10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 11, 2021

| ☒ |

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

|

| ☐ |

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

|

|

Delaware

|

11-3516358

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

37000 Grand River Avenue, Suite 1200

Farmington Hills, MI

|

48335

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

||

|

Common Stock, $0.0001 par value per share

|

OCUP

|

The Nasdaq Stock Market LLC

|

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

||

|

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

||

|

Emerging growth company ☐

|

|||

|

PART I

|

7

|

||

|

ITEM 1.

|

7

|

||

|

ITEM 1A.

|

68

|

||

|

ITEM 1B.

|

108

|

||

|

ITEM 2.

|

108

|

||

|

ITEM 3.

|

108

|

||

|

ITEM 4.

|

108

|

||

|

PART II

|

109

|

||

|

ITEM 5.

|

109

|

||

|

ITEM 6.

|

109

|

||

|

ITEM 7.

|

110

|

||

|

ITEM 7A.

|

124

|

||

|

ITEM 8.

|

124

|

||

|

ITEM 9A.

|

124

|

||

|

ITEM 9B.

|

125

|

||

|

PART III

|

126

|

||

|

ITEM 10.

|

126 |

||

|

ITEM 11.

|

EXECUTIVE COMPENSATION |

126

|

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

126

|

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

126

|

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES | 126 | |

|

|

|||

| PART IV | 127 | ||

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

127

|

|

|

ITEM 16.

|

131 | ||

|

159

|

|||

|

|

• |

Ocuphire currently depends entirely on the success of Nyxol and APX3330, its only product candidates. Ocuphire may never receive marketing approval for, or successfully commercialize, Nyxol, APX3330, or other

product candidates it may pursue in the future for any indication.

|

|

|

• |

The results of previous clinical trials may not be predictive of future results, and the results of Ocuphire’s current and planned clinical trials may not satisfy the requirements of the FDA or non-U.S. regulatory

authorities.

|

|

|

• |

Changes in regulatory requirements or FDA guidance, or unanticipated events during Ocuphire’s clinical trials, may result in changes to clinical trial protocols or additional clinical trial requirements, which could

result in increased costs to Ocuphire or delays in its development timeline.

|

|

|

• |

Ocuphire has incurred only losses since inception. Ocuphire expects to incur losses for the foreseeable future and may never achieve or maintain profitability.

|

|

|

• |

Ocuphire’s recurring operating losses have raised substantial doubt regarding its ability to continue as a going concern.

|

|

|

• |

Raising additional capital may cause dilution to Ocuphire’s stockholders, restrict Ocuphire’s operations, or require Ocuphire to relinquish rights to its technologies or product candidates.

|

|

|

• |

Even if it receives marketing approval for its product candidates in the United States, Ocuphire may never receive regulatory approval to market such product candidates outside of the United States.

|

|

|

• |

Even if Ocuphire obtains marketing approval for its product candidates, such product candidates could be subject to post-marketing restrictions or withdrawal from the market, and Ocuphire may be subject to

substantial penalties if it fails to comply with regulatory requirements or experience unanticipated problems with a product following approval.

|

|

|

• |

Ocuphire’s relationships with healthcare providers and third-party payors will be subject to applicable fraud and abuse and other healthcare laws and regulations, which could expose Ocuphire to criminal sanctions,

civil penalties, contractual damages, reputational harm, and diminished profits and future earnings, among other penalties and consequences.

|

|

|

• |

Ocuphire employees may engage in misconduct or other improper activities, including violating applicable regulatory standards and requirements or engaging in insider trading, which could significantly harm

Ocuphire’s business.

|

|

|

• |

Ocuphire faces substantial competition, which may result in others discovering, developing, or commercializing products before or more successfully than it does.

|

|

|

• |

Ocuphire lacks experience in commercializing products, which may have an adverse effect on its business.

|

|

|

• |

If Ocuphire is unable to establish sales and marketing capabilities or enter into agreements with third parties to sell, market, and distribute its product candidates, if approved, it may not be successful in

commercializing such product candidates if and when they are approved.

|

|

|

• |

Even if Ocuphire is able to commercialize its product candidates, their profitability will likely depend in significant part on third-party reimbursement practices, which, if unfavorable, would harm its business.

|

|

|

• |

Product liability lawsuits against Ocuphire, or its suppliers and manufacturers, could cause it to incur substantial liabilities and could limit commercialization of any product candidate that it may develop.

|

|

|

• |

Ocuphire will be unable to directly control all aspects of its clinical trials due to its reliance on clinical research organizations (“CROs”) and other third parties that assist Ocuphire in conducting clinical

trials.

|

|

|

• |

If Ocuphire is not able to establish new collaborations on commercially reasonable terms, it may have to alter its development, manufacturing, and commercialization plans.

|

|

|

• |

If Ocuphire is unable to obtain and maintain sufficient patent protection for its product candidates, its competitors could develop and commercialize products or technology similar or identical to those of Ocuphire,

which would adversely affect Ocuphire’s ability to successfully commercialize any product candidates it may develop, its business, results of operations, financial condition and prospects.

|

|

|

• |

If Ocuphire does not obtain protection under the Hatch-Waxman Act and similar foreign legislation by extending the patent terms and obtaining data exclusivity for its product candidate, its business may be

materially harmed.

|

|

|

• |

Changes in U.S. patent law could diminish the value of patents in general, thereby impairing Ocuphire’s ability to protect its product candidates.

|

|

|

• |

Ocuphire may not be able to protect or practice its intellectual property rights throughout the world.

|

|

|

• |

Obtaining and maintaining Ocuphire’s patent protection depends on compliance with various procedural, document submission, fee payment, and other requirements imposed by governmental agencies, and its patent

protection could be reduced or eliminated for noncompliance with these requirements.

|

|

|

• |

Ocuphire depends on intellectual property sublicensed from Apexian Pharmaceuticals, Inc. (“Apexian”) for its APX3330 product candidate under development and its additional pipeline candidates, and the termination

of, or reduction or loss of rights under, this sublicense would harm Ocuphire’s business.

|

|

|

• |

Ocuphire is dependent on its key personnel, and if it is not successful in attracting and retaining highly qualified personnel, it may not be able to successfully implement its business strategy.

|

|

|

• |

Ocuphire will need to develop and expand its company and may encounter difficulties in managing this development and expansion, which could disrupt its operations.

|

|

|

• |

The COVID-19 pandemic has and could continue to adversely impact Ocuphire’s business, including preclinical and clinical trials and regulatory approvals.

|

|

|

• |

Ocuphire’s insurance policies are expensive and protect only from some business risk, which leaves Ocuphire exposed to significant uninsured liabilities.

|

|

|

• |

If Ocuphire fails to comply with the continued listing standards of the Nasdaq Capital Market, Ocuphire common stock could be delisted. If it is delisted, Ocuphire common stock and the liquidity of its common stock

would be impacted.

|

|

|

• |

The market price of Ocuphire common stock may fluctuate significantly.

|

|

|

• |

Ocuphire may be subject to securities litigation, which is expensive and could divert management attention.

