efficacy and safety of

phentolamine mesylate

|

|

0.2%, 0.4%, 0.8%

PMOS

|

Nyxol*=16 Placebo=12

Total = 16

|

Single-dose

|

Safety and Efficacy

|

|||||

|

OP-NYX-SNV

(70-736)

|

|

Severe Night Vision Disturbances Patients

|

2

|

Double-masked, randomized, placebo-controlled, single-dose trial to assess the efficacy and safety of phentolamine mesylate ophthalmic solution

|

|

1.0%

PMOS

|

Nyxol*=16, Placebo=8

Total = 24

|

Single-dose

|

Safety and Efficacy (PD, LCVA, CS, WA)

|

|||||

|

OP-NYX-01a2

(70-499)

|

|

Severe Night Vision Disturbances Patients

|

2

|

Double-masked, randomized, placebo-controlled, single-dose, 3-arm trial to assess the efficacy and safety of Nyxol

|

0.5%, 1.0%

PMOS

|

Nyxol=40 Placebo=20

Total = 60

|

Multiple doses (15-28 days)

|

Safety and Efficacy (PD, LCVA, CS)

|

||||||

|

OPI-NYXG-201

(ORION-1)

(70-499)

|

|

Glaucoma and Ocular Hypertension, Elderly Patients

|

2b

|

Double-masked, randomized, placebo-controlled, multiple-dose, multi-center trial to assess the efficacy and safety of Nyxol

|

|

1.0%

PMOS

|

Nyxol=19 Placebo=20

Total = 39

|

Multiple doses (14 days)

|

Safety and Efficacy (IOP, PD, near VA, VA)

|

|||||

|

OPI-

NYXRM-201

(MIRA-1)

(70-499)

|

|

Healthy Patients/ Reversal of Mydriasis

|

2b

|

Double-masked, randomized, placebo-controlled, crossover, single-dose, multi-center trial to assess the efficacy and safety of Nyxol in reducing pharmacologically

induced mydriasis

|

1.0%

PMOS

|

Nyxol=31 Placebo=32

Total = 32

|

Single-dose

|

Safety and Efficacy (PD, Accommodation, VA)

|

||||||

|

OPI-

NYXRM-301

(MIRA-2)

(70-499)

|

|

Healthy Patients/ Reversal of Mydriasis (including 12–17 years-old)

|

3

|

Double-masked, randomized, placebo-controlled, single-dose, multi-center trial to assess the efficacy and safety of Nyxol in reducing pharmacologically induced

mydriasis

|

0.75%

POS

|

Nyxol=94

Placebo=91

Total = 185

|

Single-dose

|

Safety and Efficacy (PD, Accommodation, VA)

|

||||||

|

OPI-NYXRM-302 (MIRA-3)

(70-499)

|

Healthy Patients/ Reversal of Mydriasis (including 12-17-years old)

|

Double-masked, randomized, placebo-controlled, single-dose, multi-center trial to assess the efficacy and safety of Nyxol in reducing pharmacologically induced mydriasis

|

0.75%

POS

|

Pending data

Total = 368

|

Single-dose

|

Safety and Efficacy (PD, Accommodation, VA)

|

|

OPI-NYXRMP-303 (MIRA-4)

(70-499)

|

Healthy Patients/ Reversal of Mydriasis (between ages of 3-and 11)

|

Randomized, Parallel-Arm, Double-Masked, Placebo-Controlled Study of the Safety and Efficacy of Nyxol (0.75% Phentolamine Ophthalmic Solution) to Reverse Pharmacologically Induced

Mydriasis in Healthy Pediatric Subjects

|

0.75%

POS

|

Pending data

Total = 23

|

Single-dose

|

Safety and Efficacy (PD)

|

||||||||

|

OPI-NYXP-201

(VEGA-1)

(70-499)

|

Presbyopia patients (ages of 40 and 64)

|

2

|

Randomized, Placebo-Controlled, Double-Masked Study of the Safety and Efficacy of Nyxol (0.75% Phentolamine Ophthalmic Solution) with Low-Dose (0.4%) Pilocarpine Eye Drops in Subjects with

Presbyopia

|

0.75%

POS

|

Nyxol +LDP

= 44

Placebo alone = 45

Nyxol alone

= 30

Placebo +LDP = 31

|

Multiple doses (up to 4 days), Single dose of LDP

|

Safety and Efficacy (DCNVA, VA, PD)

|

|||||||

|

OPI-NYXDLD-301

(LYNX-1)

(70-499)

|

Night Vision Disturbances in adults

|

Randomized, Placebo-Controlled, Double-Masked Study of the Safety and Efficacy of Nyxol (0.75% Phentolamine Ophthalmic Solution) in Subjects with Dim Light Vision Disturbances

|

0.75%

POS

|

Pending data

Total =145

|

Multiple doses

(14 days)

|

Safety and Efficacy (mLCVA, VA, PD)

|

Note: Nyxol = phentolamine mesylate in proprietary formulation, Nyxol* = phentolamine mesylate in commercial artificial tears solution. ^ Total patient numbers will not equal

to the sum of the subgroups in crossover studies (NYX-002, NYX-004, and NYXRM-201). 0.75% POS (Phentolamine Ophthalmic Solution) is the same as 1% PMOS (Phentolamine Mesylate Ophthalmic Solution). References to

Nyxol with both designations appear throughout this document, there is no difference in formulation between the two designations.

