EXHIBIT 99.1

Published on May 19, 2022

Exhibit 99.1

Ocuphire Corporate Presentation May 19, 2022

Disclosures and Forward-Looking Statements This presentation contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning the regulatory timelines, commercial timelines, product labels, cash runway, scalability, and

future clinical trials in reversal of mydriasis (RM), presbyopia (P), dim light/night vision disturbance (NVD) and diabetic retinopathy (DR)/diabetic macular edema (DME), including the potential for Nyxol to be a “best in class” presbyopia

drop and the potential market opportunity in RM/NVD/P/DR/DME. These forward-looking statements are based upon the Company’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results

and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, including, without limitation: (i) the success, costs, and timing of regulatory

submissions and pre-clinical and clinical trials, including enrollment and data readouts; (ii) regulatory requirements or developments; (iii) changes to clinical trial designs and regulatory pathways; (iv) changes in capital resource

requirements; (v) risks related to the inability of Ocuphire to obtain sufficient additional capital to continue to advance its product candidates and its preclinical programs; (vi) legislative, regulatory, political and economic

developments, (vii) changes in market opportunities, (viii) the effects of COVID-19 on clinical programs and business operations, (ix) the success and timing of commercialization of any of Ocuphire’s product candidates, including the

scalability of Ocuphire’s product candidates and (x) the maintenance of Ocuphire’s intellectual property rights. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as

exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors detailed in documents that have been and may be filed by the Company from time to time with the SEC. All

forward-looking statements contained in this presentation speak only as of the date on which they were made. The Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the

date on which they were made. The Company makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained in or incorporated by reference into this presentation. Nothing contained in

or incorporated by reference into this presentation is, or shall be relied upon as, a promise or representation by the Company as to the past or future. The Company assumes no responsibility for the accuracy or completeness of any such

information. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market shares and other data about our industry. This data involves a number of assumptions and limitations,

and you are cautioned not to give undue weight to such estimates. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of such

products.

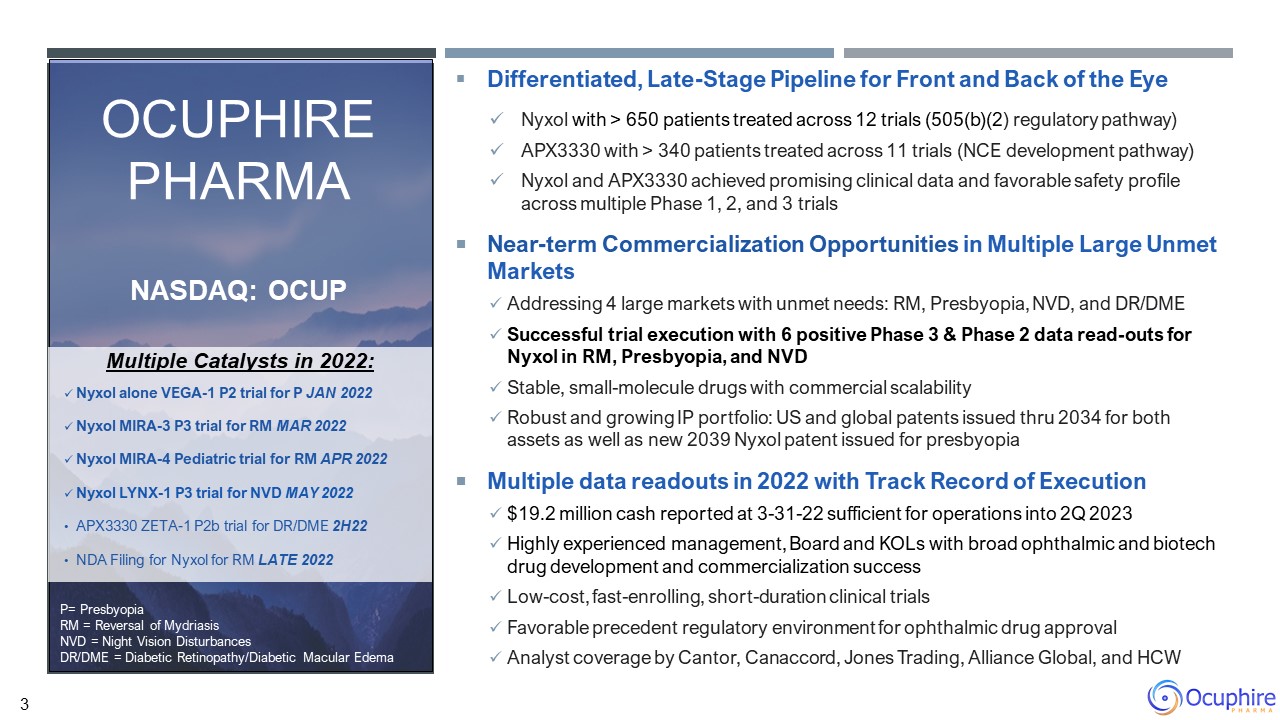

Differentiated, Late-Stage Pipeline for Front and Back of the Eye Nyxol with > 650 patients treated

across 12 trials (505(b)(2) regulatory pathway) APX3330 with > 340 patients treated across 11 trials (NCE development pathway) Nyxol and APX3330 achieved promising clinical data and favorable safety profile across multiple Phase 1, 2,

and 3 trials Near-term Commercialization Opportunities in Multiple Large Unmet Markets Addressing 4 large markets with unmet needs: RM, Presbyopia, NVD, and DR/DME Successful trial execution with 6 positive Phase 3 & Phase 2 data

read-outs for Nyxol in RM, Presbyopia, and NVD Stable, small-molecule drugs with commercial scalability Robust and growing IP portfolio: US and global patents issued thru 2034 for both assets as well as new 2039 Nyxol patent issued for

presbyopia Multiple data readouts in 2022 with Track Record of Execution $19.2 million cash reported at 3-31-22 sufficient for operations into 2Q 2023 Highly experienced management, Board and KOLs with broad ophthalmic and biotech drug

development and commercialization success Low-cost, fast-enrolling, short-duration clinical trials Favorable precedent regulatory environment for ophthalmic drug approval Analyst coverage by Cantor, Canaccord, Jones Trading, Alliance

Global, and HCW Multiple Catalysts in 2022: Nyxol alone VEGA-1 P2 trial for P JAN 2022 Nyxol MIRA-3 P3 trial for RM MAR 2022 Nyxol MIRA-4 Pediatric trial for RM APR 2022 Nyxol LYNX-1 P3 trial for NVD MAY 2022 APX3330 ZETA-1 P2b trial

for DR/DME 2H22 NDA Filing for Nyxol for RM LATE 2022 Ocuphire Pharma Nasdaq: OCUP P= Presbyopia RM = Reversal of Mydriasis NVD = Night Vision Disturbances DR/DME = Diabetic Retinopathy/Diabetic Macular Edema 3

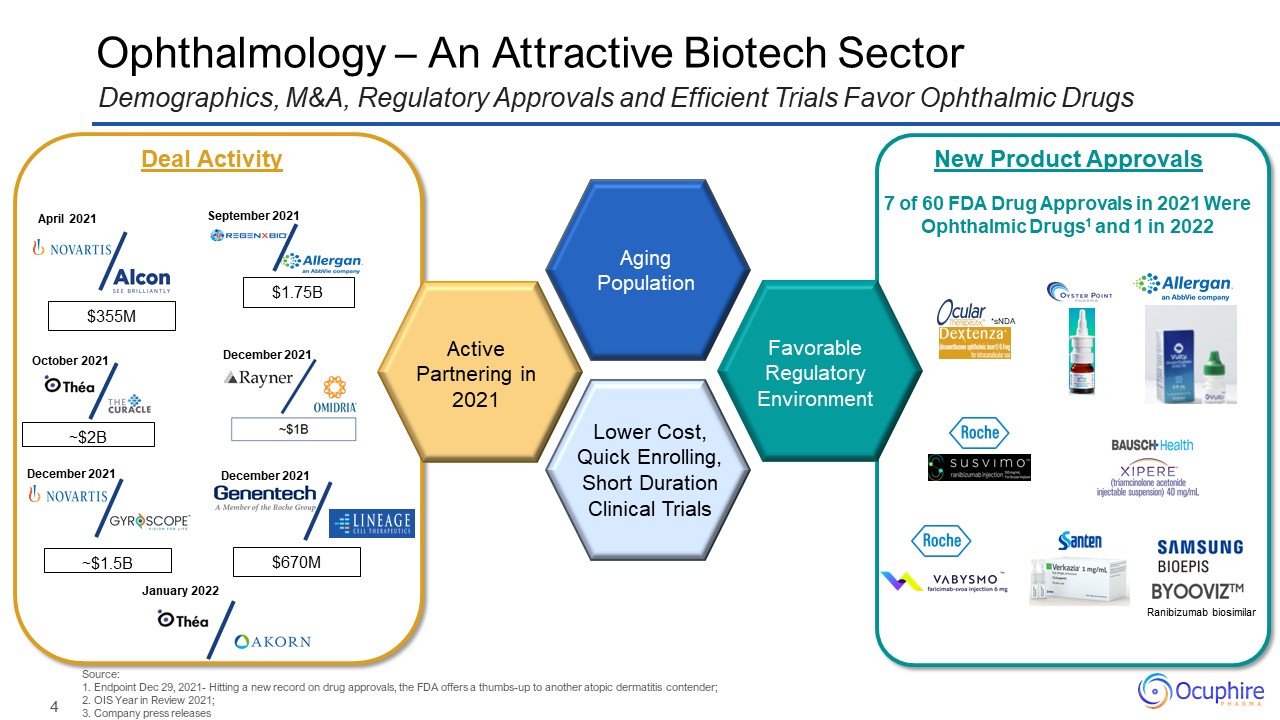

Ophthalmology – An Attractive Biotech Sector Favorable Regulatory Environment Source:1. Endpoint

Dec 29, 2021- Hitting a new record on drug approvals, the FDA offers a thumbs-up to another atopic dermatitis contender; 2. OIS Year in Review 2021; 3. Company press releases Demographics, M&A, Regulatory Approvals and Efficient Trials

Favor Ophthalmic Drugs New Product Approvals *sNDA 7 of 60 FDA Drug Approvals in 2021 Were Ophthalmic Drugs1 and 1 in 2022 Aging Population Ranibizumab biosimilar Active Partnering in 2021 April 2021 ~$2B October 2021 December

2021 ~$1.5B December 2021 $1.75B September 2021 Lower Cost, Quick Enrolling, Short Duration Clinical Trials Deal Activity December 2021 $670M $355M January 2022

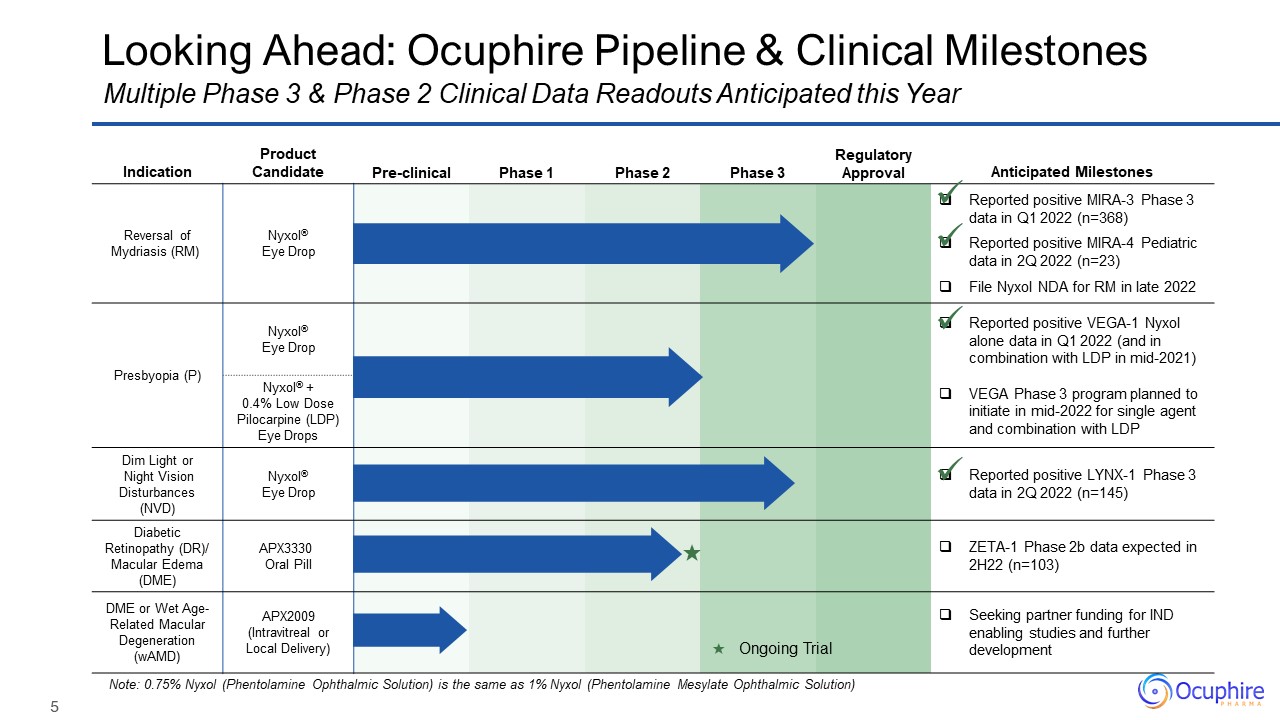

Indication Product Candidate Pre-clinical Phase 1 Phase 2 Phase

3 Regulatory Approval Anticipated Milestones Reversal of Mydriasis (RM) Nyxol® Eye Drop Reported positive MIRA-3 Phase 3 data in Q1 2022 (n=368) Reported positive MIRA-4 Pediatric data in 2Q 2022 (n=23) File Nyxol NDA for RM in

late 2022 Presbyopia (P) Nyxol® Eye Drop Reported positive VEGA-1 Nyxol alone data in Q1 2022 (and in combination with LDP in mid-2021) VEGA Phase 3 program planned to initiate in mid-2022 for single agent and combination with

LDP Presbyopia (P) Nyxol® + 0.4% Low Dose Pilocarpine (LDP) Eye Drops Dim Light or Night Vision Disturbances (NVD) Nyxol® Eye Drop Reported positive LYNX-1 Phase 3 data in 2Q 2022 (n=145) Diabetic Retinopathy (DR)/ Macular Edema

(DME) APX3330 Oral Pill ZETA-1 Phase 2b data expected in 2H22 (n=103) DME or Wet Age-Related Macular Degeneration (wAMD) APX2009 (Intravitreal or Local Delivery) Seeking partner funding for IND enabling studies and further

development Looking Ahead: Ocuphire Pipeline & Clinical Milestones Note: 0.75% Nyxol (Phentolamine Ophthalmic Solution) is the same as 1% Nyxol (Phentolamine Mesylate Ophthalmic Solution) Multiple Phase 3 & Phase 2 Clinical Data

Readouts Anticipated this Year ★ Ongoing Trial ★

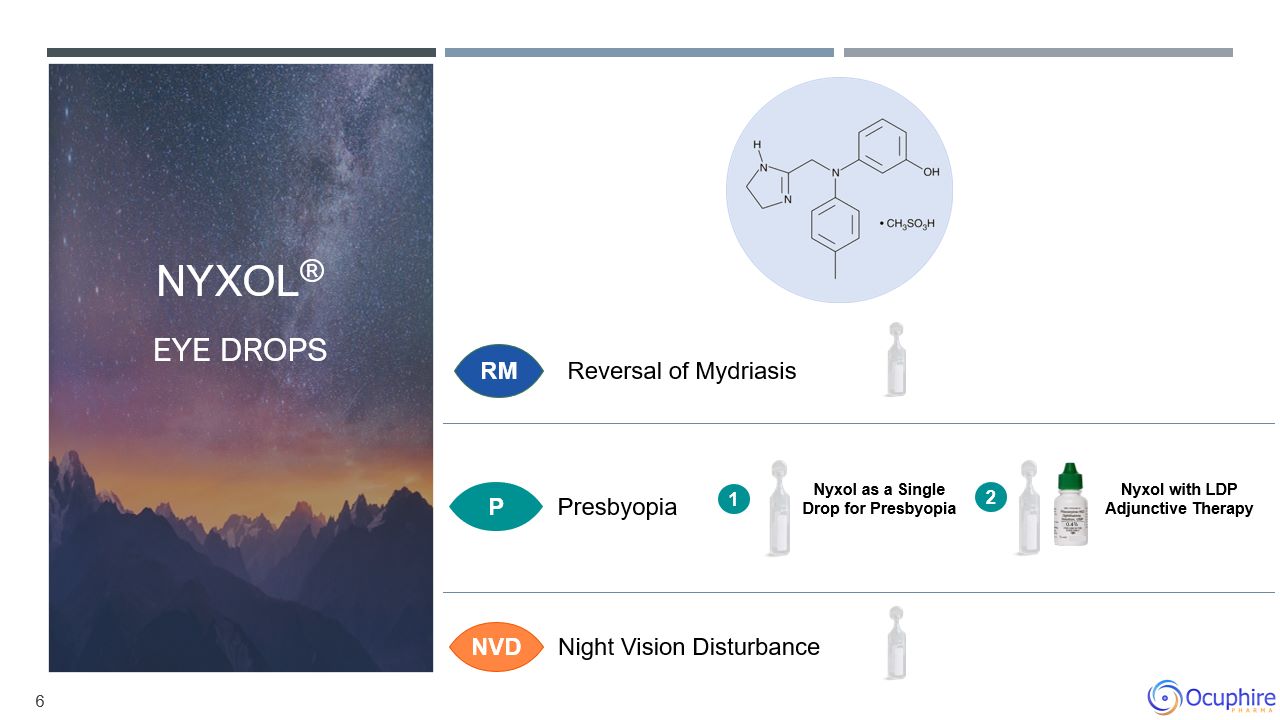

6 Reversal of Mydriasis P NVD Presbyopia Night

Vision Disturbance Nyxol® Eye Drops Nyxol as a Single Drop for Presbyopia Nyxol with LDP Adjunctive Therapy 1 0.4% 2 RM

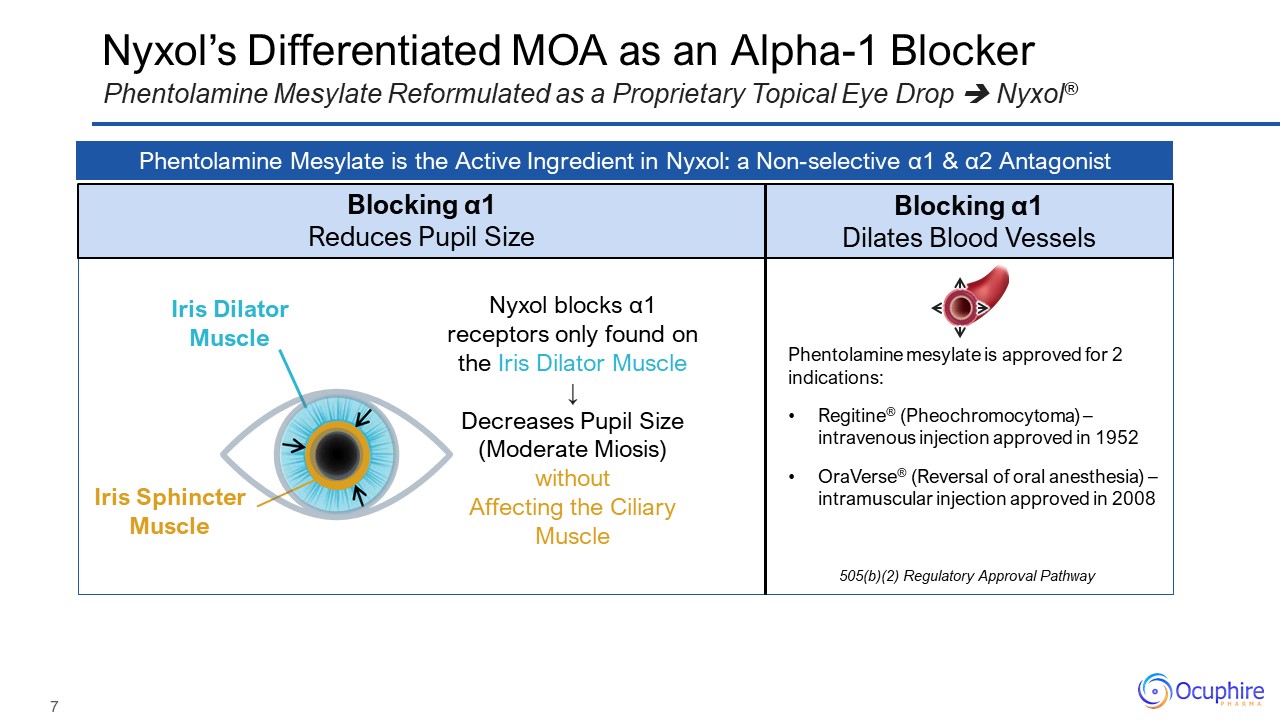

Nyxol’s Differentiated MOA as an Alpha-1 Blocker Phentolamine Mesylate Reformulated as a Proprietary

Topical Eye Drop Nyxol® Phentolamine Mesylate is the Active Ingredient in Nyxol: a Non-selective α1 & α2 Antagonist Blocking α1 Reduces Pupil Size Blocking α1 Dilates Blood Vessels Phentolamine mesylate is approved for 2

indications: Regitine® (Pheochromocytoma) – intravenous injection approved in 1952 OraVerse® (Reversal of oral anesthesia) – intramuscular injection approved in 2008 505(b)(2) Regulatory Approval Pathway Nyxol blocks α1 receptors only

found on the Iris Dilator Muscle ↓ Decreases Pupil Size (Moderate Miosis) without Affecting the Ciliary Muscle Iris Dilator Muscle Iris Sphincter Muscle

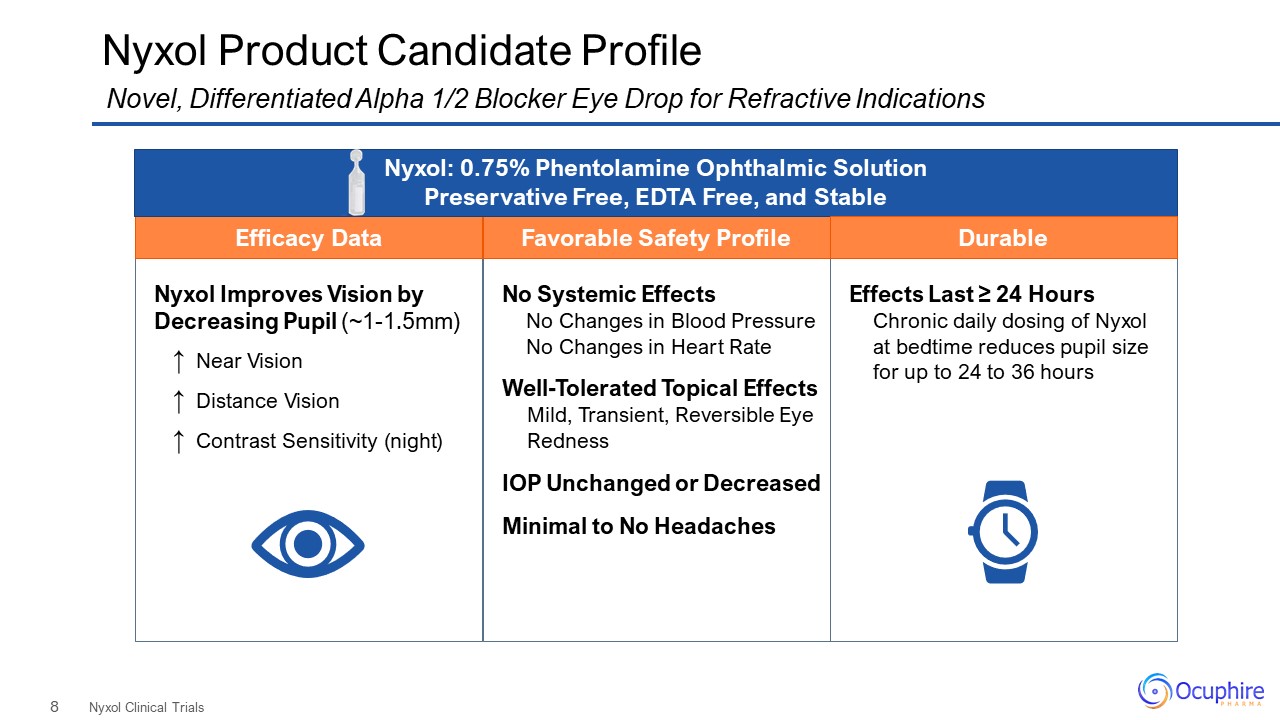

Nyxol Improves Vision by Decreasing Pupil (~1-1.5mm) ↑ Near Vision ↑ Distance Vision ↑ Contrast