|

| ITEM 1. |

BUSINESS

|

|

|

• |

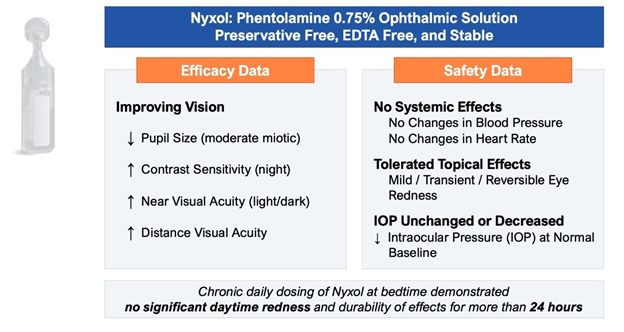

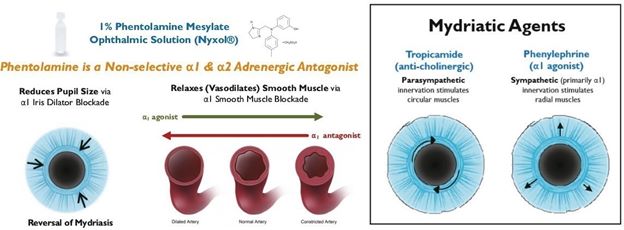

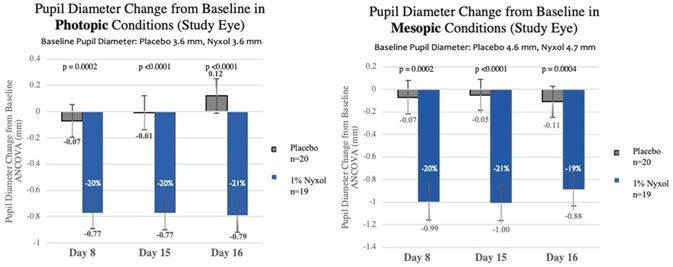

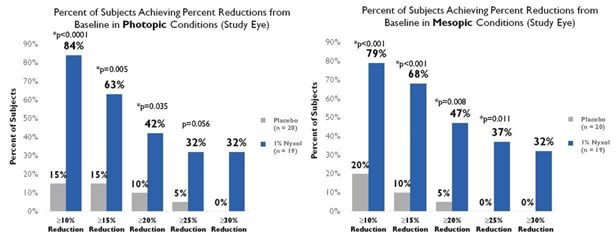

Reduction in pupil diameter with durable effects. In multiple Phase 2 trials Nyxol reduced pupil diameter by approximately 20% (~1 – 1.5 mm) in both mesopic (dim) and photopic

(bright) conditions, with such reductions sustained over 24 hours.

|

|

|

• |

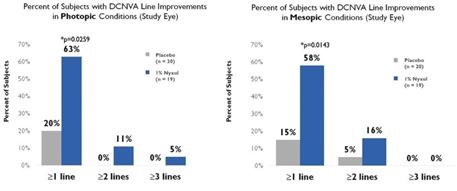

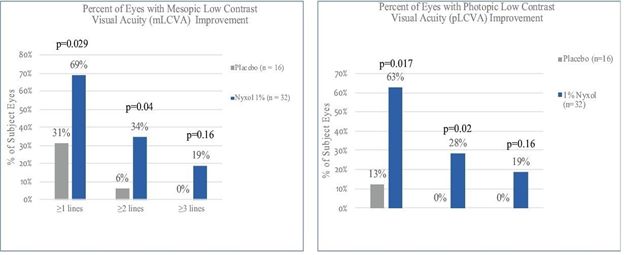

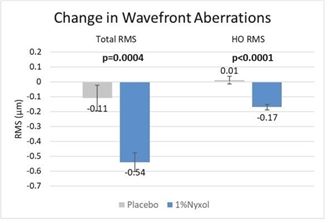

Improvement in low contrast visual acuity. When studied in patients with NVD in multiple Phase 2 trials, Nyxol showed statistically significant improvement in low contrast

mesopic best-corrected distance visual acuity at ≥1 and ≥2 lines, with a trend at ≥3 lines on a standard visual chart.

|

|

|

• |

Promising tolerability profile. To date, Nyxol has been observed to be well tolerated, with unchanged or decreased intraocular pressure in the 7 completed Phase 1 and Phase 2

clinical trials conducted. Nyxol produces a transient, mild hyperemia effect that disappears within 4 to 8 hours or immediately upon application of anti-redness eye drops. Nyxol is also observed to have no systemic effects such as changes in

blood pressure or heart rate.

|

|

|

• |

Designed to be a convenient, once-daily eye drop. Nyxol is being evaluated for chronic use as a once-daily administration before bedtime. Nyxol has also been shown in multiple

Phase 2 trials to have an over 24-hour durable effect, which could allow for better patient compliance.

|

|

|

• |

Stable, cost-effective ophthalmic formulation. Nyxol is a single-use, preservative-free, proprietary eye drop formulation with good stability for eventual commercialization.

Its active pharmaceutical ingredient, phentolamine mesylate USP grade, is a small molecule with advantages of standardized, scalable, lower-cost manufacturing processes.

|

|

|

• |

NVD, a condition in which peripheral imperfections (aberrations) of the cornea scatter light when the pupil opens wide in dim light. Patients with NVD experience glare, halos,

starbursts, and decreased contrast sensitivity. NVD is a new indication with no approved therapies.

|

|

|

• |

RM, a reversal of pharmacologically induced dilation of the pupils, where dilation leads to increased sensitivity to light and an inability to focus, making it difficult to

read, work, and drive. RM is a single-use indication with no commercially available therapies.

|

|

|

• |

Presbyopia, a condition in which the eye’s lens loses elasticity, affecting its ability to focus on near objects. Presbyopia typically occurs after age 40 and most patients

use reading glasses in order to read or see objects close to them. There are no currently approved pharmacological therapies for presbyopia, but those in development plan to create a small pupil to better focus images on the retina via the

“pinhole effect”.

|

|

|

• |

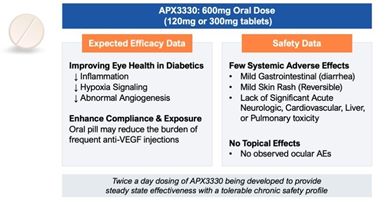

Potential to be the first oral therapy. Compared to frequent intravitreal anti-VEGF injections, associated with ocular complications, twice a day oral administration of

APX3330 could be a convenient alternative treatment for retinal disease, if approved.

|

|

|

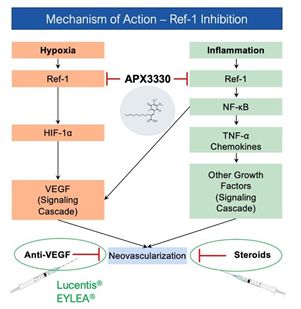

• |

Upstream target implicated in two validated pathways. APX3330 is designed to lead to inhibition of two validated cell signaling pathways (angiogenesis and inflammation) known

to cause various retinal diseases. Moreover, the APX3330 mechanism of action is distinct by working upstream of the current anti-VEGF therapies, thus Ocuphire believes it could complement anti-VEGF therapies and potentially reduce frequency

of doctor visits.

|

|

|

• |

Promising tolerability profile. In 11 completed Phase 1 and Phase 2 clinical trials, APX3330 was well tolerated with no significant acute neurologic, cardiovascular, liver, or

pulmonary events.

|

|

|

• |

Stable, cost-effective oral tablet. APX3330 is formulated as an oral tablet with stability suitable for eventual commercialization, and its active pharmaceutical ingredient

is a small molecule with the advantages of standardized, scalable, lower-cost manufacturing processes.

|

|

|

• |

DR, the leading cause of vision loss in adults aged 20–74 years, which results from chronic elevations of glucose in the blood that lead to cell damage in the retina.

|

|

|

• |

DME, one of the most common complications of DR, in which vascular leakage causes damage to the macula, the part of the eye that is critical for central and color vision.

|

|

|

• |

wAMD, a chronic eye disorder that causes visual distortions in the central part of one’s vision, in which abnormal blood vessels leak fluid or blood into the macula, the part

of the eye that is critical for central and color vision.

|

|

|

• |

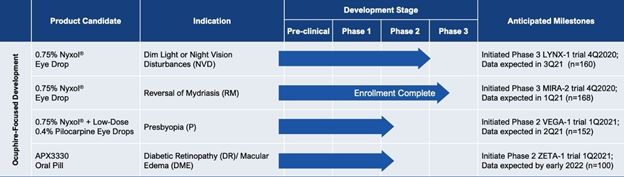

Advance the clinical development of Nyxol and APX3330. Ocuphire is preparing to conduct registration studies of Nyxol and proof of concept studies of APX3330 with the

objective of filing a U.S. NDA in early 2023 for Nyxol and advancing APX3330 towards an NDA in the future.