MIRA PROGRAM – Reversal of Mydriasis Indication for Nyxol

Nyxol RM: MIRA-3 Second Phase 3 Trial (Ongoing)

Ocuphire completed enrollment of MIRA-3, a Phase 3, double-masked, randomized, placebo-controlled, multi-center trial in healthy patients, in February 2022. The MIRA-3 trial evaluates the safety and effect of Nyxol

to reverse pharmacologically induced mydriasis. The trial expected to enroll approximately 330 healthy patients, and ultimately enrolled 368 (including 12–17-year-old patients). Eligible patients are administered a mydriatic (phenylephrine,

tropicamide, and a combination thereof) and then given 2 drops of Nyxol approximately 1 hour later after maximum pupil diameter, and then measured at multiple time points from 30 min to 6 hours and 24 hours. The primary endpoint is a

statistically significant improvement in the percent of patients who return to within 0.2 mm of their pupil diameter baseline at 90 minutes, with 60 minutes also being evaluated. Key secondary endpoints are pupil diameter at all other timepoints,

accommodation, glare, and time savings (to return normal baseline). Patient safety is assessed by AE monitoring, conjunctival redness monitoring, visual acuity, IOP, and vital sign assessments (heart rate and blood pressure). In addition, sparse

pharmacokinetics (PK) sampling was performed in this trial. Acute safety exposure for 300 healthy patients followed for 24 hours was also evaluated across the MIRA-2 and MIRA-3 trials. Ocuphire expects to report top-line data for this acute

indication Phase 3 registration trial around the end of first quarter of 2022.

Nyxol RM: MIRA-4 Pediatric Trial (Ongoing)

Ocuphire completed enrollment of MIRA-4, a Phase 3, double-masked, randomized, placebo-controlled trial in healthy pediatric patients

(ages 3-11) in March 2022. The MIRA-4 trial evaluated the safety and effect of Nyxol to reverse pharmacologically induced mydriasis in healthy pediatric patients. The trial was expected to enroll approximately 20 healthy pediatric patients in 2

age groups (3 to 5 years old and 6 to 11 years old), and ultimately enrolled 23 healthy pediatric patients (eleven 3 to 5 years old and twelve 6 to 11 years old). Eligible pediatric patients were administered a mydriatic agent (phenylephrine,

tropicamide, or Paremyd, a combination thereof) and then given 1 drop of Nyxol approximately 1 hour later after maximum pupil diameter, and then measured at multiple time points from 90 minutes to 3 hours and 24 hours. The primary endpoint is

safety and key secondary endpoints are pupil diameter, accommodation, and time savings. Patient safety is assessed by AE monitoring, conjunctival redness monitoring, visual acuity, IOP, and vital sign assessments (heart rate and blood

pressure). Ocuphire expects to report top-line data for this acute indication Phase 3 registration trial in the second quarter of 2022.

Nyxol RM: MIRA-2 First Phase 3 Trial (Completed)

In MIRA-2 (OPI-NYXRM-301), the first of two Phase 3 studies for the reversal of pharmacologically induced mydriasis, 185 patients, including 14 pediatric patients aged 12 to 17 years, were randomized to receive

either Nyxol or placebo 1 hour after receiving one of 3 mydriatic agents (phenylephrine, tropicamide or Paremyd randomized 3:1:1, respectively). Pediatric patients received 1 drop of study drug in each eye, and adult patients received 2 drops of

study drug in study eye and the fellow eye received a single drop of study drug. The primary endpoint was an increase in the percent of study eyes returning to within 0.2 mm of baseline PD at 90 min after Nyxol dosing compared to placebo dosing

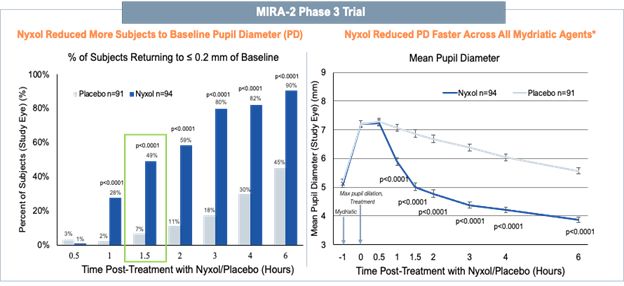

in patients who were pharmacologically dilated. The data from this study were presented at ASCRS 2021 by Dr. Jay Pepose MD. PhD in July 2021, and the presentation was given the Best Paper of the Session award.