Sensitivity (night) No Systemic Effects No Changes in Blood Pressure No Changes in Heart Rate Well-Tolerated Topical Effects Mild, Transient, Reversible Eye Redness IOP Unchanged or Decreased Minimal to No Headaches Nyxol Product

Candidate Profile Nyxol Clinical Trials Novel, Differentiated Alpha 1/2 Blocker Eye Drop for Refractive Indications Favorable Safety Profile Efficacy Data Nyxol: 0.75% Phentolamine Ophthalmic Solution Preservative Free, EDTA Free, and

Stable Effects Last ≥ 24 Hours Chronic daily dosing of Nyxol at bedtime reduces pupil size for up to 24 to 36 hours Durable

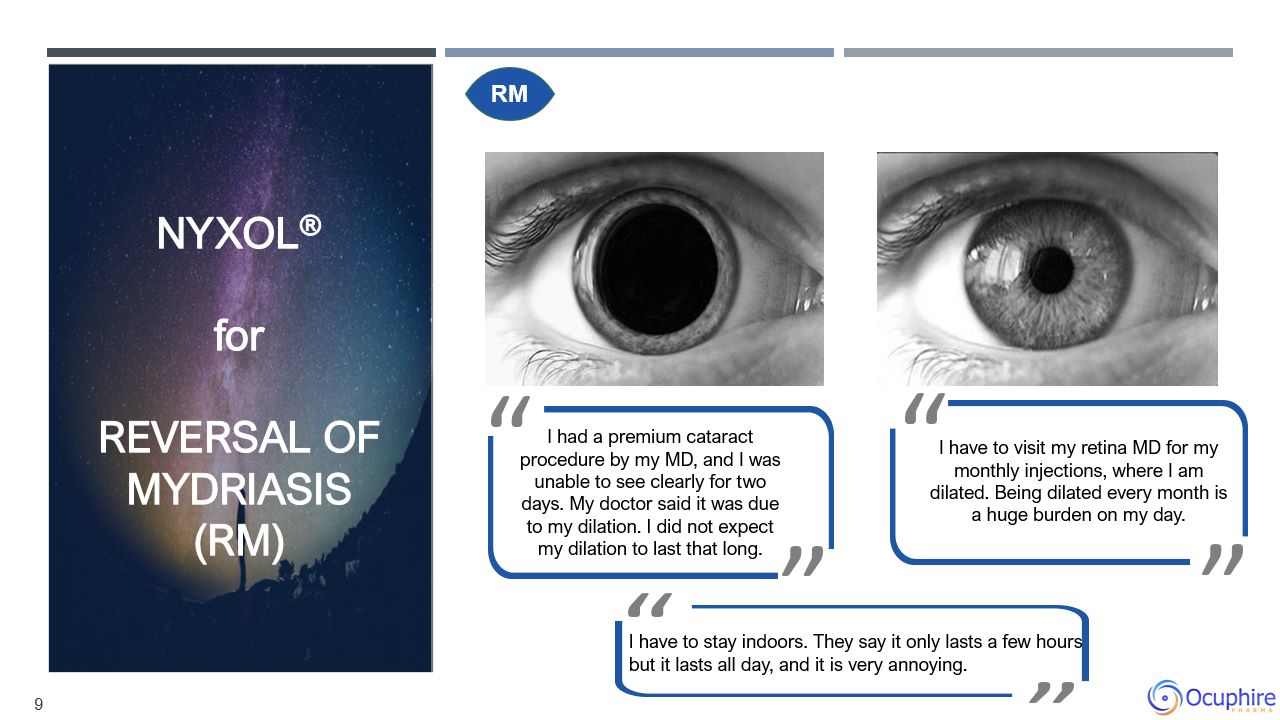

9 I have to visit my retina MD for my monthly injections, where I am dilated. Being

dilated every month is a huge burden on my day. I had a premium cataract procedure by my MD, and I was unable to see clearly for two days. My doctor said it was due to my dilation. I did not expect my

dilation to last that long. I have to stay indoors. They say it only lasts a few hours, but it lasts all day, and it is very annoying. RM Nyxol®forReversal of Mydriasis (RM)

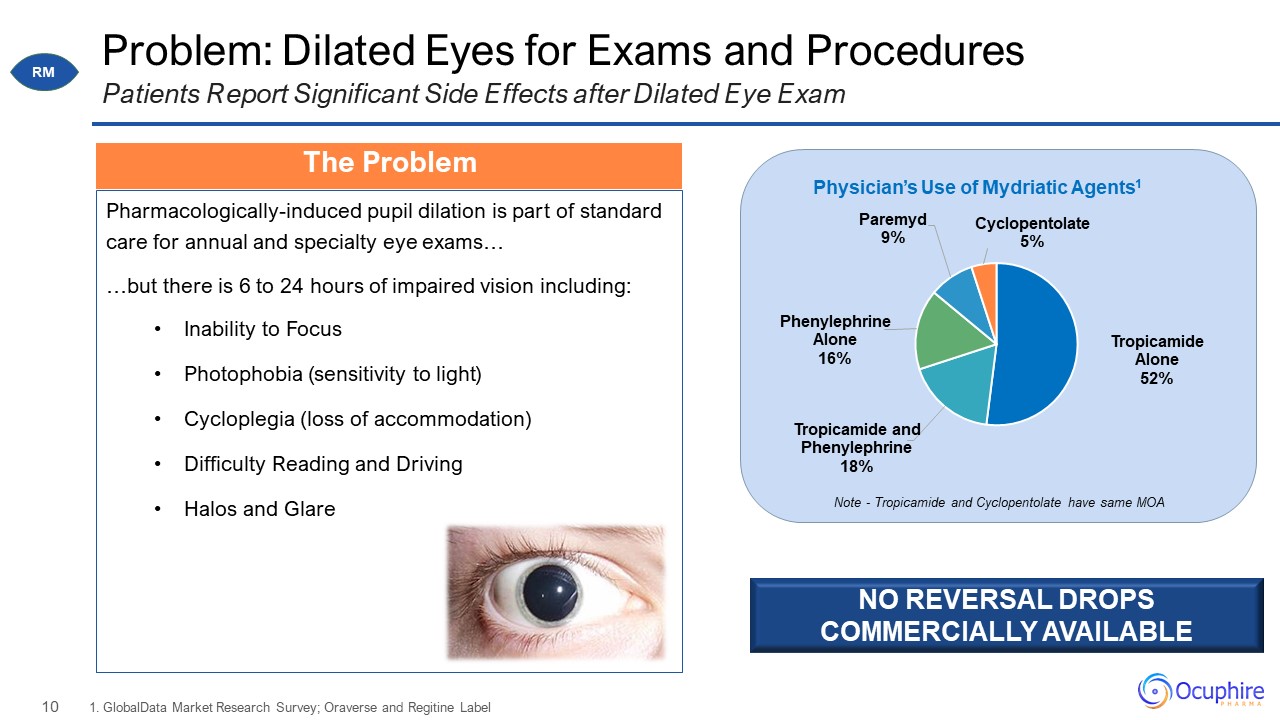

Problem: Dilated Eyes for Exams and Procedures Pharmacologically-induced pupil dilation is part of

standard care for annual and specialty eye exams… …but there is 6 to 24 hours of impaired vision including: Inability to Focus Photophobia (sensitivity to light) Cycloplegia (loss of accommodation) Difficulty Reading and

Driving Halos and Glare 1. GlobalData Market Research Survey; Oraverse and Regitine Label Patients Report Significant Side Effects after Dilated Eye Exam Note - Tropicamide and Cyclopentolate have same MOA NO REVERSAL DROPS COMMERCIALLY

AVAILABLE The Problem RM

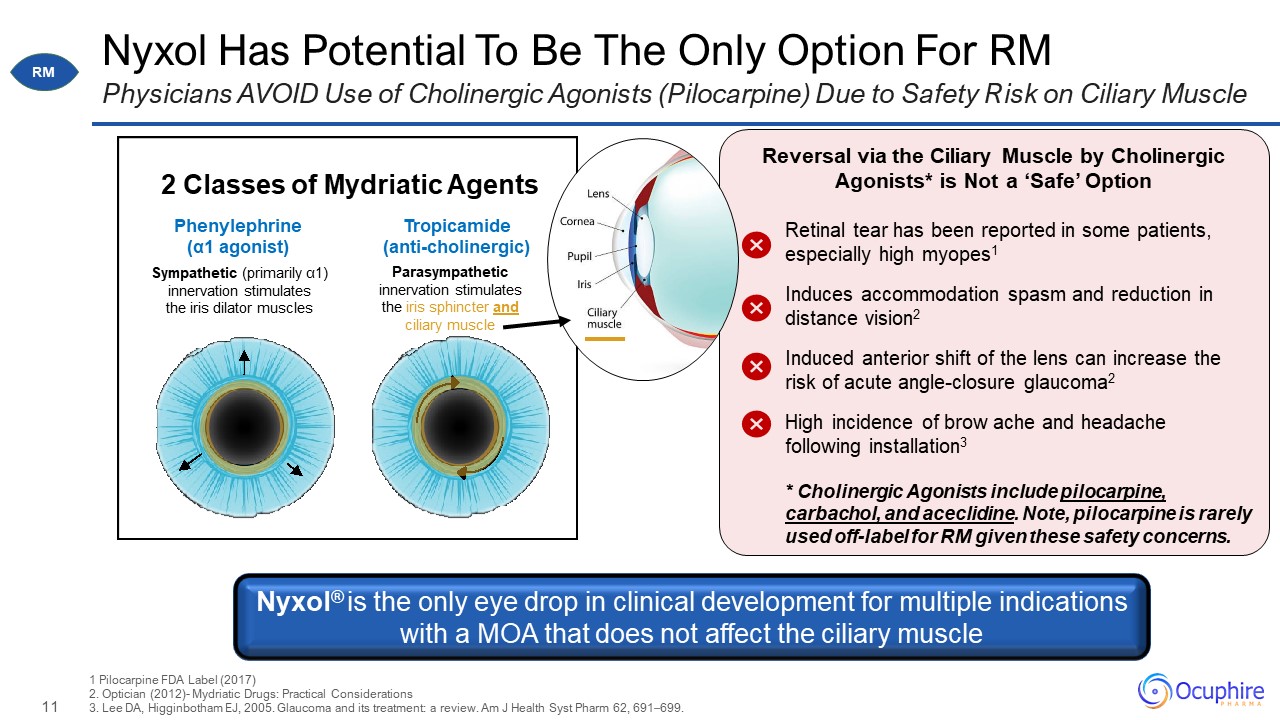

Nyxol Has Potential To Be The Only Option For RM Physicians AVOID Use of Cholinergic Agonists

(Pilocarpine) Due to Safety Risk on Ciliary Muscle 1 Pilocarpine FDA Label (2017)2. Optician (2012)- Mydriatic Drugs: Practical Considerations 3. Lee DA, Higginbotham EJ, 2005. Glaucoma and its treatment: a review. Am J Health Syst Pharm

62, 691–699. Parasympathetic innervation stimulates the iris sphincter and ciliary muscle Sympathetic (primarily α1) innervation stimulates the iris dilator muscles 2 Classes of Mydriatic Agents Tropicamide

(anti-cholinergic) Phenylephrine (α1 agonist) Reversal via the Ciliary Muscle by Cholinergic Agonists* is Not a ‘Safe’ Option Retinal tear has been reported in some patients, especially high myopes1 Induces accommodation spasm and

reduction in distance vision2 Induced anterior shift of the lens can increase the risk of acute angle-closure glaucoma2 High incidence of brow ache and headache following installation3 * Cholinergic Agonists include pilocarpine, carbachol,

and aceclidine. Note, pilocarpine is rarely used off-label for RM given these safety concerns. Nyxol® is the only eye drop in clinical development for multiple indications with a MOA that does not affect the ciliary muscle RM

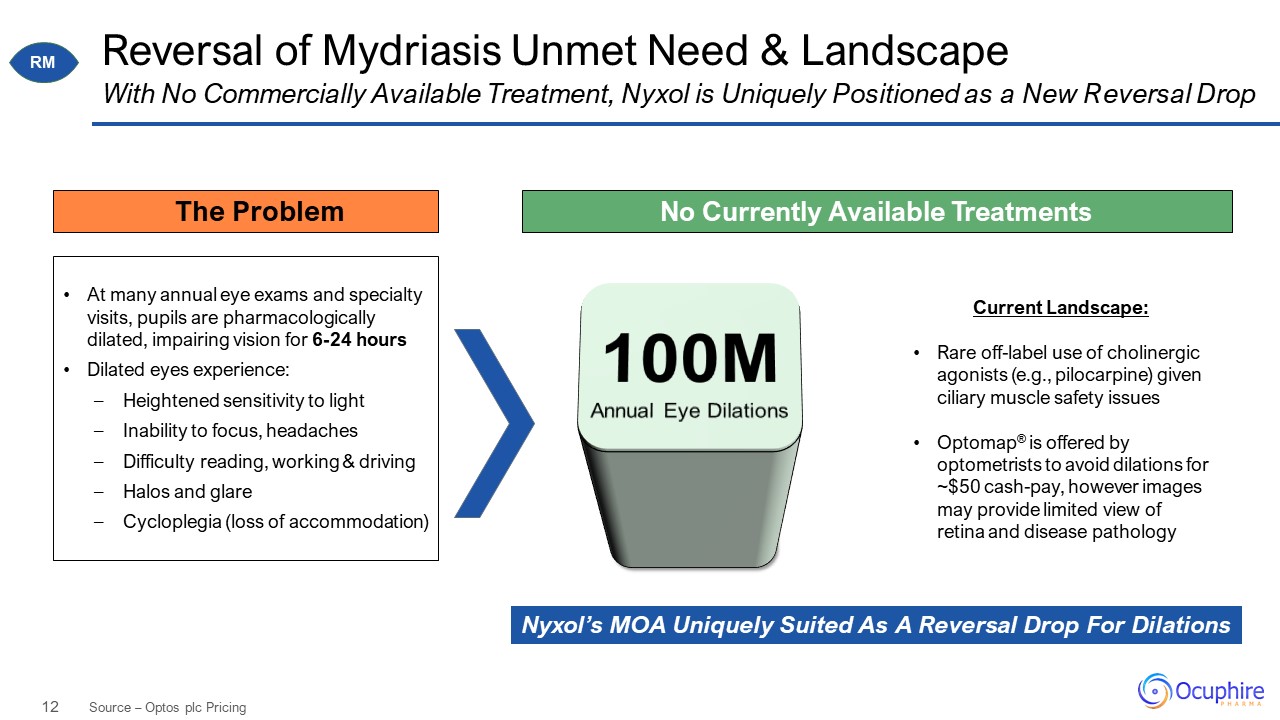

Reversal of Mydriasis Unmet Need & Landscape Source – Optos plc Pricing With No Commercially

Available Treatment, Nyxol is Uniquely Positioned as a New Reversal Drop At many annual eye exams and specialty visits, pupils are pharmacologically dilated, impairing vision for 6-24 hours Dilated eyes experience: Heightened sensitivity

to light Inability to focus, headaches Difficulty reading, working & driving Halos and glare Cycloplegia (loss of accommodation) Current Landscape: Rare off-label use of cholinergic agonists (e.g., pilocarpine) given ciliary

muscle safety issues Optomap® is offered by optometrists to avoid dilations for ~$50 cash-pay, however images may provide limited view of retina and disease pathology No Currently Available Treatments 100M Annual Eye Dilations Nyxol’s

MOA Uniquely Suited As A Reversal Drop For Dilations The Problem RM

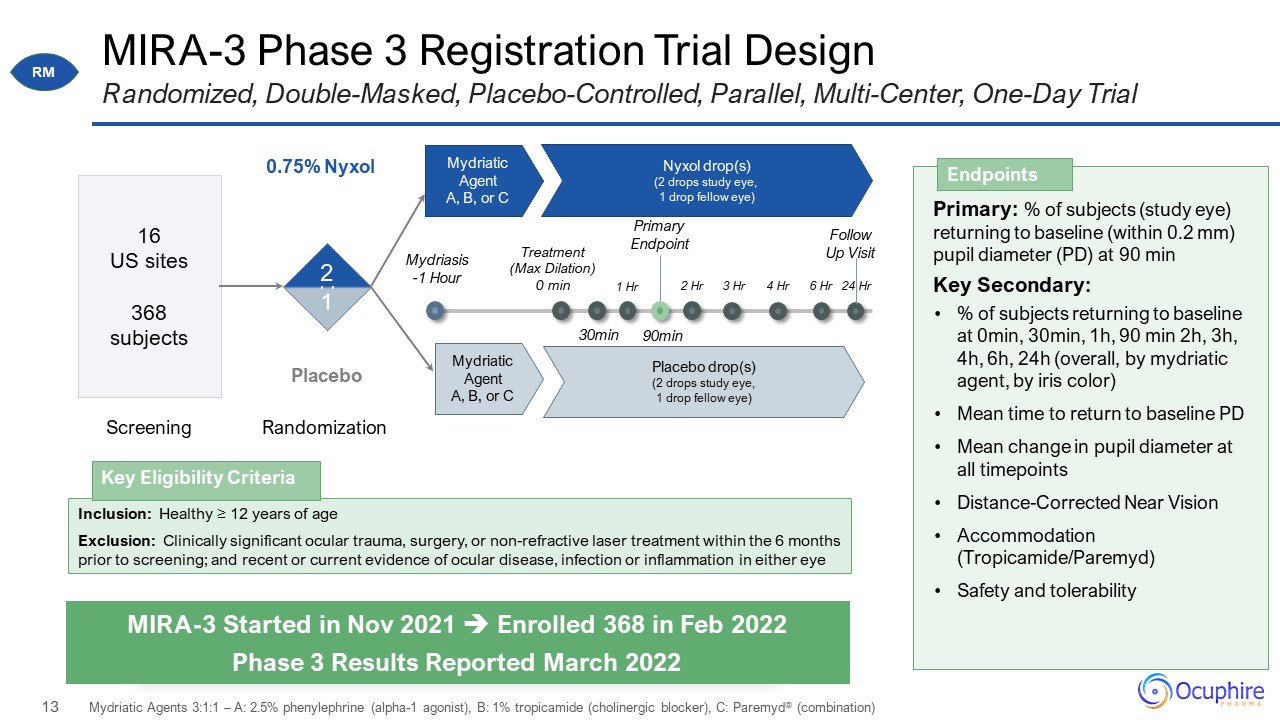

MIRA-3 Phase 3 Registration Trial Design Randomized, Double-Masked, Placebo-Controlled, Parallel,

Multi-Center, One-Day Trial Mydriasis -1 Hour 1:1 Mydriatic Agent A, B, or C 0.75% Nyxol Placebo 16 US sites 368 subjects Nyxol drop(s) (2 drops study eye, 1 drop fellow eye) Mydriatic Agent A, B, or C Placebo drop(s) (2

drops study eye, 1 drop fellow eye) Primary: % of subjects (study eye) returning to baseline (within 0.2 mm) pupil diameter (PD) at 90 min Key Secondary: % of subjects returning to baseline at 0min, 30min, 1h, 90 min 2h, 3h, 4h, 6h, 24h

(overall, by mydriatic agent, by iris color) Mean time to return to baseline PD Mean change in pupil diameter at all timepoints Distance-Corrected Near Vision Accommodation (Tropicamide/Paremyd) Safety and

tolerability Endpoints MIRA-3 Started in Nov 2021 Enrolled 368 in Feb 2022 Phase 3 Results Reported March 2022 Screening Randomization 2 1 Treatment (Max Dilation) 0 min 30min 1 Hr 90min 2 Hr 3 Hr 4 Hr 6 Hr 24

Hr Primary Endpoint Follow Up Visit Mydriatic Agents 3:1:1 – A: 2.5% phenylephrine (alpha-1 agonist), B: 1% tropicamide (cholinergic blocker), C: Paremyd® (combination) : Inclusion: Healthy ≥ 12 years of age Exclusion: Clinically

significant ocular trauma, surgery, or non-refractive laser treatment within the 6 months prior to screening; and recent or current evidence of ocular disease, infection or inflammation in either eye Key Eligibility Criteria RM

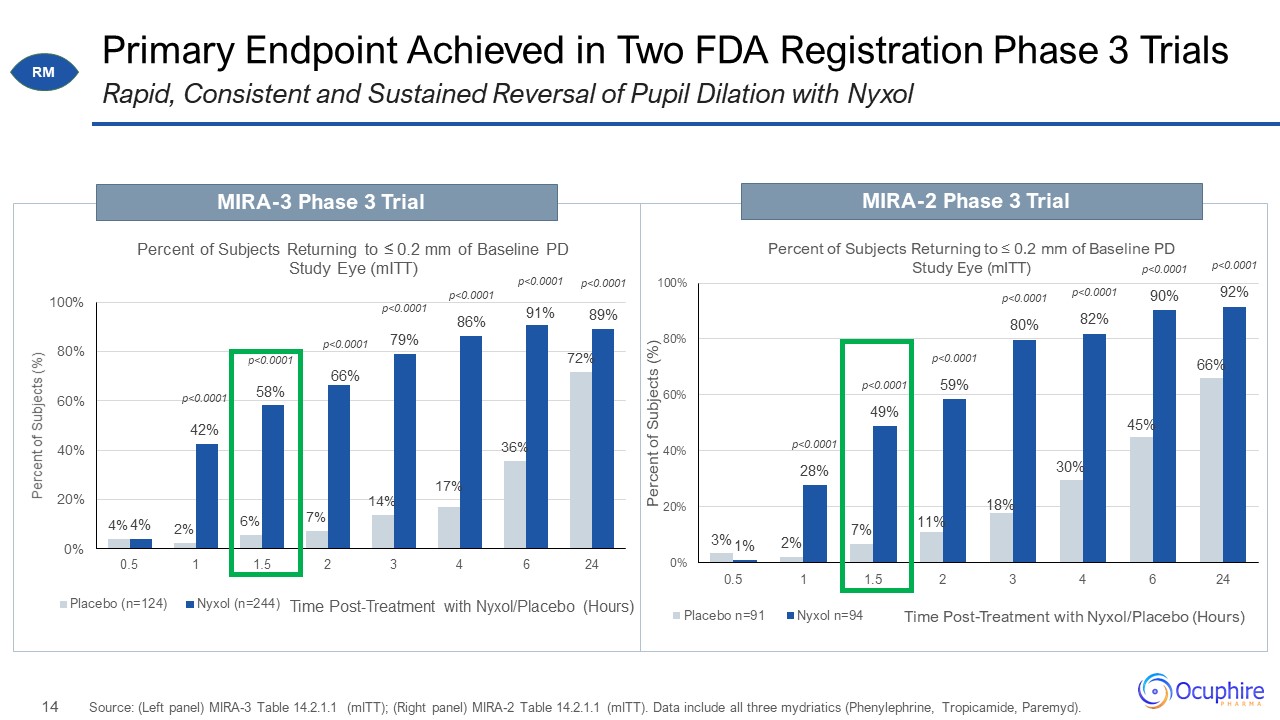

Primary Endpoint Achieved in Two FDA Registration Phase 3 Trials Source: (Left panel) MIRA-3 Table

14.2.1.1 (mITT); (Right panel) MIRA-2 Table 14.2.1.1 (mITT). Data include all three mydriatics (Phenylephrine, Tropicamide, Paremyd). Rapid, Consistent and Sustained Reversal of Pupil Dilation with Nyxol MIRA-3 Phase 3 Trial MIRA-2 Phase 3