|

|

|

• |

Target Nyxol and APX3330 for large ophthalmic indications. Ocuphire believes Nyxol has therapeutic potential to improve vision performance in NVD, RM, and presbyopia. Ocuphire

also believes AXP3330 has potential to improve the health of the retina in patients with diabetic retinopathy, diabetic macular edema, and wAMD, while reducing the burden of intravitreal injections.

|

|

|

• |

Maintain and expand its intellectual property portfolio. Ocuphire owns all global patent rights to Nyxol with respect to its formulation, combinations, and use in multiple

indications. Ocuphire also owns an exclusive worldwide sublicense for the Ref-1 Inhibitor program, including its lead product candidate APX3330, for all its ophthalmic and diabetic indications, and compositions and methods of use for Ref-1

pipeline candidates, including APX2009 and APX2014. Ocuphire continues to explore additional opportunities to expand and extend this intellectual property protection, both in the U.S. and in other jurisdictions.

|

|

|

• |

Maximize the global commercial value of Nyxol and APX3330. Ocuphire plans to seek commercial partners both in and outside of the United States. Alternatively, Ocuphire

believes it could independently commercialize Nyxol and/or APX3330 in the United States with a targeted sales force.

|

|

|

• |

Evaluate in-licensing and acquisition opportunities. Ocuphire’s team is well qualified to identify and in-license or acquire clinical-stage ophthalmological assets and is

evaluating opportunities to expand and diversify its pipeline.

|

Vision at night or in dim light conditions is different from daytime vision in several important ways. Most notably, at night, the pupils dilate to allow more light into the eye. Diminished night vison is a natural part of aging as well as a common side effect of several conditions and procedures. NVD is caused by peripheral imperfections (aberrations) of the cornea which scatter light when the pupil dilates in dim light conditions. These imperfections can be naturally occurring, especially with age, or surgically-induced from refractive procedures such as LASIK. As the pupil dilates in response to mesopic conditions, light passes through the periphery of the cornea and lens, unlike during photopic conditions. Any imperfections or aberrations present on the periphery cause light to reach the retina in a non-focused and scattered way, creating glare, halos, starbursts, ghosting, and a loss of contrast sensitivity (“CS”). These visual disturbances can be debilitating to a variety of everyday activities, especially driving. The light emitted by traffic lights and other cars scatters and obscures most of the visual field, making driving in dim light conditions hazardous. Glare, in particular, can be dangerous while driving. In one study of 297 drivers given vision tests that correlate with accidents, 45% of the drivers who reported difficulty driving at night were unable to perform any of the tests with glare.

|

|

• |

Non-proliferative DR, or NPDR. NPDR is an earlier, more typical stage of DR and can progress into more severe forms of DR over time if untreated and if exposure to elevated

blood sugar levels persists.

|

|

|

• |

Proliferative DR, or PDR. PDR is a more advanced stage of DR than NPDR. It is characterized by retinal neovascularization and, if left untreated, leads to permanent damage

and blindness.

|

|

|

• |

In a double-masked, randomized, single dose, 3-arm controlled, parallel design Phase 1 trial (OP-NYX-001, IND 67-288), 45 healthy volunteers were administered a single dose of 0.2% Nyxol with or without

tetrahydrozoline or tetrahydrozoline alone. Both Nyxol-treated groups showed a statistically significant reduction in pupil diameter (PD) compared to tetrahydrozoline alone.

|

|

|

• |

In a 12-day, double-masked, randomized, placebo-controlled, single-dose, incomplete block, 3-period crossover, dose escalation Phase 1 trial in 16 healthy volunteers (OP-NYX-002, IND 67-288), there was a

dose-related response in improvement in LCVA relative to placebo.

|

|

|

• |

In a 2-week, double-masked, randomized, placebo-controlled, single-dose, incomplete block 3-period crossover, dose escalation Phase 1/2 trial in 16 patients with NVD (OP-NYX-004, IND 73-987), Nyxol was

well-tolerated with no severe adverse events (SAEs).

|

|

|

• |

In a 1-day, double-masked, randomized, placebo-controlled, single-dose Phase 2 trial in 24 patients with severe NVD (OP-NYX-SNV, IND 70-736), patients treated with Nyxol exhibited greater reductions in pupil

diameter and greater improvements in low contrast visual acuity compared to those on placebo.

|

|

|

• |

In a 15-day, double-masked, randomized, placebo-controlled, multiple-dose, 3-arm (0, 0.5%, and 1% Nyxol) Phase 2 trial in 60 patients with severe NVD (OP-NYX-01a2, IND 70499), improvements in contrast sensitivity

frequencies and VA, as well as reductions in intraocular pressure (IOP) and pupil diameter, were observed.

|

|

|

• |

In a 14-day, double-masked, randomized, placebo-controlled, multiple-dose, multi-center Phase 2b trial in 39 patients with elevated intraocular pressure (ORION-1, IND 070499), patients treated with 1% Nyxol showed

statistically significant reduction in PD and improvement in near visual acuity relative to placebo, with evening bedtime daily dosing regimen.

|

|

|

• |

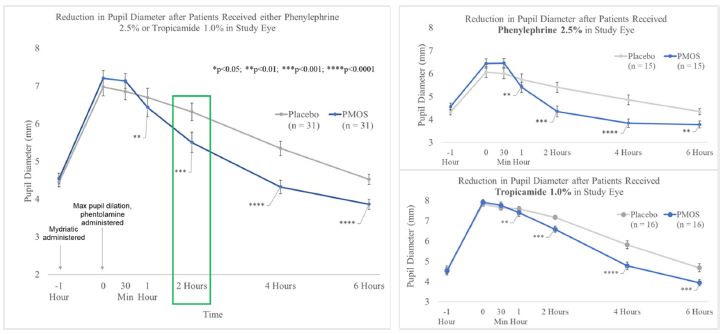

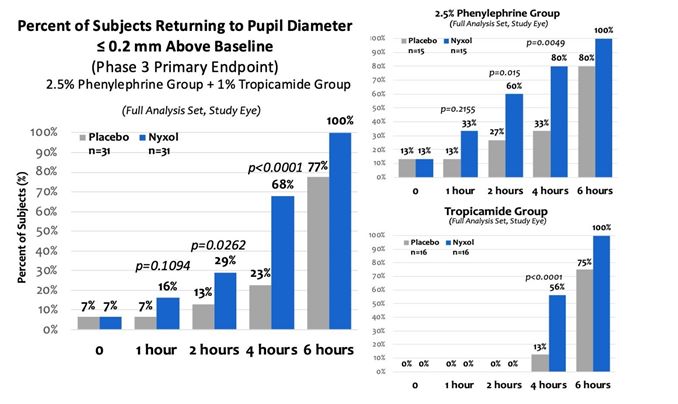

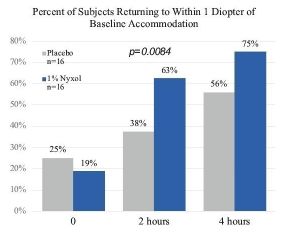

In a double-masked, randomized, placebo-controlled, crossover, single-dose, multi-center Phase 2b trial with 32 healthy patients (MIRA-1, IND 070499) to study reversal of pharmacologically induced mydriasis, healthy

patients treated with 1% Nyxol had statistically significantly greater reductions in PD at multiple time points compared to placebo, and more patients in the study group returned to baseline PD at 2 hours compared to the placebo group.