The primary endpoint was met in this Phase 3 study. For patients in the mITT Population treated with Nyxol, 49% had PD returned to within 0.2 mm of baseline PD at 90 min compared to only 7% of patients treated with

placebo (p < 0.0001). This benefit was seen as early as 60 min post dose (28% vs 2%; p < 0.0001). Further, Nyxol returned more patients to baseline PD than

placebo at all time points from 1-6 hours (p<0.0001 for each timepoint). Similarly, significant differences in PD between Nyxol and placebo were seen at all time points from 1-6 hours (p<0.0001 for each).

The mean time to return to baseline PD 2 hours in Nyxol-treated study eyes and 6 hours in placebo-treated study eyes. Examination of mean PD by treatment group further support the results of the categorical responder

analysis. Significant benefit of Nyxol was also observed in fellow eyes that received a single drop of Nyxol. For the mITT Population, the reduction in mean PD from the maximum PD observed at 1 hour post-mydriatic dosing was 1.15 mm at 60 min

after Nyxol administration and increased to a mean reduction of 1.95 mm at 90 min. Both of these reductions from the maximum PD were statistically significant (p < 0.0001). See FIGURE 3. Nyxol treatment was efficacious for all 3 mydriatic agents and for patients with either light or dark irides.

FIGURE 3. Study OPI-NYXRM-301 (MIRA-2): Percent of patients returning to ≤0.2 mm of baseline pupil diameter (left panel) and mean pupil diameter (right panel)

Nyxol was well-tolerated with a favorable safety profile. Instillation site discomfort and conjunctival hyperemia were the only adverse events (AEs) that occurred in ≥5% patients treated with Nyxol, and 95% of the

AEs were mild. Visual acuity was not adversely affected. There were no deaths, no systemic AEs, no serious AEs or withdrawals due to AEs.

Nyxol RM: MIRA-1 Phase 2b Trial (Completed)

MIRA-1 (NYXRM-201) was a double-masked, randomized, placebo-controlled, multicenter, cross-over trial of Nyxol compared with vehicle (placebo) ophthalmic solution in normal healthy patients with eyes dilated using a

mydriatic agent (phenylephrine or tropicamide). Thirty-two patients (median age of 27) were randomized in a 1:1 ratio to placebo at Visit 1 followed by Nyxol at Visit 2 or Nyxol at Visit 1 followed by placebo at Visit 2. The study medication was

administered 1 hour after dilation and measurements were taken between 0 and 6 hours. The primary efficacy endpoint was a change in mean pupil diameter (PD) at 2 hours post-treatment. Highlights of this trial were presented at the 2020 annual

meeting of the Association for Research in Vision and Ophthalmology (ARVO) by Dr. Paul Karpecki and were also published in February 2021 in Optometry and Visual Science, the international, peer-reviewed journal of the American Academy of

Optometry.

The primary efficacy endpoint for this trial, the change in mean pupil diameter at 2 hours post-treatment, was met with a statistically significant result (-1.69 mm vs -0.69 mm, p<0.0001, primary efficacy

endpoint). A statistically significant difference favoring Nyxol treatment was also observed at all time points tested from 1 hour through 6 hours in the study eye and non-study eye. This was true for participants dilated with both 2.5%

phenylephrine and 1% tropicamide. A greater percentage of patients receiving Nyxol treatment compared with placebo had study eyes that showed reversal of mydriasis (returning to within 0.2mm of baseline diameter) at 2 hours and 4 hours, with a

trend towards significance at 1 hour. This confirmed the FDA approvable endpoint for the timepoints measured in MIRA-1, which helped inform the Phase 3 trial design for the RM indication. Nyxol also improved accommodation in patients treated with

tropicamide.

When treated with Nyxol, 36% of patients experienced eye disorder TEAEs (all mild cases of conjunctival hyperemia), with no serious TEAEs or TEAEs leading to withdrawal or study medication discontinuation. No other

TEAEs were observed with Nyxol treatment.

VEGA PROGRAM – Presbyopia Indication for Nyxol and Nyxol+LDP

Nyxol Presbyopia: Phase 2 VEGA-1 Trial (Completed)

VEGA-1 (NYXP-201) was a double-masked, randomized, placebo-controlled, multi-center trial of Nyxol and LDP compared with vehicle (placebo) ophthalmic solution in presbyopic patients. A total of 150 patients were

randomized 3:2:2:3 to receive Nyxol + LDP, Nyxol alone, LDP alone, or placebo, respectively. Nyxol or placebo was dosed for 3 or 4 consecutive evenings prior to binocular and monocular testing under photopic and mesopic lighting conditions.