Trial RM 0

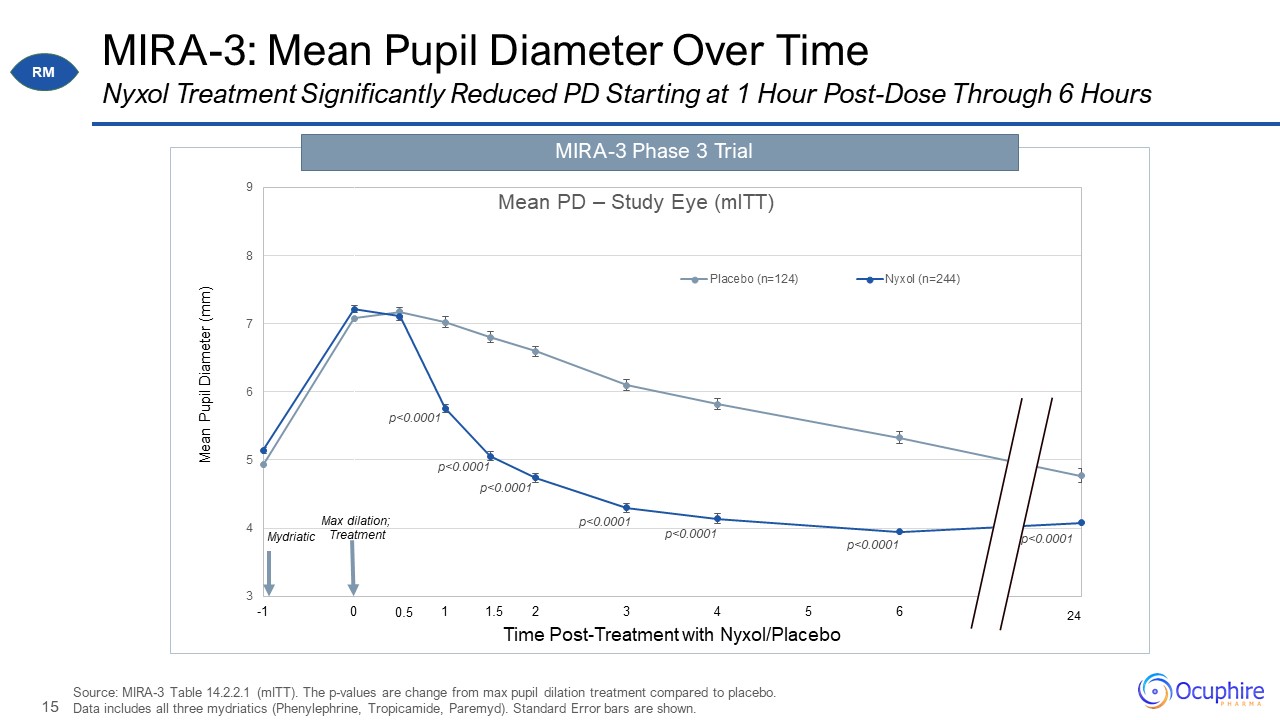

MIRA-3: Mean Pupil Diameter Over Time Source: MIRA-3 Table 14.2.2.1 (mITT). The p-values are change

from max pupil dilation treatment compared to placebo. Data includes all three mydriatics (Phenylephrine, Tropicamide, Paremyd). Standard Error bars are shown. Nyxol Treatment Significantly Reduced PD Starting at 1 Hour Post-Dose Through

6 Hours MIRA-3 Phase 3 Trial 1.5 0.5 RM

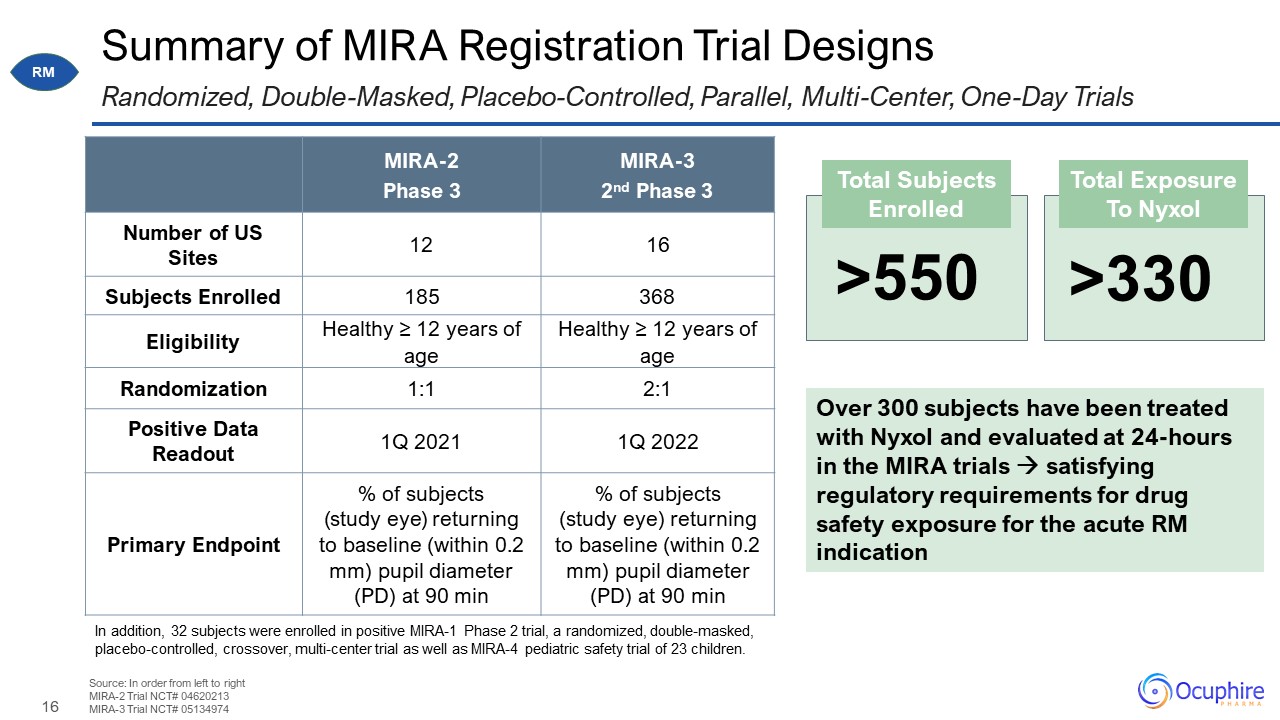

Summary of MIRA Registration Trial Designs Source: In order from left to right MIRA-2 Trial NCT#

04620213 MIRA-3 Trial NCT# 05134974 Randomized, Double-Masked, Placebo-Controlled, Parallel, Multi-Center, One-Day Trials MIRA-2 Phase 3 MIRA-3 2nd Phase 3 Number of US Sites 12 16 Subjects Enrolled 185 368 Eligibility Healthy

≥ 12 years of age Healthy ≥ 12 years of age Randomization 1:1 2:1 Positive Data Readout 1Q 2021 1Q 2022 Primary Endpoint % of subjects (study eye) returning to baseline (within 0.2 mm) pupil diameter (PD) at 90 min % of subjects

(study eye) returning to baseline (within 0.2 mm) pupil diameter (PD) at 90 min >550 Total Exposure To Nyxol Total Subjects Enrolled >330 Over 300 subjects have been treated with Nyxol and evaluated at 24-hours in the MIRA trials

satisfying regulatory requirements for drug safety exposure for the acute RM indication In addition, 32 subjects were enrolled in positive MIRA-1 Phase 2 trial, a randomized, double-masked, placebo-controlled, crossover, multi-center trial

as well as MIRA-4 pediatric safety trial of 23 children. RM

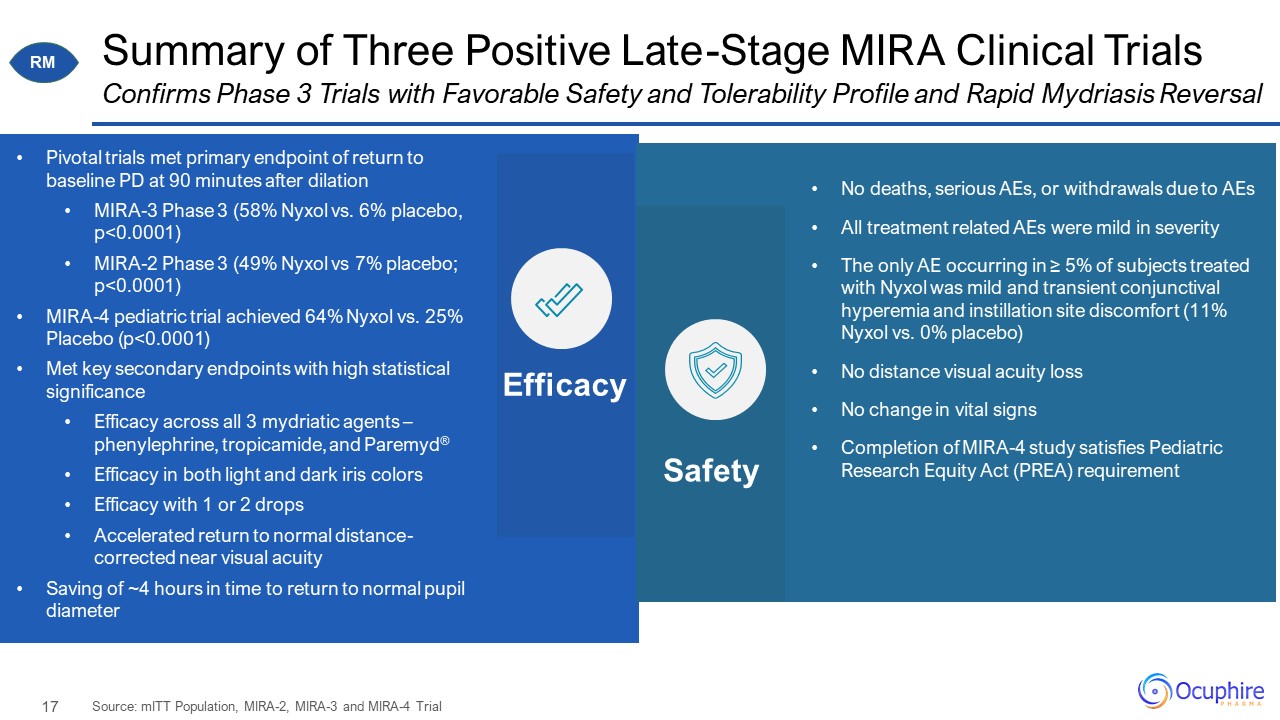

Summary of Three Positive Late-Stage MIRA Clinical Trials Source: mITT Population, MIRA-2, MIRA-3 and

MIRA-4 Trial Confirms Phase 3 Trials with Favorable Safety and Tolerability Profile and Rapid Mydriasis Reversal No deaths, serious AEs, or withdrawals due to AEs All treatment related AEs were mild in severity The only AE occurring in ≥

5% of subjects treated with Nyxol was mild and transient conjunctival hyperemia and instillation site discomfort (11% Nyxol vs. 0% placebo) No distance visual acuity loss No change in vital signs Completion of MIRA-4 study satisfies

Pediatric Research Equity Act (PREA) requirement Efficacy Safety Pivotal trials met primary endpoint of return to baseline PD at 90 minutes after dilation MIRA-3 Phase 3 (58% Nyxol vs. 6% placebo, p<0.0001) MIRA-2 Phase 3 (49% Nyxol

vs 7% placebo; p<0.0001) MIRA-4 pediatric trial achieved 64% Nyxol vs. 25% Placebo (p<0.0001) Met key secondary endpoints with high statistical significance Efficacy across all 3 mydriatic agents – phenylephrine, tropicamide, and

Paremyd® Efficacy in both light and dark iris colors Efficacy with 1 or 2 drops Accelerated return to normal distance-corrected near visual acuity Saving of ~4 hours in time to return to normal pupil diameter RM

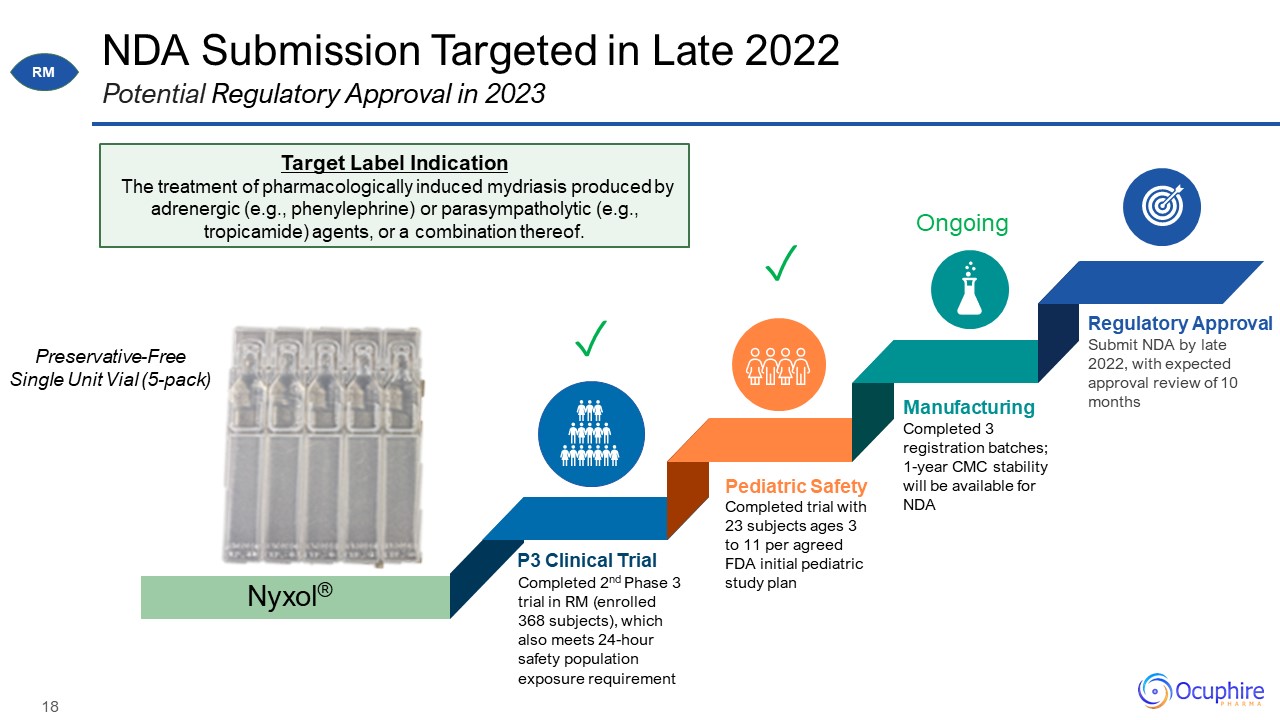

NDA Submission Targeted in Late 2022 Potential Regulatory Approval in 2023 Completed trial with 23

subjects ages 3 to 11 per agreed FDA initial pediatric study plan Pediatric Safety Completed 2nd Phase 3 trial in RM (enrolled 368 subjects), which also meets 24-hour safety population exposure requirement P3 Clinical Trial Completed 3

registration batches; 1-year CMC stability will be available for NDA Manufacturing Submit NDA by late 2022, with expected approval review of 10 months Regulatory Approval Nyxol® Target Label Indication The treatment of

pharmacologically induced mydriasis produced by adrenergic (e.g., phenylephrine) or parasympatholytic (e.g., tropicamide) agents, or a combination thereof. Preservative-Free Single Unit Vial (5-pack) ✓ Ongoing RM ✓

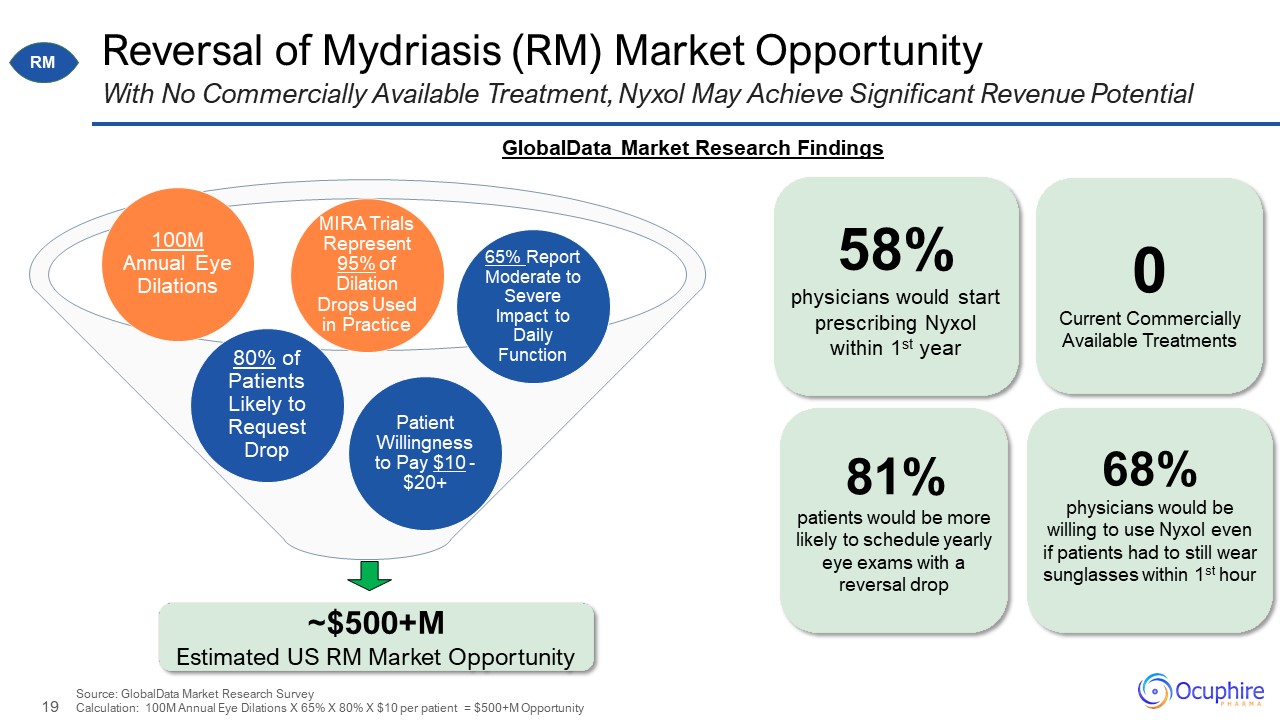

~$500+M Estimated US RM Market Opportunity Reversal of Mydriasis (RM) Market Opportunity With

No Commercially Available Treatment, Nyxol May Achieve Significant Revenue Potential Patient Willingness to Pay $10 - $20+ 65% Report Moderate to Severe Impact to Daily Function 100M Annual Eye Dilations 80% of Patients Likely to Request

Drop 58% physicians would start prescribing Nyxol within 1st year 81% patients would be more likely to schedule yearly eye exams with a reversal drop 0 Current Commercially Available Treatments MIRA Trials Represent 95% of Dilation

Drops Used in Practice Source: GlobalData Market Research SurveyCalculation: 100M Annual Eye Dilations X 65% X 80% X $10 per patient = $500+M Opportunity 68% physicians would be willing to use Nyxol even if patients had to still wear

sunglasses within 1st hour GlobalData Market Research Findings RM

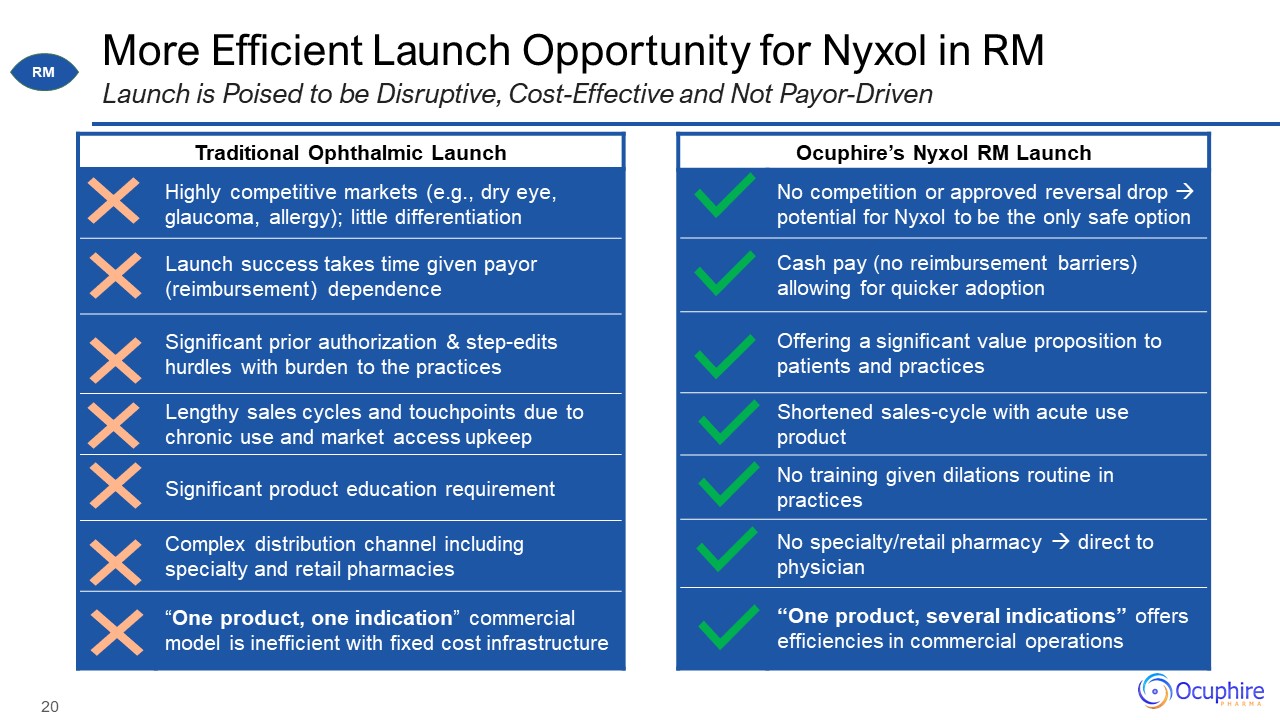

More Efficient Launch Opportunity for Nyxol in RM Launch is Poised to be Disruptive, Cost-Effective

and Not Payor-Driven Traditional Ophthalmic Launch Traditional Ophthalmic Launch Highly competitive markets (e.g., dry eye, glaucoma, allergy); little differentiation Launch success takes time given payor (reimbursement)

dependence Significant prior authorization & step-edits hurdles with burden to the practices Lengthy sales cycles and touchpoints due to chronic use and market access upkeep Significant product education requirement Complex

distribution channel including specialty and retail pharmacies “One product, one indication” commercial model is inefficient with fixed cost infrastructure Ocuphire’s Nyxol RM Launch Ocuphire’s Nyxol RM Launch No competition or approved

reversal drop potential for Nyxol to be the only safe option Cash pay (no reimbursement barriers) allowing for quicker adoption Offering a significant value proposition to patients and practices Shortened sales-cycle with acute use

product No training given dilations routine in practices No specialty/retail pharmacy direct to physician “One product, several indications” offers efficiencies in commercial operations RM