|

|

Trial

Name (IND

Number)

|

|

Patient /

Indication

|

|

Phase

|

|

Trial Objectives

|

|

Doses

|

|

Number of

Patients^

|

|

Dosing

|

|

Key

Endpoints

|

|

NYX-001

(67-288)

|

|

Healthy Volunteers

|

|

1

|

|

Double-masked, randomized, single dose, 3-arm controlled, parallel trial to determine the efficacy and safety of phentolamine mesylate

|

|

0.2%

|

|

Nyxol*=15, Visine=15,

Visine + Nyxol*=15

Total = 45

|

|

Single-dose

|

|

Safety and Efficacy (PD)

|

|

NYX-002

(67-288)

|

|

Healthy Volunteers

|

|

1

|

|

Double-masked, randomized, placebo-controlled, single-dose, incomplete block, 3-period crossover, dose escalation trial evaluating the tolerability and efficacy of phentolamine mesylate

|

|

0.2%, 0.4%, 0.8%

|

|

Nyxol*=16 Placebo=12

Total = 16

|

|

Single-dose

|

|

Safety and Efficacy (PD, VA)

|

|

OP-NYX-004

(73-987)

|

|

Night Vision Disturbances Patients

|

|

1 / 2

|

|

Double-masked, randomized, placebo-controlled, single-dose, incomplete block 3-period crossover, dose escalation trial to determine the efficacy and safety of phentolamine mesylate

|

|

0.2%, 0.4%, 0.8%

|

|

Nyxol*=16 Placebo=12

Total = 16

|

|

Single-dose

|

|

Safety and Efficacy

|

|

OP-NYX-SNV

(70-736)

|

|

Severe Night Vision Disturbances Patients

|

|

2

|

|

Double-masked, randomized, placebo-controlled, single-dose trial to assess the efficacy and safety of phentolamine mesylate ophthalmic solution

|

|

1.0%

|

|

Nyxol*=16, Placebo=8

Total = 24

|

|

Single-dose

|

|

Safety and Efficacy (PD, LCVA, CS, WA)

|

|

OP-NYX-01a2

(70-499)

|

|

Severe Night Vision Disturbances Patients

|

|

2

|

|

Double-masked, randomized, placebo-controlled, single-dose, 3-arm trial to assess the efficacy and safety of Nyxol

|

|

0.5%, 1.0%

|

|

Nyxol=40 Placebo=20

Total = 60

|

|

Multiple doses (15-28 days)

|

|

Safety and Efficacy (PD, LCVA, CS)

|

|

OPI-NYXG-201

(ORION-1)

(70-499)

|

|

Glaucoma and Ocular Hypertension, Elderly Patients

|

|

2b

|

|

Double-masked, randomized, placebo-controlled, multiple-dose, multi-center trial to assess the efficacy and safety of Nyxol

|

|

1.0%

|

|

Nyxol=19 Placebo=20

Total = 39

|

|

Multiple doses (14 days)

|

|

Safety and Efficacy (IOP, PD, near VA, VA)

|

|

OPI-

NYXRM-201

(MIRA-1)

(70-499)

|

|

Healthy Patients/ Reversal of Mydriasis

|

|

2b

|

|

Double-masked, randomized, placebo-controlled, crossover, single-dose, multi-center trial to assess the efficacy and safety of Nyxol in reducing pharmacologically induced

mydriasis

|

|

1.0%

|

|

Nyxol=31 Placebo=32

Total = 32

|

|

Single-dose

|

|

Safety and Efficacy (PD, Accommodation, VA)

|

|

Study

|

|

Group

|

|

Mesopic Conditions

|

||||||||

|

|

Pre-Treatment

(Baseline) Pupil

Diameter

|

|

Post-

Treatment

Pupil

Diameter

|

|

Change (%)

|

|

p-value

compared

to baseline

|

|

p-value

compared

to placebo

|

|||

|

NYX-SNV

|

|

Placebo (N = 16)

|

|

6.6mm

|

|

6.4mm

|

|

-0.2mm (-3%)

|

|

p = 0.08

|

|

p < 0.0001

|

|

|

1% Nyxol (N = 32)

|

|

6.5mm

|

|

5.2mm

|

|

-1.3mm (-20%)

|

|

p < 0.0001

|

|

||

|

NYX-01a2

|

|

Placebo (N = 38)

|

|

6.25mm

|

|

6.31mm

|

|

0.07mm (+1%)

|

|

p = 0.6

|

|

p < 0.0001

|

|

|

1% Nyxol (N = 40)

|

|

6.17mm

|

|

5.31mm

|

|

-0.86mm (-14%)

|

|

p < 0.0001

|

|

||

|

NYXG-201

|

|

Placebo (N = 20)

|

|

4.57mm

|

|

4.52mm

|

|

-0.05mm (-1%)

|

|

p = 0.6178

|

|

p < 0.0001

|

|

|

1% Nyxol (N = 19)

|

|

4.69mm

|

|

3.70mm

|

|

-1.00mm (-21%)

|

|

p < 0.0001

|

|

||

|

System Organ Class

Preferred Term

|

|

Nyxol

(n=19)

n (%)

|

|

Placebo

(n=20)

n (%)

|

|

Total number of TEAEs, n[1]

|

|

16

|

|

2

|

|

Eye disorders

|

|

3 (15.8)

|

|

1 (5.0)

|

|

Conjunctival hyperemia

|

|

3 (15.8)

|

|

1 (5.0)

|

|

Eye pruritus

|

|

1 (5.3)

|

|

0

|

|

Vision blurred

|

|

0

|

|

0

|

|

Conjunctival hemorrhage

|

|

0

|

|

0

|

|

Corneal deposits

|

|

0

|

|

0

|

|

Erythema of eyelid

|

|

0

|

|

0

|

|

Eye irritation

|

|

0

|

|

0

|

|

Eyelid edema

|

|

0

|

|

0

|

|

System Organ Class

Preferred Term

|

|

Nyxol

(n=19)

n (%)

|

|

Placebo

(n=20)

n (%)

|

|

Lacrimation increased

|

|

0

|

|

0

|

|

Eye pain

|

|

0

|

|

0

|

|

Visual acuity reduced

|

|

0

|

|

0

|

|

Conjunctival edema

|

|

0

|

|

0

|

|

Foreign body sensation in eyes

|

|

0

|

|

0

|

|

Punctate keratitis

|

|

0

|

|

0

|

|

General disorders and administration site conditions

|

|

3 (15.8)

|

|

0

|

|

Instillation site burn

|

|

2 (10.5)

|

|

0

|

|

Instillation site pain

|

|

1 (5.3)

|

|

0

|

|

Infections and infestations

|

|

1 (5.3)

|

|

0

|

|

Prostate infection

|

|

1 (5.3)

|

|

0

|

|

Upper respiratory tract infection

|

|

1 (5.3)

|

|

0

|

|

Nervous system disorders

|

|

0

|

|

0

|

|

Headache

|

|

0

|

|

0

|

|

Skin and subcutaneous tissue disorders

|

|

0

|

|

0

|

|

Injury, poisoning and procedural complication

|

|

0

|

|

0

|

|

Respiratory, thoracic, and mediastinal disorders

|

|

0

|

|

0

|

|

Cardiac disorders

|

|

0

|

|

0

|

|

Vascular disorders

|

|

0

|

|

0

|

|

Variable

|

|

Placebo

(N = 40)

|

|

0.5% Nyxol

(N = 40)

|

|

1% Nyxol

(N = 40)

|

|

Pre-Treatment Day 1 IOP (mmHg ± STDEV)

|

|

16.1 ± 2.3

|

|

16.7 ± 2.7

|

|

16.6 ± 2.5

|

|

Post-Treatment Day 1 IOP (mmHg ± STDEV)

|

|

16.2 ± 3.2

|

|

15.4 ± 3.6

|

|

14.2 ± 2.9

|

|

Change from Pretreatment Day 1 IOP (mmHg ± STDEV)

|

|

0.1 ± 2.7

|

|

-1.3 ± 3.2

|

|

-2.4 ± 2.2

|

|

Change in Baseline Significance^

|

|

p = 0.9192

|

|

p = 0.0043

|

|

p < 0.0001

|

|

Change compared to Placebo Significance^

|

|

N/A

|

|

p = 0.0148

|

|

p < 0.0001

|

| ^ |

P-values were generated using the Wilcoxon Signed Rank Test.