Measurements were made between 0 and 6 hours following administration of Treatment 2 (LDP or No Treatment). The primary efficacy endpoint for this study was the percent of patients who improved by ≥ 15 letters in DCNVA at 90 minutes

post-treatment. The data from this study were presented at ASCRS 2021 by Dr. Jay Pepose, MD, PhD in July 2021.

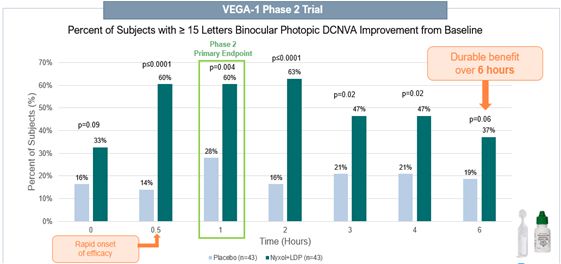

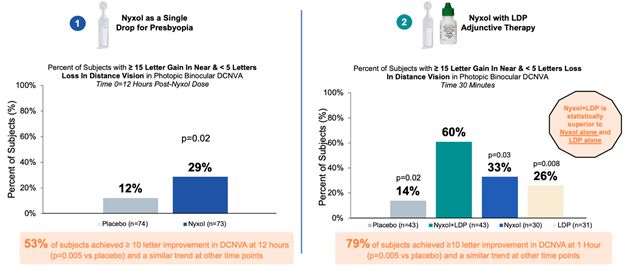

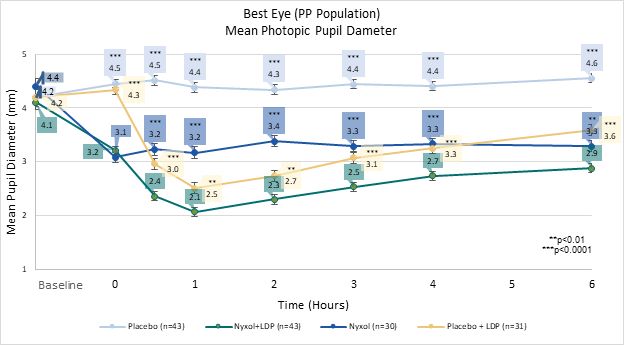

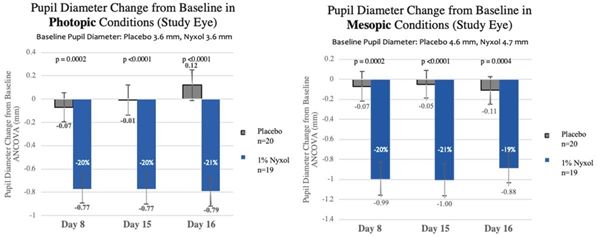

The primary endpoint of an increase in the percent of patients gaining ≥ 15 letters binocular photopic DCNVA at 1 hour in patients

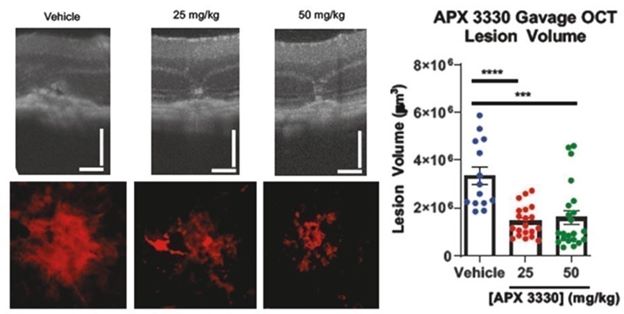

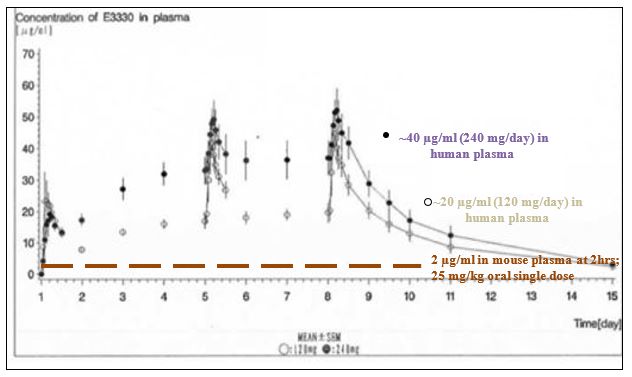

treated with Nyxol + LDP compared to placebo was met. In addition, key prespecified secondary endpoints were met, including the effect of Nyxol monotherapy on DCNVA and PD 12 hours after dosing, near vision gains at multiple time points and PD