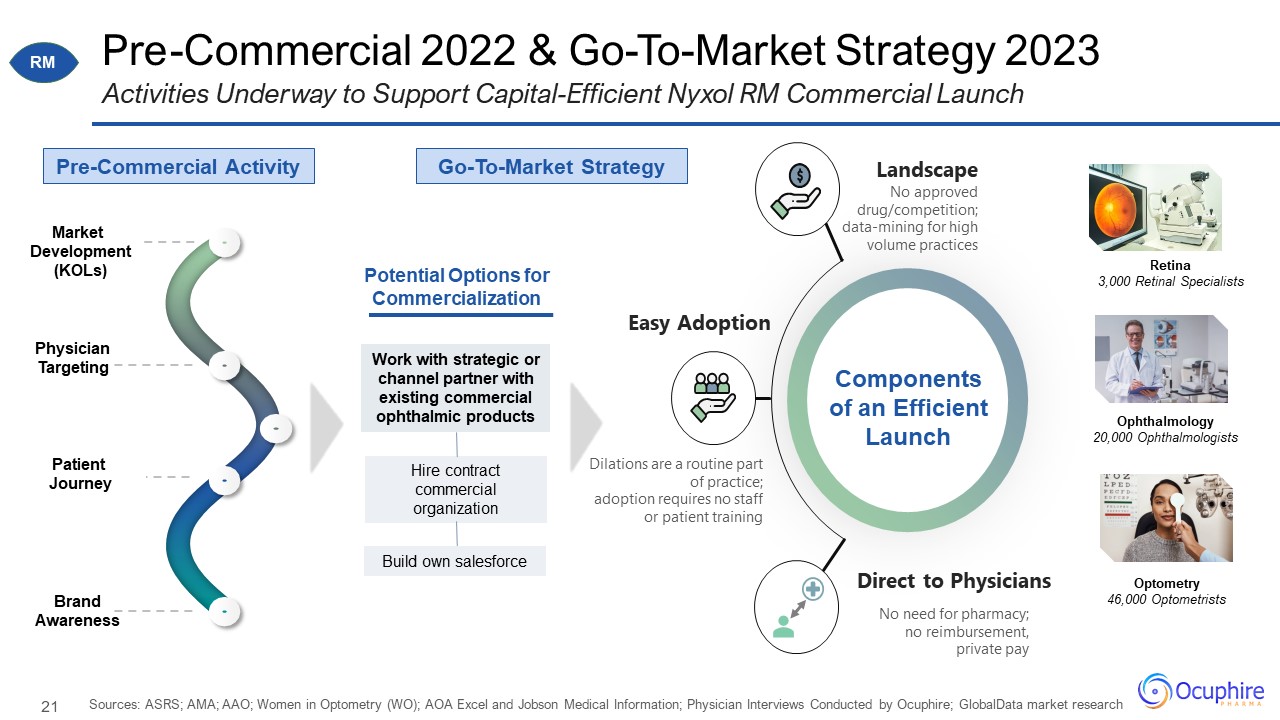

Pre-Commercial 2022 & Go-To-Market Strategy 2023 Sources: ASRS; AMA; AAO; Women in Optometry (WO);

AOA Excel and Jobson Medical Information; Physician Interviews Conducted by Ocuphire; GlobalData market research Activities Underway to Support Capital-Efficient Nyxol RM Commercial Launch Physician Targeting Pre-Commercial

Activity Market Development (KOLs) Patient Journey Brand Awareness No approved drug/competition; data-mining for high volume practices Landscape No need for pharmacy; no reimbursement, private pay Direct to Physicians Dilations

are a routine part of practice; adoption requires no staff or patient training Easy Adoption Components of an Efficient Launch Retina 3,000 Retinal Specialists Ophthalmology 20,000 Ophthalmologists Optometry 46,000 Optometrists

Potential Options for Commercialization RM Go-To-Market Strategy Work with strategic or channel partner with existing commercial ophthalmic products Hire contract commercial organization Build own salesforce

P 22 “By age 45, 80% of Americans will struggle with Presbyopia, and by age 50, nearly everyone

will.” NY Times Effectively everyone over 40 will have the problems with reading. Physician KOL Nyxol® forPRESBYOPIA

2021: The Time for Presbyopia Drops Sources: Academic review articles, journals, and publications

between July 2021 to December 2021 Headlines from Academia and Industry Articles with an Early First Approval for VuityTM “The correction of presbyopia remains ophthalmology’s ‘Holy Grail’…” -OIS 10/29/2021 P

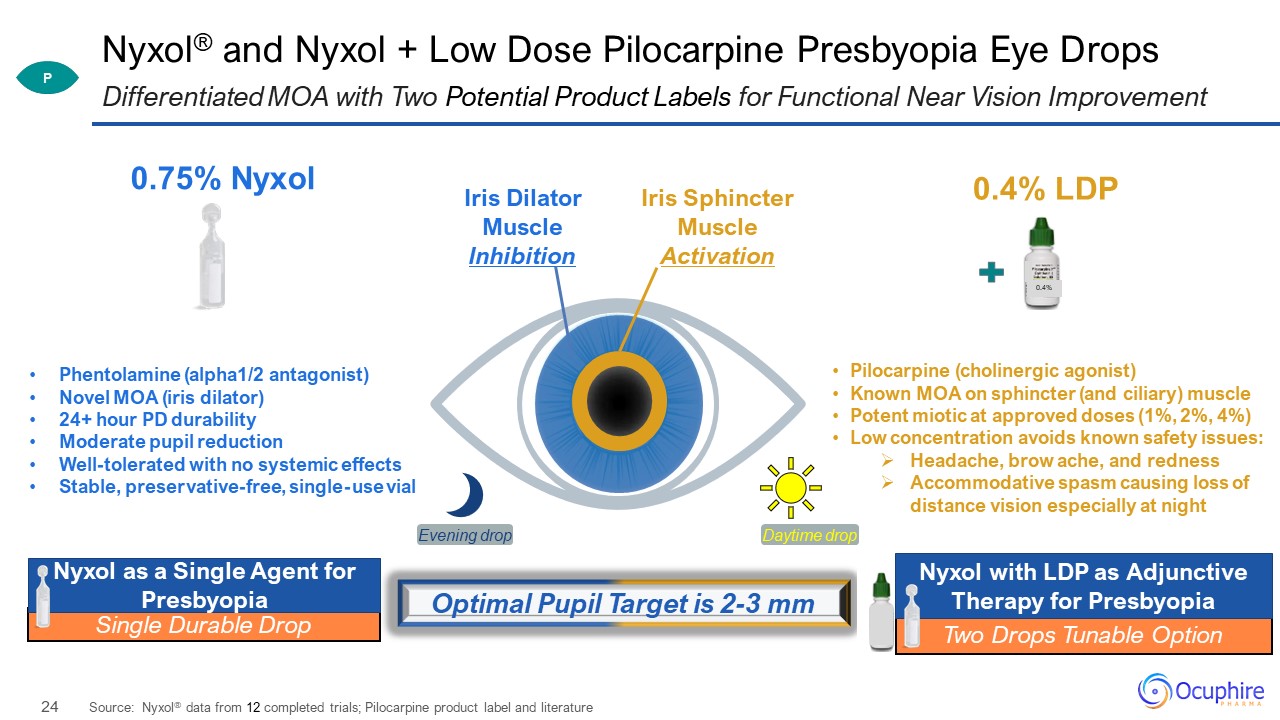

Nyxol® and Nyxol + Low Dose Pilocarpine Presbyopia Eye Drops Source: Nyxol® data from 12 completed

trials; Pilocarpine product label and literature Differentiated MOA with Two Potential Product Labels for Functional Near Vision Improvement 0.4% 0.75% Nyxol 0.4% LDP Iris Dilator Muscle Inhibition Iris Sphincter Muscle

Activation Evening drop Phentolamine (alpha1/2 antagonist) Novel MOA (iris dilator) 24+ hour PD durability Moderate pupil reduction Well-tolerated with no systemic effects Stable, preservative-free, single-use vial Pilocarpine

(cholinergic agonist) Known MOA on sphincter (and ciliary) muscle Potent miotic at approved doses (1%, 2%, 4%) Low concentration avoids known safety issues: Headache, brow ache, and redness Accommodative spasm causing loss of distance

vision especially at night Daytime drop Optimal Pupil Target is 2-3 mm P Two Drops Tunable Option Nyxol with LDP as Adjunctive Therapy for Presbyopia Single Durable Drop Nyxol as a Single Agent for Presbyopia

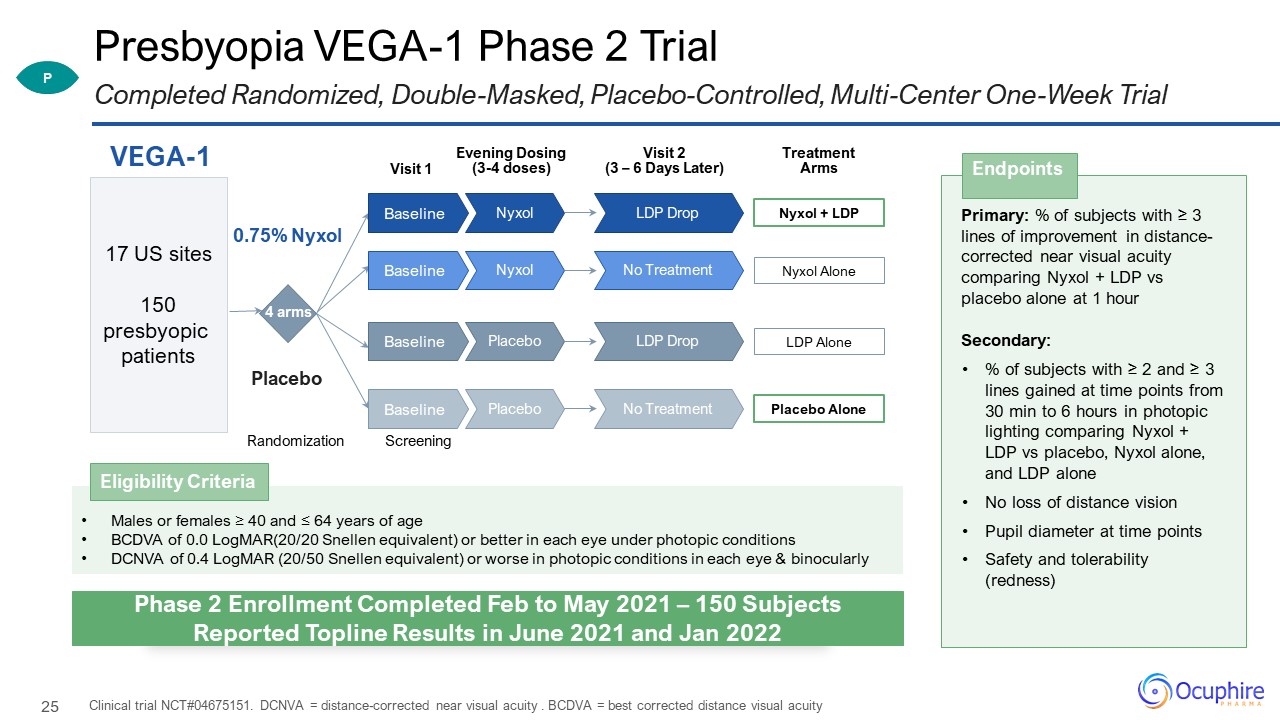

Presbyopia VEGA-1 Phase 2 Trial Clinical trial NCT#04675151. DCNVA = distance-corrected near visual

acuity . BCDVA = best corrected distance visual acuity Completed Randomized, Double-Masked, Placebo-Controlled, Multi-Center One-Week Trial Primary: % of subjects with ≥ 3 lines of improvement in distance-corrected near visual acuity

comparing Nyxol + LDP vs placebo alone at 1 hour Secondary: % of subjects with ≥ 2 and ≥ 3 lines gained at time points from 30 min to 6 hours in photopic lighting comparing Nyxol + LDP vs placebo, Nyxol alone, and LDP alone No loss

of distance vision Pupil diameter at time points Safety and tolerability (redness) Endpoints Visit 1 VEGA-1 Randomization 4 arms 0.75% Nyxol Placebo 17 US sites 150 presbyopic patients Visit 2 (3 – 6 Days

Later) Screening Treatment Arms Nyxol + LDP LDP Drop Nyxol Baseline Nyxol Alone No Treatment Nyxol Baseline LDP Alone LDP Drop Placebo Baseline Placebo Alone No Treatment Placebo Baseline Evening Dosing (3-4

doses) Males or females ≥ 40 and ≤ 64 years of age BCDVA of 0.0 LogMAR(20/20 Snellen equivalent) or better in each eye under photopic conditions DCNVA of 0.4 LogMAR (20/50 Snellen equivalent) or worse in photopic conditions in each eye

& binocularly Eligibility Criteria P Phase 2 Enrollment Completed Feb to May 2021 – 150 Subjects Reported Topline Results in June 2021 and Jan 2022

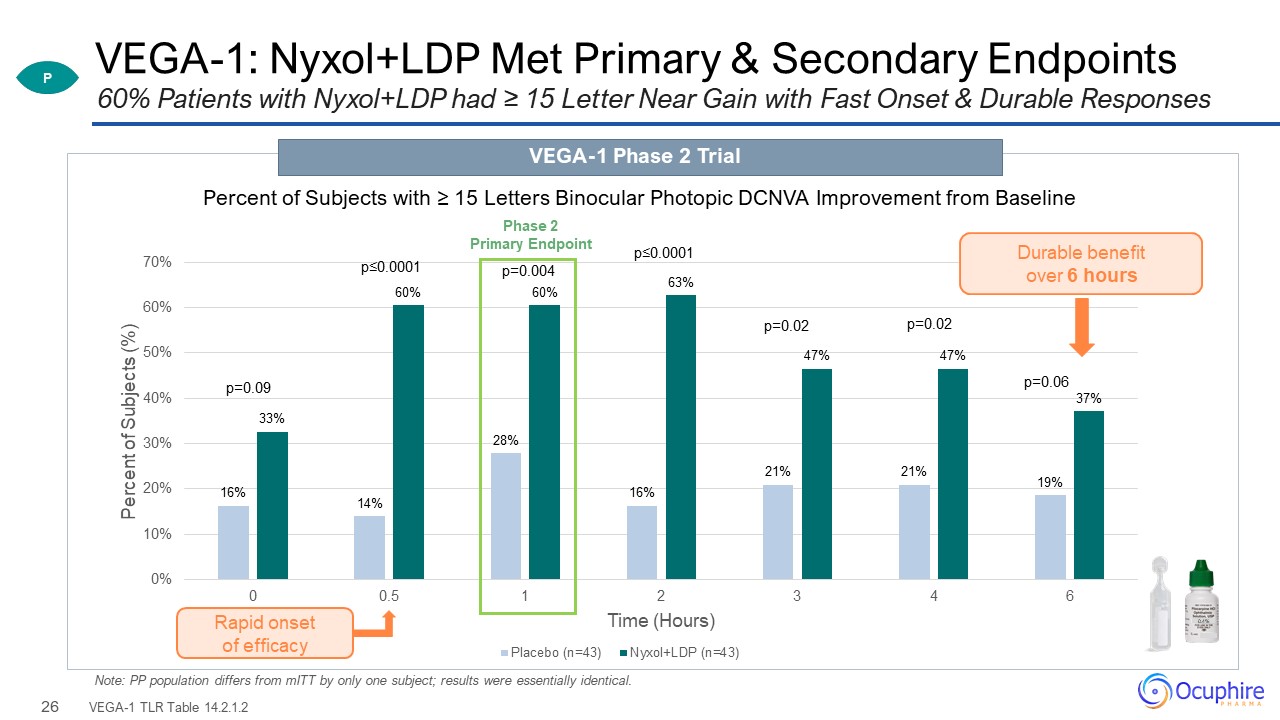

VEGA-1: Nyxol+LDP Met Primary & Secondary Endpoints VEGA-1 TLR Table 14.2.1.2 60% Patients with

Nyxol+LDP had ≥ 15 Letter Near Gain with Fast Onset & Durable Responses VEGA-1 Phase 2 Trial Note: PP population differs from mITT by only one subject; results were essentially

identical. P p=0.09 p≤0.0001 p=0.004 p≤0.0001 p=0.02 p=0.02 p=0.06 Rapid onset of efficacy Phase 2 Primary Endpoint Durable benefit over 6 hours Percent of Subjects with ≥ 15 Letters Binocular Photopic DCNVA Improvement from

Baseline 0.4%

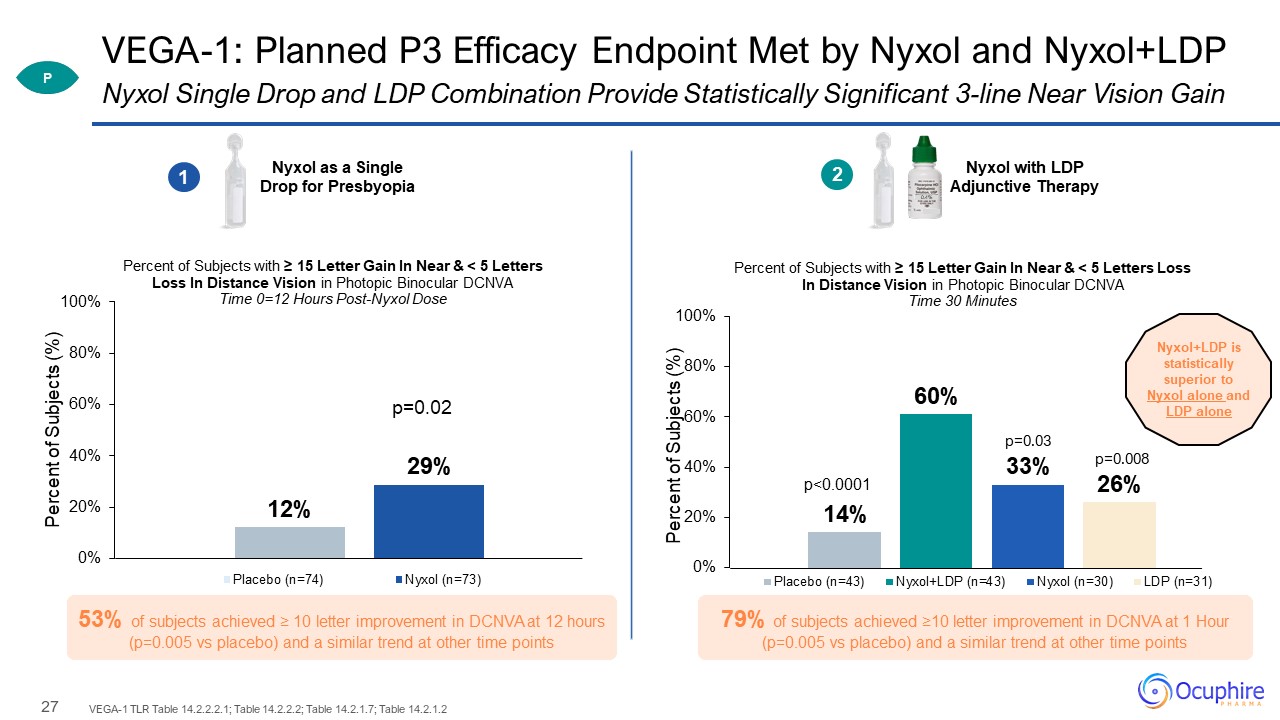

VEGA-1: Planned P3 Efficacy Endpoint Met by Nyxol and Nyxol+LDP VEGA-1 TLR Table 14.2.2.2.1; Table

14.2.2.2; Table 14.2.1.7; Table 14.2.1.2 Nyxol Single Drop and LDP Combination Provide Statistically Significant 3-line Near Vision Gain Nyxol as a Single Drop for Presbyopia Nyxol with LDP Adjunctive Therapy 1 0.4% 2 Nyxol+LDP is

statistically superior to Nyxol alone and LDP alone p<0.0001 p=0.03 p=0.008 P DCNVA Letters Gained 79% of subjects achieved ≥10 letter improvement in DCNVA at 1 Hour (p=0.005 vs placebo) and a similar trend at other time points 53%

of subjects achieved ≥ 10 letter improvement in DCNVA at 12 hours (p=0.005 vs placebo) and a similar trend at other time points

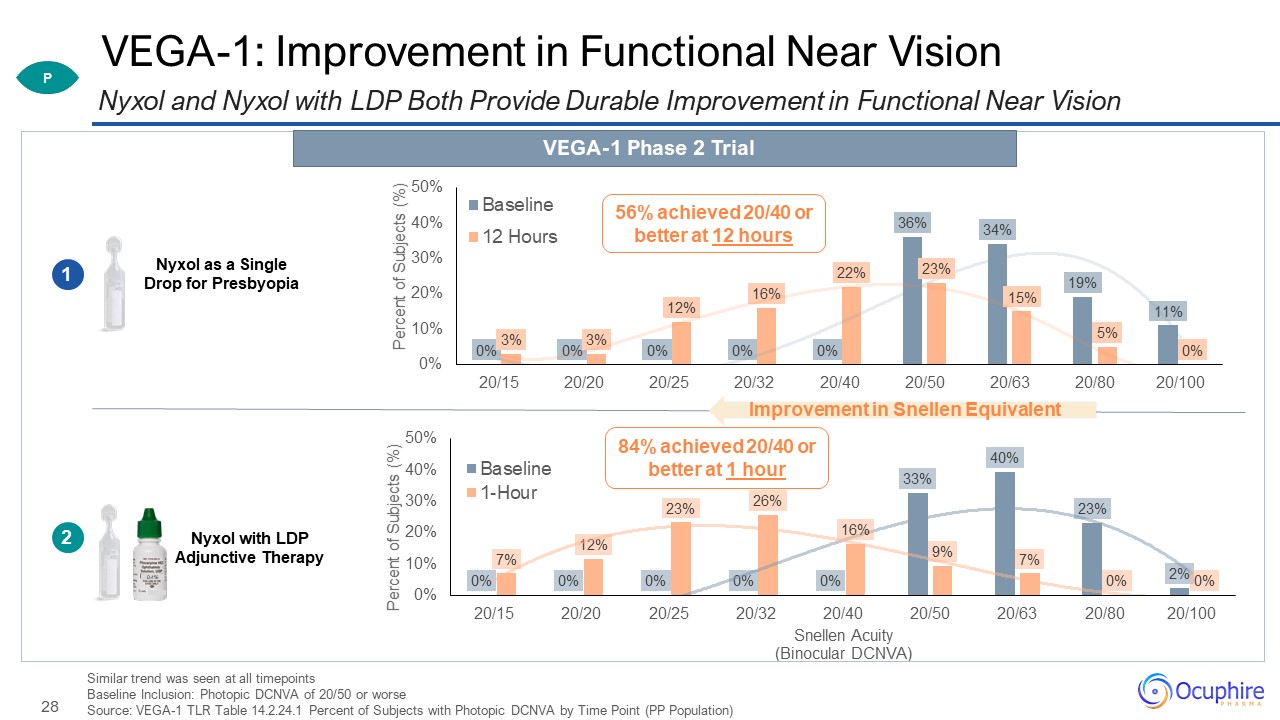

VEGA-1: Improvement in Functional Near Vision Similar trend was seen at all timepoints Baseline

Inclusion: Photopic DCNVA of 20/50 or worse Source: VEGA-1 TLR Table 14.2.24.1 Percent of Subjects with Photopic DCNVA by Time Point (PP Population) Nyxol and Nyxol with LDP Both Provide Durable Improvement in Functional Near Vision Nyxol

as a Single Drop for Presbyopia Nyxol with LDP Adjunctive Therapy 1 0.4% 2 56% achieved 20/40 or better at 12 hours 84% achieved 20/40 or better at 1 hour VEGA-1 Phase 2 Trial Improvement in Snellen Equivalent P