|

|

|

• |

APX_CLN_0001: A Phase 1, randomized, single-dose placebo-controlled trial of APX3330 to investigate the safety and pharmacokinetics during oral dosing of APX3330 to healthy

adult males. A total of 18 patients were treated with single oral doses of APX3330 (10 mg, 30 mg, 60 mg, 120 mg, 180 mg or 240 mg) or the placebo in a blind manner.

|

|

|

• |

APX_CLN_0002: An 8-day, randomized Phase 1 repeat-dose placebo-controlled trial to investigate the safety and pharmacokinetics of orally dosed APX3330 in healthy adult male

patients. A total of 18 patients were treated with oral dosing of APX3330 (120 mg or 240 mg) or the placebo in a blind manner once or twice a day for 8 successive days.

|

|

|

• |

APX_CLN_0003: A 7-day Phase 1 repeat-dose trial (120 mg) in 6 healthy patients to determine the effects of food on orally administered APX3330.

|

|

|

• |

APX_CLN_0004 A single-dose trial (120 mg) in 6 healthy patients to determine the effect of meals on the pharmacokinetics of APX3330.

|

|

|

• |

APX_CLN_0005 A 12-week dose-escalation Phase 2 trial (20 mg, 60 mg, 120 mg, 240 mg) in 40 chronic hepatitis B patients. Patients received oral administration of one tablet per

dose (2 tablets in the case of the administration of 240 mg) twice a day, after breakfast and after dinner.

|

|

|

• |

APX_CLN_0006 A 12-week dose-escalation Phase 2 trial (20 mg, 60 mg, 120 mg, 240 mg) in 51 chronic hepatitis C patients. The objective of the trial was to investigate the

safety, efficacy and utility of APX3330 in treating patients with chronic hepatitis C.

|

|

|

• |

APX_CLN_0007 A 12-week double-masked, randomized placebo-controlled Phase 2 trial (0 mg, 120 mg, 240 mg) in chronic hepatitis C patients that had failed previous interferon

treatment. Safety was evaluated in 196 completed patients. The mean treatment period in each group was 82 days in the placebo group, 79 days in the 120 mg group and 78 days in the 240 mg group. The primary endpoints of this trial were

measurement of the rate of change in the glutamic pyruvate transaminase (GPT) level, degree of improvement in liver function and assessment of general performance status.

|

|

|

• |

APX_CLN_0008 A 3-step, Phase 1 single-dose, single-blind trial (300 mg, 420 mg, 600 mg) in 27 healthy patients to investigate the safety and pharmacokinetics of higher doses.

|

|

|

• |

APX_CLN_0009 A 2-week repeated-dose Phase 2 trial (120 mg) in 30 patients with acute severe hepatitis, including patients with advanced liver cirrhosis. Efficacy endpoints

included objective measures of liver function and subjective improvement of patient functional status. Safety measures included the assessment of the general tolerability of the drug (i.e., changes in vital signs) and changes in clinical

laboratory values.

|

|

|

• |

APX_CLN_00010 A 4-week repeated-dose Phase 2 trial (120 mg) in 30 patients with alcoholic hepatitis, including patients with liver cirrhosis. Efficacy endpoints included

objective measures of liver function and subjective improvement of patient functional status. Safety measures included the assessment of the general tolerability of the product candidate (i.e., changes in vital signs) and changes in clinical

laboratory values.

|

|

|

• |

APX_CLN_0011 was a multi-center, open-label, dose-escalation Phase 1 oncology trial in patients with advanced solid tumors. Patients received daily oral doses of APX3330 each

day of repeated 21-day cycles until disease progression or trial withdrawal. Nineteen patients received APX3330 in escalating doses from 240 mg/d dose to 720 mg/d in increments of 120mg/d. The top dose tested (720 mg/d) produced a

self-limiting, diffuse macular rash and was confirmed as the dose-limiting toxicity. The dose of 600 mg/d was then confirmed as a dose tolerable for chronic administration and for further clinical development as a modulator of Ref-1 activity

in inflammatory diseases. Biopsy analyses of patients participating in the trial confirmed that APX3330 directly targets the Ref-1 protein and that the targeting produces subsequent regulation of transcription factors such as NF-κB and

HIF-1α, regulators of VEGF and other inflammatory molecules. This mechanism of action provides significant rationale for testing APX3330 in diseases in which inflammation and neo-vascular development play a critical pathogenic role.

|

|

Trial Number /

Name

|

|

Patient /

Indication

|

|

Phase

|

|

Trial Objectives

|

|

Doses

|

|

Number

of

Patients

|

|

Dosing

|

|

Key Endpoints

|

|

APX_CLN_0001

|

|

Healthy Volunteers

|

|

1

|

|

Single-dose placebo-controlled trial of APX3330 to investigate safety and pharmacokinetics

|

|

10 mg 30 mg 60 mg 120 mg 180 mg 240 mg

|

|

APX3330 = 9 Placebo = 9

|

|

Single dose

|

|

Plasma Concentration of total quinone forms, safety

|

|

APX_CLN_0002

|

|

Healthy Volunteers

|

|

1

|

|

Repeat-dose placebo-controlled trial to investigate safety and pharmacokinetics

|

|

120 mg QD 120 mg BID

|

|

APX3330 = 9 Placebo = 9

|

|

8 days

|

|

Plasma Concentration of APX3330, safety

|

|

APX_CLN_0003

|

|

Healthy Volunteers

|

|

1

|

|

Repeat-dose trial to determine effects of food on pharmacokinetics

|

|

240 mg

|

|

APX3330 = 6

|

|

1 week

|

|

Plasma Concentration of APX3330, safety

|

|

APX_CLN_0004

|

|

Healthy Volunteers

|

|

1

|

|

Single-dose trial to determine the effects of meals on pharmacokinetics

|

|

120 mg

|

|

APX3330 = 6

|

|

Single dose

|

|

Plasma Concentration of APX3330, Safety

|

|

APX_CLN_0005

|

|

Chronic Hepatitis B Patients

|

|

2

|

|

Dose-escalation trial to investigate safety, efficacy and tolerability

|

|

20 mg 60 mg 120 mg 240 mg

|

|

APX3330 = 40

|

|

12 weeks

|

|

Safety

|

|

APX_CLN_0006

|

|

Chronic Hepatitis C Patients

|

|

2

|

|

Dose-escalation trial to investigate safety, efficacy and tolerability

|

|

20 mg 60 mg 120 mg 240 mg

|

|

APX3330 = 51

|

|

12 weeks

|

|

Safety

|

|

Trial Number /

Name

|

|

Patient /

Indication

|

|

Phase

|

|

Trial Objectives

|

|

Doses

|

|

Number

of

Patients

|

|

Dosing

|

|

Key Endpoints

|

|

APX_CLN_0007

|

|

Chronic Hepatitis C Patients

|

|

2

|

|

Double-masked, placebo-controlled trial to investigate safety, efficacy and tolerability

|

|

120 mg 240 mg

|

|

APX3330 = 128

Placebo = 68

|

|

Placebo = 82 days

APX3330 120 mg = 79 days

240 mg = 78 days

|

|

Rate of change in GPT level, improvement in liver function, general performance

|

|

APX_CLN_0008

|

|

Healthy Patients

|

|

1

|

|

Single-blind, single-dose, 3-step trial to investigate safety and pharmacokinetics of higher doses

|

|

300 mg 420 mg 600 mg

|

|

APX3330 = 27

|

|

Single dose

|

|

Plasma Concentration of APX3330, safety

|

|

APX_CLN_0009

|

|

Advanced Liver Cirrhosis Patients

|

|

2

|

|

Repeated-dose trial to investigate safety, efficacy and tolerability

|

|

120 mg

|

|

APX3330 = 30

|

|

2 weeks

|

|

Liver function, patient functional status, tolerability

|

|

APX_CLN_0010

|

|

Advanced Liver Cirrhosis Patients

|

|

2

|

|

Repeated-dose trial to investigate safety, efficacy and tolerability

|

|

120 mg

|

|

APX3330 = 30

|

|

4 weeks

|

|

Liver function, patient functional status, tolerability

|

|

APX_CLN_0011

|

|

Advanced Solid Tumor Patients

|

|

1

|

|

Multicenter, open-label, dose-escalation to investigate safety, efficacy, pharmacokinetics, and recommended Phase 2 dose

|

|

240 mg 360 mg 480 mg 600 mg 720 mg

|

|

APX3330 = 19

|

|

21-day cycles until disease progression or study withdrawal

|

|

Tumor response, safety, PK, target engagement

|

|

System Organ Class

Preferred Term

|

|

|

APX3330

20-240 mg

(N=279)

|

|

|

Placebo

(N=68)

|

||||||

|

|

n (%)

|

|

|

# events

|

|

|

n (%)

|

|

|

# events

|

||

|

Adverse Events

|

|

|

40 (14.3)

|

|

|

52

|

|

|

11 (16.2)

|

|

|

15

|

|

Blood and lymphatic system disorders

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Anemia

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Cardiac disorders

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Palpitations

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Gastrointestinal disorders

|

|

|

12 (4.3)

|

|

|

14

|

|

|

2 (2.9)

|

|

|

2

|

|

Abdominal discomfort

|

|

|

1 (0.4)

|

|

|

1

|

|

|

1 (1.5)

|

|

|

1

|

|

Abdominal pain

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Abdominal pain lower

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Cheilitis

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Diarrhea

|

|

|

3 (1.1)

|

|

|

3

|

|

|

0

|

|

|

0

|

|

Feces soft

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Gastric ulcer

|

|

|

2 (0.7)

|

|

|

2

|

|

|

0

|

|

|

0

|

|

Hypo aesthesia oral

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Mouth swelling

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Stomatitis

|

|

|

0

|

|

|

0

|

|

|

1 (1.5)

|

|

|

1

|

|

Tongue dry

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Vomiting

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

General disorders and administration site conditions

|

|

|

6 (2.2)

|

|

|

6

|

|

|

3 (4.4)

|

|

|

3

|

|

Chest discomfort

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Feeling abnormal

|

|

|

0

|

|

|

0

|

|

|

1 (1.5)

|

|

|

1

|

|

Malaise

|

|

|

3 (1.1)

|

|

|

3

|

|

|

1 (1.5)

|

|

|

1

|

|

Peripheral edema

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Peripheral swelling

|

|

|

0

|

|

|

0

|

|

|

1 (1.5)

|

|

|

1

|

|

Pyrexia

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Infections and infestations

|

|

|

3 (1.1)

|

|

|

3

|

|

|

0

|

|

|

0

|

|

Nasopharyngitis

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Upper respiratory tract infections

|

|

|

2 (0.7)

|

|

|

2

|

|

|

0

|

|

|

0

|

|

Investigations

|

|

|

2 (0.7)

|

|

|

2

|

|

|

0

|

|

|

0

|

|

Blood urea increased

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Urobilinogen urine increased

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Musculoskeletal and connective tissue disorders

|

|

|

0

|

|

|

0

|

|

|

2 (2.9)

|

|

|

3

|

|

Limb discomfort

|

|

|

0

|

|

|

0

|

|

|

1 (1.5)

|

|

|

1

|

|

Musculoskeletal pain

|

|

|

0

|

|

|

0

|

|

|

1 (1.5)

|

|

|

1

|

|

Pain in extremity

|

|

|

0

|

|

|

0

|

|

|

1 (1.5)

|

|

|

1

|

|

Nervous system disorders

|

|

|

4 (1.4)

|

|

|

6

|

|

|

4 (5.9)

|

|

|

5

|

|

Ageusia

|

|

|

0

|

|

|

0

|

|

|

1 (1.5)

|

|

|

1

|

|

Burning sensation

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Dizziness

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Headache

|

|

|

2 (0.7)

|

|

|

2

|

|

|

1 (1.5)

|

|

|

1

|

|

Hypoaesthesia

|

|

|

1 (0.4)

|

|

|

1

|

|

|

1 (1.5)

|

|

|

1

|

|

Hypoglycemic coma

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Parosmia

|

|

|

0

|

|

|

0

|

|

|

1 (1.5)

|

|

|

1

|

|

Subarachnoid hemorrhage

|

|

|

0

|

|

|

0

|

|

|

1 (1.5)

|

|

|

1

|

|

Eye disorders

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Ocular discomfort

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Psychiatric disorders

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Insomnia

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Renal and urinary disorders

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Hematuria

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Respiratory, thoracic and mediastinal disorders

|

|

|

2 (0.7)

|

|

|

2

|

|

|

1 (1.5)

|

|

|

1

|

|

Acute respiratory distress syndrome

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Upper respiratory tract inflammation

|

|

|

1 (0.4)

|

|

|

1

|

|

|

1 (1.5)

|

|

|

1

|

|

System Organ Class

Preferred Term

|

|

|

APX3330

20-240 mg

(N=279)

|

|

|

Placebo

(N=68)

|

||||||

|

|

n (%)

|

|

|

#

events

|

|

|

n (%)

|

|

|

#

events

|

||

|

Skin and subcutaneous tissue disorders

|

|

|

12 (4.3)

|

|

|

14

|

|

|

1 (1.5)

|

|

|

1

|

|

Alopecia

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Drug eruption

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Dry skin

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Eczema

|

|

|

2 (0.7)

|

|

|

2

|

|

|

0

|

|

|

0

|

|

Papule

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

Pruritus

|

|

|

5 (1.8))

|

|

|

5

|

|

|

1 (1.5)

|

|

|

1

|

|

Rash

|

|

|

2 (0.7)

|

|

|

2

|

|

|

0

|

|

|

0

|

|

Urticaria

|

|

|

1 (0.4)

|

|

|

1

|

|

|

0

|

|

|

0

|

|

|

• |

Liquid Vision®, with aceclidine (another miotic agent), developed by Presbyopia Therapies, LLC.

|

|

|

• |

MicroLine®, which is a microdose formulation of pilocarpine, developed by Eyenovia, Inc.

|

|

|

• |

KT-101, which uses pilocarpine in the AcuStream delivery system, developed by Kedalion Therapeutics, Inc.

|

|

|

• |

BrimocholTM, with brimonidine and carbachol (both are miotic agents), developed by Visus Therapeutics, Inc.

|

|

|

• |

UNR844, which uses a mechanism that involves softening the lens to increase near visual acuity, developed by Novartis AG (originally Encore Vision, Inc.).

|

|

|

• |

Lucentis® (ranibizumab) and Avastin® (bevacizumab), which are anti-VEGF monoclonal antibody intravitreal injections, developed by Genentech, Inc.

|

|

|

• |

EYLEA® (aflibercept), a VEGF inhibitor intravitreal injection, developed by Regeneron Pharmaceuticals.

|

|

|

• |

Beovu® Brolucizumab, an anti-VEGF monoclonal antibody intravitreal injection, developed by Novartis AG.

|

|

|

• |

MACUGEN® (pegaptanib sodium injection), a selective inhibitor of VEGF-165, developed by Bausch + Lomb.

|

|

|

• |

Ozurdex® (dexamethasone), a corticosteroid IVT implant, developed by Allergan plc.

|

|

|

• |

Iluvien (fluocinolone acetonide), a corticosteroid IVT implant, developed by Alimera Sciences, Inc.

|

|

|

• |

Abicipar, an anti-VEGF intravitreal injection with a long duration of action, developed by Allergan plc and Molecular Partners.

|

|

|

• |

Farcimab, a bispecific antibody intravitreal injection that suppresses both VEGF and Angiopoietin-2, developed by Genentech, Inc. and Roche AG.