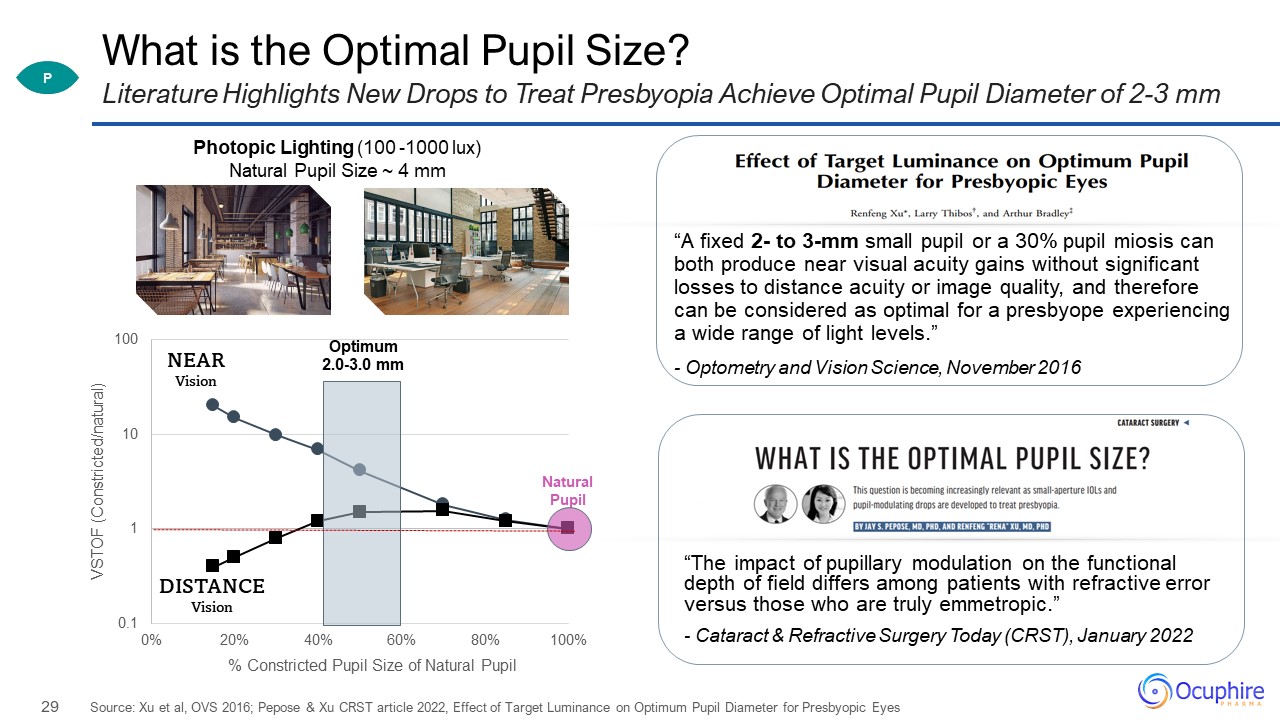

What is the Optimal Pupil Size? “A fixed 2- to 3-mm small pupil or a 30% pupil miosis can both produce

near visual acuity gains without significant losses to distance acuity or image quality, and therefore can be considered as optimal for a presbyope experiencing a wide range of light levels.” - Optometry and Vision Science, November

2016 Source: Xu et al, OVS 2016; Pepose & Xu CRST article 2022, Effect of Target Luminance on Optimum Pupil Diameter for Presbyopic Eyes Literature Highlights New Drops to Treat Presbyopia Achieve Optimal Pupil Diameter of 2-3

mm Photopic Lighting (100 -1000 lux) Natural Pupil Size ~ 4 mm DISTANCE Vision NEAR Vision “The impact of pupillary modulation on the functional depth of field differs among patients with refractive error versus those who are truly

emmetropic.” - Cataract & Refractive Surgery Today (CRST), January 2022 P

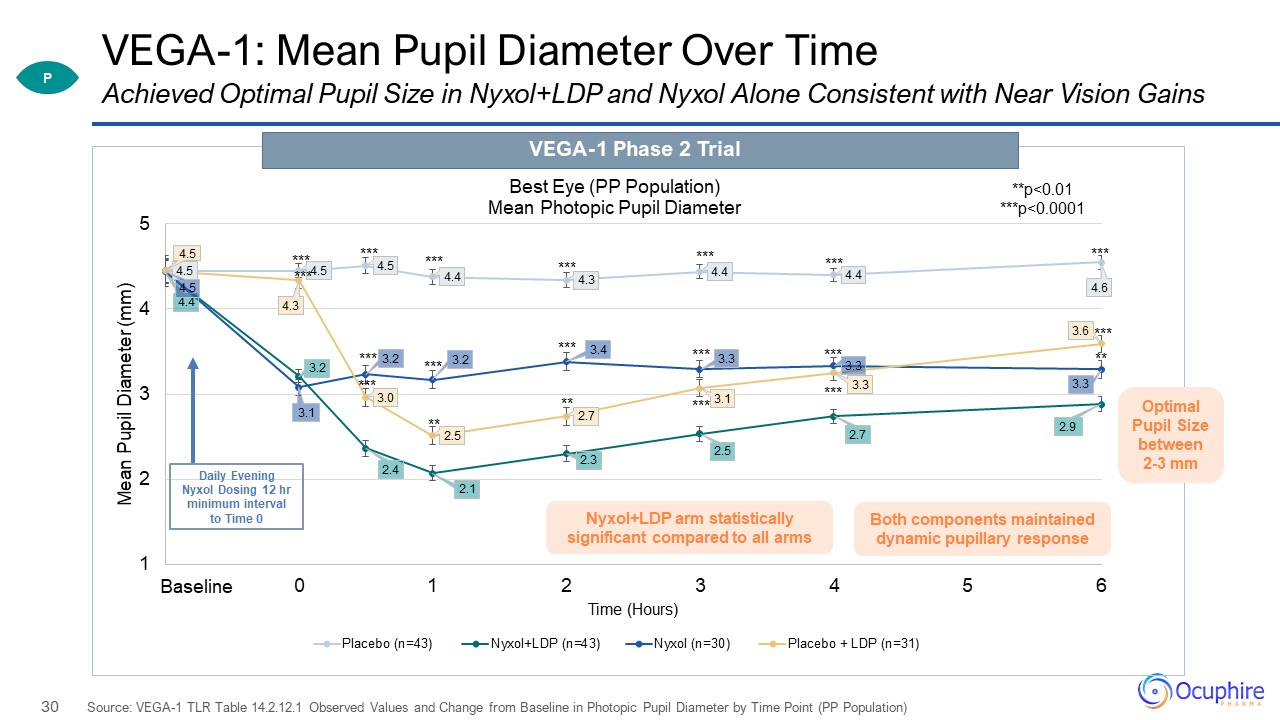

VEGA-1: Mean Pupil Diameter Over Time Source: VEGA-1 TLR Table 14.2.12.1 Observed Values and Change

from Baseline in Photopic Pupil Diameter by Time Point (PP Population) Achieved Optimal Pupil Size in Nyxol+LDP and Nyxol Alone Consistent with Near Vision Gains VEGA-1 Phase 2 Trial Daily Evening Nyxol Dosing 12 hr minimum interval to

Time 0 Nyxol+LDP arm statistically significant compared to all arms Both components maintained dynamic pupillary response P Optimal Pupil Size between 2-3 mm

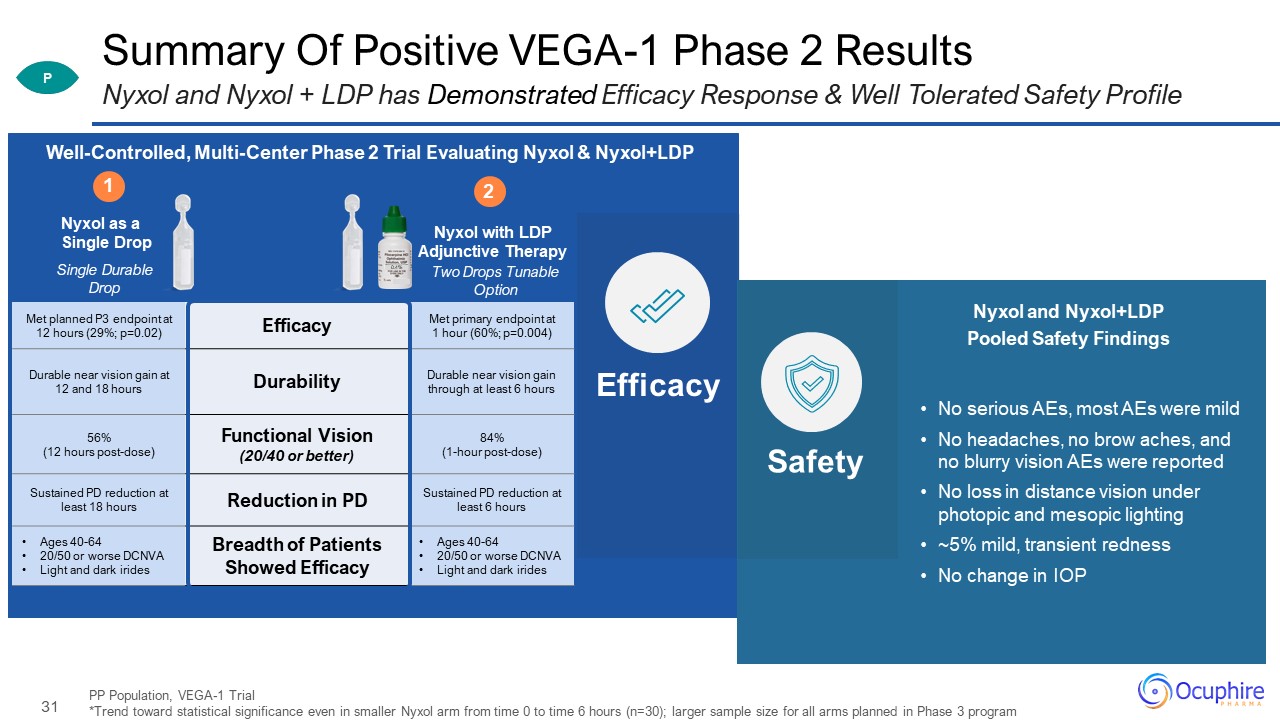

Met planned P3 endpoint at 12 hours (29%; p=0.02) Efficacy Met primary endpoint at 1 hour (60%;

p=0.004) Durable near vision gain at 12 and 18 hours Durability Durable near vision gain through at least 6 hours 56% (12 hours post-dose) Functional Vision (20/40 or better) 84% (1-hour post-dose) Sustained PD reduction at least

18 hours Reduction in PD Sustained PD reduction at least 6 hours Ages 40-64 20/50 or worse DCNVA Light and dark irides Breadth of Patients Showed Efficacy Ages 40-64 20/50 or worse DCNVA Light and dark irides Summary Of Positive

VEGA-1 Phase 2 Results PP Population, VEGA-1 Trial *Trend toward statistical significance even in smaller Nyxol arm from time 0 to time 6 hours (n=30); larger sample size for all arms planned in Phase 3 program Nyxol and Nyxol + LDP has

Demonstrated Efficacy Response & Well Tolerated Safety Profile P No serious AEs, most AEs were mild No headaches, no brow aches, and no blurry vision AEs were reported No loss in distance vision under photopic and mesopic

lighting ~5% mild, transient redness No change in IOP Single Durable Drop Nyxol as a Single Drop Two Drops Tunable Option Nyxol with LDP Adjunctive Therapy 1 0.4% 2 Well-Controlled, Multi-Center Phase 2 Trial Evaluating Nyxol &

Nyxol+LDP Efficacy Safety Nyxol and Nyxol+LDP Pooled Safety Findings

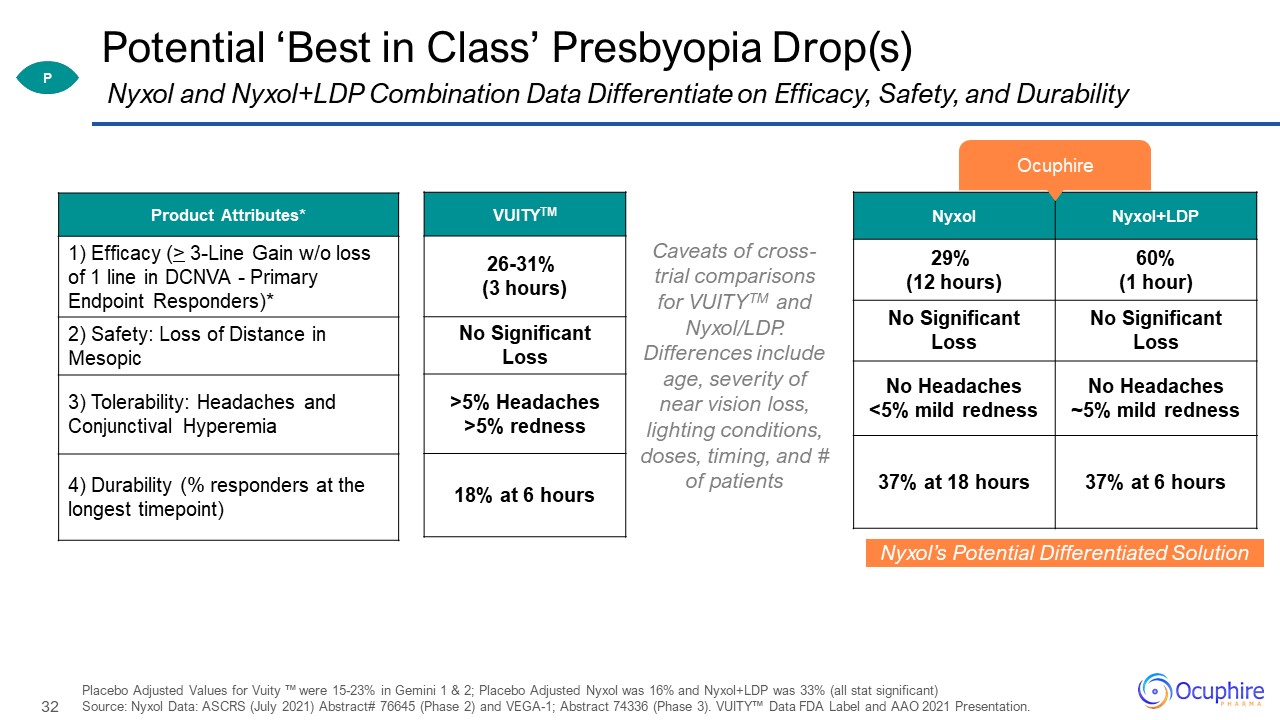

Potential ‘Best in Class’ Presbyopia Drop(s) Product Attributes* 1) Efficacy (> 3-Line Gain w/o

loss of 1 line in DCNVA - Primary Endpoint Responders)* 2) Safety: Loss of Distance in Mesopic 3) Tolerability: Headaches and Conjunctival Hyperemia 4) Durability (% responders at the longest timepoint) Placebo Adjusted Values for Vuity ™

were 15-23% in Gemini 1 & 2; Placebo Adjusted Nyxol was 16% and Nyxol+LDP was 33% (all stat significant) Source: Nyxol Data: ASCRS (July 2021) Abstract# 76645 (Phase 2) and VEGA-1; Abstract 74336 (Phase 3). VUITY™ Data FDA Label and AAO

2021 Presentation. Nyxol and Nyxol+LDP Combination Data Differentiate on Efficacy, Safety, and Durability Nyxol’s Potential Differentiated Solution Nyxol Nyxol+LDP 29% (12 hours) 60% (1 hour) No Significant Loss No Significant

Loss No Headaches <5% mild redness No Headaches ~5% mild redness 37% at 18 hours 37% at 6 hours VUITYTM 26-31% (3 hours) No Significant Loss >5% Headaches >5% redness 18% at 6 hours Caveats of cross-trial comparisons

for VUITYTM and Nyxol/LDP. Differences include age, severity of near vision loss, lighting conditions, doses, timing, and # of patients Ocuphire P

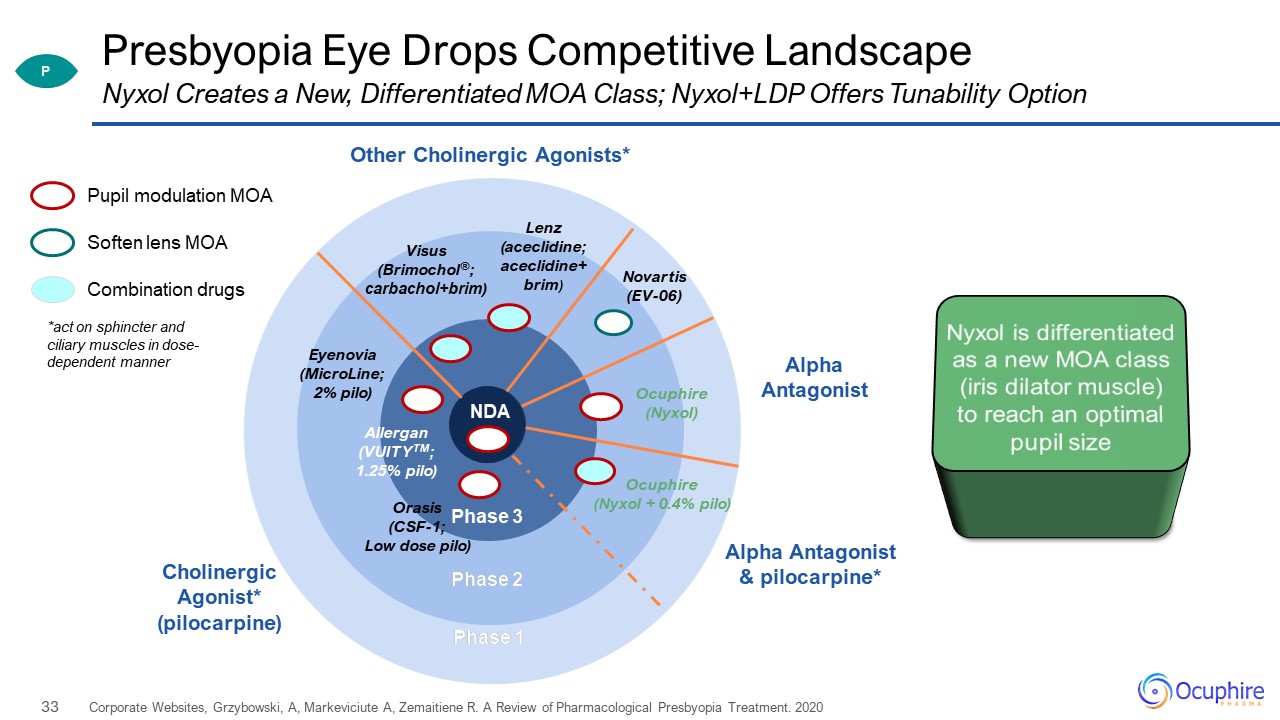

Phase 2 Phase 1 Presbyopia Eye Drops Competitive Landscape Corporate Websites, Grzybowski, A,

Markeviciute A, Zemaitiene R. A Review of Pharmacological Presbyopia Treatment. 2020 Pupil modulation MOA Combination drugs Soften lens MOA Phase 3 Phase 2 Phase 1 Allergan (VUITYTM; 1.25% pilo) Orasis (CSF-1; Low dose

pilo) Ocuphire (Nyxol + 0.4% pilo) Visus (Brimochol®; carbachol+brim) Other Cholinergic Agonists* Cholinergic Agonist* (pilocarpine) Lenz (aceclidine; aceclidine+brim) Eyenovia (MicroLine; 2% pilo) Novartis (EV-06) Alpha

Antagonist & pilocarpine* NDA *act on sphincter and ciliary muscles in dose-dependent manner Nyxol is differentiated as a new MOA class (iris dilator muscle) to reach an optimal pupil size Nyxol Creates a New, Differentiated

MOA Class; Nyxol+LDP Offers Tunability Option Ocuphire (Nyxol) Alpha Antagonist P

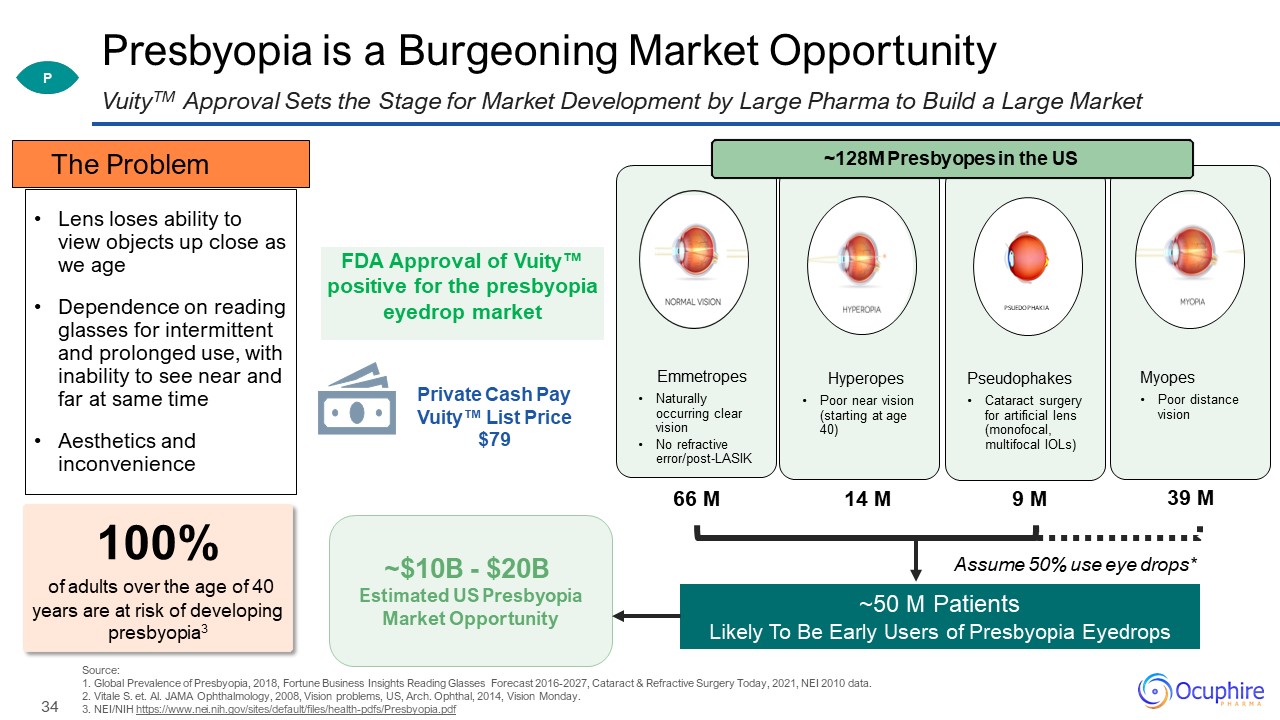

Presbyopia is a Burgeoning Market Opportunity Source: 1. Global Prevalence of Presbyopia, 2018,

Fortune Business Insights Reading Glasses Forecast 2016-2027, Cataract & Refractive Surgery Today, 2021, NEI 2010 data.2. Vitale S. et. Al. JAMA Ophthalmology, 2008, Vision problems, US, Arch. Ophthal, 2014, Vision Monday. 3. NEI/NIH

https://www.nei.nih.gov/sites/default/files/health-pdfs/Presbyopia.pdf VuityTM Approval Sets the Stage for Market Development by Large Pharma to Build a Large Market 100% of adults over the age of 40 years are at risk of developing

presbyopia3 P Assume 50% use eye drops* ~50 M Patients Likely To Be Early Users of Presbyopia Eyedrops Pseudophakes Cataract surgery for artificial lens (monofocal, multifocal IOLs) Hyperopes Poor near vision (starting at age

40) Emmetropes Naturally occurring clear vision No refractive error/post-LASIK Myopes Poor distance vision PSUEDOPHAKIA 66 M 14 M 39 M 9 M ~128M Presbyopes in the US Lens loses ability to view objects up close as we

age Dependence on reading glasses for intermittent and prolonged use, with inability to see near and far at same time Aesthetics and inconvenience The Problem FDA Approval of Vuity™ positive for the presbyopia eyedrop market Private Cash

Pay Vuity™ List Price $79 ~$10B - $20B Estimated US Presbyopia Market Opportunity

I’m no longer comfortable driving at night, especially with my son in the car. I have a hard time

playing beach volleyball in the evenings due to the bright lights at the courts. Post-LASIK, Age 42 35 NVD Nyxol® for Dim Light or Night Vision Disturbances

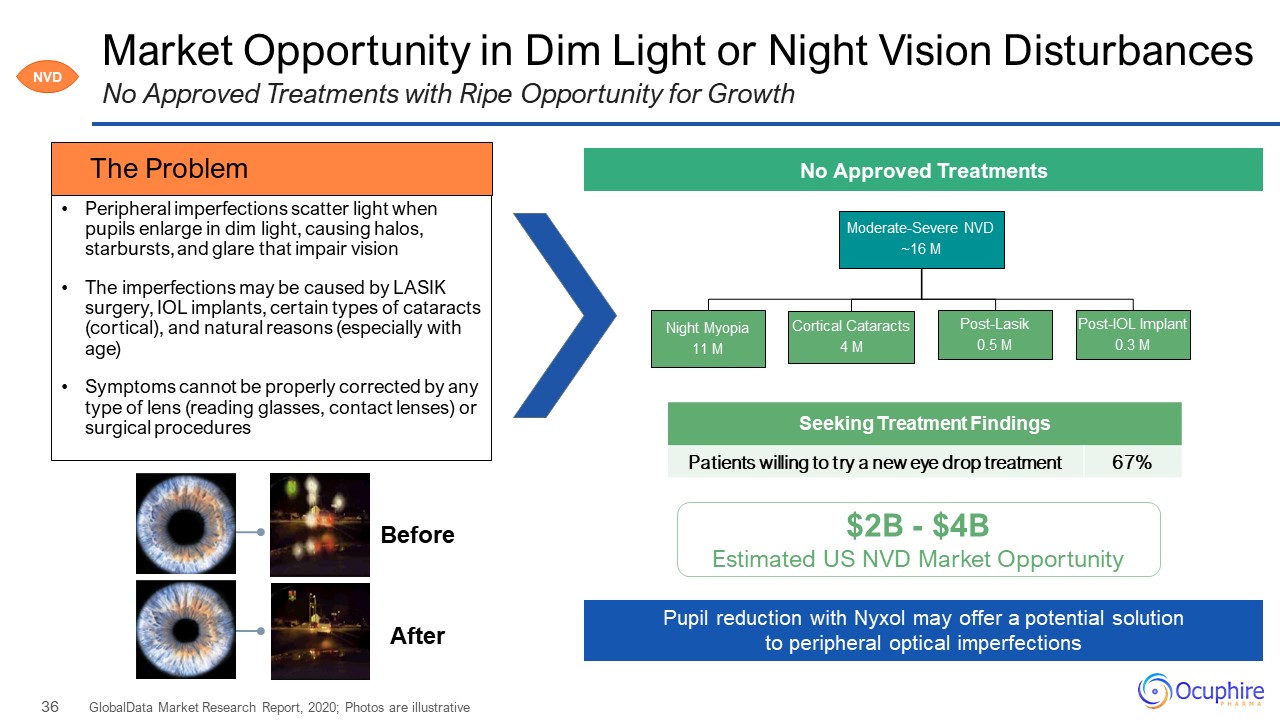

Market Opportunity in Dim Light or Night Vision Disturbances GlobalData Market Research Report, 2020;

Photos are illustrative No Approved Treatments with Ripe Opportunity for Growth NVD No Approved Treatments $2B - $4B Estimated US NVD Market Opportunity Peripheral imperfections scatter light when pupils enlarge in dim light, causing

halos, starbursts, and glare that impair vision The imperfections may be caused by LASIK surgery, IOL implants, certain types of cataracts (cortical), and natural reasons (especially with age) Symptoms cannot be properly corrected by any

type of lens (reading glasses, contact lenses) or surgical procedures The Problem Pupil reduction with Nyxol may offer a potential solution to peripheral optical imperfections After Before Seeking Treatment Findings Patients willing

to try a new eye drop treatment 67%

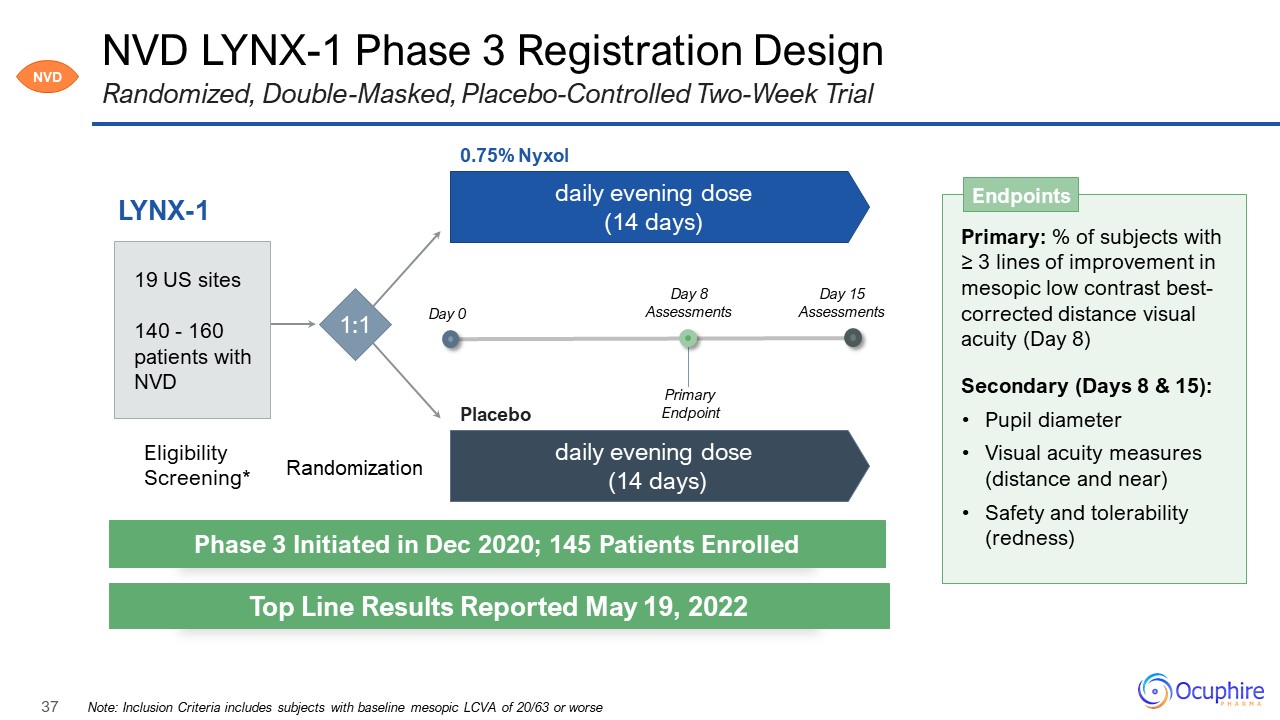

NVD LYNX-1 Phase 3 Registration Design Note: Inclusion Criteria includes subjects with baseline

mesopic LCVA of 20/63 or worse Randomized, Double-Masked, Placebo-Controlled Two-Week Trial LYNX-1 Primary: % of subjects with ≥ 3 lines of improvement in mesopic low contrast best-corrected distance visual acuity (Day 8) Secondary (Days

8 & 15): Pupil diameter Visual acuity measures (distance and near) Safety and tolerability (redness) Endpoints Eligibility Screening* Randomization 1:1 daily evening dose (14 days) daily evening dose (14 days) 0.75% Nyxol

Placebo 19 US sites 140 - 160 patients with NVD Phase 3 Initiated in Dec 2020; 145 Patients Enrolled Top Line Results Reported May 19, 2022 NVD Day 0 Day 8 Assessments Primary Endpoint Day 15 Assessments

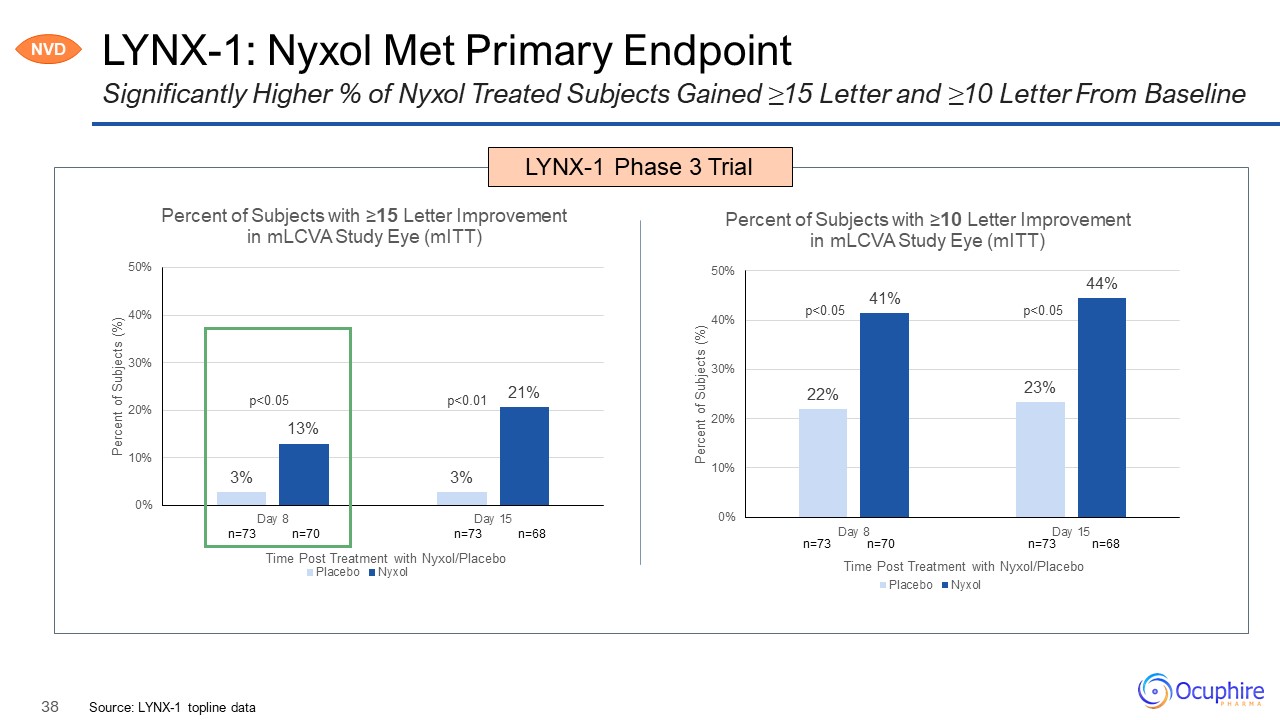

LYNX-1: Nyxol Met Primary Endpoint Source: LYNX-1 topline data Significantly Higher % of Nyxol

Treated Subjects Gained ≥15 Letter and ≥10 Letter From Baseline LYNX-1 Phase 3 Trial n=73 n=70 n=73 n=68 NVD p<0.05 p<0.01

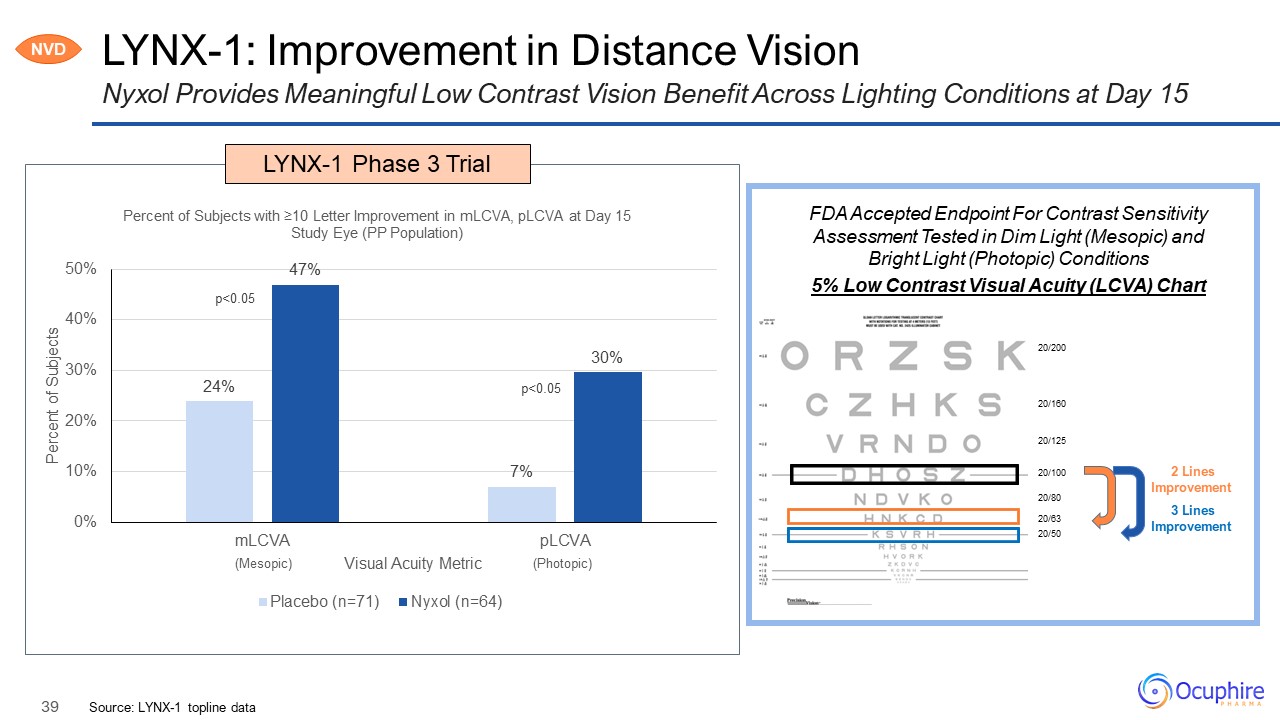

LYNX-1: Improvement in Distance Vision Source: LYNX-1 topline data Nyxol Provides Meaningful Low

Contrast Vision Benefit Across Lighting Conditions at Day 15 NVD p<0.05 p<0.05 LYNX-1 Phase 3 Trial 3 Lines Improvement FDA Accepted Endpoint For Contrast Sensitivity Assessment Tested in Dim Light (Mesopic) and Bright Light

(Photopic) Conditions 2 Lines Improvement 20/200 20/160 20/125 20/100 20/80 20/63. 20/50. (Mesopic) (Photopic) 5% Low Contrast Visual Acuity (LCVA) Chart

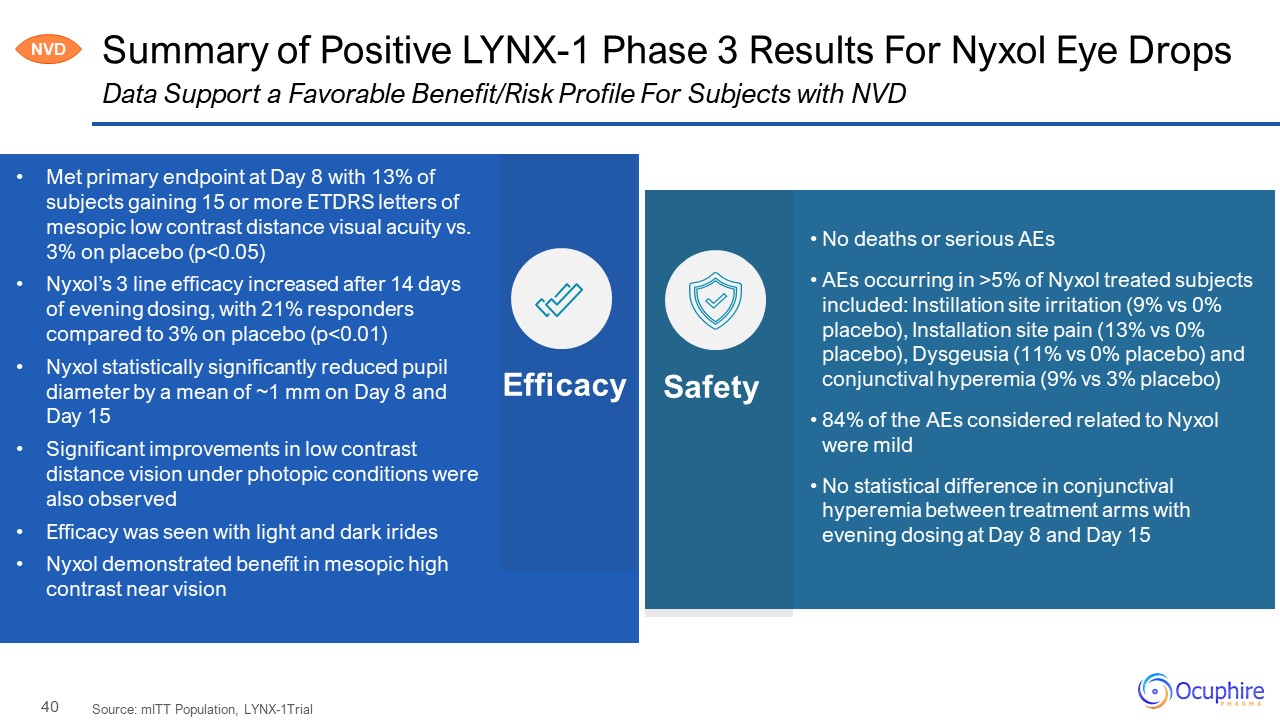

Summary of Positive LYNX-1 Phase 3 Results For Nyxol Eye Drops Source: mITT Population,

LYNX-1Trial Data Support a Favorable Benefit/Risk Profile For Subjects with NVD No deaths or serious AEs AEs occurring in >5% of Nyxol treated subjects included: Instillation site irritation (9% vs 0% placebo), Installation site pain

(13% vs 0% placebo), Dysgeusia (11% vs 0% placebo) and conjunctival hyperemia (9% vs 3% placebo) 84% of the AEs considered related to Nyxol were mild No statistical difference in conjunctival hyperemia between treatment arms with evening

dosing at Day 8 and Day 15 Efficacy Safety Met primary endpoint at Day 8 with 13% of subjects gaining 15 or more ETDRS letters of mesopic low contrast distance visual acuity vs. 3% on placebo (p<0.05) Nyxol’s 3 line efficacy increased

after 14 days of evening dosing, with 21% responders compared to 3% on placebo (p<0.01) Nyxol statistically significantly reduced pupil diameter by a mean of ~1 mm on Day 8 and Day 15 Significant improvements in low contrast distance

vision under photopic conditions were also observed Efficacy was seen with light and dark irides Nyxol demonstrated benefit in mesopic high contrast near vision NVD

DR DME 41 Diabetic Retinopathy Diabetic Macular Edema Apx3330 ORAL tablet

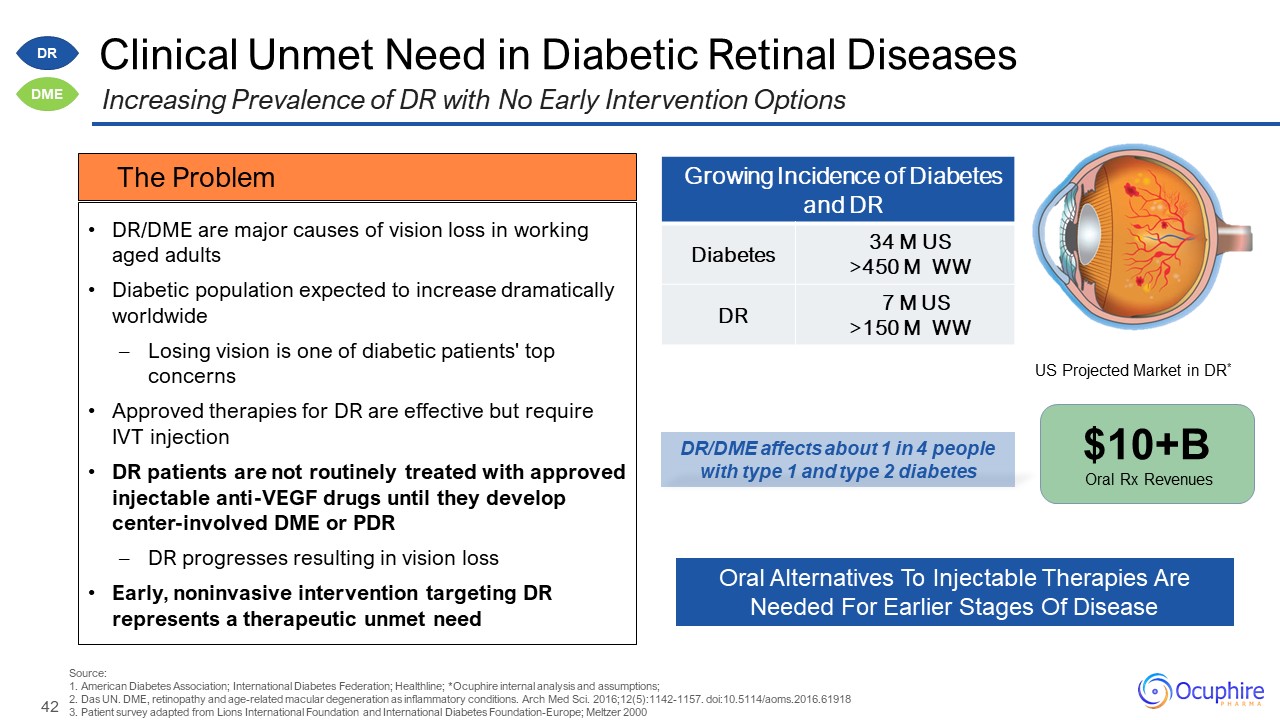

Growing Incidence of Diabetes and DR Diabetes 34 M US >450 M WW DR 7 M US >150 M

WW Clinical Unmet Need in Diabetic Retinal Diseases DR/DME are major causes of vision loss in working aged adults Diabetic population expected to increase dramatically worldwide Losing vision is one of diabetic patients' top

concerns Approved therapies for DR are effective but require IVT injection DR patients are not routinely treated with approved injectable anti-VEGF drugs until they develop center-involved DME or PDR DR progresses resulting in vision

loss Early, noninvasive intervention targeting DR represents a therapeutic unmet need Increasing Prevalence of DR with No Early Intervention Options DR DME Source:1. American Diabetes Association; International Diabetes Federation;

Healthline; *Ocuphire internal analysis and assumptions; 2. Das UN. DME, retinopathy and age-related macular degeneration as inflammatory conditions. Arch Med Sci. 2016;12(5):1142-1157. doi:10.5114/aoms.2016.61918 3. Patient survey adapted

from Lions International Foundation and International Diabetes Foundation-Europe; Meltzer 2000 DR/DME affects about 1 in 4 people with type 1 and type 2 diabetes Oral Alternatives To Injectable Therapies Are Needed For Earlier Stages Of

Disease $10+B Oral Rx Revenues US Projected Market in DR* The Problem

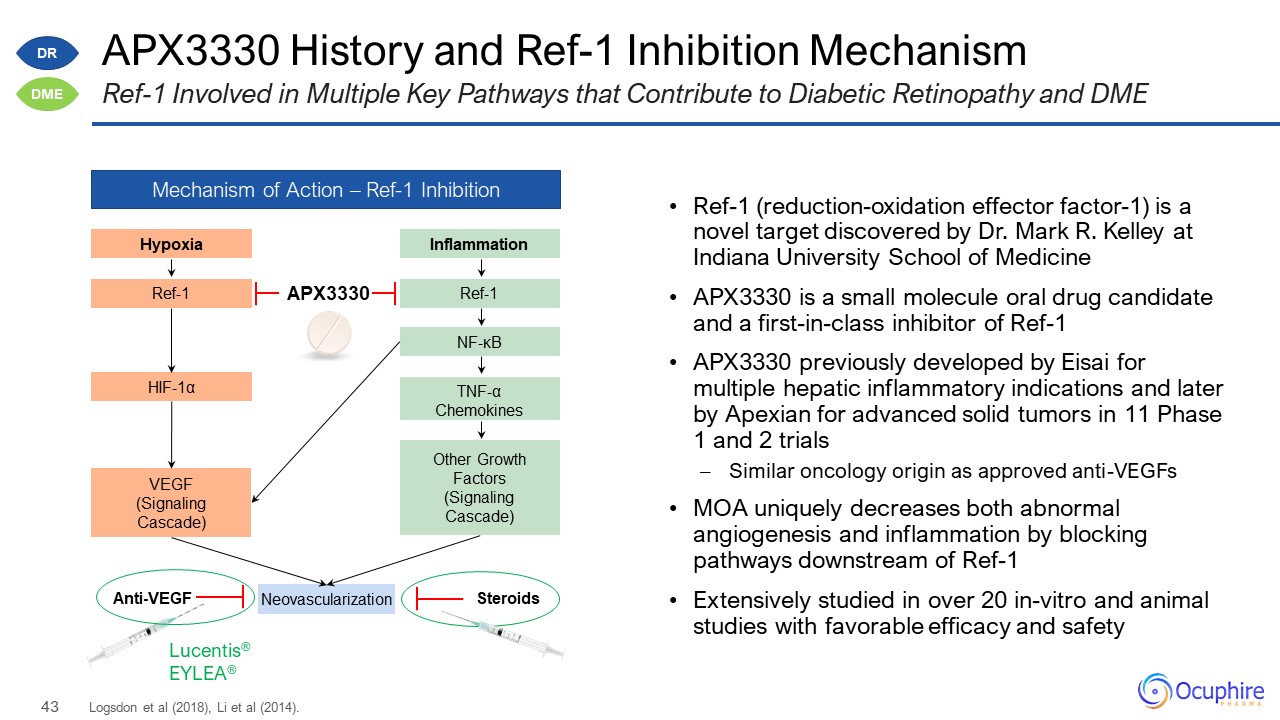

APX3330 History and Ref-1 Inhibition Mechanism Logsdon et al (2018), Li et al (2014). Ref-1 Involved

in Multiple Key Pathways that Contribute to Diabetic Retinopathy and DME Mechanism of Action – Ref-1 Inhibition Hypoxia Ref-1 HIF-1α VEGF (Signaling Cascade) Inflammation Ref-1 NF-κB Other Growth Factors (Signaling