|

|

|

• |

KSI-301, an anti-VEGF antibody intravitreal injection coupled with a biopolymer that is intended to increase the time between injections, developed by Kodiak Sciences.

|

|

|

• |

OPT-302, an intravitreal injection which binds to multiple types of VEGF receptors that could be used with other anti-VEGF agents, developed by Opthea Limited.

|

|

|

• |

ALG-1001, an integrin peptide therapy intravitreal injection that is being evaluated as a sequential or in-combination therapy with bevacizumab in patients with DME, developed by Allegro Ophthalmics, LLC.

|

|

|

• |

completion of preclinical laboratory tests, animal studies and formulation studies in compliance, as applicable, with the Animal Welfare Act and FDA’s good laboratory practice, or GLP, regulations;

|

|

|

• |

submission to the FDA of an IND, which must take effect before human clinical trials may begin;

|

|

|

• |

approval by an independent institutional review board, or IRB, representing each clinical site before each clinical trial may be initiated;

|

|

|

• |

performance of adequate and well-controlled human clinical trials in accordance with good clinical practices, or GCP, to establish the safety and efficacy of the proposed drug product for each indication;

|

|

|

• |

preparation and submission to the FDA of an NDA;

|

|

|

• |

review of the product by an FDA advisory committee, where appropriate or if applicable;

|

|

|

• |

satisfactory completion of one or more FDA inspections of the manufacturing facility or facilities at which the product, or components thereof, are produced to assess compliance with current Good Manufacturing Practices, or cGMP,

requirements and to assure that the facilities, methods and controls are adequate to preserve the product’s identity, strength, quality and purity;

|

|

|

• |

satisfactory completion of FDA audits of clinical trial sites to assure compliance with GCPs and the integrity of the clinical data;

|

|

|

• |

payment of user fees and securing FDA approval of the NDA; and

|

|

|

• |

compliance with any post-approval requirements, including Risk Evaluation and Mitigation Strategies, or REMS, and post-approval studies required by the FDA.

|

|

|

• |

Phase 1. The drug is initially introduced into healthy human patients or, in certain indications such as cancer, patients with the target disease or condition and tested for safety, dosage

tolerance, absorption, metabolism, distribution, excretion and, if possible, to gain an early indication of its effectiveness and to determine optimal dosage.

|

|

|

• |

Phase 2. The drug is administered to a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted

diseases and to determine dosage tolerance and optimal dosage.

|

|

|

• |

restrictions on the marketing or manufacturing of the product, complete withdrawal of the product from the market or product recalls;

|

|

|

• |

fines, warning letters or holds on post-approval clinical trials;

|

|

|

• |

refusal of the FDA to approve pending NDAs or supplements to approved NDAs, or suspension or revocation of product license approvals;

|

|

|

• |

product seizure or detention, or refusal to permit the import or export of products; or

|

|

|

• |

injunctions or the imposition of civil or criminal penalties.

|

|

|

• |

the federal Anti-Kickback Statute, which prohibits, among other things, persons and entities from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in cash or in kind, to induce or

reward either the referral of an individual for, or the purchase, order or recommendation of, any good or service, for which payment may be made, in whole or in part, under a federal healthcare program such as Medicare and Medicaid;

|

|

|

• |

the federal civil and criminal false claims laws, including the civil False Claims Act, and civil monetary penalties laws, which prohibit individuals or entities from, among other things, knowingly presenting, or causing to be presented,

to the federal government, claims for payment that are false or fraudulent or making a false statement to avoid, decrease or conceal an obligation to pay money to the federal government;

|

|

|

• |

the federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, which created additional federal criminal laws that prohibit, among other things, knowingly and willingly executing, or attempting to execute, a scheme to

defraud any healthcare benefit program or making false statements relating to healthcare matters;

|

|

|

• |

HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act and its implementing regulations, which also imposes obligations, including mandatory contractual terms, with respect to safeguarding the privacy,

security and transmission of individually identifiable health information;

|

|

|

• |

the federal transparency requirements known as the federal Physician Payments Sunshine Act, under the Patient Protection and Affordable Care Act, as amended by the Health Care Education Reconciliation Act, or the Affordable Care Act, which

requires certain manufacturers of drugs, devices, biologics and medical supplies to report specially to the Centers for Medicare & Medicaid Services, or CMS, within the U.S. Department of Health and Human Services, information related to

payments and other transfers of value to clinicians and teaching hospitals and clinician ownership and investment interests; and

|

|

|

• |

analogous state and foreign laws and regulations, such as state anti-kickback and false claims laws, which may apply to healthcare items or services that are reimbursed by non-governmental third-party payors, including private insurers.

|

|

|

• |

a special, nondeductible fee on any entity that manufactures or imports specified branded prescription drugs and biologic agents, apportioned among these entities according to their market share in certain government healthcare programs,

although this fee would not apply to sales of certain products approved exclusively for orphan indications;

|

|

|

• |

expansion of eligibility criteria for Medicaid programs by, among other things, allowing states to offer Medicaid coverage to certain individuals with income at or below 133% of the federal poverty level, thereby potentially increasing a

manufacturer’s Medicaid rebate liability;

|

|

|

• |

expanded manufacturers’ rebate liability under the Medicaid Drug Rebate Program by increasing the minimum rebate for both branded and generic drugs and revising the definition of “average manufacturer price,” or AMP, for calculating and

reporting Medicaid drug rebates on outpatient prescription drug prices and extending rebate liability to prescriptions for individuals enrolled in Medicare Advantage plans; addressed a new methodology by which rebates owed by manufacturers

under the Medicaid Drug Rebate Program are calculated for drugs that are inhaled, infused, instilled, implanted or injected;

|

|

|

• |

expanded the types of entities eligible for the 340B drug discount program;

|

|

|

• |

established the Medicare Part D coverage gap discount program by requiring manufacturers to provide a 50% point-of-sale-discount off the negotiated price of applicable brand drugs to eligible beneficiaries during their coverage gap period

as a condition for the manufacturers’ outpatient drugs to be covered under Medicare Part D;

|

|

|

• |

a new Patient-Centered Outcomes Research Institute to oversee, identify priorities in, and conduct comparative clinical effectiveness research, along with funding for such research;

|

|

|

• |

the Independent Payment Advisory Board, or IPAB, which has authority to recommend certain changes to the Medicare program to reduce expenditures by the program that could result in reduced payments for prescription drugs. However, the IPAB

implementation has been not been clearly defined. The ACA provided that under certain circumstances, IPAB recommendations will become law unless Congress enacts legislation that will achieve the same or greater Medicare cost savings; and

|

|

|

• |

established the Center for Medicare and Medicaid Innovation within CMS to test innovative payment and service delivery models to lower Medicare and Medicaid spending, potentially including prescription drug spending. Funding has been

allocated to support the mission of the Center for Medicare and Medicaid Innovation from 2011 to 2019.

|

| ITEM 1A. |

|

|

• |

the data collected from preclinical studies and clinical trials of Ocuphire’s product candidates may not be sufficient to support the submission of an NDA;

|

|

|

• |

Ocuphire may not be able to demonstrate to the satisfaction of the FDA that its product candidates are safe and effective for any indication;

|

|

|

• |

the results of clinical trials may not meet the level of statistical significance or clinical significance required by the FDA for approval;

|

|

|

• |

the FDA may disagree with the number, design, size, conduct, or implementation of Ocuphire’s clinical trials;

|

|

|

• |

the FDA may not find the data from preclinical studies and clinical trials sufficient to demonstrate that Ocuphire’s product candidates’ clinical and other benefits outweigh the safety risks;

|

|

|

• |

the FDA may disagree with Ocuphire’s interpretation of data from preclinical studies or clinical trials;

|

|

|

• |

the FDA may not accept data generated at Ocuphire’s clinical trial sites;

|

|

|

• |

the FDA may have difficulties scheduling an advisory committee meeting in a timely manner or the advisory committee may recommend against approval of Ocuphire’s application or may recommend that the FDA require, as a condition of

approval, additional preclinical studies or clinical trials, limitations on approved labeling or distribution and use restrictions;

|

|

|

• |

the FDA may require development of a Risk Evaluation and Mitigation Strategy (REMS) as a condition of approval;

|

|

|

• |

the FDA may identify deficiencies in the manufacturing processes or facilities of third-party manufacturers with which Ocuphire enters into agreements for clinical and commercial supplies; or

|

|

|

• |

the FDA may change its approval policies or adopt new regulations.