Cascade) TNF-α Chemokines Neovascularization Lucentis® EYLEA® Anti-VEGF Steroids APX3330 Ref-1 (reduction-oxidation effector factor-1) is a novel target discovered by Dr. Mark R. Kelley at Indiana University School of

Medicine APX3330 is a small molecule oral drug candidate and a first-in-class inhibitor of Ref-1 APX3330 previously developed by Eisai for multiple hepatic inflammatory indications and later by Apexian for advanced solid tumors in 11 Phase

1 and 2 trials Similar oncology origin as approved anti-VEGFs MOA uniquely decreases both abnormal angiogenesis and inflammation by blocking pathways downstream of Ref-1 Extensively studied in over 20 in-vitro and animal studies with

favorable efficacy and safety DR DME

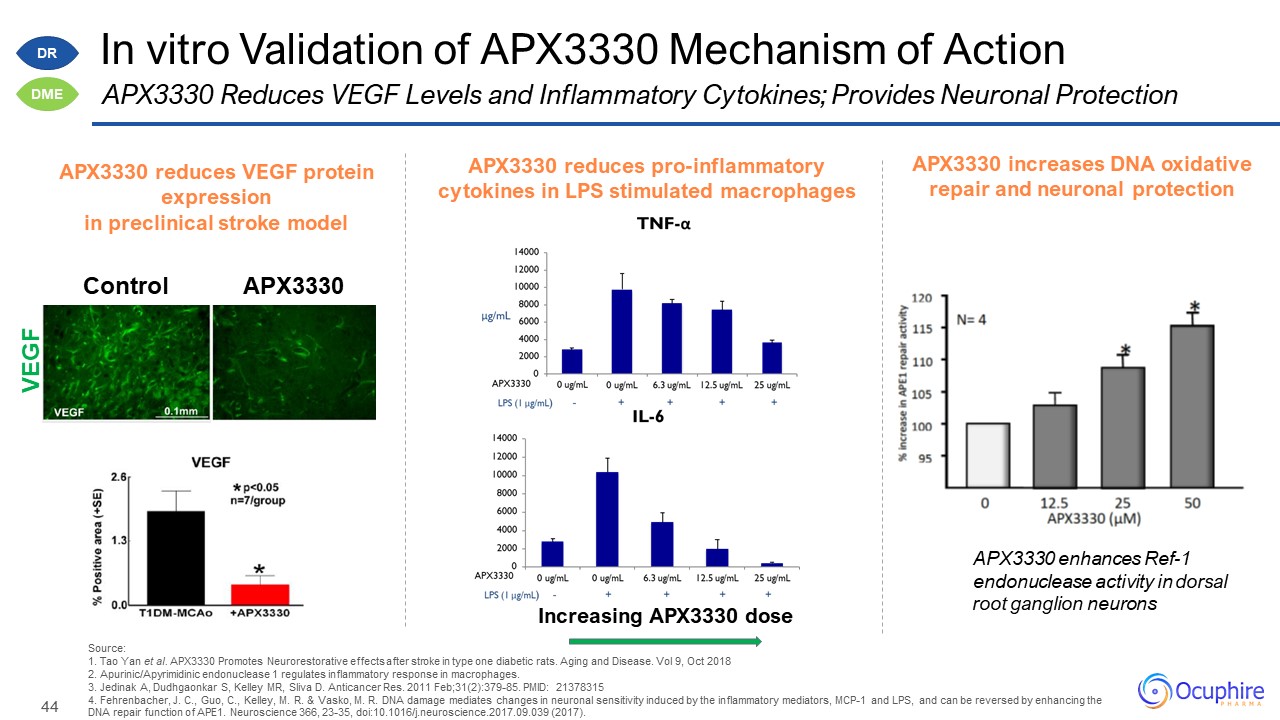

Source: 1. Tao Yan et al. APX3330 Promotes Neurorestorative effects after stroke in type one diabetic

rats. Aging and Disease. Vol 9, Oct 2018 2. Apurinic/Apyrimidinic endonuclease 1 regulates inflammatory response in macrophages. 3. Jedinak A, Dudhgaonkar S, Kelley MR, Sliva D. Anticancer Res. 2011 Feb;31(2):379-85. PMID: 21378315 4.

Fehrenbacher, J. C., Guo, C., Kelley, M. R. & Vasko, M. R. DNA damage mediates changes in neuronal sensitivity induced by the inflammatory mediators, MCP-1 and LPS, and can be reversed by enhancing the DNA repair function of APE1.

Neuroscience 366, 23-35, doi:10.1016/j.neuroscience.2017.09.039 (2017). APX3330 reduces VEGF protein expression in preclinical stroke model APX3330 reduces pro-inflammatory cytokines in LPS stimulated macrophages Increasing APX3330

dose VEGF Control APX3330 APX3330 increases DNA oxidative repair and neuronal protection APX3330 enhances Ref-1 endonuclease activity in dorsal root ganglion neurons In vitro Validation of APX3330 Mechanism of Action APX3330 Reduces

VEGF Levels and Inflammatory Cytokines; Provides Neuronal Protection DR DME

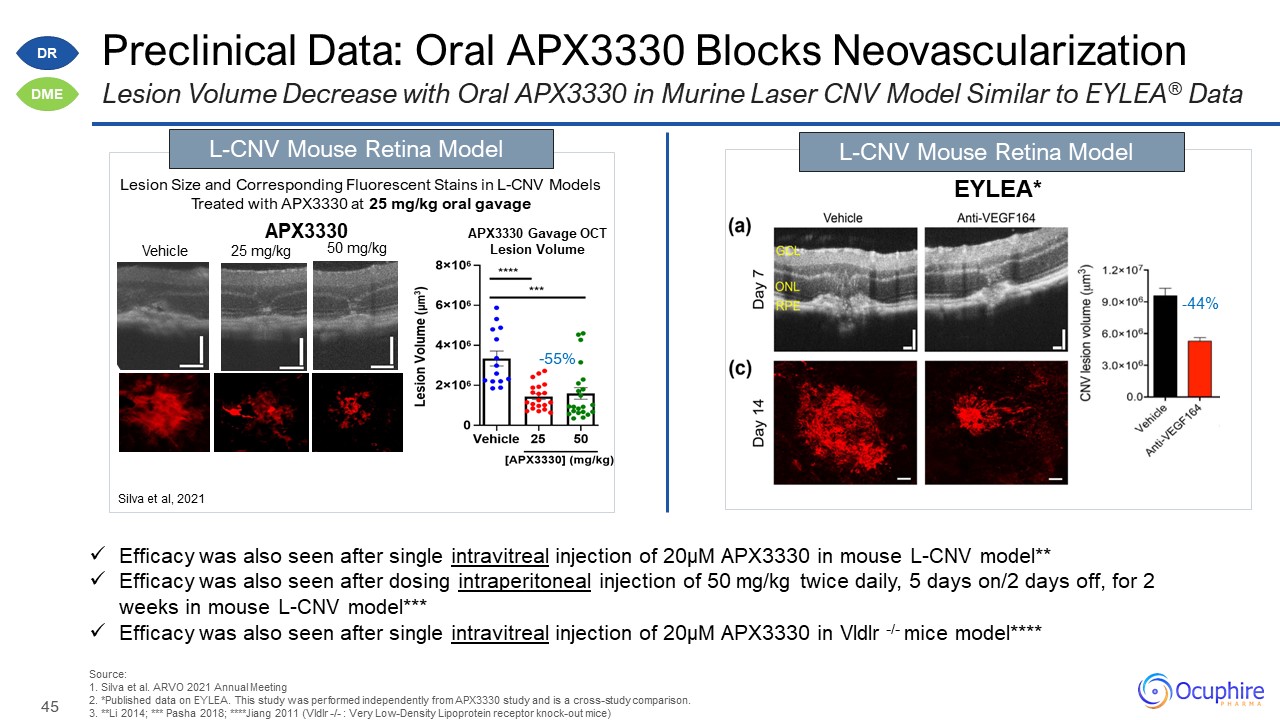

Preclinical Data: Oral APX3330 Blocks Neovascularization Source:1. Silva et al. ARVO 2021 Annual

Meeting 2. *Published data on EYLEA. This study was performed independently from APX3330 study and is a cross-study comparison. 3. **Li 2014; *** Pasha 2018; ****Jiang 2011 (Vldlr -/- : Very Low-Density Lipoprotein receptor knock-out

mice) Lesion Volume Decrease with Oral APX3330 in Murine Laser CNV Model Similar to EYLEA® Data EYLEA* Lesion Size and Corresponding Fluorescent Stains in L-CNV Models Treated with APX3330 at 25 mg/kg oral gavage -55% L-CNV Mouse Retina

Model Silva et al, 2021 Vehicle 25 mg/kg 50 mg/kg APX3330 Gavage OCT Lesion Volume L-CNV Mouse Retina Model APX3330 Efficacy was also seen after single intravitreal injection of 20µM APX3330 in mouse L-CNV model** Efficacy was

also seen after dosing intraperitoneal injection of 50 mg/kg twice daily, 5 days on/2 days off, for 2 weeks in mouse L-CNV model*** Efficacy was also seen after single intravitreal injection of 20µM APX3330 in Vldlr -/- mice

model**** -44% DR DME

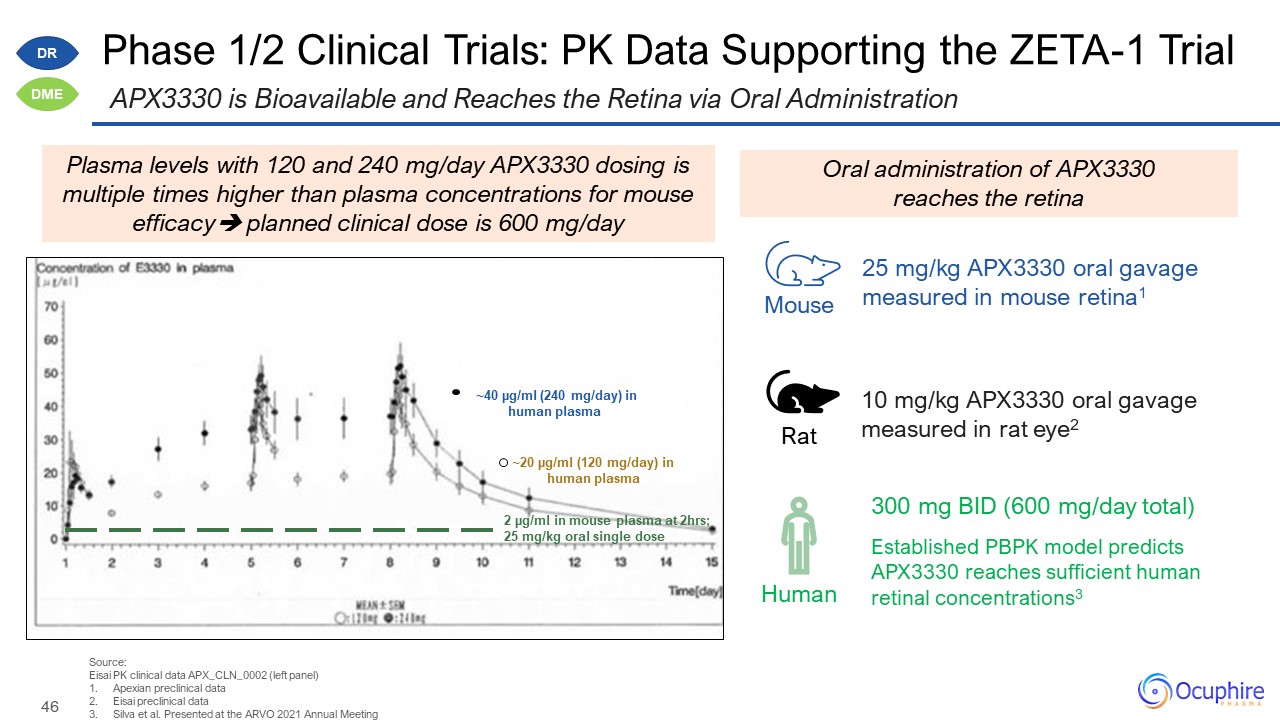

Phase 1/2 Clinical Trials: PK Data Supporting the ZETA-1 Trial Source: Eisai PK clinical data

APX_CLN_0002 (left panel) Apexian preclinical data Eisai preclinical data Silva et al. Presented at the ARVO 2021 Annual Meeting APX3330 is Bioavailable and Reaches the Retina via Oral Administration Human Mouse Rat 10 mg/kg APX3330

oral gavage measured in rat eye2 Established PBPK model predicts APX3330 reaches sufficient human retinal concentrations3 300 mg BID (600 mg/day total) 25 mg/kg APX3330 oral gavage measured in mouse retina1 Oral administration of APX3330

reaches the retina DR DME 2 µg/ml in mouse plasma at 2hrs; 25 mg/kg oral single dose ~20 µg/ml (120 mg/day) in human plasma ~40 µg/ml (240 mg/day) in human plasma Plasma levels with 120 and 240 mg/day APX3330 dosing is multiple times

higher than plasma concentrations for mouse efficacy planned clinical dose is 600 mg/day

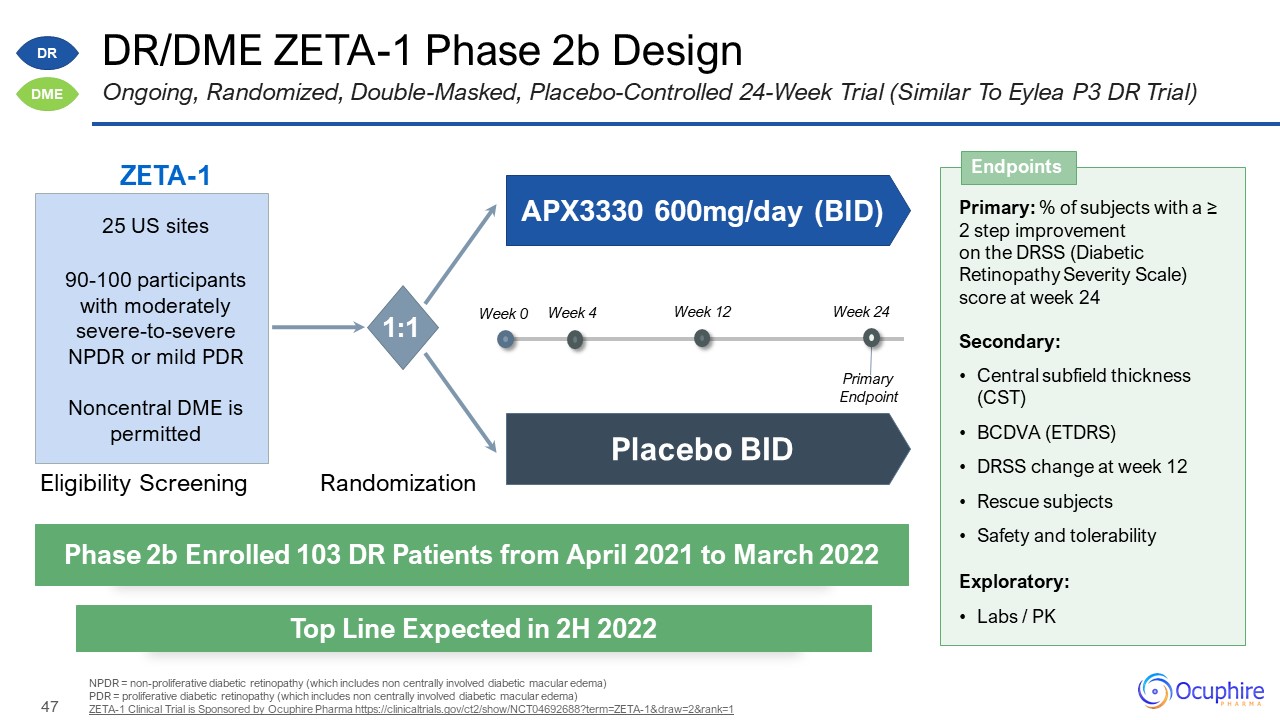

DR/DME ZETA-1 Phase 2b Design NPDR = non-proliferative diabetic retinopathy (which includes non

centrally involved diabetic macular edema) PDR = proliferative diabetic retinopathy (which includes non centrally involved diabetic macular edema) ZETA-1 Clinical Trial is Sponsored by Ocuphire Pharma

https://clinicaltrials.gov/ct2/show/NCT04692688?term=ZETA-1&draw=2&rank=1 Ongoing, Randomized, Double-Masked, Placebo-Controlled 24-Week Trial (Similar To Eylea P3 DR Trial) Primary: % of subjects with a ≥ 2 step improvement on the

DRSS (Diabetic Retinopathy Severity Scale) score at week 24 Secondary: Central subfield thickness (CST) BCDVA (ETDRS) DRSS change at week 12 Rescue subjects Safety and tolerability Exploratory: Labs / PK Endpoints Phase 2b Enrolled

103 DR Patients from April 2021 to March 2022 Top Line Expected in 2H 2022 ZETA-1 Eligibility Screening Randomization APX3330 600mg/day (BID) Placebo BID 25 US sites 90-100 participants with moderately severe-to-severe NPDR or mild

PDR Noncentral DME is permitted 1:1 Week 0 Week 12 Week 24 Week 4 Primary Endpoint DR DME

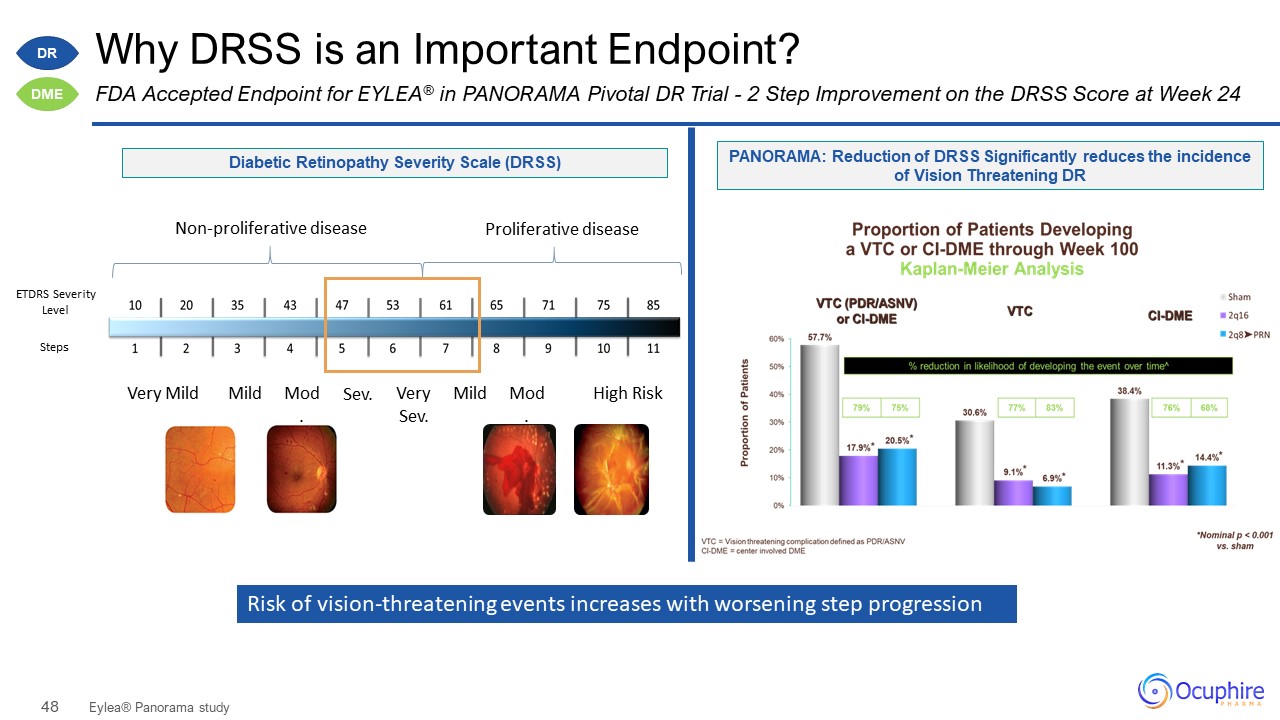

Why DRSS is an Important Endpoint? Eylea® Panorama study FDA Accepted Endpoint for EYLEA® in PANORAMA

Pivotal DR Trial - 2 Step Improvement on the DRSS Score at Week 24 ETDRS Severity Level Steps Very Mild Mild Mod. Sev. VerySev. Mild Mod. High Risk Non-proliferative disease Proliferative disease PANORAMA: Reduction of DRSS

Significantly reduces the incidence of Vision Threatening DR Diabetic Retinopathy Severity Scale (DRSS) Risk of vision-threatening events increases with worsening step progression DR DME