|

|

|

• |

regulators or IRBs may not authorize Ocuphire or its investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site including due to the ongoing COVID-19 pandemic or other public health emergency;

|

|

|

• |

government or regulatory delays and changes in regulatory requirements, policy and guidelines may require Ocuphire to perform additional clinical trials or use substantial additional resources to obtain regulatory approval, including

due to the ongoing COVID-19 pandemic or other public health emergency;

|

|

|

• |

Ocuphire may have delays in reaching or fail to reach agreement on acceptable clinical trial contracts or clinical trial protocols with prospective trial sites, including due to the ongoing COVID-19 pandemic or other public health

emergency;

|

|

|

• |

clinical trials may produce negative or inconclusive results, and Ocuphire may decide, or regulators may require it, to conduct additional clinical trials or abandon product development programs, including due to the ongoing COVID-19

pandemic or other public health emergency;

|

|

|

• |

the number of patients required for clinical trials may be larger, enrollment in these clinical trials may be slower or participants may drop out of these clinical trials at a higher rate than Ocuphire anticipates, including due to the

ongoing COVID-19 pandemic or other public health emergency;

|

|

|

• |

Ocuphire’s third-party contractors may fail to comply with regulatory requirements or meet their contractual obligations to Ocuphire in a timely manner, or at all;

|

|

|

• |

Ocuphire’s patients or medical investigators may be unwilling to follow its clinical trial protocols;

|

|

|

• |

Ocuphire might have to suspend or terminate clinical trials for various reasons, including a finding that the participants are being exposed to unacceptable health risks;

|

|

|

• |

the cost of clinical trials may be greater than Ocuphire anticipates, including due to the ongoing COVID-19 pandemic or other public health emergency;

|

|

|

• |

the supply or quality of any product candidate or other materials necessary to conduct clinical trials may be insufficient or inadequate;

|

|

|

• |

the product candidate may have undesirable side effects or other unexpected characteristics, causing Ocuphire or its investigators, regulators or IRBs to suspend or terminate the trials;

|

|

|

• |

clinical trials may be delayed or terminated because of the ongoing COVID-19 pandemic or another public health emergency; and

|

|

|

• |

federal agencies may, due to reduced manpower or diverted resources to the COVID-19 pandemic, require more time to review clinical trial protocols and INDs.

|

|

|

• |

severity of the disease under investigation;

|

|

|

• |

availability and efficacy of medications already approved for the disease under investigation;

|

|

|

• |

eligibility criteria for the trial in question;

|

|

|

• |

competition for eligible patients with other companies conducting clinical trials for product candidates seeking to treat the same indication or patient population;

|

|

|

• |

its payments for conducting clinical trials;

|

|

|

• |

perceived risks and benefits of the product candidate under study;

|

|

|

• |

efforts to facilitate timely enrollment in clinical trials;

|

|

|

• |

patient referral practices of physicians;

|

|

|

• |

the ability to monitor patients adequately during and after treatment;

|

|

|

• |

proximity and availability of clinical trial sites for prospective patients;

|

|

|

• |

the ability of patients to safely participate in clinical trials during the COVID-19 pandemic or other public health emergencies; and

|

|

|

• |

the ability to monitor patients adequately during periods in which social distancing is required or recommended due to the COVID-19 pandemic.

|

|

|

• |

regulatory authorities may withdraw their approval of the product;

|

|

|

• |

Ocuphire may be required to recall the product, change the way this product is administered, conduct additional clinical trials, or change the labeling or distribution of the product (including REMS);

|

|

|

• |

additional restrictions may be imposed on the marketing of, or the manufacturing processes for, the product;

|

|

|

• |

Ocuphire may be subject to fines, injunctions, or the imposition of civil or criminal penalties;

|

|

|

• |

Ocuphire could be sued and held liable for harm caused to patients;

|

|

|

• |

the product may be rendered less competitive and sales may decrease; or

|

|

|

• |

Ocuphire’s reputation may suffer generally both among clinicians and patients.

|

|

|

• |

obtain favorable results from and complete the clinical development of both Nyxol and APX3330 for their planned indications, including successful completion of the Phase 2 and Phase 3 trials for these indications;

|

|

|

• |

submit an application to regulatory authorities for both product candidates and receive marketing approval in the United States and foreign countries;

|

|

|

• |

contract for the manufacture of commercial quantities of its product candidates at acceptable cost levels;

|

|

|

• |

establish sales and marketing capabilities to effectively market and sell its product candidates in the United States or other markets, alone or with a pharmaceutical partner; and

|

|

|

• |

achieve market acceptance of its product candidates in the medical community and with third-party payors.

|

|

|

• |

the scope, size, rate of progress, results, and costs of researching and developing its product candidates, and initiating and completing its preclinical studies and clinical trials;

|

|

|

• |

the cost, timing and outcome of its efforts to obtain marketing approval for its product candidates in the United States and other countries, including to fund the preparation and filing of an NDA with the FDA for its product

candidates and to satisfy related FDA requirements and regulatory requirements in other countries;

|

|

|

• |

the number and characteristics of any additional product candidates it develops or acquires, if any;

|

|

|

• |

Ocuphire’s ability to establish and maintain collaborations on favorable terms, if at all;

|

|

|

• |

the amount of revenue, if any, from commercial sales, should its product candidates receive marketing approval;

|

|

|

• |

the costs associated with commercializing its product candidates, if Ocuphire receives marketing approval, including the cost and timing of developing sales and marketing capabilities or entering into strategic collaborations to market

and sell its product candidates;

|

|

|

• |

the cost of manufacturing its product candidates or products Ocuphire successfully commercializes; and

|

|

|

• |

the costs associated with general corporate activities, such as the cost of filing, prosecuting and enforcing patent claims and making regulatory filings.

|

|

|

• |

litigation involving patients taking Ocuphire’s drugs;

|

|

|

• |

restrictions on such drugs, manufacturers, or manufacturing processes;

|

|

|

• |

restrictions on the labeling or marketing of a drug;

|

|

|

• |

restrictions on drug distribution or use;

|

|

|

• |

requirements to conduct post-marketing studies or clinical trials;

|

|

|

• |

warning letters or untitled letters;

|

|

|

• |

withdrawal of the drugs from the market;

|

|

|

• |

refusal to approve pending applications or supplements to approved applications that Ocuphire submits;

|

|

|

• |

product recall or public notification or medical product safety alerts to healthcare professionals;

|

|

|

• |

fines, restitution, or disgorgement of profits or revenues;

|

|

|

• |

suspension or withdrawal of marketing approvals;

|

|

|

• |

damage to relationships with any potential collaborators;

|

|

|

• |

unfavorable press coverage and damage to Ocuphire’s reputation;

|

|

|

• |

refusal to permit the import or export of drugs;

|

|

|

• |

product seizure; or

|

|

|

• |

injunctions or the imposition of civil or criminal penalties.

|

|

|

• |

the federal Anti-Kickback Statute prohibits, among other things, persons and entities from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in cash or in kind, to induce or

reward, or in return for, either the referral of an individual for, or the purchase, order or recommendation of, any good or service, for which payment may be made under a federal healthcare program such as Medicare and Medicaid;

|

|

|

• |

the federal false claims and civil monetary penalties laws, including the civil False Claims Act, impose criminal and civil penalties, including civil whistleblower or qui tam actions, against individuals or entities for knowingly