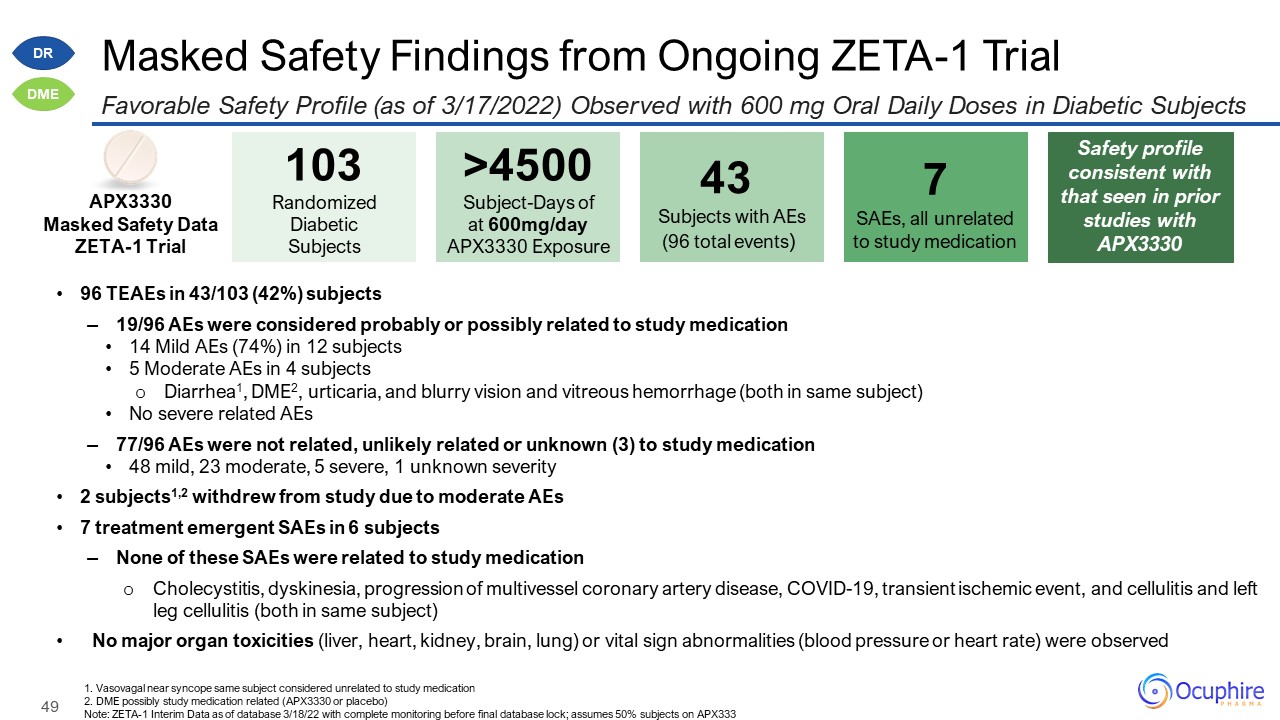

Masked Safety Findings from Ongoing ZETA-1 Trial Favorable Safety Profile (as of 3/17/2022) Observed

with 600 mg Oral Daily Doses in Diabetic Subjects 103 Randomized Diabetic Subjects >4500Subject-Days of at 600mg/day APX3330 Exposure 43 Subjects with AEs (96 total events) APX3330 Masked Safety Data ZETA-1 Trial 7 SAEs,

all unrelated to study medication 1. Vasovagal near syncope same subject considered unrelated to study medication 2. DME possibly study medication related (APX3330 or placebo) Note: ZETA-1 Interim Data as of database 3/18/22 with complete

monitoring before final database lock; assumes 50% subjects on APX333 96 TEAEs in 43/103 (42%) subjects 19/96 AEs were considered probably or possibly related to study medication 14 Mild AEs (74%) in 12 subjects 5 Moderate AEs in 4

subjects Diarrhea1, DME2, urticaria, and blurry vision and vitreous hemorrhage (both in same subject) No severe related AEs 77/96 AEs were not related, unlikely related or unknown (3) to study medication 48 mild, 23 moderate, 5 severe, 1

unknown severity 2 subjects1,2 withdrew from study due to moderate AEs 7 treatment emergent SAEs in 6 subjects None of these SAEs were related to study medication Cholecystitis, dyskinesia, progression of multivessel coronary artery

disease, COVID-19, transient ischemic event, and cellulitis and left leg cellulitis (both in same subject) No major organ toxicities (liver, heart, kidney, brain, lung) or vital sign abnormalities (blood pressure or heart rate) were

observed Safety profile consistent with that seen in prior studies with APX3330 DR DME

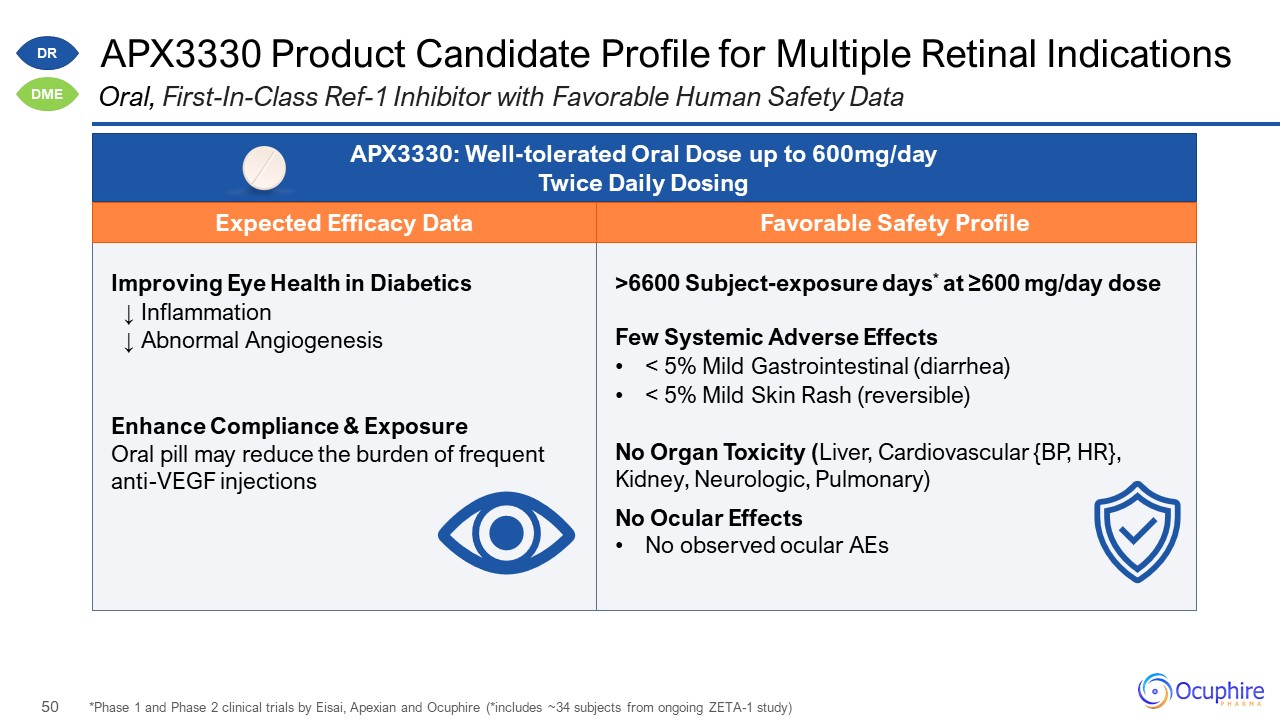

Improving Eye Health in Diabetics ↓ Inflammation ↓ Abnormal Angiogenesis Enhance Compliance &

Exposure Oral pill may reduce the burden of frequent anti-VEGF injections >6600 Subject-exposure days* at ≥600 mg/day dose Few Systemic Adverse Effects < 5% Mild Gastrointestinal (diarrhea) < 5% Mild Skin Rash (reversible) No

Organ Toxicity (Liver, Cardiovascular {BP, HR}, Kidney, Neurologic, Pulmonary) No Ocular Effects No observed ocular AEs APX3330 Product Candidate Profile for Multiple Retinal Indications *Phase 1 and Phase 2 clinical trials by Eisai,

Apexian and Ocuphire (*includes ~34 subjects from ongoing ZETA-1 study) Oral, First-In-Class Ref-1 Inhibitor with Favorable Human Safety Data APX3330: Well-tolerated Oral Dose up to 600mg/day Twice Daily Dosing DR DME Expected Efficacy

Data Favorable Safety Profile

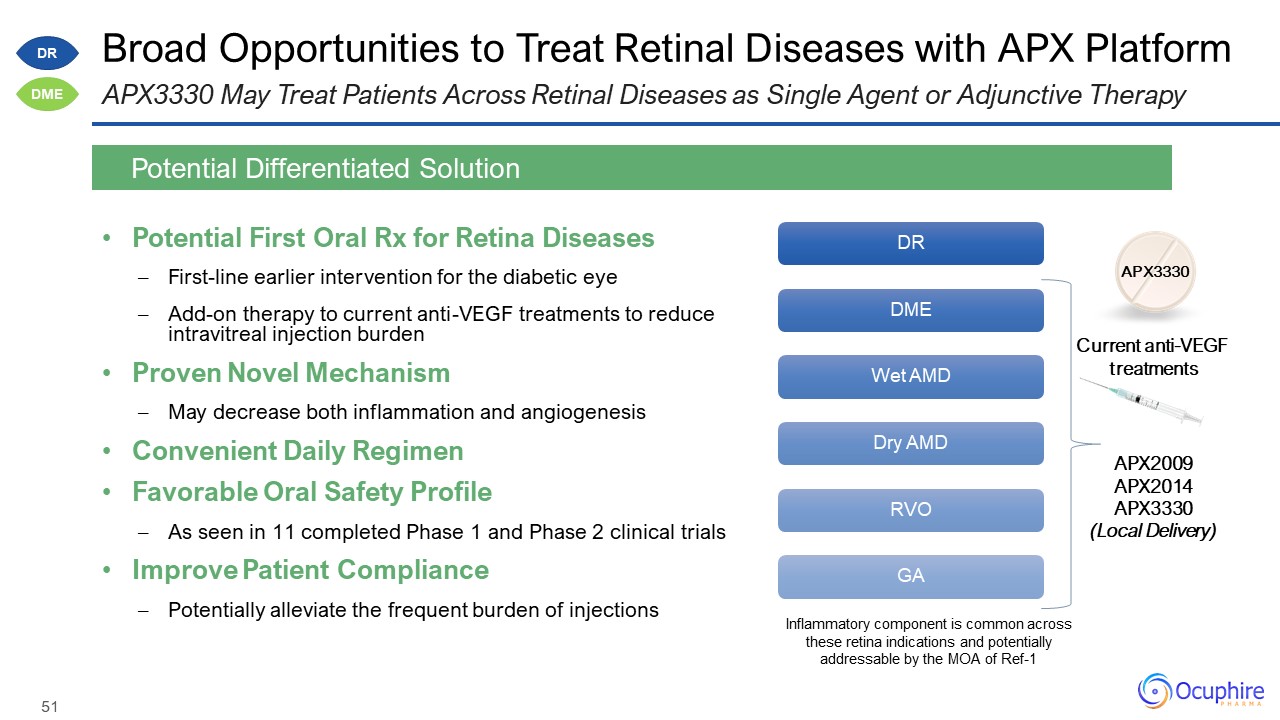

Broad Opportunities to Treat Retinal Diseases with APX Platform Potential First Oral Rx for Retina

Diseases First-line earlier intervention for the diabetic eye Add-on therapy to current anti-VEGF treatments to reduce intravitreal injection burden Proven Novel Mechanism May decrease both inflammation and angiogenesis Convenient Daily

Regimen Favorable Oral Safety Profile As seen in 11 completed Phase 1 and Phase 2 clinical trials Improve Patient Compliance Potentially alleviate the frequent burden of injections Potential Differentiated Solution APX3330 May Treat

Patients Across Retinal Diseases as Single Agent or Adjunctive Therapy APX3330 Current anti-VEGF treatments APX2009 APX2014 APX3330 (Local Delivery) DR DME Inflammatory component is common across these retina indications and

potentially addressable by the MOA of Ref-1

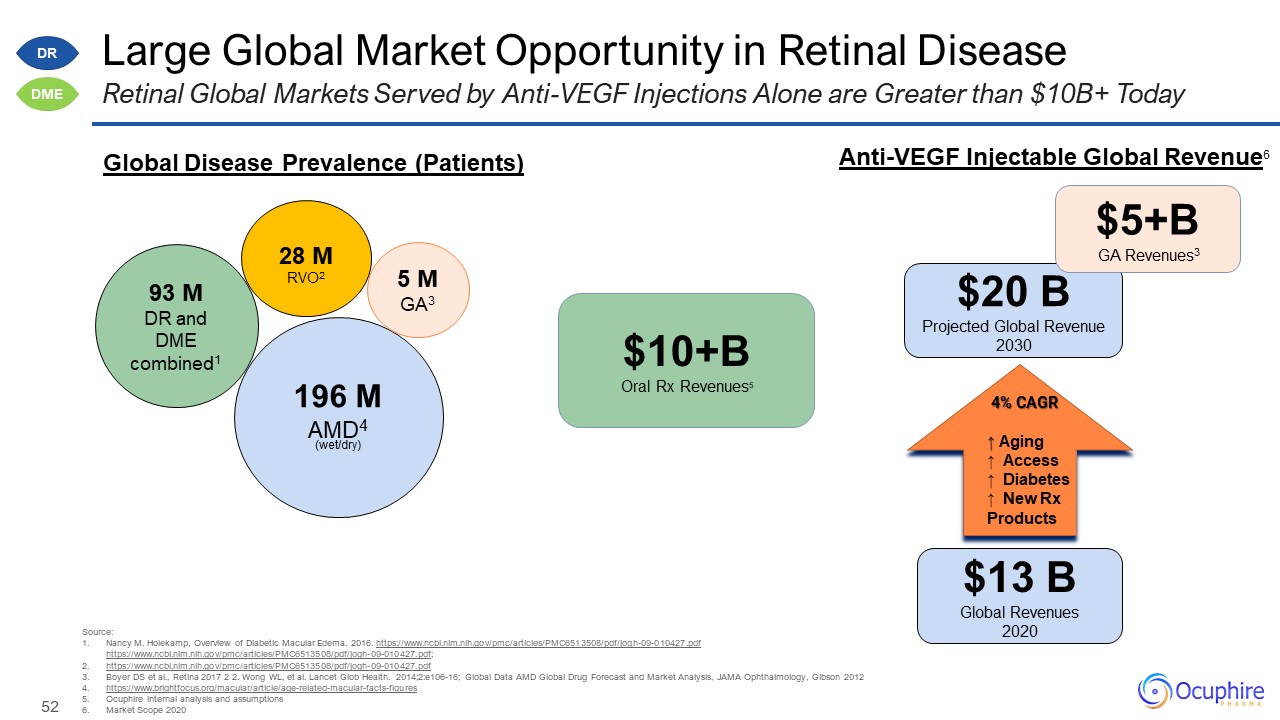

Large Global Market Opportunity in Retinal Disease Source: Nancy M. Holekamp, Overview of Diabetic

Macular Edema, 2016.

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6513508/pdf/jogh-09-010427.pdfhttps://www.ncbi.nlm.nih.gov/pmc/articles/PMC6513508/pdf/jogh-09-010427.pdf; https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6513508/pdf/jogh-09-010427.pdf Boyer DS et

al., Retina 2017 2 2. Wong WL, et al. Lancet Glob Health. 2014;2:e106-16; Global Data AMD Global Drug Forecast and Market Analysis, JAMA Ophthalmology, Gibson

2012 https://www.brightfocus.org/macular/article/age-related-macular-facts-figures Ocuphire internal analysis and assumptions Market Scope 2020 Retinal Global Markets Served by Anti-VEGF Injections Alone are Greater than $10B+ Today 196

MAMD4 (wet/dry) 93 MDR and DME combined1 5 M GA3 28 MRVO2 4% CAGR ↑ Aging ↑ Access ↑ Diabetes ↑ New Rx Products $13 BGlobal Revenues 2020 $20 B Projected Global Revenue 2030 Global Disease Prevalence (Patients) Anti-VEGF

Injectable Global Revenue6 $10+B Oral Rx Revenues5 $5+B GA Revenues3 DR DME

Team/Boards, Milestones, and Financial Data

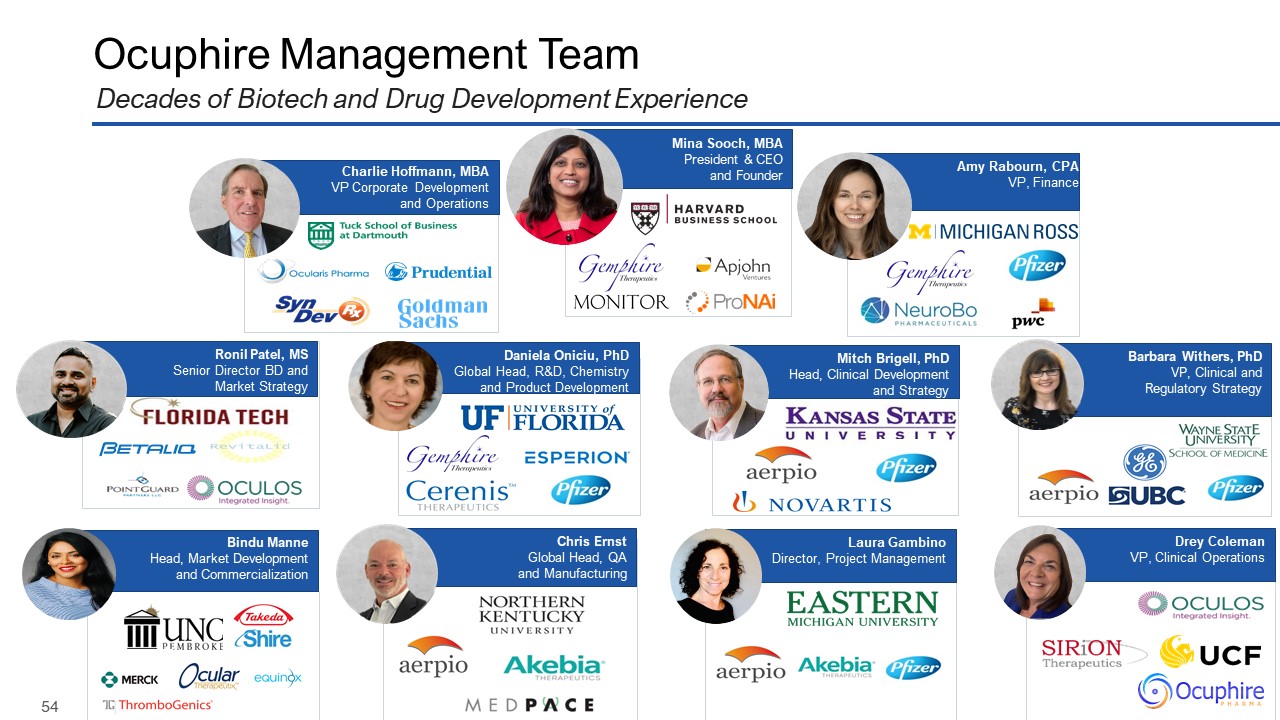

Ocuphire Management Team Decades of Biotech and Drug Development Experience Mina Sooch,

MBA President & CEO and Founder Drey ColemanVP, Clinical Operations Amy Rabourn, CPA VP, Finance Charlie Hoffmann, MBA VP Corporate Development and Operations Mitch Brigell, PhD Head, Clinical Development and

Strategy Daniela Oniciu, PhD Global Head, R&D, Chemistry and Product Development Ronil Patel, MS Senior Director BD and Market Strategy Chris Ernst Global Head, QA and Manufacturing Barbara Withers, PhDVP, Clinical and

Regulatory Strategy Bindu Manne Head, Market Development and Commercialization Laura Gambino Director, Project Management

Ocuphire's World-Class Medical Advisory Board Fortunate for the Insights of Leading KOLs & Drug

Candidate Co-Founders James Katz, MD University of Illinois Jay Pepose, MD, PhD UCLA School of Medicine Thomas Samuelson, MD University of Minnesota Paul Karpecki, OD Indiana University Eliot Lazar, MD Georgetown

University Marguerite McDonald, MD Columbia University David Boyer, MD Chicago Medical School Mark Kelley, PhD Indiana University Co-Founder Apexian/APX3330 elCON Medical Michael Allingham, MD, PhD University of North

Carolina Peter Kaiser, MD Harvard Medical School Jeffrey Heier, MD Boston University Y. Ralph Chu, MD Northwestern University Douglas Devries, OD University of Nevada David Brown, MD Baylor University Mitch Jackson, MD University

of Chicago Ed Holland, MD Loyola University Chicago Jack Holladay, MD University of Texas David Lally, MD Vanderbilt University Refractive Specialist Refractive Specialist Refractive Specialist Refractive Specialist Refractive

Specialist Retinal Specialist Retinal Specialist Retinal Specialist Retinal Specialist Retinal Specialist Refractive Specialist Refractive Specialist Refractive Specialist Retinal Specialist Optometry Optometry Refractive

Specialist

Ocuphire Board of Directors Sean Ainsworth, MBA Lead Independent Director, Board Director James

Manuso, PhD/MBA Board Director Jay Pepose, MD, PhD Board Director Richard Rodgers, MBA Board Director Susan Benton, MBA Board Director Cam Gallagher, MBA Chair, Board Director Mina Sooch, MBA Vice-Chair, Board Director

President & CEO Seasoned Directors with Decades of Drug Development, M&A/Financings, and Ophthalmology

Track Record of Achieving Milestones Exciting 2022 News Cadence Ongoing Partnering Discussions with

Leading Ophthalmic Companies (including European and Asian Players) 2021 2022 Report Positive Nyxol Alone Phase 2 Data for Presbyopia Report 2nd Phase 3 Data for RM (MIRA-3) Report Pediatric Data for RM (MIRA-4) Report Phase 3

Data for NVD (LYNX-1) Submit Nyxol NDA for RM Report Phase 2 Data for DR/DME (ZETA-1) Initiate VEGA Phase 3 Presbyopia Program Multiple Late-Stage Data Catalysts Expected in 2022 for Potential First NDA Approval in 2023

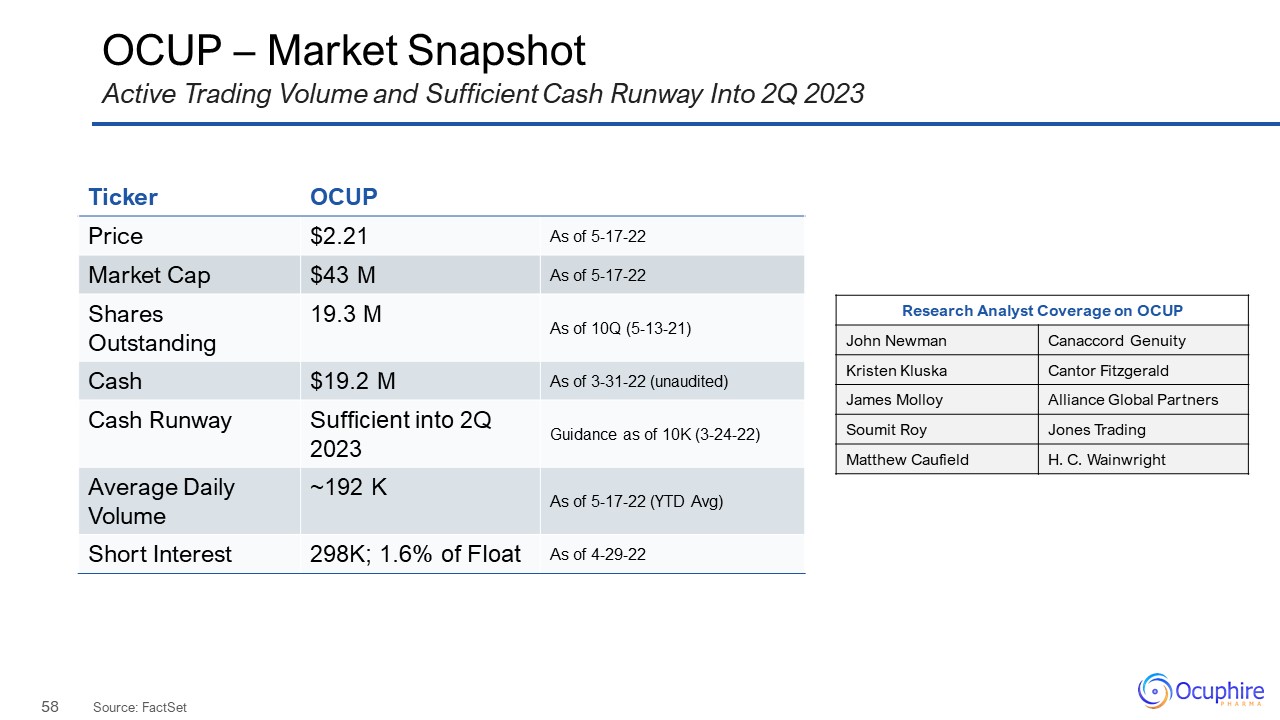

OCUP – Market Snapshot Source: FactSet Active Trading Volume and Sufficient Cash Runway Into 2Q 2023

Ticker OCUP Price $2.21 As of 5-17-22 Market Cap $43 M As of 5-17-22 Shares Outstanding 19.3 M As of 10Q (5-13-21) Cash $19.2 M As of 3-31-22 (unaudited) Cash Runway Sufficient into 2Q 2023 Guidance as of 10K

(3-24-22) Average Daily Volume ~192 K As of 5-17-22 (YTD Avg) Short Interest 298K; 1.6% of Float As of 4-29-22 Research Analyst Coverage on OCUP John Newman Canaccord Genuity Kristen Kluska Cantor Fitzgerald James

Molloy Alliance Global Partners Soumit Roy Jones Trading Matthew Caufield H. C. Wainwright

www.ocuphire.comir@ocuphire.com Ocuphire Pharma Click here to view Ocuphire Pharma’s Investor R&D Day Recording